I need help with an analyais and calculations of 125 words please !!!Calculates and analyzes the following ratio listed for their selected company for the last two years from the SEC Form 10-K. . E

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

|

|

|

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 3, 2017

or

|

| |

|

|

|

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to _________

Commission file number 1-7898

LOWE’S COMPANIES, INC.

(Exact name of registrant as specified in its charter)

|

| ||

|

|

|

|

| NORTH CAROLINA |

| 56-0578072 |

| (State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

| ||

|

|

|

|

| 1000 Lowe’s Blvd., Mooresville, NC |

| 28117 |

| (Address of principal executive offices) |

| (Zip Code) |

|

|

|

|

| Registrant’s telephone number, including area code |

| 704-758-1000 |

|

| ||

|

|

|

|

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of each class |

| Name of each exchange on which registered |

| Common Stock, $0.50 Par Value |

| New York Stock Exchange (NYSE) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| |||

|

|

|

|

|

| Large accelerated filer | Accelerated filer | Non-accelerated filer | Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No

As of July 29, 2016, the last business day of the Company’s most recent second quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $72.4 billion based on the closing sale price as reported on the New York Stock Exchange.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

| ||

|

|

|

|

| CLASS |

| OUTSTANDING AT 3/31/2017 |

| Common Stock, $0.50 par value |

| 857,332,918 |

DOCUMENTS INCORPORATED BY REFERENCE

|

| ||

|

|

|

|

| Document |

| Parts Into Which Incorporated |

| Portions of the Proxy Statement for Lowe’s 2017 Annual Meeting of Shareholders |

| Part III |

LOWE’S COMPANIES, INC.

- TABLE OF CONTENTS -

|

| |||

|

|

|

|

|

|

| Page No. | ||

| PART I |

| ||

|

| Item 1. | Business | 4 |

|

| Item 1A. | Risk Factors | 9 |

|

| Item 1B. | Unresolved Staff Comments | 14 |

|

| Item 2. | Properties | 14 |

|

| Item 3. | Legal Proceedings | 14 |

|

| Item 4. | Mine Safety Disclosures | 15 |

|

|

| Executive Officers and Certain Significant Employees of the Registrant | 16 |

|

|

|

|

|

| PART II |

| ||

|

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 17 |

|

| Item 6. | Selected Financial Data | 18 |

|

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 |

|

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 34 |

|

| Item 8. | Financial Statements and Supplementary Data | 36 |

|

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 69 |

|

| Item 9A. | Controls and Procedures | 69 |

|

| Item 9B. | Other Information | 69 |

|

|

|

|

|

| PART III |

| ||

|

| Item 10. | Directors, Executive Officers and Corporate Governance | 70 |

|

| Item 11. | Executive Compensation | 70 |

|

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 70 |

|

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 70 |

|

| Item 14. | Principal Accountant Fees and Services | 70 |

|

|

|

| |

| PART IV |

| ||

|

| Item 15. | Exhibits and Financial Statement Schedules | 71 |

|

| Item 16. | Form 10-K Summary | 79 |

|

|

|

|

|

|

|

| Signatures | 80 |

Table of Contents

Part I

Item 1 - Business

General Information

Lowe’s Companies, Inc. and subsidiaries (the Company or Lowe’s) is a Fortune® 50 company and the world’s second largest home improvement retailer. As of February 3, 2017, Lowe’s operated 2,129 home improvement and hardware stores, representing approximately 213 million square feet of retail selling space. These operations were comprised of 1,820 stores located across 50 U.S. states, including 87 Orchard Supply Hardware (Orchard) stores, as well as 299 stores in Canada, and 10 stores in Mexico.

During 2016, Lowe’s acquired RONA inc. (RONA) which owns and operates 245 stores in Canada as of February 3, 2017, as well as services approximately 236 dealer-owned stores. The RONA stores represent various complementary store formats operating under various banners.

Lowe’s was incorporated in North Carolina in 1952 and has been publicly held since 1961. The Company’s common stock is listed on the New York Stock Exchange - ticker symbol “LOW”.

See Item 6, “Selected Financial Data”, of this Annual Report on Form 10-K (Annual Report), for historical revenues, profits and identifiable assets. For additional information about the Company’s performance and financial condition, see also Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, of this Annual Report.

Customers, Market and Competition

Our Customers

We serve homeowners, renters, and professional customers (Pro customers). Retail customers, comprised of individual homeowners and renters, complete a wide array of projects and vary along the spectrum of do-it-yourself (DIY) and do-it-for-me (DIFM). The Pro customer consists of two broad categories: construction trades; and maintenance, repair & operations.

Our Market

The U.S. market remains our predominant market, accounting for approximately 94% of consolidated sales as of February 3, 2017. We are among the many businesses, including home centers, paint stores, hardware stores, lumber yards and garden centers, whose revenues are included in the Building Material and Garden Equipment and Supplies Dealers Subsector (444) of the Retail Trade Sector of the North American Industry Classification System (NAICS), the standard used by Federal statistical agencies in classifying business establishments for the purpose of collecting, analyzing, and publishing statistical data related to the U.S. business economy. The total annual revenue reported for businesses included in NAICS 444 in 2016 was $352.3 billion, which represented an increase of 5.9% over the amount reported for the same category in 2015. The total annual revenue reported for businesses included in NAICS 444 in 2015 was $332.6 billion, which represented an increase of 4.7% over the amount reported for the same category in 2014. These figures are subject to periodic revision by the U.S. Department of Commerce.

NAICS 444 represents less than half of what we consider the total U.S. market for our products and services. The broader market in which Lowe’s operates includes home-related sales through a variety of companies beyond those in NAICS 444. These consist of other companies in the retail sector, including mass retailers, home furnishings stores, and online retailers, as well as wholesalers that provide home-related products and services to homeowners, businesses, and the government. Based on our analysis of the most recent comprehensive data available, we estimate the size of the U.S. home improvement market at $775 billion in 2016, comprised of $578 billion of product sales and $197 billion of installed labor sales. That compares with $730 billion total market sales in 2015, comprised of $543 billion of product sales and $187 billion of installed labor sales. These figures are subject to periodic revision by the U.S. Department of Commerce and other third-party sources.

There are many variables that affect consumer demand for the home improvement products and services Lowe’s offers. Key indicators we monitor include real disposable personal income, employment, home prices, and housing turnover. We also monitor demographic and societal trends that shape home improvement industry growth.

4

Table of Contents

|

|

|

| • | Growth in real disposable personal income is projected to moderate to 2.3% in 2017 as compared with 2.8% growth in 2016, based on the March 2017 Blue Chip Economic Indicators ® . * |

|

|

|

| • | The average unemployment rate for 2017 is forecasted to decline to 4.6%, according to the March 2017 Blue Chip Economic Indicators, which would be an improvement from the 4.9% average rate in 2016. The unemployment rate should continue to trend lower as the job market continues to expand at a moderate pace. |

|

|

|

| • | Recent evidence suggests that home prices will continue to increase. In 2016, home prices increased an estimated 5.4% similar to the 5.5% increase in 2015, according to the latest Federal Housing Finance Agency index. Economists generally expect the rate of home price growth to moderate in 2017. |

|

|

|

| • | Housing turnover increased an estimated 5.1% in 2016 after a 7.3% increase in 2015, according to The National Association of Realtors and U.S. Census Bureau. Turnover is generally expected to continue to moderately increase in 2017, supported by persisting growth in the job market, rising incomes, and historically low mortgage rates. |

These indicators are important to our business because they signal a customer’s willingness to engage in home maintenance, repair, and upgrade projects and favorably impact income available to purchase our products and services. Overall, the outlook for the home improvement industry remains positive for 2017, supported by continuing gains in jobs and incomes, home buying, and home price appreciation.

