1. Prepare a worksheet for Morin Co. 2. Using the worksheet in Module 4 assignment for Sanchez Computer Center, journalize and post the adjusting entries and prepare the financial statements. 3. Th

1.

2.

| PARKER'S PLOWING GENERAL JOURNAL | |||||||||

| PAGE 1 | |||||||||

| Date 201X | Account Titles and Description | PR | Dr. | Cr. | |||||

| Jan. | Cash | 111 | 1,4000 | 00 | |||||

| Snow Equipment | 123 | 9000 | 00 | ||||||

| Parker Muroney, Capital | 311 | 2,3000 | 00 | ||||||

| Owner Investment | |||||||||

| Prepaid Rent | 114 | 3,500 | 00 | ||||||

| Cash | 111 | 3,500 | 00 | ||||||

| Rent Paid in Advance | |||||||||

| Office Equipment | 121 | 12,600 | 00 | ||||||

| Accounts Payable | 211 | 12,600 | 00 | ||||||

| Bought Equipment on Account | |||||||||

| Snow Supplies | 115 | 500 | 00 | ||||||

| Cash | 111 | 500 | 00 | ||||||

| Cash Purchases of Supplies | |||||||||

| Cash | 111 | 1,5000 | 00 | ||||||

| Plowing Fees | 411 | 1,5000 | 00 | ||||||

| Cash Fees Earned | |||||||||

| 12 | Parker Muroney, Withdrawals | 312 | 5,000 | 00 | |||||

| Cash | 111 | 5,000 | 00 | ||||||

| Owner Withdrawal | |||||||||

| 20 | Accounts Receivable | 112 | 7,000 | 00 | |||||

| Plowing Fees | 411 | 7,000 | 00 | ||||||

| Fees Earned on Account | |||||||||

| 26 | Salaries Expense | 511 | 1,400 | 00 | |||||

| Cash | 111 | 1,400 | 00 | ||||||

| Paid Salaries | |||||||||

| PARKER'S PLOWING GENERAL JOURNAL | PAGE 2 | ||||||||

| Date 201X | Account Titles and Description | PR | Dr. | Cr. | |||||

| Jan. | 28 | Accounts Payable | 211 | 6,300 | 00 | ||||

| Cash | 111 | 6,300 | 00 | ||||||

| Paid On Account | |||||||||

| 29 | Advertising Expense | 512 | 600 | 00 | |||||

| Accounts Payable | 211 | 600 | 00 | ||||||

| Advertising Bill Received | |||||||||

| 30 | Telephone Expense | 513 | 200 | 00 | |||||

| Cash | 111 | 200 | 00 | ||||||

| Paid Telephone Bill | |||||||||

| Adjusting Entries | |||||||||

| 31 | Snow Supplies Expense | 515 | 100 | 00 | |||||

| Snow Supplies | 115 | 100 | 00 | ||||||

| 31 | Rent Expense | 514 | 700 | 00 | |||||

| Prepaid Rent | 114 | 700 | 00 | ||||||

| 31 | Depreciation Expense, Office Equipment | 516 | 210 | 00 | |||||

| Accumulated Depreciation, Office Equip. | 122 | 210 | 00 | ||||||

| 31 | Depreciation Expense, Snow Equipment | 517 | 150 | 00 | |||||

| Accumulated Depreciation, Snow Equip. | 124 | 150 | 00 | ||||||

| 31 | Salaries Expense | 511 | 380 | 00 | |||||

| Salaries Payable | 212 | 380 | 00 | ||||||

| Closing Entries | |||||||||

| 31 | Plowing Fees | 411 | 22,000 | 00 | |||||

| Income Summary | 313 | 22,000 | 00 | ||||||

| PARKER'S PLOWING GENERAL JOURNAL | PAGE 3 | |||||||||||

| Date 201X | Account Titles and Description | PR | Dr. | Cr. | ||||||||

| Jan. | 31 | Income Summary | 313 | 3,740 | 00 | |||||||

| Salaries Expense | 511 | 1,780 | 00 | |||||||||

| Advertising Expense | 512 | 600 | 00 | |||||||||

| Telephone Expense | 513 | 200 | 00 | |||||||||

| Snow Supplies Expense | 515 | 100 | 00 | |||||||||

| Rent Expense | 514 | 700 | 00 | |||||||||

| Depreciation Expense, Office Equipment | 516 | 210 | 00 | |||||||||

| Depreciation Expense, Snow Equipment | 517 | 150 | 00 | |||||||||

| 31 | Income Summary | 313 | 18,260 | 00 | ||||||||

| Parker Muroney, Capital | 311 | 18,260 | 00 | |||||||||

| 31 | Parker Muroney, Capital | 311 | 5,000 | 00 | ||||||||

| Parker Muroney, Withdrawals | 312 | 5,000 | 00 | |||||||||

| CASH | ACCOUNT NO. 111 | ||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||

