operations management

Chapter 13 - Inventory Management

Chapter 13

Inventory Management

Teaching NotesThis is a fairly long and important chapter. Important points are:

1. Good inventory management is important for successful organizations.

2. The key issues are when to order and how much to order.

3. Because all items are not of equal importance, it is necessary to establish a classification system for allocating resources for inventory control.

4. EOQ models answer the question of how much to order. Variations of the basic EOQ model include the quantity discount model and the economic run size model.

5. EOQ models tend to be rather robust: even though one or more of the parameters may be only roughly correct, the model can yield a total cost that is close to the actual minimum.

6. ROP models are used to answer the question of when to order. Different models are used, depending on whether demand, lead time, or both are variable.

7. Other models described are the fixed interval model and the single period model in the supplement.

8. All of the models in this chapter pertain to independent demand.

The Single-Period Model is used to handle ordering of perishables (such as fresh fruits and vegetables, seafood, and cut flowers) as well as items that have a limited useful life (such as newspapers and magazines). Analysis of single-period situations generally focuses on two costs: shortage and excess. Shortage costs may include a charge for loss of customer goodwill as well as the opportunity cost of lost sales or unrealized profit per unit. Excess cost pertains to items left over at the end of the period and is the difference between purchase cost and salvage value. There may be costs associated with disposing of excess items which would make the salvage value negative and hence increase the excess cost per unit.

1. Inventories are held (1) to take advantage of price discounts, (2) to take advantage of economic lot sizes, (3) to provide a certain level of customer service, and (4) because production requires some in-process inventory.

2. Effective inventory management requires (1) cost information, information on demand and lead time (amounts and variabilities), an accounting system, and a priority system (e.g., A-B-C).

3. Carrying or holding costs include interest, security, warehousing, obsolescence, and so on. Procurement costs relate to determining how much is needed, vendor analysis, inspection of receipts and movement to temporary storage, and typing up invoices. Shortage costs refer to opportunity costs incurred through failure to make a sale due to lack of inventory. Excess costs refer to having too much inventory on hand.

4. The RFID (Radio Frequency Identification) chip tags are beginning to be used with consumer products and they contain bits of data, such as product serial number. Scanners will automatically read the information on an RFID chip into a database, so the companies can keep track of sales and inventory. Keeping track of inventory will enable suppliers to keep track of trends and react to market changes. In addition, RFID chips will assist in increasing the speed of communication on a supply chain. The information between parties will travel faster, which will improve the responsiveness of buyers and ordering information on the supply chain. The risk of using RFID chip tags stems from privacy concerns. It is feared that computer pirates will figure out security controls and be able to scan shoppers’ merchandise and determine what they have bought. In order to avoid this risk, companies are considering turning of RFID tags once the items are purchased.

5. It may be inappropriate to compare the inventory turnover ratios of companies in different industries because the production process, requirements and the length of production run varies across different industries. The shorter the production time, the less the need for inventory.

In addition, the material delivery lead times may vary between different industries. The higher the variability of lead time and the longer the lead time, the greater the need for inventory. As supplier reliability increases, the need for inventory decreases. The industries with higher forecast accuracies have less of a need for inventories.

6. a. Only one product is involved.

b. Annual demand requirements are known.

c. Demand is spread evenly throughout the year so that the demand rate is reasonably constant.

d. Lead time does not vary.

e. Each order is received in a single delivery.

f. There are no quantity discounts

7. The total cost curve is relatively flat in the vicinity of the EOQ, so that there is a “zone” of values of order quantity for which the total cost is close to its minimum. The fact that the EOQ calculation involves taking a square root lessens the impact of estimation errors. Also, errors may cancel each other out.

8. As the carrying cost increases, holding inventory becomes more expensive. Therefore, in order to avoid higher inventory carrying costs, the company will order more frequently in smaller quantities because ordering smaller quantities will lead to carrying less inventory.

9. Safety stock is inventory held in excess of expected demand to reduce the risk of stockout presented by variability in either lead time or demand rates.

10. Safety stock is large when large variations in lead time and/or usage are present. Conversely, small variations in usage or lead time require small safety stock. Safety stock is zero when usage and lead time are constant, or when the service level is 50 percent (and hence, z = 0).

11. Service level can be defined in a number of ways. The text focuses mainly on “the probability that demand will not exceed the amount on hand.” Other definitions relate to the percentage of cycles per year without a stockout, or the percentage of annual demand satisfied from inventory. (This last definition often tends to confuse students in my experience.)

Increasing the service level requires increasing the amount of safety stock.

