BSA 221 Beiser Final Exam Chapters 6 through 13 Please document all answers in one file and submit these as a Word document when completed. 5%...

BSA 221

Beiser

Final Exam

Chapters 6 through 13

Please document all answers in one file and submit these as a Word document when completed.

| 1. |

5%

Explain the nature of subsidiary ledgers, and give two specific examples. For each of these examples, explain (1) the unit of organization within this ledger, and (2) the usefulness of this ledger in business operations.

2. 10%

A customer purchased merchandise for $400 which cost the seller $200. The customer was dissatisfied with some of the goods and thus returned $100 worth and received a cash refund.

(a) What journal entries should the seller make when the merchandise is sold and at the time of the return? Assume that the seller uses a perpetual inventory system.

(b) If the seller uses a periodic inventory system, what entries would be made?

3. 5% Periodic inventory system

Armstrong Creation uses a periodic inventory system. During the current year, the company purchased merchandise at a cost of $245,000. You are to compute the cost of goods sold under each of the following alternative assumptions:

4. 10% Bank reconciliation

At March 31, the balance of the Cash account according to the records of Fisher Company was $7,261. The March 31 bank statement showed a balance of $8,798. You are to prepare the bank reconciliation of Fisher Company at March 31, using the following supplementary information and as per the given format:

(a.) Deposit in transit at March 31, $6,772.

(b.) Outstanding checks: no. 120, $140; no. 121, $932; no. 127, $307; no. 134, $2,200.

(c.) Service charge by bank, $50.

(d.) A note receivable for $5,050 left by Fisher Company with bank for collection that had been collected and credited to company's account. No interest involved.

(e.) A check for $90 drawn by a customer, Stuart Sands, but deducted from Fisher's account by the bank and returned with the notation "NSF."

(f.) Fisher's check no. 480, issued in payment of $970 worth of office equipment, correctly written in the amount of $970 but erroneously recorded in Fisher's accounting records as $790.

5. 5%

Balance sheet method-journal entries

The general ledger controlling account for Accounts Receivable has a balance of $120,500 at year-end before adjustment. The company uses the balance sheet approach to estimate uncollectible accounts. By aging the individual customers' accounts, it was determined that the doubtful accounts amounted to $5,020. Prepare the year-end adjusting entry for uncollectible accounts under each of the following independent assumptions.

(a.) Allowance for Doubtful Accounts has a credit balance of $2,850.

(b.) Allowance for Doubtful Accounts has a debit balance of $925.

6. 5% The Valley Garden Company had the following transactions:

(A) Prepare journal entries for Valley Garden assuming the company uses a perpetual inventory.

(B) Prepare journal entries for Valley Garden assuming the company uses a periodic inventory.

7. 5% On September 6, 2014, East River Tug Co. purchased a new tugboat for $400,000. The estimated life of the boat was 20 years, with an estimated residual value of $40,000.

Compute the depreciation on this tugboat in 2014 and 2015 using the following methods. Apply the half-year convention. (If necessary, round to the nearest dollar.)

8. 5%

On March 1, 2015, five-year bonds are sold for $508,026 that have a face value of $500,000 and an interest rate of 10%. Interest is paid semi-annually on March 1 and September 1. Using the straight-line amortization method, prepare the borrower's journal entries on:

March 1, 2015; September 1, 2015; December 31, 2015; and March 1, 2016.

9. 5%

On September 1, 2015, Charles Associates borrowed $600,000 from Diana Credit Union and signed a 9%, one-year note payable, all due at maturity.

