Please answer two finance quesrions attached

MSFS 670

XBRL Study Module and Homework

This is a self-paced study module with a graded homework assignment due in your assignment folder no later than the date shown in the related Conference and Course Schedule.

In each section, I offer lecture notes on aspects of XBRL that take you to vetted XBRL resources that offer review of the concepts covered in the lecture. During this activity, remember, we do not have to learn a lot of XBRL code. What we have to learn is 1) the terminology, 2) how to read some code (similar to reading html code from an Internet doc), 3) how to select appropriate code from an XBRL taxonomy, and 4) how to check code in financial statements. At the end of module are several homework problems that you will submit for grading.

Background on XBRL

eXtensible Business Reporting Language (XBRL) is a language for the electronic communication of business and financial data and has been implemented by International Financial Reporting Standards (IFRS), the United States Generally Accepted Accounting Principles (U.S. GAAP), and many other national and international accounting standards bodies. In the United States, the Securities and Exchange Commission (SEC) requires public companies to file their financial statements in XBRL. The following article from Accounting Web provides a good summary to-date of the path to XBRL compliance and the SEC’s filing requirements: Public companies must submit XBRL exhibits to SEC in 2011. Essentially, we are now in “Phase 3”, details of which are available by visiting: Summary of XBRL for Phase 3. The FASB reports that

This [XBRL] standard is maintained by XBRL International, an international non-profit consortium of approximately 450 major companies, organizations, and government agencies around the world. It is an open standard, provided free of license fees, and is already being used in numerous countries. (http://www.fasb.org/jsp/FASB/Page/SectionPage&cid=1176157087972, 2013)

XBRL – Learning the Terminology

XBRL is an “open technology standard for reporting and analyzing business and financial information. Instead of treating financial information as a block of text, XBRL provides a computer-readable tag to identify each individual item of data” (E&Y, 2010). Each tag contains information on reading, calculating and presenting the data. The tags employed in XBRL are interactive, meaning they actively link back to source documents. An example of tagging is shown in the following figure (and you’ll see a real-world example in a later section):

Figure 1-2: Example of XBRL tagging in a financial document (Source: Hoffman and Watson, 2010)

| Financial Highlights | 2009 | 2008 | |

|

| 5,347 | 1,147 | |

| Sales, Net | 244,508 | 366,375 | |

|

<gaap:NetIncomeOrLoss contextRef=”Period-2009” unitRef=”Us-Dollars” decimals=”3”>534700</gaap:NetIncomeOrLoss> |

This is the XBRL tag hiding behind the number. That’s a lot of information! It’s telling us the reporting period, the account, the amount, and how to format it. | ||

A document that is tagged is called an XBRL-enabled “instance document”. Instance documents can be any kind of report, but are primarily financial statements. To learn XBRL, we DO NOT have to learn a lot of coding because there is now software and services to help us. We DO NEED to learn the terminology, be able to read some code, select code from a taxonomy, and check the coding on our documents. The steps involved in creating an XBRL instance document are deciding on your software, selecting the taxonomy, creating your entity profile in your software, tagging your data, validating your tagging (which the software helps with) and exporting/publishing your document.

As Hoffman and Watson (2010) describe, XBRL tags add the behind-the-scenes structure to instance documents, but “People don’t work with the information at the tag level…computers can work with the information and help people do all sorts of new, interesting and helpful tasks (p. 20).

In our example about, the $1,147 appears on a GAAP Income Statement for the period 2009, in US dollars with three decimal places.

Let’s start to get a better feel for the process

Begin by viewing this video provided by Altova, an XBRL software provider: XBRL Overview

Now let’s carefully read this overview prepared by IFRS.org: XBRL Fundamentals.

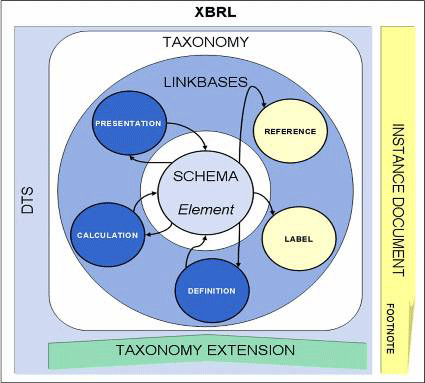

What I particularly like is the diagram the IFRS presents (shown below). Simply, an element is an item on a financial statement whose label, definition, calculation, presentation and reference are determined by the schema (list of elements), linkbases (directions or specifications) contained within the larger taxonomy (classification system).