| Debit | Credit | ||||||||||||||

| Jan. | GJ1 | 14000 | 00 | 14000 | 00 | ||||||||||

| GJ1 | 3500 | 00 | 10500 | 00 | |||||||||||

| GJ1 | 500 | 00 | 10000 | 00 | |||||||||||

| GJ1 | 15000 | 00 | 25000 | 00 | |||||||||||

| 12 | GJ1 | 5000 | 00 | 20000 | 00 | ||||||||||

| 26 | GJ1 | 1400 | 00 | 18600 | 00 | ||||||||||

| 28 | GJ2 | 6300 | 00 | 12300 | 00 | ||||||||||

| 30 | GJ2 | 200 | 00 | 12100 | 00 | ||||||||||

| ACCOUNTS RECEIVABLE | ACCOUNT NO. 112 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | 20 | GJ1 | 7000 | 00 | 7000 | 00 | |||||||||||

| PREPAID RENT | ACCOUNT NO. 114 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | GJ1 | 3500 | 00 | 3500 | 00 | ||||||||||||

| 31 | Adjusting | GJ2 | 700 | 00 | 2800 | 00 | |||||||||||

| SNOW SUPPLIES | ACCOUNT NO. 115 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | GJ1 | 500 | 00 | 500 | 00 | ||||||||||||

| 31 | Adjusting | GJ2 | 100 | 00 | 400 | 00 | |||||||||||

| OFFICE EQUIPMENT | ACCOUNT NO. 121 | ||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||

| Debit | Credit | ||||||||||||||

| Jan. | GJ1 | 12600 | 00 | 12600 | 00 | ||||||||||

| ACCUMULATED DEPRECIATION, OFFICE EQUIPMENT | ACCOUNT NO. 122 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | 31 | Adjusting | GJ2 | 210 | 00 | 210 | 00 | ||||||||||

| SNOW EQUIPMENT | ACCOUNT NO. 123 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | GJ1 | 9000 | 00 | 9000 | 00 | ||||||||||||

| ACCUMULATED DEPRECIATION, SNOW EQUIPMENT | ACCOUNT NO. 124 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | 31 | Adjusting | GJ2 | 150 | 00 | 150 | 00 | ||||||||||

| ACCOUNTS PAYABLE | ACCOUNT NO. 211 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | GJ1 | 12600 | 00 | 12600 | 00 | ||||||||||||

| 28 | GJ2 | 6300 | 00 | 6300 | 00 | ||||||||||||

| 29 | GJ2 | 600 | 00 | 6900 | 00 | ||||||||||||

| SALARIES PAYABLE | ACCOUNT NO. 212 | ||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||

| Debit | Credit | ||||||||||||||

| Jan. | 31 | Adjusting | GJ2 | 380 | 00 | 380 | 00 | ||||||||

| PARKER MURONEY, CAPITAL | ACCOUNT NO. 311 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | GJ1 | 23000 | 00 | 23000 | 00 | ||||||||||||

| 31 | Closing | GJ3 | 18260 | 00 | 41260 | 00 | |||||||||||

| 31 | Closing | GJ3 | 5000 | 00 | 36260 | 00 | |||||||||||

| PARKER MURONEY, WITHDRAWALS | ACCOUNT NO. 312 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | 12 | GJ1 | 5000 | 00 | 5000 | 00 | |||||||||||

| 31 | Closing | GJ3 | 5000 | 00 | ------- | ||||||||||||

| INCOME SUMMARY | ACCOUNT NO. 313 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | 31 | Closing | GJ2 | 22000 | 00 | 22000 | 00 | ||||||||||

| 31 | Closing | GJ3 | 3740 | 00 | 18260 | 00 | |||||||||||

| 31 | Closing | GJ3 | 18260 | 00 | |||||||||||||

| PLOWING FEES | ACCOUNT NO. 411 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | GJ1 | 15000 | 00 | 15000 | 00 | ||||||||||||

| 20 | GJ1 | 7000 | 00 | 22000 | 00 | ||||||||||||

| 31 | Closing | GJ2 | 22000 | 00 | |||||||||||||

| SALARIES EXPENSE | ACCOUNT NO. 511 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | 26 | GJ1 | 1400 | 00 | 1400 | 00 | |||||||||||

| 31 | Adjusting | GJ2 | 380 | 00 | 1780 | 00 | |||||||||||

| 31 | Closing | GJ3 | 1780 | 00 | |||||||||||||

| ADVERTISING EXPENSE | ACCOUNT NO. 512 | |||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | |||||||||