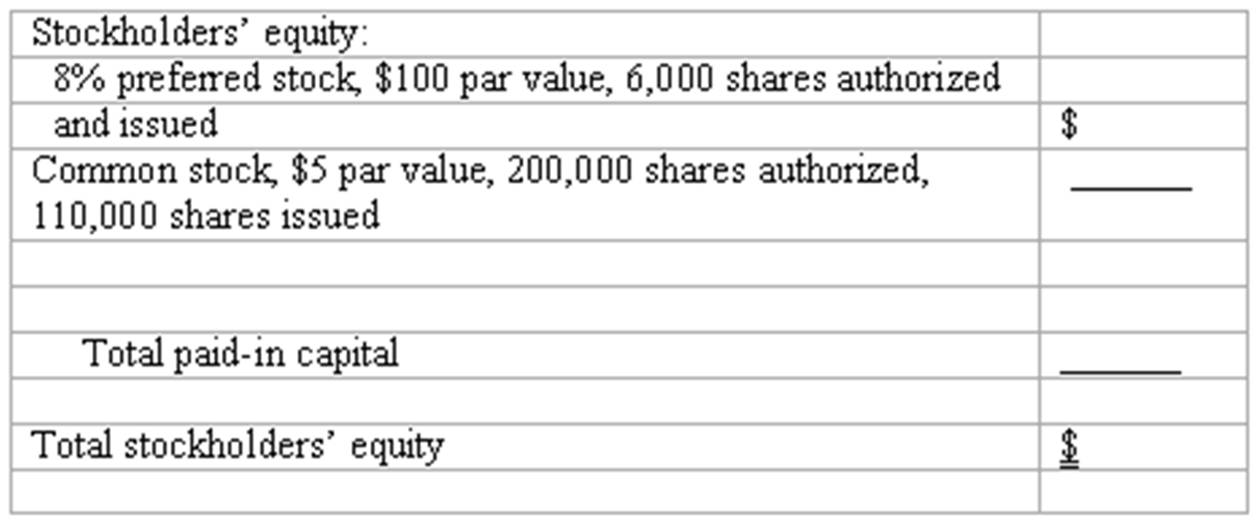

10. 10% When Haven Corporation was incorporated in 2013, authorization was obtained to issue 200,000 shares of $5 par value common stock and 6,000 shares of 8% cumulative preferred stock. The preferred stock has a par value of $100. All the preferred stock was issued at $107 per share, and 110,000 shares of the common stock were sold for $9 per share. The operations of the company resulted in a net loss of $19,000 in 2013 and net income of $125,000 in 2014. In 2015, net income was $352,000, and the cash position was sufficient to allow the board of directors to declare a cash dividend of $1 per share to the common shareholders, as well as satisfy all preferred stock dividend requirements.

Complete in good form the stockholders' equity section of Haven Corporation's balance sheet at December 31, 2015. (Hint: First determine the total amount of dividends declared in 2015.)

11. 10%

Shown below is information relating to operations of Broadway Industries for 2015:

In the space provided, complete the income statement for Broadway Industries, including earnings per share figures. Broadway Industries has 100,000 shares of a single class of common stock outstanding throughout the year.

12. 5% Greenwich Corporation had net income of $1,712,500 in 2015. The company had 300,000 shares of $4 par value common stock and 25,000 shares of 8%, $100 par, preferred stock outstanding throughout the year. Each share of preferred stock is both cumulative and convertible. Each share of preferred stock is convertible into four shares of common stock. Compute the following for 2015:

13. 5%

Differences between net income and operating cash flow.

Identify three factors that may cause net income to differ from the net cash flow from operating activities.

14. 10% The following information was obtained from the Champion Company for the year ending December 31, 20__.

Using the direct method, prepare a statement of cash flows.

15. 5%

An analysis of the 2015 financial statements of Portside Provisions reveals the following:

(a) Accounts payable to suppliers of merchandise decreased by $65,000 during 2015.

(b) Dividends of $135,000 were declared in November 2015, to be paid in January 2016.

(c) Dividends of $120,000, declared in November 2014, were paid in January 2015.

(d) Inventory levels increased by $91,000 during 2015.

(e) Depreciation expense for 2015 amounted to $53,000.

(f) Land, which had a cost of $350,000, was sold in 2015 for $400,000 cash, resulting in a gain of $50,000.

(g) Net income for 2015 was $745,000.

Using only the above information, follow the indirect method to compute Portside Provisions' net cash flows from operating activities for 2015.