*Blue Chip Economic Indicators® (ISSN: 0193-4600) is published monthly by Aspen Publishers, 76 Ninth Avenue, New York, NY 10011, a division of Wolters Kluwer Law and Business. Printed in the U.S.A.

Our Competition

The home improvement industry includes a broad competitive landscape. We compete with other national and international home improvement warehouse chains and lumberyards in most of our trade areas. We also compete with traditional hardware, plumbing, electrical, home supply retailers, and maintenance and repair organizations. In addition, we compete with general merchandise retailers, warehouse clubs, and online and other specialty retailers as well as service providers that install home improvement products. Location of stores continues to be a key competitive factor in our industry; however, the increasing use of technology and the simplicity of online shopping also underscore the importance of omni-channel capabilities as a competitive factor. We differentiate ourselves from our competitors by providing better customer experiences while delivering superior value in products and service. See further discussion of competition in Item 1A, “Risk Factors”, of this Annual Report.

Products and Services

Our Products

Product Selection

To meet customers’ varying home improvement needs, we offer a complete line of products for maintenance, repair, remodeling, and decorating. We offer home improvement products in the following categories: Lumber & Building Materials; Tools & Hardware; Appliances; Fashion Fixtures; Rough Plumbing & Electrical; Seasonal Living; Lawn & Garden; Paint; Millwork; Flooring; Kitchens; Outdoor Power Equipment; and Home Fashions. A typical Lowe’s-branded home improvement store stocks approximately 37,000 items, with hundreds of thousands of additional items available through our Special Order Sales system and various online selling channels. See Note 17 of the Notes to Consolidated Financial Statements included in Item 8, “Financial Statements and Supplementary Data”, of this Annual Report for historical revenues by product category for each of the last three fiscal years.

We are committed to offering a wide selection of national brand-name merchandise complemented by our selection of private brands. In addition, we are dedicated to ensuring the products we sell are sourced in a socially responsible, efficient, and cost effective manner.

National Brand-Name Merchandise

In many product categories, customers look for a familiar and trusted national brand to instill confidence in their purchase. Lowe’s home improvement stores carry a wide selection of national brand-name merchandise such as Whirlpool ® , GE ® , LG ® , and Samsung ® appliances, Stainmaster ® carpets, Valspar ® paints and stains, Pella ® windows and doors, Sylvania ® light bulbs, Dewalt ® power tools, Hitachi ® pneumatic tools, Owens Corning ® insulation and roofing, GAF ® roofing, James Hardie ® fiber cement siding, Husqvarna ® outdoor power equipment, Werner ® ladders, and many more. In 2016, we added

5

Table of Contents

brand name merchandise such as Pergo® hardwood flooring, Quoizel® lighting, Marshalltown® masonry tools, and a suite of Nest ® products to our portfolio. Our merchandise selection provides the retail and Pro customer a one-stop shop for a wide variety of national brand-name merchandise needed to complete home improvement, repair, maintenance, or construction projects.

Private Brands

Private brands are an important element of our overall portfolio, helping to provide significant value and coordinated style across core categories. We sell private brands in several of our product categories. Some of Lowe’s most important private brands include Kobalt ® tools, allen+roth ® home décor products, Blue Hawk ® home improvement products, Project Source ® basic value products, Portfolio ® lighting products, Garden Treasures ® lawn and patio products, Utilitech ® electrical and utility products, Reliabilt ® doors and windows, Aquasource ® faucets, sinks and toilets, Harbor Breeze ® ceiling fans, Top Choice ® lumber products and Iris ® home automation and management products.

Supply Chain

We source our products from vendors worldwide and believe that alternative and competitive suppliers are available for virtually all of our products. Whenever possible, we purchase directly from manufacturers to provide savings for customers and improve our gross margin.

To efficiently move product from our vendors to our stores and maintain in-stock levels, we own and operate distribution facilities that enable products to be received from vendors, stored and picked, or cross-docked, and then shipped to our retail locations or directly to customers. These facilities include 15 highly-automated Regional Distribution Centers (RDC) in the United States. On average, each domestic RDC serves approximately 118 stores. We also own and operate ten distribution centers, including four lumber yards, to serve our Canadian market, and we lease and operate a distribution facility to serve our Orchard stores. Additionally, we have a service agreement with a third party logistics provider to manage a distribution facility to serve our stores in Mexico.

In addition to the RDCs, we also operate coastal holding facilities, transload facilities, appliance distribution centers, and flatbed distribution centers. The flatbed distribution centers distribute merchandise that requires special handling due to size or type of packaging such as lumber, boards, panel products, pipe, siding, ladders, and building materials. Collectively, our facilities enable our import and e-commerce, as well as parcel post eligible products, to get to their destination as efficiently as possible. Most parcel post items can be ordered by a customer and delivered within two business days at standard shipping rates.

In fiscal 2016, on average, approximately 80% of the total dollar amount of stock merchandise we purchased was shipped through our distribution network, while the remaining portion was shipped directly to our stores from vendors.

Our Services

Installed Sales

We offer installation services through independent contractors in many of our product categories, with Appliances, Flooring, Kitchens, Lumber & Building Materials, and Millwork accounting for the majority of installed sales. Our Installed Sales model, which separates selling and project administration tasks, allows our sales associates to focus on project selling, while project managers ensure that the details related to installing the products are efficiently executed. Installed Sales, which includes both product and labor, accounted for approximately 7% of total sales in fiscal 2016.

Extended Protection Plans and Repair Services

We offer extended protection plans in Kitchens, Appliances, Tools & Hardware, Outdoor Power Equipment, Seasonal Living, Rough Plumbing Electrical Fixtures, and Garage Door Openers. These protection plans provide customers with product protection that enhances or extends coverage previously offered by the manufacturer’s warranty. The protection plans provide in-warranty and out-of-warranty repair services for major appliances, outdoor power equipment, tools, grills, fireplaces, air conditioners, water heaters, and other eligible products through our stores or in the home through the Lowe’s Authorized Service Repair Network. We offer replacement plans for products in most of these categories when priced below $300, or otherwise specified category specific price points. Our contact center takes customers’ calls, assesses the problems, and facilitates resolutions, making after-sales service easier for our customers because we manage the entire process.