12. The A-B-C approach refers to the classification of items stocked according to some measure of importance (e.g., cost, cost-volume, criticalness, cost of stockout) and allocating control efforts on that basis.

13. In effect, this situation is a “quantity discount” case with a time dimension. Hence, buying larger quantities will result in lower annual purchase costs, lower ordering costs (fewer orders), but increased carrying costs. Since it is unlikely that the compressor supplier announces price increases far in advance, the purchasing agent will have to develop a forecast of future price increases to use in determining order size. Unlike the standard discount approach, the agent may opt to use trial and error to determine the best order size, taking into account the three costs (carrying, ordering and purchasing). In any event, it is reasonable to expect that a larger order size would be more appropriate; although obsolescence may also be a factor.

14. Annual carrying costs are determined by average inventory. Hence, a decrease in average inventory is desirable, if possible. Average inventory is Qo/2, and Qo decreases (run size model) if setup cost, S, decreases.

15. The Single-Period Model is used when inventory items have a limited useful life (i.e., items are not carried over from one period to the next).

16. Yes. When excess costs are high and shortage costs are low, the optimum stocking level is less than expected demand.

17. A company can reduce the need for inventories by:

using standardized parts

improved forecasting of demand

using preventive maintenance on equipment and machines

reducing supplier delivery lead times and delivery reliability

utilizing reliable suppliers and improving the relationships in the supply chain

restructuring the supply chain so that the supplier holds the inventory

reducing production lead time by using more efficient manufacturing methods

developing simpler product designs with fewer parts.

1. a. If we buy additional amounts of a particular good to take advantage of quantity discounts, then we will save money on a per unit purchasing cost of the item. We will also save on ordering cost because since we bought a larger quantity, we will not have to order this item as frequently. However, as a result of ordering larger quantity, we will have to carry larger inventory in stock, which in turn will result in an increase in inventory holding cost.

b. If we treat holding cost as a percentage of the unit price, as the unit price increases, so will the holding cost, and as a result, if we are using the EOQ approach, we will have to place a smaller order, resulting in a lesser inventory. On the other hand, if we use a constant amount of a holding cost, the inventory decisions will not be affected by the changes in unit cost (price) of the item.

c. Conducting a cycle count once a quarter instead of once a year will result in more frequent counting, which will result in an increase in labor and overhead costs. However, the more frequent counting would also lead to less errors in inventory accuracy and more timely detection of errors, which in turn would lead to timely deliveries to customers, less work in process inventory, more efficient operations, improved customer service, and assurance of material availability.

2. In making inventory decisions involving holding costs, setting inventory levels and deciding on quantity discount purchases, the materials manager, plant manager, production planning and control manager, the purchasing manager, and in some cases the planners who work in production planning and control or purchasing departments should be involved. The level and the nature of involvement will depend on the organizational structure of the company and the type of product being manufactured or purchased.

3. The technology has had a tremendous impact on inventory management. The utilization of bar coding has not only reduced the cost of taking physical inventory but also enabled real time updating of inventory records. The satellite control systems available in trucks and automobiles has enabled companies to determine and track the location of in-transit inventory.

1. Including a wider range of foods provide fast food companies with a competitive edge in terms of improving customer satisfaction and service. However, it has also complicated the operational function of the company. Expansion of menu offerings can create problems for inventory management because there are more ingredients and inventory items to order and to control the levels of inventory. This means higher labor costs in terms of placing orders, increased storage facility needs and increased need for coordinating the shipments from the supplier so that deliveries can be at low cost and efficient. Increasing the variety of items on the menu will also cause problems with forecasting. Since we have more items on the menu, it is likely that the demand for current menu items will decrease. The forecasts for all items will need to be revised. If we are not able to estimate this possible decrease, then the forecasting problem will result in excess or insufficient inventory levels.

2. a. How important is the item? For example, does it relate to a holiday or other important event,

such as graduation cards?

b. Are comparable substitutes readily available?

c. What competitor alternatives are available to customers?

d. Is this an occasional occurrence, or indicative of a larger, perhaps ongoing, problem?

3. Among considerations are:

How many stamps does he now have? Does he know how many he has? If so, how many?

What is his usage rate or current need for stamps?

What else does he need the cash for today?

Can he get more money at a bank or ATM?

How long will it be before he will return to the post office?

Will the post office be closed for a holiday or a Sunday?

Can he buy stamps elsewhere in case he runs low?

How convenient is it for him to visit the post office?

Can he purchase “forever stamps” and temporarily avoid a price increase?