| Debit | Credit | |||||||||||||

| Jan. | 29 | GJ2 | 600 | 00 | 600 | 00 | ||||||||

| 30 | Closing | GJ3 | 600 | 00 | ||||||||||

| TELEPHONE EXPENSE | ACCOUNT NO. 513 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | 30 | GJ2 | 200 | 00 | 200 | 00 | |||||||||||

| 31 | Closing | GJ3 | 200 | 00 | |||||||||||||

| RENT EXPENSE | ACCOUNT NO. 514 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | 31 | Adjusting | GJ2 | 700 | 00 | 700 | 00 | ||||||||||

| 31 | Closing | GJ3 | 700 | 00 | |||||||||||||

| SNOW SUPPLIES EXPENSE | ACCOUNT NO. 515 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | 31 | Adjusting | GJ2 | 100 | 00 | 100 | 00 | ||||||||||

| 31 | Closing | GJ3 | 100 | 00 | |||||||||||||

| DEPRECIATION EXPENSE, OFFICE EQUIPMENT | ACCOUNT NO. 516 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | 31 | Adjusting | GJ2 | 210 | 00 | 210 | 00 | ||||||||||

| 31 | Closing | GJ3 | 210 | 00 | |||||||||||||

| DEPRECIATION EXPENSE, SNOW EQUIPMENT | ACCOUNT NO. 517 | ||||||||||||||||

| Date 201X | Explanation | Post Ref. | Debit | Credit | Balance | ||||||||||||

| Debit | Credit | ||||||||||||||||

| Jan. | 31 | Adjusting | GJ2 | 150 | 00 | 150 | 00 | ||||||||||

| 31 | Closing | GJ3 | 150 | 00 | |||||||||||||

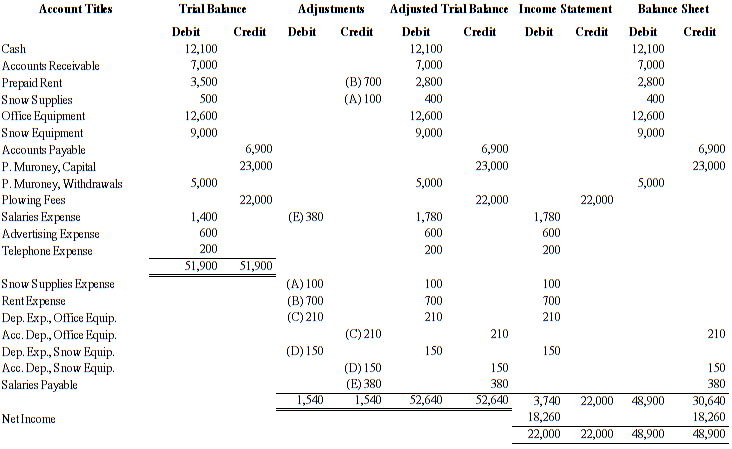

PARKER'S PLOWING

WORKSHEET

FOR MONTH ENDED JANUARY 31, 201X

PARKER'S PLOWING

INCOME STATEMENT

FOR MONTH ENDED JANUARY 31, 201X

| Revenue: | ||||

| Plowing Fees | $22,000 | 00 | ||

| Operating Expenses: | ||||

| Salaries Expense | $1,780 | 00 | ||

| Advertising Expense | 600 | 00 | ||

| Telephone Expense | 200 | 00 | ||

| Snow Supplies Expense | 100 | 00 | ||

| Rent Expense | 700 | 00 | ||

| Depreciation Expense, Office Equipment | 210 | 00 | ||

| Depreciation Expense, Snow Equipment | 150 | 00 | ||

| Total Operating Expenses | 3,740 | 00 | ||

| Net Income | $18260 | 00 | ||

| |

PARKER'S PLOWING

STATEMENT OF OWNER'S EQUITY

FOR MONTH ENDED JANUARY 31, 201X

| Parker Muroney, Capital, January 1, 201X | $23,000 | 00 | ||

| Net Income for January | $18,260 | 00 | ||

| Less: Withdrawals for January | (5,000 | 00) | ||

| Increase in Capital | 13,260 | 00 | ||

| Parker Muroney, Capital, January 31, 201X | $36,260 | 00 | ||