Selling Channels

We are continuing our progress towards becoming an omni-channel retail company, which allows our customers to move from channel to channel with simple and seamless transitions even within the same transaction. For example, for many projects,

6

Table of Contents

more than half of our customers conduct research online before making an in-store purchase. For purchases made on Lowes.com, approximately 60% are picked up in-store, 10% are delivered from a store, and 30% are parcel shipped. For the 60% picked up in-store, 40% of those customers elect to purchase additional products when they arrive in our stores. Regardless of the channels through which customers choose to engage with us, we strive to provide them with a seamless experience across channels and an endless aisle of products, enabled by our flexible fulfillment capabilities. Our ability to sell products in-store, online, on-site, or through our contact centers speaks to our ability to leverage our existing infrastructure with the omni-channel capabilities we continue to introduce.

In-Store

Our 1,797 Lowe’s-branded home improvement stores, inclusive of 1,733 in the U.S., 54 in Canada and 10 in Mexico, are generally open seven days per week and average approximately 112,000 square feet of retail selling space, plus approximately 32,000 square feet of outdoor garden center selling space. The 245 stores acquired in the RONA acquisition operate under various complementary store formats that address target customers and occasions. In addition, we operate 87 Orchard hardware stores located throughout California, Oregon, and Florida that also serve home improvement customers and average approximately 36,000 square feet of retail selling space. Our home improvement stores in the U.S. and Canada offer similar products and services, with certain variations based on local market factors; however, Orchard stores are primarily focused on paint, repair, and backyard products. We continue to develop and implement tools to make our sales associates more efficient and to integrate our order management and fulfillment processes. Our home improvement stores have Wi-Fi capabilities that provide customers with internet access, making information available quickly to further simplify the shopping experience.

Online

Through our websites and mobile applications, we seek to empower consumers by providing a 24/7 shopping experience, online product information, customer ratings and reviews, online buying guides and how-to videos and other information. These tools help consumers make more informed purchasing decisions and give them increased confidence to undertake home improvement projects. In 2016, sales through our online selling channels accounted for approximately 3.5% of our total sales. We enable customers to choose from a variety of fulfillment options, including buying online and picking up in-store as well as delivery or parcel shipment to their homes.

In addition, our LowesForPros.com online tool allows for easy online ordering for our Pro customers, and their choice of in-store pick-up or delivery, saving them time and money.

On-Site

We have on-site specialists available for retail and Pro customers to assist them in selecting products and services for their projects. Our Account Executives ProServices meet with Pro customers at their place of business or on a job site and leverage stores within the area to ensure we meet customer needs for products and resources. Our Project Specialist Exteriors (PSE) program is available in all U.S. Lowe’s home improvement stores to discuss exterior projects such as roofing, siding, fencing, and windows, whose characteristics lend themselves to an in-home consultative sales approach. In addition, our Project Specialist Interiors (PSI) program is also now available in all U.S. Lowe’s home improvement stores to provide similar consultative services on interior projects such as kitchens and bathrooms.

Contact Centers

Lowe’s operates three contact centers which are located in Wilkesboro, NC, Albuquerque, NM, and Indianapolis, IN. These contact centers help Lowe’s enable an omni-channel customer experience by providing the ability to tender sales, coordinate deliveries, manage after-sale installations, facilitate repair services for Appliances and Outdoor Power Equipment, and answer general customer questions via phone, mail, e-mail, live chat, and social media.

Employees

As of February 3, 2017, we employed approximately 190,000 full-time and 100,000 part-time employees. Our employees in Mexico, and certain employees in Canada, are subject to collective bargaining agreements. No other employees are subject to collective bargaining agreements. Management considers its relations with employees to be good.

Seasonality and Working Capital

The retail business in general is subject to seasonal influences, and our business is, to some extent, seasonal. Historically, we have realized the highest volume of sales during our second fiscal quarter (May, June and July) and the lowest volume of sales during our fourth fiscal quarter (November, December and January). Accordingly, our working capital requirements have historically been greater during our fourth fiscal quarter as we build inventory in anticipation of the spring selling season and as we experience lower fourth fiscal quarter sales volumes. We fund our working capital requirements primarily through cash

7

Table of Contents

flows generated from operations, but also with short-term borrowings, as needed. For more detailed information, see the Financial Condition, Liquidity and Capital Resources section in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, of this Annual Report.

Intellectual Property

The name “Lowe’s” is a registered service mark of one of our wholly-owned subsidiaries. We consider this mark and the accompanying name recognition to be valuable to our business. This subsidiary and other wholly owned subsidiaries own and maintain various additional registered and unregistered trademarks, trade names and service marks, including but not limited to retail names “RONA”, “Reno Depot”, and “Orchard Supply Hardware”, online retail name “ATG Stores”, and private brand product names “Kobalt” and “allen+roth”. These subsidiaries also maintain various Internet domain names that are important to our business, and we also own registered and unregistered copyrights. In addition, we maintain patent portfolios related to some of our products and services and seek to patent or otherwise protect certain innovations that we incorporate into our products, services, or business operations.

Environmental Stewardship

Lowe’s knows that operating a business can impact the environment and our communities, and we continue to work to positively influence that impact. It is a responsibility we take seriously.

In 2016, we created a Sustainability & Product Stewardship Council, led by senior executives, to review significant strategies and policies regarding sustainability and product stewardship, and make recommendations across the organization. The company initiated work on a comprehensive sustainability strategy that creates business value and supports our purpose, and we expect to finalize that strategy during 2017.

Each year, Lowe’s participates in the Carbon Disclosure Project to track our carbon footprint. In 2016, Lowe’s externally verified its greenhouse gas emissions data collection and analysis to validate our findings and increase confidence in our reporting. In 2016, 32 retail locations upgraded to interior light-emitting diode (LED) lighting, and seven new stores opened with LED lighting already installed. We plan to continue to implement interior LED lighting and seek solutions for specific lighting needs to enhance energy efficiency as well as the customer experience.

In 2016, we expanded our test of a state-of-the-art building management system (BMS) to 100 stores. The BMS monitors equipment performance and provides valuable information that helps facility managers manage energy consumption to reduce costs and carbon emissions. Lowe’s conducted energy efficiency audits of heating, ventilation and air conditioning systems, and will be implementing upgrades to a number of systems in 2017.

Lowe’s is committed to promoting sustainable practices in the transportation industry. We collaborate with the Environmental Protection Agency’s SmartWay program to reduce transportation emissions by creating incentives for freight contractors to improve efficiency, and are proud to be one of only nine companies in 2016 to receive the Environmental Protection Agency SmartWay Excellence Award in the logistics and shipping category-the only retailer to achieve this honor eight years in a row.

Our recycling program continues to be a priority as we seek to reduce landfill waste and increase recycling at our stores and distribution centers. We operate in-store recycling centers at every Lowe’s store in the continental United States, encouraging customers to recycle compact fluorescent lamps, plastic bags, rechargeable batteries and cell phones. We offer haul-away service to customers who purchase replacement appliances, and our Garden Centers also accept plastic plant trays and pots for recycling.

Managing our water resources is essential in regions experiencing drought conditions. In 2016, we installed HydroPoint irrigation technology that combines real-time weather data with site-specific information to reduce water consumption and save on utility costs. The systems are in 200 locations and we expect to expand to 200 more in the coming year.