4. Student answers will vary.

Memo Writing Exercises1. Cost of carrying inventory must be weighted against the following costs:

cost of shortages (finished goods inventory)

cost of failures (work-in-process inventory)

cost of supplier reliability

cost of ordering

cost of setups

cost of quantity discounts

cost of smoothing production for seasonal products.

2. The possible advantages of using a single supplier include:

obtaining a discount due to additional volume purchased from the supplier

building trust and working with the supplier so that the material will be delivered in a timely fashion to avoid stockouts and excess inventory.

The possible advantages of using multiple suppliers include:

the adverse effect of tardiness will be felt much less when there are multiple sources for the materials.

The main advantage of using the fixed order interval model is the reduction in ordering cost because orders for different parts are aggregated during the order interval.

The main disadvantage of using the fixed order interval model is that the company faces the risk of experiencing shortages during the fixed interval.

In this particular situation, the advantages of using a single supplier may be offset by using the fixed order interval model.

Solutions

| 1. a. | | Item | Usage | Unit Cost | Usage x Unit Cost | Category |

| | | 4021 | 90 | $1,400 | $126,000 | A |

| | | 9402 | 300 | 12 | 3,600 | C |

| | | 4066 | 30 | 700 | 21,000 | B |

| | | 6500 | 150 | 20 | 3,000 | C |

| | | 9280 | 10 | 1,020 | 10,200 | C |

| | | 4050 | 80 | 140 | 11,200 | C |

| | | 6850 | 2,000 | 10 | 20,000 | B |

| | | 3010 | 400 | 20 | 8,000 | C |

| | | 4400 | 5,000 | 5 | 25,000 | B |

In descending order:

| | | Item | | Usage x Cost | | Category |

| | | 4021 | | $126,000 | | A |

| | | | | | | |

| | | 4400 | | 25,000 | | B |

| | | 4066 | | 21,000 | | B |

| | | 6850 | | 20,000 | | B |

| | | | | | | |

| | | 4050 | | 11,200 | | C |

| | | 9280 | | 10,200 | | C |

| | | 3010 | | 8,000 | | C |

| | | 9402 | | 3,600 | | C |

| | | 6500 | | 3,000 | | |

| | | | | 228,000 | | |

| 1. b. | Category | Percent of Items | Percent of Total Cost |

| 11.1% | 55.3% | ||

| 33.3% | 28.9% | ||

| 55.6% | 15.8% |

2. The following table contains figures on the monthly volume and unit costs for a random sample of 16 items for a list of 2,000 inventory items.

| | | | | | Dollar | |

| | | Item | Unit Cost | Usage | Usage | Category |

| | | K34 | 10 | 200 | 2,000 | C |

| | | K35 | 25 | 600 | 15,000 | A |

| | | K36 | 36 | 150 | 5,400 | B |

| | | M10 | 16 | 25 | 400 | C |

| | | M20 | 20 | 80 | 1,600 | C |

| | | Z45 | 80 | 250 | 16,000 | A |

| | | F14 | 20 | 300 | 6,000 | B |

| | | F95 | 30 | 800 | 24,000 | A |

| | | F99 | 20 | 60 | 1,200 | C |

| | | D45 | 10 | 550 | 5,500 | B |

| | | D48 | 12 | 90 | 1,080 | C |

| | | D52 | 15 | 110 | 1,650 | C |

| | | D57 | 40 | 120 | 4,800 | B |

| | | N08 | 30 | 40 | 1,200 | C |

| | | P05 | 16 | 500 | 8,000 | B |

| | | P09 | 10 | 30 | 300 | C |

a. Develop an A-B-C classification for these items. [See table.]

b. How could the manager use this information? To allocate control efforts.

c. It might be important for some reason other than dollar usage, such as cost of a stockout, usage highly correlated to an A item, etc.

3. D = 1,215 bags/yr.

S = $10

H = $75

a. ![]()

b. Q/2 = 18/2 = 9 bags

c. ![]()

![]()

e. Assuming that holding cost per bag increases by $9/bag/year

Q = 17 bags

![]()

Increase by [$1,428.71 – $1,350] = $78.71

4. D = 40/day x 260 days/yr. = 10,400 packages

S = $60 H = $30

a. ![]()

b.

![]()

c. Yes

d. ![]()

TC200 = 3,000 + 3,120 = $6,120

6,120 – 6,118.82 (only $1.18 higher than with EOQ, so 200 is acceptable.)

