aNSWER THE BIG BOX SECTION PLEASE

Dr. Festus Olorunniwo

MGMT 4600: Chapter 6: Global Supply Chains

Decision Trees Examples

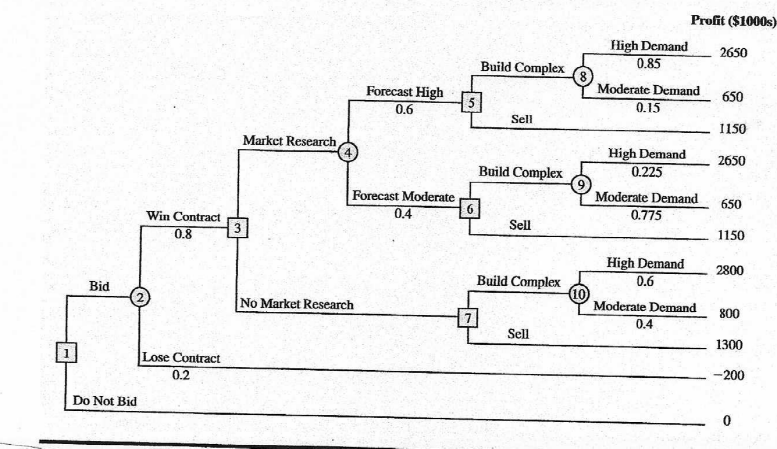

Dante Development Corporation is considering bidding on a contract for a new office building complex. Figure shows the decision tree prepared by one of Dante's analysts. At node 1, the company must decide whether to bid on the contract. The cost of preparing the bid is $200,000. The upper branch from node 2 shows that the company has a 0.8 probability of winning the contract if it submits a bid. If the company wins the bid, it will have to pay $2,000,000 to become a partner in the project. Node 3 shows that the company will then consider doing a market research study to forecast demand for the office units prior to beginning construction. The cost of this study is $150,000. Node 4 is a chance node showing the possible outcomes of the market research study.

Nodes 5,6, and 7 are similar in that they are the decision nodes for Dante to either build the office complex or sell the rights in the project to another developer. The decision to build the complex will result in an income of $5,000,000 if demand is high and $3,000,000 if demand is moderate. If Dante chooses to sell its rights in the project to another developer, income from the sale is estimated to be $3,500,000. The probabilities shown at nodes 4, 8, and 9 are based on the projected outcomes of the market research study.

Verify Dante's profit projections shown at the ending branches of the decision tree by calculating the payoffs of $2,650,000 and $650,000 for first two outcomes.

What is the optimal decision strategy for Dante, and what is the expected profit for this project?

What would the cost of the market research study have to be before Dante would change its decision about the market research study?

Develop a risk profile for Dante.

The Big Box

Bahouth Ltd. is planning for the next two years of production and debating whether to construct a large cross-dock facility with 40 truck bays or a smaller one with 20 truck bays. The cost to build the large facility is $2 million and the cost to build the small one is $1.2 million. If they construct a large facility and demand is as high as they hope, then operating costs are $450,000 annually. If they construct a large facility and demand is low, then operating costs are $300,000. If they construct a small facility and demand is low, the operating costs are $275,000 but if they experience high demand, the operating cost of a small facility increases to $600,000. After having conducted some market research, they feel that the likelihood of high demand is 0.7 and the likelihood of small demand is 0.3. The company uses a discount rate (cost of money) of 12% per year. FIRST DRAW THE DECISION TREE FOR THE PROBLEM

Use the information from Scenario 6.1 to determine the expected cost of operating a large facility for two years.

Use the information from Scenario 6.1 to determine the expected cost of operating a small facility for a period of two years.

Use the information from Scenario 6.1 to determine the cost of the best alternative for a two year period.

Use the information from Scenario 6.1 to determine the likelihood of high demand that would make the decision maker indifferent between the two alternatives for a two year operating time.

Suppose the contractor has found some materials on Craigslist that can drop the construction cost of a large facility to $1,500,000. These materials cannot be used in the construction of the small facility, so its price remains as indicated in Scenario 6.1. Determine the likelihood of high demand that would make the decision maker indifferent between the two alternatives for a two year time period.