More than ever, customers expect products that are safe, socially and environmentally responsible, and also affordable. Lowe’s increasingly provides product choices that save energy and water, reduce potentially harmful chemicals, or mitigate safety concerns for their families. We also engage with our product suppliers, manufacturers and other external stakeholders to ensure we carry the most innovative new products.

For more information about Lowe’s environmental efforts, please visit Lowes.com/SocialResponsibility.

8

Table of Contents

Investing in Our Communities

Lowe’s has a long and proud history of supporting local communities through public education and community improvement projects, beginning with the creation of the Lowe’s Charitable and Educational Foundation in 1957. In 2016, Lowe’s and the Lowe’s Charitable and Educational Foundation donated approximately $38 million to schools and community organizations in the United States, Canada, and Mexico, including but not limited to the following discussed below.

Our commitment to improving educational opportunities is best exemplified by our signature education grant program, Lowe’s Toolbox for Education ® , and 2016 marked the program’s 11-year anniversary. In 2016, Lowe’s Toolbox for Education ® provided approximately $7 million in grants and since inception has provided funding improvements at nearly 12,000 schools, benefiting more than six million children.

Each year, we work with national nonprofit partners to strengthen and stabilize neighborhoods in the communities we serve. In 2016, Lowe’s contributed $7 million and teamed with Habitat for Humanity and Rebuilding Together to provide housing solutions in partnership with families across the country. We also continued to build on our longstanding partnerships with the Boys & Girls Clubs of America, SkillsUSA, The Nature Conservancy, and Keep America Beautiful to improve communities and build tomorrow’s leaders.

Lowe’s is also committed to helping residents of the communities we serve by being there when we’re needed most - when a natural disaster threatens and in the recovery that follows. In 2016, Lowe’s donated nearly $2.1 million and mobilized hundreds of Lowe’s Heroes employee volunteers to help families recover from disasters across the United States.

For the second year in a row, 100% of Lowe’s stores in the United States participated in a Lowe’s Heroes volunteer project.

For more information on Lowe’s partnerships and latest community improvement projects, visit Lowes.com/SocialResponsibility .

Available Information

Our Annual Report, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are made available free of charge through our internet website at www.Lowes.com/investor , as soon as reasonably practicable after such documents are electronically filed with, or furnished to, the Securities and Exchange Commission (SEC). The public may also read and copy any materials the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site, www.sec.gov , that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Item 1A - Risk Factors

We have developed a risk management process using periodic surveys, external research, planning processes, risk mapping, analytics and other tools to identify and evaluate the operational, financial, environmental, reputational, strategic and other risks that could adversely affect our business. For more information about our risk management framework, which is administered by our Chief Financial Officer and includes developing risk mitigation controls and procedures for the material risks we identify, see the description included in the definitive Proxy Statement for our 2017 annual meeting of shareholders (as defined in Item 10 of Part III of this Annual Report) under “Board’s Role in the Risk Management Process.”

We describe below certain risks that could adversely affect our results of operations, financial condition, business reputation or business prospects. These risk factors may change from time to time and may be amended, supplemented or superseded by updates to the risk factors contained in our future periodic reports on Form 10-K, Form 10-Q and reports on other forms we file with the Securities and Exchange Commission. All forward-looking statements about our future results of operations or other matters made by us in this Annual Report, in our Annual Report to Lowe’s Shareholders and in our subsequently filed reports to the Securities and Exchange Commission, as well as in our press releases and other public communications, are qualified by the risks described below.

You should read these risk factors in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 and our consolidated financial statements and related notes in Item 8. There also may be other factors that we cannot anticipate or that are not described in this Annual Report generally because we do not currently perceive them to be material. Those factors could cause results to differ materially from our expectations.

9

Table of Contents

We may be unable to adapt our business concept in a rapidly evolving retail environment to address the changing shopping habits, demands and demographics of our customers, or realize the intended benefits of organizational change initiatives.

The home improvement retail environment, like the retail environment generally, is rapidly evolving, and adapting our business concept to respond to our customers’ changing shopping habits and demands and their changing demographics is critical to our future success. Our success is dependent on our ability to identify and respond to the economic, social, style and other trends that affect demographic and consumer preferences in a variety of our merchandise categories and service offerings. Customers’ expectations about how they wish to research, purchase and receive products and services have also evolved. It is difficult to predict the mix of products and services that our customers will demand. Failure to identify such trends, adapt our business concept, and implement change, growth, and productivity initiatives successfully could negatively affect our relationship with our customers, the demand for the home improvement products and services we sell, the rate of growth of our business, our market share, and results of operations.

We may not be able to realize the benefits of our strategic initiatives focused on omni-channel sales and marketing presence if we fail to deliver the capabilities required to execute on them.

Our interactions with customers has evolved into an omni-channel experience as they increasingly are using computers, tablets, mobile phones and other devices to shop in our stores and online and provide feedback and public commentary about all aspects of our business. Omni-channel retail is quickly evolving, and we must anticipate and meet our customers’ expectations and counteract new developments and technology investments by our competitors. Our customer-facing technology systems must appeal to our customers, function as designed and provide a consistent customer experience. The success of our strategic initiatives to adapt our business concept to our customers’ changing shopping habits and demands and changing demographics will require us to deliver large, complex programs requiring more integrated planning, initiative prioritization and program sequencing. These initiatives will require new competencies in many positions, and our management, employees and contractors will have to adapt and learn new skills and capabilities. To the extent they are unable or unwilling to make these transformational changes, we may be unable to realize the full benefits of our strategic initiatives and expand our relevant market access. Our results of operations, financial condition or business prospects could also be adversely affected if we fail to provide a consistent experience for our customers, regardless of sales channel, if our technology systems do not meet our customers’ expectations, if we are unable to counteract new developments and innovations implemented by our competitors, or if we are unable to attract, retain, and manage the talent succession of additional personnel at various levels of the Company who have the skills and capabilities we need to implement our strategic initiatives and drive the changes that are essential to successfully adapting our business concept in the rapidly changing retail environment.

Our business and our reputation could be adversely affected by the failure to protect sensitive customer, employee, vendor or Company information or to comply with evolving regulations relating to our obligation to protect our systems, assets and such information from the threat of cyber-attacks.

Cyber-attacks and tactics designed to gain access to and exploit sensitive information by breaching mission critical systems of large organizations are constantly evolving, and high profile electronic security breaches leading to unauthorized release of sensitive customer information have occurred in recent years with increasing frequency at a number of major U.S. companies, including several large retailers, despite widespread recognition of the cyber-attack threat and improved data protection methods. As with many other retailers, we receive and store certain personal information about our customers, employees and vendors. Additionally, we use third-party service providers for services, such as authentication, content delivery, back-office support and other functions. Despite our continued vigilance and investment in information security, we or our third-party service providers may be unable to adequately anticipate or prevent a breach in our or their systems that results in the unauthorized release of sensitive data. Should this occur, it may have a material adverse effect on our reputation, drive customers away and lead to financial losses from remedial actions, or potential liability, including possible punitive damages. A security breach resulting in the unauthorized release of sensitive data from our or our third-party service providers’ information systems could also materially increase the costs we already incur to protect against such risks. In addition, as the regulatory environment relating to retailers and other companies’ obligation to protect such sensitive data becomes stricter, a material failure on our part to comply with applicable regulations could subject us to fines or other regulatory sanctions and potentially to lawsuits.