A taxonomy is an “electronic dictionary of business reporting elements used to report business data. A taxonomy is composed of an element names file (.xsd) and relationships files directly referenced by that schema. The taxonomy schema files together with the relationships files define the concepts (elements) and relationships that form the basis of the taxonomy. The set of related schemas and relationships files altogether constitute a taxonomy (SEC, 2011).

Taxonomies may contain hundreds or even thousands of individual business reporting concepts, mathematical and definitional relationships, along with text labels in multiple languages, references to authoritative literature, and information about how to display each concept to a user.

There’s other terminology used in XBRL, so let’s take a closer look at terminology. Visit this link and print the glossary: http://www.tryxbrl.com/Learn/Glossary/tabid/58/Default.aspx. Read the terms, and now continue reading to learn how they relate to each other in more detail.

Now we’re going to take a closer look at XBRL tagging. Don’t let this scare you because later on, I will show you the software that we use to make our work easier.

Reading the Tagging

Let’s begin by looking at some financial statements that companies have prepared in XBRL. Many companies who file interactive data documents with the SEC also share the information on their websites.

Go to: Footlocker. com then click on the About Us link near the bottom followed by the Investor Relations link at the top. On the right hand side there is an Investor Relations Links menu; from there choose SEC Filings - XBRL Content

Select one of the 10-K financial statement filings from the left hand menu. This takes you to a very nice view of the company’s most recent SEC filings. It’s in a web-friendly and readable format. Click on some of the account names on the financial statement. What are you seeing in the pop-up boxes? Keep these in mind. We’ll come back to them in homework.

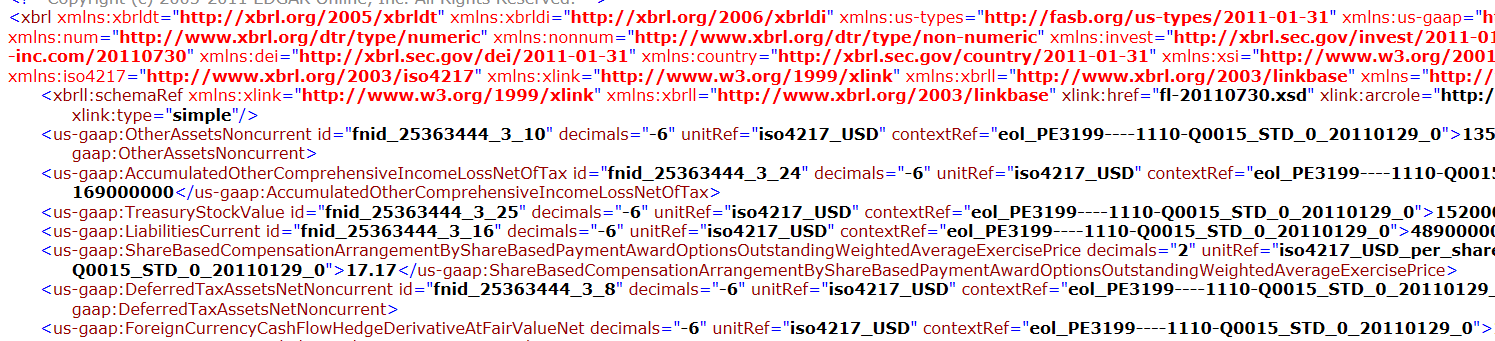

Now exit back to Footlocker. com. Select “XBRL Instance Document”. WOW! You should be seeing something like this.

This is the XBRL tagging stored behind Footlocker’s SEC financials. It’s A LOT of information, but every tag comes from the greater taxonomy and determines the label, definition, calculation, presentation and reference of the linkbase reference.

Now we don’t have to worry, because software (like Altova, Fujitsu, Crossfire, Webfilings) is going to help us create such instance documents. But, we need to have a basic understanding of things so that we know if we are using the software correctly. So, before digging into how to create an instance document, let’s learn more about taxonomies.

More on Taxonomies

Anyone can create a taxonomy, ranging from a local community of users to governing bodies for accounting. XBRL.org is an international non-profit organization for XBRL users that has a process for recognizing and approving taxonomies. Visit their page titled The Standard from the top menu.

If a taxonomy doesn’t contain all the elements needed, the preparer can change it by adding extensions, or company-defined line items that “extend” the current taxonomy. Preparers have the ability to create new custom terms if they have a very unique reporting situation that is not available in the taxonomy terms. The extension taxonomy may include, exclude, or change information from the base taxonomy. The extension can be regarded as an overlay that modifies the structure of the taxonomy, adds and prohibits elements, their labels, linking, order of appearance, and other characteristics. The main idea behind an extension is to encourage business users to tailor the taxonomy to their specific needs, while using the elements of the base taxonomy to ensure comparability. For example, if you include revenues for various products in the income statement but the standard taxonomy only includes an element called Other Revenue, you should add these new revenue tags as “children” of Other Revenue that could be rolled up into Other Revenue “parent” for comparability (Edgar Online).