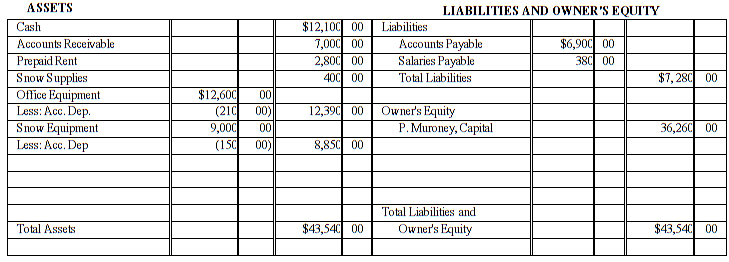

PARKER'S PLOWING

BALANCE SHEET

JANUARY 31, 201X

PARKER'S PLOWING

POST-CLOSING TRIAL BALANCE

JANUARY 31, 201X

| Dr. | Cr. | ||||

| Cash | 12,100 | 00 | |||

| Accounts Receivable | 7,000 | 00 | |||

| Prepaid Rent | 2,800 | 00 | |||

| Snow Supplies | 400 | 00 | |||

| Office Equipment | 12,600 | 00 | |||

| Accumulated Depreciation, Office Equipment | 210 | 00 | |||

| Snow Equipment | 9,000 | 00 | |||

| Accumulated Depreciation, Snow Equipment | 150 | 00 | |||

| Accounts Payable | 6,900 | 00 | |||

| Salaries Payable | 380 | 00 | |||

| Parker Muroney, Capital | 36,260 | 00 | |||

| Totals | 43,900 | 00 | 43,900 | 00 | |

3.

The question in the case is whether Todd should purchase 75% of his orders from Gem Corporation. Although Todd is offered a luxurious vacation, he should not let this affect his decision to purchase products from Gem. Also, Todd should not be influenced by the fact that he’s upset with his management. Thus, I feel that Todd should not purchase the supplies solely because he is offered a free vacation. This is a conflict of interest.

4.

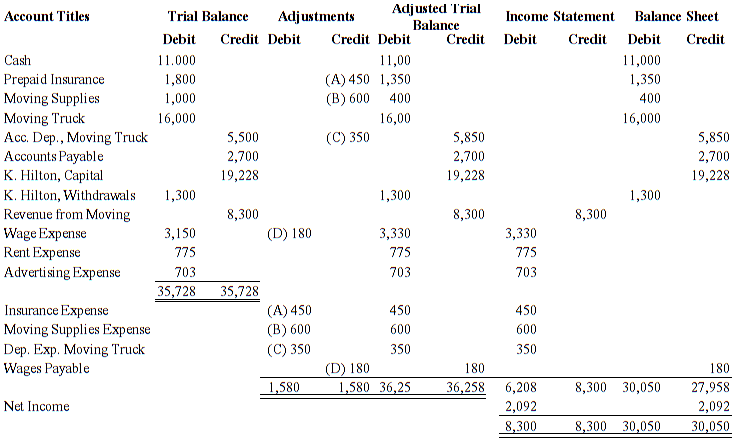

KYLER'S MOVING CO.

WORKSHEET

FOR MONTH ENDED JANUARY 31, 201X

(2)

KYLER’S MOVING CO.

INCOME STATEMENT

FOR MONTH ENDED JANUARY 31, 201X

| Revenue: | ||||||||||

| Revenue from Moving | $8 | 00 | ||||||||

| Operating Expenses: | ||||||||||

| Wage Expense | $3 | 00 | ||||||||

| Rent Expense | 00 | |||||||||

| Advertising Expense | 00 | |||||||||

| Insurance Expense | 00 | |||||||||

| Moving Supplies Expense | 00 | |||||||||

| Depreciation Expense; Moving Truck | 00 | |||||||||

| Total Operating Expenses | 00 | |||||||||

| Net Income | $2 | 00 | ||||||||

KYLER'S MOVING CO.

STATEMENT OF OWNER'S EQUITY

FOR MONTH ENDED JANUARY 31, 201X

| K. Hilton, Capital, January 1, 201X | $19 | 00 | ||||||||

| Net Income for January | $2 | 00 | ||||||||

| Less: Withdrawals for January | (1 | 00) | ||||||||

| Increase in Capital | 00 | |||||||||

| K. Hilton, Capital, January 31, 201X | $22 | 00 | ||||||||

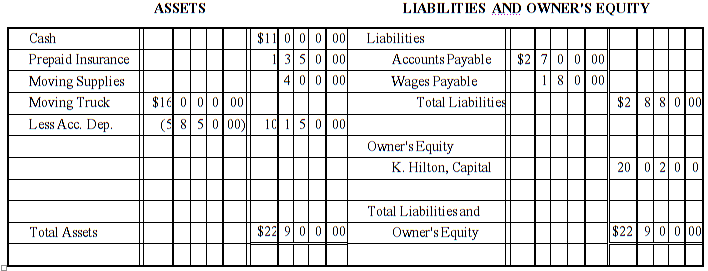

KYLER'S MOVING CO.

BALANCE SHEET

JANUARY 31, 201X

Cited: Jeanette Morgan

Cited: Jeanette Morgan