We are subject to payments-related risks that could increase our operating costs, expose us to fraud, subject us to potential liability and potentially disrupt our business.

We accept payments using a variety of methods, including credit cards, debit cards, credit accounts, our private label and co-branded credit cards, gift cards, direct debit from a customer’s bank account, consumer invoicing and physical bank checks, and we may offer different payment options over time. These payment options subject us to many compliance requirements, including, but not limited to, compliance with payment card association operating rules, including data security rules, certification requirements, rules governing electronic funds transfers and Payment Card Industry Data Security Standards. They also subject us to potential fraud by criminal elements seeking to discover and take advantage of security vulnerabilities

10

Table of Contents

that may exist in some of these payment systems. For certain payment methods, including credit and debit cards, we pay interchange and other fees, which may increase over time and raise our operating costs and lower profitability. We rely on third parties to provide payment processing services, including the processing of credit cards, debit cards, electronic checks, gift cards and promotional financing, and it could disrupt our business if these companies become unwilling or unable to provide these services to us. If we fail to comply with these rules or requirements, or if our data security systems are breached or compromised, we may be liable for card issuing banks’ costs, subject to fines and higher transaction fees, and lose our ability to accept credit and debit card payments from our customers, process electronic funds transfers, or facilitate other types of online payments, and our business and operating results could be adversely affected.

As customer-facing technology systems become an increasingly important part of our omni-channel sales and marketing strategy, the failure of those systems to perform effectively and reliably could keep us from delivering positive customer experiences.

Access to the Internet from computers, tablets, smart phones and other mobile communication devices has empowered our customers and changed the way they shop and how we interact with them. Our websites, including Lowes.com and Lowesforpros.com, are a sales channel for our products, and are also a method of making product, project and other relevant information available to our customers that impacts our in-store sales. Additionally, we have multiple affiliated websites and mobile apps through which we seek to inspire, inform, cross-sell, establish online communities among and otherwise interact with our customers. Performance issues with these customer-facing technology systems, including temporary outages caused by distributed denial of service, ransomware or other cyber-attacks, or a complete failure of one or more of them without a disaster recovery plan that can be quickly implemented, could quickly destroy the positive benefits they provide to our home improvement business and negatively affect our customers’ perceptions of Lowe’s as a reliable online vendor and source of information about home improvement products and services.

If we fail to hire, train, manage and retain qualified sales associates and specialists with expanded skill sets or corporate support staff with the capabilities of delivering on strategic objectives, we could lose sales to our competitors and our labor costs, resulting from operations or the execution of corporate strategies, could be negatively affected.

Our customers, whether they are homeowners, renters or commercial businesses, expect our sales associates and specialists to be well trained and knowledgeable about the products we sell and the home improvement services we provide. We compete with other retailers for many of our sales associates and specialists, and we invest significantly in them with respect to training and development to strive for high engagement. Increasingly, our sales associates and specialists must have expanded skill sets, including, in some instances, the ability to do in-home or telephone sales. A critical challenge we face is attracting and retaining a sufficiently diverse workforce that can deliver relevant, culturally competent and differentiated experiences for a wide variety of culturally diverse customers. In fact, in many of our stores, our employees must be able to serve customers whose primary language and cultural traditions are different from their own. Additionally, in order to deliver on the omni-channel expectations of our customers, we rely on the specialized training and capabilities of corporate support staff which are broadly sought after by our competitors. If we are unable to hire, train, manage and retain qualified sales associates and specialists, the quality of service we provide to our customers may decrease and our results of operations could be negatively affected. Furthermore, our ability to meet our labor needs while controlling our costs is subject to a variety of external factors, including wage rates, the availability of and competition for talent, health care and other benefit costs, our brand image and reputation, changing demographics, and adoption of new or revised employment and labor laws and regulations. Periodically, we are subject to labor organizing efforts, and if we become subject to collective bargaining agreements in the future, it could adversely affect how we operate our business and adversely affect our labor costs and our ability to retain a qualified workforce.

Positively and effectively managing our public image and reputation is critical to our business success, and, if our public image and reputation are damaged, it could negatively impact our relationships with our customers, vendors and store associates and specialists and, consequently, our business and results of operations.

Our public image and reputation are critical to ensuring that our customers shop at Lowe’s, our vendors want to do business with Lowe’s and our sales associates and specialists want to work for Lowe’s. We must continue to manage, preserve and grow Lowe’s public image and reputation. Any negative incident can erode trust and confidence quickly, and adverse publicity about us could damage our reputation and brand image, undermine our customers’ confidence, reduce demand for our products and services, affect our relationships with current and future vendors, impact our results of operations and affect our ability to retain and recruit store associates and specialists. The significant expansion in the use of social media over recent years has compounded the potential scope of the negative publicity that could be generated by such negative incidents.

Strategic transactions, such as our acquisition of RONA, involve risks, and we may not realize the expected benefits because of numerous uncertainties and risks.

We regularly consider and enter into strategic transactions, including mergers, acquisitions, joint ventures, investments and other growth, market and geographic expansion strategies, with the expectation that these transactions will result in increases in

11

Table of Contents

sales, cost savings, synergies and other various benefits. Our ability to deliver the expected benefits from any strategic transaction is subject to numerous uncertainties and risks, including our ability to integrate personnel, labor models, financial, IT and other systems successfully; disruption of our ongoing business and distraction of management; hiring additional management and other critical personnel; and increasing the scope, geographic diversity and complexity of our operations. Effective internal controls are necessary to provide reliable and accurate financial reports, and the integration of businesses may create complexity in our financial systems and internal controls and make them more difficult to manage. Integration of businesses into our internal control system could cause us to fail to meet our financial reporting obligations. Additionally, any impairment of goodwill or other assets acquired or divested in a strategic transaction or charges to earnings associated with any strategic transaction, may materially reduce our earnings. Our shareholders may react unfavorably to our strategic transactions, and, if we do not realize any anticipated benefits from such transactions, we may be exposed to additional liabilities of any acquired business or joint venture and we may be exposed to litigation in connection with the strategic transaction. Further, we may finance these strategic transactions by incurring additional debt, which could increase leverage or impact our ability to access capital in the future.

Failure to achieve and maintain a high level of product and service quality could damage our image with customers and negatively impact our sales, profitability, cash flows and financial condition.

Product and service quality issues could result in a negative impact on customer confidence in Lowe’s and our brand image. If our product and service offerings do not meet applicable safety standards or our customers’ expectations regarding safety or quality, we could experience lost sales and increased costs and be exposed to legal, financial and reputational risks. Actual, potential or perceived product safety concerns could expose us to litigation, as well as government enforcement action, and result in costly product recalls and other liabilities. As a result, Lowe’s reputation as a retailer of high quality products and services, including both national and Lowe’s private brands, could suffer and impact customer loyalty.

We have many competitors who could take sales and market share from us if we fail to execute our merchandising, marketing and distribution strategies effectively, or if they develop a substantially more effective or lower cost means of meeting customer needs, resulting in a negative impact on our business and results of operations.