To gain a deeper understanding of taxonomies, feel free to read the attached XBRL U.S. Preparers Guide.

Rules for Creating XBRL Instance Documents

The “rules” for creating XBRL instance documents, according to White (2010), are that all XBRL instance documents must have the items listed below. (Note: in this example we are referring to a previously approved 2009 GAAP taxonomy, which we might find in an older SEC filing.)

use xbrl as the root “parent” element name with namespace declaration attributes -

the namespace is the unique identifier of the taxonomy, for example the root element and namespace declaration for 2009 us-gaap taxonomies is:

<xbrl xmlns:us-gaap=http://xbrl.us/us-gaap/2009-01-31>

(for 2011, the namespace looks like this: <namespace=http://fasb.org/us-gaap/2011-01-31>)

have a first “child” element that is a schemaRef element with two xLink (creates hyperlinks) attributes – one that declares a “simple” link and another that points to the URL of the taxonomy’s schema. for example, to point to the 2009 us-gaap taxonomy schema would read:

<schemaRef xlink:type=”simple” xlink:ref=http://taxonomies.xbrl.us/us-gaap/2009/elts/us-gaap-std-2009-01-31.xsd/>

contain at least one context element with entity and period identifiers, the purpose of which is to identify the business entity, specify the reporting period, and indicate the reporting purpose, for example

<context id=”November-30-2008”>

<entity>

<identifier scheme=http://www.nasdaq.com>BIKES</identifier>

</entity>

<period>

<instant>2008-11-30</instant>

</period>

</context>

contain at least one unit element with a measure element (when reporting numbers), for example

<unit id=”USD”>

<measure>iso4217:USD</measure>

</unit>

have at least one reference to the reported item (properly formatted), for example, if we were tagging the line item for Current Accounts Payable

<us-gaap:AccountsPayableCurrent contextRef=”November-30-2008”unitRef=”USD” decimals=”-3”>50921000</us-gaap:AccountsPayableCurrent>

If you feel you want a little more about tagging read: http://xbrl.us/preparersguide/Pages/Section3.aspx

Let’s test ourselves and see if we can pick out elements that White (2010) described for us. Go back to the SEC Filings – XBRL Content on the the Footlocker. com website and select XBRL Instance Document for the 10-K filing you chose earlier.

Did you see these rules being followed in the instance documents that you viewed above? When you go to the financial statement by selecting the SEC XBRL Viewer, do the elements of the financials seem to be following the specifications appearing in the tags?

Ready for some Individual Practice?

Complete these Exercises on your own in preparation for the XBRL Graded Assignment. I am not checking them, but you will benefit by working them.

Exercise 1

Go to the SEC EDGAR website to search for company filings: https://www.sec.gov/edgar/searchedgar/companysearch.html

Enter 4NET Software in the Company Name search field then click on the SEARCH button.

Enter 10-Q in the Filing Type field for a listing of Quarterly Reports

Explore the information available in the SEC EDGAR database for the Interactive Data option. Locate the following information. You may insert screenshots for your responses.

What is the company’s CIK (SEC Central Index Key) number? and What is the company’s Trading Symbol (a.k.a. ticker) and fiscal year-end?

Exercise 2

Go back to the Footlocker. com website and choose a 10-Q filing and select the SEC XBRL Viewer. Under the financial statements, select the Consolidated Balance Sheets. Locate the following information for elements on the statement. Insert a screenshot of the statement below.

For the accounts payable account, Aug 2, 2014, provide the following information from the XBRL tags. You may copy and paste your responses.

| Element Name | |

| Taxonomy Namespace | |

| Data Type | |

| Balance | |

| Period | |

| Would the element name or the account label be used to tag the amount of AP reported on the financial statement? Show the proper format. |

Looking at the Summary of Significant Accounting Policies (left-hand menu), identify the tags for “Recent Accounting Pronouncements”.

| Element Name | |

| Taxonomy Namespace | |

| Data Type | |

| Balance | |

| Period | |

Note: To create a screenshot, go to the screen that you want to capture, press Ctrl PrtScn. Go to the Word document where you want to insert your screen shot. Hit Ctrl V. Resize the image for the page. Or try JING, which is free capture software located at http://www.techsmith.com/download/jing/

Conclusion

A first look at XBRL can be intimidating. I gave a presentation to one of the financial management organizations that I belong to and a Controller from a small firm asked, “what does this do for me?” I’m going to ask you to help with this question and show me how comfortable you are feeling with what you learned through the homework in the next section.

KK, UMUC, 2013 Page 9