5. D = 750 pots/mo. x 12 mo./yr. = 9,000 pots/yr.

Price = $2/pot S = $20 H = ($2)(.30) = $.60/unit/year

a. ![]()

![]()

TC = 232.35 + 232.36

= 464.71

If Q = 1500

![]()

TC = 450 + 120 = $570

Therefore the additional cost of staying with the order size of 1,500 is:

$570 – $464.71 = $105.29

b. Only about one half of the storage space would be needed.

6. u = 800/month, so D = 12(800) = 9,600 crates/yr.

H = .35P = .35($10) = $3.50/crate per yr.

S = $28

![]()

a. ![]()

TC at EOQ: ![]() Savings approx. $364.28 per year.

Savings approx. $364.28 per year.

7. H = $2/month

S = $55

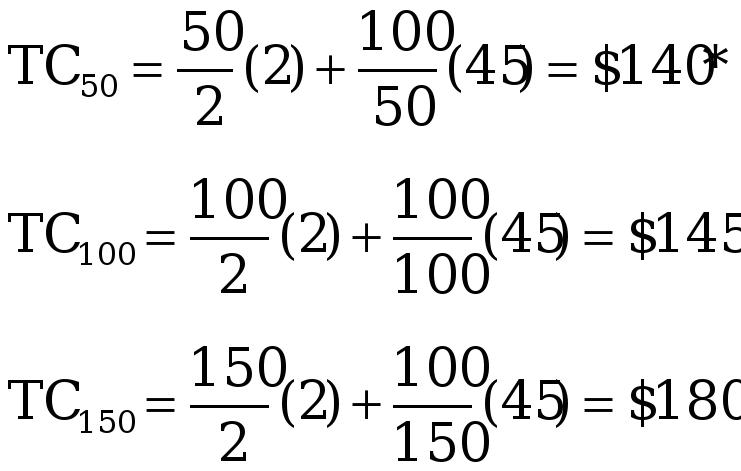

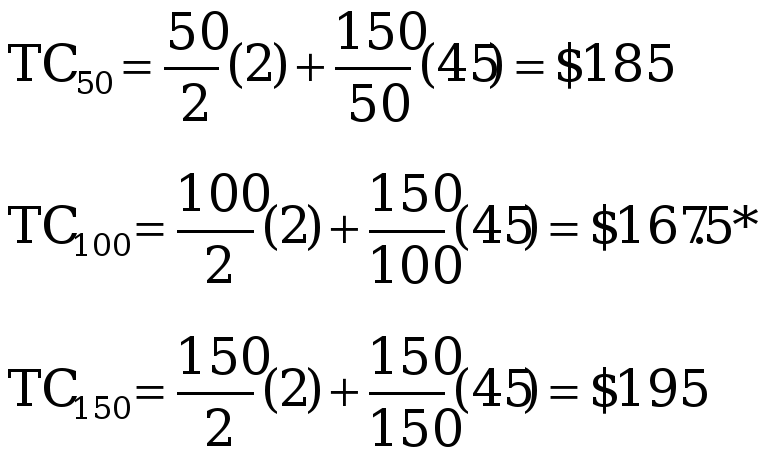

D1 = 100/month (months 1–6)

D2 = 150/month (months 7–12)

a. ![]()

![]()

b. The EOQ model requires this.

c. Discount of $10/order is equivalent to S – 10 = $45 (revised ordering cost)

1–6 TC74 = $148.32

7–12 TC91 = $181.66

8. D = 27,000 jars/month

H = $.18/month

S = $60

a. ![]()

TC=

TC4,000 = $765.00

Difference

TC4,243 = TC4000 = ![]()

TC4243 = ![]()

b. Current:

Forto equal 10, Q must be 2,700

![]()

Solving, S = $24.30

c. the carrying cost happened to increase rather dramatically from $.18 to approximately $.3705.

![]()

Solving, H = $.3705

9. p = 5,000 hotdogs/day

D= 250/day x 300 days/yr. = 75,000 hotdogs/yr.

u = 250 hotdogs/day300 days per year

S = $66

H = $.45/hotdog per yr.

a. ![]()

b. D/Qo = 75,000/4,812 = 15.59, or about 16 runs/yr.

c. run length: Qo/p = 4,812/5,000 = .96 days, or approximately 1 day

10. p = 50/ton/day

D= 20 tons/day x 200 days/yr. = 4,000 tons/yr.

u = 20 tons/day200 days/yr.

S = $100

H = $5/ton per yr.

a. ![]()

b. ![]()

Average is tons [approx. 3,098 bags]

c. Run length =