We operate in a highly competitive market for home improvement products and services and have numerous large and small, direct and indirect competitors. The principal competitive factors in our industry include convenience, customer service, quality and price of merchandise and services, in-stock levels, and merchandise assortment and presentation. We face growing competition from online and multi-channel retailers who have a similar product or service offering. Customers are increasingly able to quickly comparison shop and determine real-time product availability and price using digital tools. Our failure to respond effectively to competitive pressures and changes in the markets for home improvement products and services could affect our financial performance. Moreover, changes in the promotional pricing and other practices of our competitors, including the effects of competitor liquidation activities, may impact our results.

Our inability to effectively and efficiently manage and maintain our relationships with selected suppliers of brand name products could negatively impact our business operations and financial results.

We form strategic relationships with selected suppliers to market and develop products under a variety of recognized and respected national and international brand names. We also have relationships with certain suppliers to enable us to sell proprietary products which differentiate us from other retailers. The inability to effectively and efficiently manage and maintain our relationships with these suppliers could negatively impact our business operations and financial results.

Failure of a key vendor or service provider that we cannot quickly replace could disrupt our operations and negatively impact our business, financial condition and results of operations.

We rely upon a number of vendors as the sole or primary source of some of the products we sell. We also rely upon many independent service providers for technology solutions and other services that are important to many aspects of our business. Many of these vendors and service providers have certain products or specialized skills needed to support our business concept and our strategies. If these vendors or service providers discontinue operations or are unable to perform as expected or if we fail to manage them properly and we are unable to replace them quickly, our business could be adversely affected, at least temporarily, until we are able to replace them and potentially, in some cases, permanently.

If our domestic or international supply chain or our fulfillment network for our products is ineffective or disrupted for any reason, or if these operations are subject to trade policy changes, our results of operations could be adversely affected.

We source, stock and sell products from domestic and international vendors and their ability to reliably and efficiently fulfill our orders is critical to our business success. We source a large number of our products from foreign manufacturers with China continuing to be the dominant import source. The results of the November 2016 U.S. elections may signal a change in trade policy between the United States and other countries. Because we source a large percentage of our merchandise from outside the United States, major changes in tax policy or trade relations, such as the disallowance of tax deductions for imported

12

Table of Contents

merchandise or the imposition of additional tariffs or duties on imported products, could adversely affect our business, results of operations, effective income tax rate, liquidity and net income.

Financial instability among key vendors, political instability and labor unrest in source countries or elsewhere in our supply chain, changes in the costs of commodities in our supply chain (fuel, labor and currency exchange rates), port labor disputes and security, the outbreak of pandemics, weather-related events, natural disasters, work stoppages, shipping capacity restrains, changes in trade policy, retaliatory trade restrictions imposed by either the United States or a major source country, tariffs or duties, fluctuations in currency exchange rates and transport availability, capacity and costs are beyond our control and could negatively impact our business if they seriously disrupted the movement of products through our supply chain or increased their costs. Additionally, as we add fulfillment capabilities or pursue strategies with different fulfillment requirements, our fulfillment network becomes increasingly complex and operating it becomes more challenging. If our fulfillment network does not operate properly or if a vendor fails to deliver on its commitments, we could experience delays in inventory, increased delivery costs or merchandise out-of-stocks that could lead to lost sales and decreased customer confidence, and adversely affect our results of operations.

Failure to effectively manage our third-party installers could result in increased operational and legal risks and negatively impact our business, financial condition and results of operations.

We use third-party installers to provide installation services to our customers, and, as the general contractor, we are subject to regulatory requirements and risks, applicable to general contractors, including the management of the permitting, licensing and quality of our third-party installers. Our failure to effectively manage such requirements, the third-party installers, and our internal processes regarding installation services could result in lost sales, fines and lawsuits, as well as damage to our reputation, which could negatively affect our business.

Operating internationally presents unique challenges, including some that have required us to adapt our store operations, merchandising, marketing and distribution functions to serve customers in Canada and Mexico. Our business and results of operations could be negatively affected if we are unable to effectively address these challenges.

We expect continued store growth over the next five years in Canada and Mexico. Expanding internationally presents unique challenges that may increase the anticipated costs and risks, and slow the anticipated rate, of such expansion. Our future operating results in these countries or in other countries or regions in which we currently operate or may operate in the future could be negatively affected by a variety of factors, including unfavorable political or economic factors, adverse tax consequences, volatility in foreign currency exchange rates, increased difficulty in enforcing intellectual property rights, costs and difficulties of managing international operations, challenges with identifying and contracting with local suppliers and other risks created as a result of differences in culture, laws and regulations. These factors could restrict our ability to operate our international businesses profitably and therefore have a negative impact on our results of operations and financial position. In addition, our reported results of operations and financial position could also be negatively affected by exchange rates when the activities and balances of our foreign operations are translated into U.S. dollars for financial reporting purposes.

We must comply with various and multiple laws and regulations that differ substantially in each area where we operate. Changes in existing or new laws and regulations or regulatory enforcement priorities, or our inability to comply with such laws and regulations, could adversely affect our business, financial condition and results of operations.

Laws and regulations at the local, regional, state, federal and international levels change frequently, and the changes can impose significant costs and other burdens of compliance on our business and our vendors. If we fail to comply with these laws, rules and regulations, or the manner in which they are interpreted or applied, we may be subject to government enforcement action, litigation, damage to our reputation, civil and criminal liability, damages, fines and penalties, and increased cost of regulatory compliance, any of which could adversely affect our results of operations and financial performance. These laws, rules and regulations include, but are not limited to, import and export requirements, U.S. laws such as the Foreign Corrupt Practices Act, and local laws prohibiting corrupt payments to governmental officials. Although we have implemented policies and procedures to help ensure compliance with these laws, rules and regulations, there can be no certainty that our employees and third parties with whom we do business will not take actions in violation of our policies or laws. Many of these laws, rules and regulations are complex, evolving and are subject to varying interpretations and enforcement actions. Any changes in regulations, the imposition of additional regulations, or the enactment of any new legislation could have an adverse impact, directly or indirectly, on our financial condition and results of operations. We may also be subject to investigations or audits by governmental authorities and regulatory agencies as a result of enforcing existing laws and regulations or changes in enforcement priorities, which can occur in the ordinary course of business or which can result from increased scrutiny from a particular agency towards an industry, country or practice.

13

Table of Contents

Future litigation or governmental proceedings could result in material adverse consequences, including judgments or settlements, negatively affecting our business, financial condition and results of operations.

We are, and in the future will become, involved in lawsuits, regulatory inquiries, and governmental and other legal proceedings arising out of the ordinary course of our business. Some of these proceedings may raise difficult and complicated factual and legal issues and can be subject to uncertainties and complexities. The timing of the final resolutions to lawsuits, regulatory inquiries, and governmental and other legal proceedings is typically uncertain. Additionally, the possible outcomes of, or resolutions to, these proceedings could include adverse judgments or settlements, either of which could require substantial payments. Furthermore, defending against these proceedings may require a diversion of management’s attention and resources. None of the legal proceedings in which we are currently involved, individually or collectively, is considered material.

