Out of Eden, Inc. is planning to invest in new manufacturing equipment to make a new garden tool. The new garden tool is expected to generate...

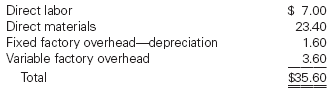

Out of Eden, Inc. is planning to invest in new manufacturing equipment to make a new garden tool. The new garden tool is expected to generate additional annual sales of 9,000 units at $42 each. The new manufacturing equipment will cost $156,000 and is expected to have a 10-year life and $12,000 residual value. Selling expenses related to the new product are expected to be 5% of sales revenue. The cost to manufacture the product includes the following on a per-unit basis:

Determine the net cash flows for the first year of the project, Years 2–9, and for the last year of the project.

Use the minus sign to indicate cash outflows.

| Schedule of Net Cash Flows | ||||||

|

| Year 1 | Years 2 - 9 | Last Year | |||

| Initial investment | |

|

| |||

| Operating cash flows: |

|

|

| |||

| Annual revenues | | | | |||

| Selling expenses | | | | |||

| Cost to manufacture | | | | |||

| Net operating cash flows | | | | |||

| Total for year 1 | |

|

| |||

| Total for years 2-9 |

| |

| |||

| Residual value |

|

| | |||

| Total for last year |

|

| | |||