Our financial performance could be adversely affected if our management information systems are seriously disrupted or we fail to properly maintain, improve, upgrade and expand those systems.

An important part of our efforts to provide an omni-channel experience for our customers, include investing in, maintaining and making ongoing improvements of our existing management information systems that support operations, such as sales, inventory replenishment, merchandise ordering, project design and execution, transportation, receipt processing and fulfillment. Our systems are subject to damage or interruption as a result of catastrophic events, power outages, viruses, malicious attacks, telecommunications failures, and we may incur significant expense, data loss as well as an erosion of customer confidence. Additionally, we continually make investments in our systems which may introduce disruption. Our financial performance could be adversely affected if our management information systems are seriously disrupted or we fail to properly maintain, improve, upgrade and expand those systems.

Liquidity and access to capital rely on efficient, rational and open capital markets and are dependent on Lowe’s credit strength. Our inability to access capital markets could negatively affect our business, financial performance and results of operations.

We have relied on the public debt markets to fund portions of our capital investments and the commercial paper market and bank credit facilities to fund our working capital needs. Our access to these markets depends on our strong credit ratings, the overall condition of debt capital markets and our operating performance. Disruption in the financial markets or an erosion of our credit strength or declines on our credit rating could impact negatively our ability to meet capital requirements or fund working capital needs.

Our sales are dependent upon the health and stability of the general economy. Adverse changes in economic factors specific to the home improvement industry may negatively impact the rate of growth of our total sales and comparable sales.

Many U.S. and global economic factors may adversely affect our financial performance. These include, but are not limited to, periods of slow economic growth or recession, decreasing housing turnover or home price appreciation, volatility and/or lack of liquidity from time to time in U.S. and world financial markets and the consequent reduced availability and/or higher cost of borrowing to Lowe’s and its customers, slower rates of growth in real disposable personal income that could affect the rate of growth in consumer spending, high rates of unemployment, consumer debt levels, fluctuations in fuel and energy costs, inflation or deflation of commodity prices, natural disasters, and acts of both domestic and international terrorism. Sales of many of our product categories and services are driven by the activity level of home improvement projects. Adverse development in these factors could result in a decrease in home improvement activity which could reduce demand for our products and services.

Item 1B - Unresolved Staff Comments

None.

Item 2 - Properties

At February 3, 2017, our properties consisted of 2,129 stores in the U.S., Canada, and Mexico with a total of approximately 213 million square feet of selling space. Of the total stores operating at February 3, 2017, approximately 79% are owned, which includes stores on leased land, with the remainder being leased from third parties. We also operate regional distribution centers and other facilities to support distribution and fulfillment, as well as data centers and various support offices. Our executive offices are located in Mooresville, North Carolina.

Item 3 - Legal Proceedings

We are, from time to time, party to various legal proceedings considered to be in the normal course of business, none of which are considered material. We do not believe that any of these proceedings, individually or in the aggregate, would be expected to have a material adverse effect on our results of operations, financial position, or cash flows.

14

Table of Contents

Item 4 - Mine Safety Disclosures

Not applicable.

15

Table of Contents

EXECUTIVE OFFICERS AND CERTAIN SIGNIFICANT EMPLOYEES OF THE REGISTRANT

Set forth below is a list of names and ages of the executive officers and certain significant employees of the registrant indicating all positions and offices with the registrant held by each such person and each person’s principal occupations or employment during the past five years. Each executive officer of the registrant is elected by the board of directors. Each executive officer of the registrant holds office from the date of election until a successor is elected or until his or her death, resignation or removal.

|

| ||||

|

|

|

|

|

|

| Name |

| Age |

| Title |

| Robert A. Niblock |

| 54 |

| Chairman of the Board, President and Chief Executive Officer since 2011. |

|

|

|

|

|

|

| Marshall A. Croom |

| 56 |

| Chief Financial Officer since March 2017; Chief Risk Officer, 2012 – March 2017; Senior Vice President and Chief Risk Officer, 2009 – 2012. |

|

|

|

|

|

|

| Rick D. Damron |

| 54 |

| Chief Operating Officer since 2012; Executive Vice President, Store Operations, 2011 – 2012. |

|

|

|

|

|

|

| Matthew V. Hollifield |

| 50 |

| Senior Vice President and Chief Accounting Officer since 2005. |

|

|

|

|

|

|

| Richard D. Maltsbarger |

| 41 |

| Chief Development Officer and President of International since 2015; Chief Development Officer, 2014 – 2015; Business Development Executive, 2012 – 2014; Senior Vice President, Strategy, 2011 – 2012. |

|

|

|

|

|

|

| Ross W. McCanless |

| 59 |

| Chief Legal Officer, Secretary and Chief Compliance Officer since 2016; General Counsel, Secretary and Chief Compliance Officer, 2015 – 2016; Chief Legal Officer, Extended Stay America, Inc. and ESH Hospitality, Inc., 2013 – 2014; Chief Legal Officer, HVM, L.L.C., 2012 – 2013. |

|

|

|

|

|

|

| Michael P. McDermott |

| 47 |

| Chief Customer Officer since 2016; Chief Merchandising Officer, 2014 – 2016; Senior Vice President and General Merchandising Manager – Building and Maintenance, 2013 – 2014; Sales Leader – Appliances, General Electric Company, 2011 – 2013. |

|

|

|

|

|

|

| N. Brian Peace |

| 51 |

| Corporate Administration Executive since 2012; Senior Vice President, Corporate Affairs, 2006 – 2012. |

|

|

|

|

|

|

| Paul D. Ramsay |

| 52 |

| Chief Information Officer since 2014; Senior Vice President, Information Technology, 2011 – 2014. |

|

|

|

|

|

|

| Jennifer L. Weber |

| 50 |

| Chief Human Resources Officer since 2016; Executive Vice President, External Affairs and Strategic Policy, Duke Energy Corporation, 2014 – 2016; Executive Vice President and Chief Human Resources Officer, Duke Energy Corporation, 2011 – 2014. |

16

Table of Contents

Part II

Item 5 - Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Lowe’s common stock is traded on the New York Stock Exchange (NYSE). The ticker symbol for Lowe’s is “LOW”. As of March 31, 2017, there were 23,575 holders of record of Lowe’s common stock. The following table sets forth, for the periods indicated, the high and low sales prices per share of the common stock as reported by the NYSE Composite Tape and the dividends per share declared on the common stock during such periods.

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

|

| Fiscal 2016 |

| Fiscal 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

| High |

| Low |

| Dividend |

| High |

| Low |

| Dividend | ||||||||||||||||||||||||||||||||||||||||

| 1st Quarter | $ | 77.63 |

|

| $ | 62.62 |

|

| $ | 0.28 |

|

| $ | 76.25 |

|

| $ | 66.17 |

|

| $ | 0.23 |

| ||||||||||||||||||||||||||||

| 2nd Quarter | 83.65 |

|

| 74.56 |

|

| 0.35 |

|

| 73.93 |

|

| 65.83 |

|

| 0.28 |

| ||||||||||||||||||||||||||||||||||

| 3rd Quarter | 82.68 |

|

| 66.71 |

|

| 0.35 |

|

| 74.78 |

|

| 64.22 |

|

| 0.28 |

| ||||||||||||||||||||||||||||||||||

| 4th Quarter | 76.47 |

|

| 64.87 |

|

| 0.35 |

|

| 78.13 |

|

| 66.93 |

|

| 0.28 |

| ||||||||||||||||||||||||||||||||||

Total Return to Shareholders

The following information in Item 5 of this Annual Report is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 or to the liabilities of Section 18 of the Securities Exchange Act of 1934, and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate it by reference into such a filing.

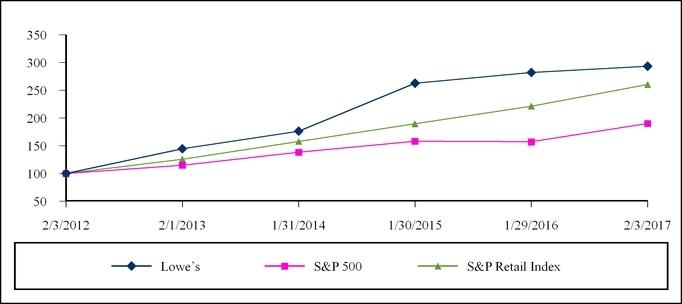

The following table and graph compare the total returns (assuming reinvestment of dividends) of the Company’s common stock, the S&P 500 Index (S&P 500) and the S&P Retailing Industry Group Index (S&P Retail Index). The graph assumes $100 invested on February 3, 2012 in the Company’s common stock and each of the indices.

|

| |||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

|

| 2/3/2012 |

|

| 2/1/2013 |

|

| 1/31/2014 |

|

| 1/30/2015 |

|

| 1/29/2016 |

|

| 2/3/2017 |

| ||||||||||||||||||||||

| Lowe’s | $ | 100.00 |

|

| $ | 144.61 |

|

| $ | 176.36 |

|

| $ | 262.41 |

|

| $ | 281.77 |

|

| $ | 293.31 |

| ||||||||||||||||

| S&P 500 | 100.00 |

|

| 115.06 |

|

| 138.42 |

|

| 158.11 |

|

| 157.06 |

|

| 190.14 |

| ||||||||||||||||||||||

| S&P Retail Index | $ | 100.00 |

|

| $ | 125.89 |

|

| $ | 157.75 |

|

| $ | 189.45 |

|

| $ | 221.27 |

|

| $ | 260.15 |

| ||||||||||||||||

17

Table of Contents

Issuer Purchases of Equity Securities

The following table sets forth information with respect to purchases of the Company’s common stock made during the fourth quarter of fiscal 2016:

|

| ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| (In millions, except average price paid per share) | Total Number of Shares Purchased 1 |

|

| Average Price Paid per Share |

|

| Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs 2 |

|

| Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs 2 |

| |||

| October 29, 2016 – November 25, 2016 3 | 3.4 |

|

| $ | 70.95 |

|

| 3.4 |

|

| $ | 367 |

| |

| November 26, 2016 – December 30, 2016 | 2.1 |

|

| 72.97 |

|

| 2.1 |

|

| 215 |

| |||

| December 31, 2016 – February 3, 2017 3 | 2.2 |

|

| 72.09 |

|

| 2.2 |

|

| 5,076 |

| |||

| As of February 3, 2017 | 7.7 |

|

| $ | 71.83 |

|

| 7.7 |

|

| $ | 5,076 |

| |

|

|

| |||||||||||||

| 1 | During the fourth quarter of fiscal 2016, the Company repurchased an aggregate of 7.7 million shares of its common stock. The total number of shares purchased also includes an insignificant number of shares withheld from employees to satisfy either the exercise price of stock options or the statutory withholding tax liability upon the vesting of restricted stock awards. | |||||||||||||

|

|

| |||||||||||||

| 2 | On March 20, 2015, the Company announced that its Board of Directors authorized a $5.0 billion repurchase program with no expiration. On January 27, 2017, the Company announced that its Board of Directors authorized an additional $5.0 billion of share repurchases with no expiration. As of February 3, 2017, the Company had $5.1 billion share repurchases remaining available under the program. In fiscal 2017, the Company expects to repurchase shares totaling $3.5 billion through purchases made from time to time either in the open market or through private off market transactions in accordance with SEC regulations. | |||||||||||||

|

|

| |||||||||||||

| 3 | In November 2016, the Company entered into an Accelerated Share Repurchase (ASR) agreement with a third-party financial institution to repurchase $190 million of the Company’s common stock. Pursuant to the agreement, the Company paid $190 million to the financial institution and received an initial delivery of 2.4 million shares. In January 2017, the Company finalized the transaction and received an additional 0.2 million shares. The average price paid per share in settlement of the ASR agreement included in the table above was determined with reference to the volume-weighted average price of the Company’s common stock over the term of the ASR agreement. See Note 9 to the consolidated financial statements included in this Annual Report. | |||||||||||||

Item 6 - Selected Financial Data

|

| |||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

| Selected Statement of Earnings Data (In millions, except per share data) | 2016 1 |

|

| 2015 |

|

| 2014 |

|

| 2013 |

|

| 2012 |

| |||||||||||||||||||||||||

| Net sales | $ | 65,017 |

|

| $ | 59,074 |

|

| $ | 56,223 |

|

| $ | 53,417 |

|

| $ | 50,521 |

| ||||||||||||||||||||

| Gross margin | 22,464 |

|

| 20,570 |

|

| 19,558 |

|

| 18,476 |

|

| 17,327 |

| |||||||||||||||||||||||||

| Operating income | 5,846 |

|

| 4,971 |

|

| 4,792 |

|

| 4,149 |

|

| 3,560 |

| |||||||||||||||||||||||||

| Net earnings | 3,093 |

|

| 2,546 |

|

| 2,698 |

|

| 2,286 |

|

| 1,959 |

| |||||||||||||||||||||||||

| Basic earnings per common share | 3.48 |

|

| 2.73 |

|

| 2.71 |

|

| 2.14 |

|

| 1.69 |

| |||||||||||||||||||||||||

| Diluted earnings per common share | 3.47 |

|

| 2.73 |

|

| 2.71 |

|

| 2.14 |

|

| 1.69 |

| |||||||||||||||||||||||||

| Dividends per share | $ | 1.33 |

|

| $ | 1.07 |

|

| $ | 0.87 |

|

| $ | 0.70 |

|

| $ | 0.62 |

| ||||||||||||||||||||

| Selected Balance Sheet Data |

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||

| Total assets | $ | 34,408 |

|

| $ | 31,266 |

|

| $ | 31,721 |

|

| $ | 32,471 |

|

| $ | 32,441 |

| ||||||||||||||||||||

| Long-term debt, excluding current maturities | $ | 14,394 |

|

| $ | 11,545 |

|

| $ | 10,806 |

|

| $ | 10,077 |

|

| $ | 9,022 |

| ||||||||||||||||||||

|

|

| ||||||||||||||||||||||||||||||||||||||

| 1 | Fiscal 2016 contained 53 weeks, while all other years contained 52 weeks. | ||||||||||||||||||||||||||||||||||||||

18

Table of Contents

Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations