Assignment 2: LASA 1Business Unit AnalysisDirections: Create a Feasibility Study for Harley-Davidson using the following outline:Part I: Differentiation StrategiesThe analysis of current strategy and

argosyModule 3 online lectures

Module 3 Overview, Part 1

Welcome to Module 3, Part 1!

This module you will make a transition from strategy analysis to strategy formulation.

Before moving on to strategy formulation, let's recall what we discussed about strategy analysis during the past two modules.

First, you, as a strategist, review the mission, vision, goals, and objectives to determine if there are any conflicts between your long-term vision and mission and the short-term goals and objectives being set.

Next, you perform a stakeholder analysis because it helps leaders formulate their stakeholder "posture" and plans. You also analyze whether or not all stakeholders hold equal importance. If not, you identify the primary and secondary stakeholders and the reasons for this categorization.

Strategy analysis also involves analyzing the external environment, including the general and the competitive environment. External environment analysis facilitates gathering key information about industry trends and driving forces that directly affect an organization and others in the same strategic group. You should be clear about what you need to scan, monitor, and forecast to stay ahead of changes in the external environment.

You need to answer some key questions to complete the external environment analysis:

How is the competitive landscape changing?

Where are the new threats likely to come from?

How profitable is the niche in which you compete, and do you need to change your competitive and market focus?

Are you well positioned to adapt to the external forces?

You can answer such questions through strategy analysis, helping in strategy planning and formulation.

Module 3 Overview Continued

Next, you perform internal analysis, which is a kind of a "pulse check" on the organization's strategy and performance to date.

By considering the organization's resources, value chain activities, financials, and strengths, weaknesses, opportunities, and threats (SWOT), you as a strategist would be able to answer the following questions:

How successful is your strategy?

How much change in strategic direction do you need to ensure healthy growth and financial performance?

Do you need to cut costs or revamp your value chain to deliver more value to your customers?

Most importantly, does the organization have a source of sustainable competitive advantage over its rivals?

Finally, after analyzing the internal and external environments, you focus on the following questions:

Given all the data of the strategy analysis, what should the organization do to achieve its goals and objectives?

What revision in strategy do you need?

This module you will learn about strategy formulation by observing three generic business-unit-level strategies:

Cost leadership

Differentiation

Focus

You will also discuss the vital role the industry life cycle plays in determining what corporate strategists should do.

Strategy Formulation: Overview

Strategy formulation may be defined as the process of creating or determining the strategies of an organization.

Strategy formulation focuses on the subject matter of strategies.

Let's discuss what the process of strategy formulation entails and how to move toward strategy formulation.

Creating and Sustaining Competitive Advantage: Selecting the "Right" Competitive Strategies

As we discussed, industries vary dramatically from one another, and organizations adopt the "most likely to be successful" stance to succeed in their industry.

There are two levels at which strategy planning takes effect—at the business-unit-level and at the corporate-level.

Levels of Strategy ? Business-Unit-Level Strategy A business-unit-level strategy is concerned with a division or product line or profit center that can be planned independently. The strategy deals with positioning the business against rivals, anticipating changes in the industry, and influencing the nature of the competition. Southwest Airlines (SWA) is a good example of a business unit — it is in a single line of business. It is also an excellent example of an overall cost leadership competitive strategy. To learn more about SWA click here. ? Corporate-Level Strategy A corporate-level strategy is concerned with selecting businesses in which an organization competes and developing and coordinating that portfolio. Corporate-level strategies focus on how to grow and manage a corporation with multiple businesses as part of its portfolio. Disney is a multibusiness unit corporation with four business broad groups including media networks — ABC TV and ESPN; parks and resorts — Disney Land and Disney World; studio entertainment — movies; and consumer products — retail and licensed products. Each of the business units pursues a competitive strategy of differentiation.

Generic Competitive Strategies

Very broadly defined, there are three stances by Michael Porter called generic strategies that firms can adopt towards being successful.

The three generic competitive strategies are:

Overall Cost Leadership: A strategy that is lean and capable of producing volumes and lowering the unit cost of services and products. The idea is to provide low-cost services and products as compared to competitors. Examples include Aldi grocery stores, Sam's Club, Cost Cutters, Great Clips hair salons, and nonbranded products.

Differentiation: A strategy where the products have a distinguishing quality or the quality of differentiation. Product differentiation refers to the services and products that stand out in the market place because they have an added value and uniqueness that customers desire and are willing to pay for. There are many ways to differentiate products, and these products are brands that stand out such as Rolex watches, Bose sound systems, Target in specialty retailing, and Toll Brothers in homebuilding.

Focus: A strategy where the product has a focus, either on cost leadership—focus-cost leadership—or on differentiation—focus differentiation. The idea is to focus on a narrow niche of customers. An organization may be a regional organization focusing on a narrow geographic niche instead of the entire U.S. market. Or the organization may have a narrow product line aimed at a particular target market. For example, Harry Winston is a jeweler targeting the "rich and famous" versus the middle-income client who may frequent a jewelry store in a mall. The key is that the organization's focus is narrow while it pursues either cost leadership or differentiation.

Generic Competitive Strategies Questionnaire

Each of these generic competitive strategies targets customers with different needs and preferences.

To be successful in any one of the generic strategies, an organization should possess:

Different competencies and capabilities.

A different set of resources and strengths.

A culture that matches the generic strategy.

Leaders and employees with background and training in different areas.

Metrics and measures that truly analyze how well the organization's employees are doing in executing its generic strategy.

Overall Cost Leadership Strategy

What is overall cost leadership, and how does it help an organization gain competitive advantage?

An overall cost leadership strategy entails pricing products at a cost lower than the competitors while not compromising on quality and service.

Organizations in industries that have some, if not all, of the following characteristics adopt overall cost leadership:

The dominant competitive force in the industry is price competition among rivals. Organizations face "cutthroat" competition as they attempt to take over one another's market share. Organizations that have lower cost structures than their rivals are better positioned for success compete on the basis of price. These organizations can ride out price wars, eventually taking over market shares from weaker rivals or prudently acquiring rivals nearing bankruptcy.

Maintaining a lower cost structure requires constant improvements of value chain functions such as inbound and outbound logistics and operations. It also requires scrutinizing advertising or marketing, sales, services, and research and development (R&D), because these activities do not reduce, but add, costs.

The experience curve effect, in most industries, lowers the unit cost of production as output or volume increases because of purchasing inputs in volume, using the production capacity to its maximum, and benefiting from other economies of scale.

The industry's product becomes a commodity-type item that is readily available. A good example of this is how, over time, personal computers (PCs) have become a commodity, and rivals have had to find efficiencies and other cost savings to compete.

Despite management efforts there are few ways to differentiate a product in the marketplace. For example, it is difficult to differentiate a board foot of lumber, which is sold primarily as a commodity.

Most buyers have similar needs or requirements that a narrow set of product offerings can satisfy. The buyers are unwilling to pay for differentiation they do not want or need.

Buyers incur low switching costs when changing sellers, so it is easy to change products. Such products may include toilet paper, light bulbs, and tissue paper. As a result there is little brand loyalty. Buyers are large and have significant bargaining power because they often purchase in bulk.

Competitive Advantages and Pitfalls

Competitive Advantage and Pitfalls of Overall Cost Leadership

By stringently managing costs and investing prudently in innovations that improve productivity, an organization can lower the unit cost of production as volume increases. This improves the organization's competitive position as compared to its rivals. It is able to buffer itself during challenging times without having to cut prices to stay in business rather than growing less profitable and more vulnerable with time.

In addition, cost leadership protects the organization against substitute products that new and existing competitors introduce. The new products would be more costly to produce and, therefore, unable to compete on price with the overall cost leader, which is key to this strategy.

The strategy, however, does have several disadvantages that managers should be aware of as they fine-tune it.

The following are three common mistakes managers make when executing this strategy:

Focus on Selected Activities: An organization focusing exclusively on cutting costs and improving performance only in selected activities in the value chain may become vulnerable in other ways. For instance, managers who vigilantly manage operating budgets only to overspend on capital projects in which there is no return on investment as planned are shortsighted. An organization should explore all value chain activities for cost savings.

Strategy Easily Copied: An overall cost leadership strategy that is easy to copy does not yield competitive advantage for long because rivals observe and imitate the investments, cost cutting, and deployment of resources the cost leader uses.

Smart Customers: Customers with pricing information erode the cost advantage. You are aware that the Internet has been a boon to customers, providing the savvy customers with significant competitive information and, therefore, bargaining power. One interesting study of the life insurance industry found that for every 10 percent increase in a consumer's use of the Internet, there was a corresponding reduction in insurance prices to consumers by 3 to 5 percent. The savings to the consumers were between $115 and $125 million annually, which corresponded to a drop in the insurance industry revenue.

- Overall Cost Leadership Strategy: Questionnaire

Organizations engaging in overall cost leadership are spartan, with a strong focus on containing costs. They often offer limited perks to executives and do not tolerate waste, emphasizing quality initiatives such as Six Sigma, lean manufacturing, and budget control.

Often, employees engage in cost control initiatives and may even benefit through productivity-sharing programs.

The organizations make investments after intensely scrutinizing cost-saving improvements such as new technology with proven benefits, automation, supply chain optimization, and outsourcing.

- Differentiation Strategy

![Assignment 2: LASA 1Business Unit AnalysisDirections: Create a Feasibility Study for Harley-Davidson using the following outline:Part I: Differentiation StrategiesThe analysis of current strategy and 3]()

What Is Differentiation?

Differentiation means adding more desirable features, services, and benefits to products that consumers want and that rival organizations cannot easily imitate. Note that it is a challenge to implement differentiation that cannot be easily copied.

Differentiation is a generic competitive strategy that is simple to define but challenging to execute well. This is because most consumers are aware of differentiated products, because many of the products they use everyday are branded products. The features and benefits differentiated goods supposedly provide distinguish the goods from others. Therefore, consumers "get" differentiation.

Managing a differentiation strategy is challenging because it is easy to foresee the rise in costs associated with differentiation. This rise is more than what the consumers are willing to pay for.

In addition, profits erode when consumers are no longer willing to pay the price for the differentiated product.

Given the warning about the rising costs of differentiation, many organizations have executed profitable and successful strategies based on one or more kinds of differentiation.

When organizations successfully differentiate their products, they may command a premium price, have greater brand loyalty, and increase unit sales.

Ways to Differentiate

Differentiation comes in many forms and touches multiple activities in an organization's value chain.

The following are some of the ways an organization can differentiate its products:

Prestige or Brand Image: For example, Neiman Marcus and Ritz-Carlton Hotels

Different Taste: For example, Dr. Pepper

Superior Service: For example, Federal Express, Nordstrom, and Lexus

Product Design: For example, Target's "design for the masses" and Apple's iPod

Spare Parts Availability: For example, Caterpillar

More Value for Money: For example, Walmart

Engineering Design and Performance: For example, Mercedes and Konica Minolta

Quality: For example, Toyota

Top-of-the-Line Image: For example, Armani, Hermes, and Manolo Blahnik shoes

Technological Leadership: For example, 3M Corporation

Unconditional Satisfaction: For example, L. L. Bean and REI

Location: For example, the top places to live

For more information on any of the organizations mentioned above, search for the organization by using Google.com, and go to its Web site to see how it presents its products and describes the features that differentiate them from its competition.

Role of Signals in the Marketplace

How do buyers judge whether a product delivers on the promises its brand implies?

Consumer research seems to support the notion that buyers listen to "signals" in the marketplace, such as price as a surrogate of quality; brand recognition or how well a brand is known; and prestige customers, which is why celebrity and sports figure endorsements are key to establishing brand recognition with target markets.

Interestingly, these signals of value may be as important as the actual product or service value for first-time buyers, who rely on price, brand recognition, and prestige to solidify the product in their minds.

For infrequent purchases, such as furniture, price can often be a signal of value to customers who may not have purchased furniture for a long time.

Sustainable Advantages of Differentiation: Brand Loyalty and Solutions

As we discussed, organizations using differentiation should be aware of the cost of differentiation and should always search for ways to provide more value to their customers. Therefore, time organizations spend listening to their customers is key, and with differentiation, providing solutions, not only products or services, is essential.

To design products and services that are unique and clearly superior in ways that appeal to customers, strategists make efforts on both primary and secondary activities in the value chain.

Differentiation provides organizations a strong defense against rivals through the strength and perception of the brands and the loyalty and frequent purchases that follow.

Are you particularly loyal to any brand? When grocery shopping, do you rarely look at prices? As you wander through the aisles, do you pick up the brands you know and count on?

Some of these may be brands your parents used—for example Tide detergent, Crest toothpaste, and Skippy peanut butter. Many people are truly brand loyal. It makes their lives simpler, with one less decision to make.

Brand loyalty is one of the main advantages of a differentiation strategy, creating a subtle form of switching cost that is difficult to overcome. No wonder organizations spend significantly to create and maintain a brand in the marketplace, because a brand is a formidable barrier to entry.

Modern tests fall into the following categories: ability testing, personality assessment, and informal assessment procedures (Neukrug & Fawcett, 2015).

Disadvantages of Differentiation

The disadvantages or pitfalls of this strategy include:

Differentiation Not Valued or Too Much Differentiation: You can find overdesigned products with too many features throughout the consumer marketplace. From programmable thermostats requiring an engineering degree to reprogram, to consumer electronics with too many features, these products fall short of consumer expectations and may end up as product flops.

Consumers Not Willing to Pay: This is another disadvantage closely related to overdesigned or overly complicated products.

High Price for Product: Pricing a product out of the range of its target market is more of a disadvantage than an advantage. An example of this is some sports and cultural events designed for a mass audience but priced too expensive for the target audience to attend.

Strategy Easily Copied or Imitated: The advantages of differentiation are short term because competitors copy the features or benefits of a product.

Erosion of Benefits: As a product becomes a commodity in the marketplace, customers are no longer willing to pay the price premium, and profits erode.

When this happens, manufacturers—to compete as a commodity—need to do two things:

Dramatically lower the cost structure of the product and move toward the generic strategy of overall cost leadership. This would be difficult to do because the business model is designed to deliver the generic strategy of differentiation.

Develop new differentiated products to replace those that no longer provide significant additional value to consumers. Apple is a good example of this. As the Apple computer became a commodity along with other PCs, the company developed the Macintosh or Mac, followed by other innovative products including the iPod, iPod touch, and iPhone. Innovation and new product development were the business models of Apple Computers, and it "found new life" after the commoditization of the Apple line.

![Assignment 2: LASA 1Business Unit AnalysisDirections: Create a Feasibility Study for Harley-Davidson using the following outline:Part I: Differentiation StrategiesThe analysis of current strategy and 5]()

What Is Focus?

The third generic competitive strategy presented by Porter is focus. Organizations select a narrow niche of potentially underserved customers and succeed by serving the needs of this niche.

The customer segment may be one that larger organizations ignore; however, the segment is still large enough to yield solid growth and profitability.

Organizations can combine a focus strategy with either overall cost leadership or differentiation, and both can be highly effective depending on the kind of customers served.

Advantages

The advantages of a focus strategy are profitability of the niche, a less complex business model, less competitive pressure, and scale.

The expectations for performance are similar. With focus cost leadership it is essential to monitor the cost structure of the entire value chain while making prudent investments in efficiency-producing technologies.

With focus differentiation it is necessary for an organization to invest in the right type of "customer listening" and market research to ensure it knows what the customer segment wants and needs. With a smaller niche, being "right" about how and in what ways to differentiate is even more important.

It is challenging for an organization to achieve a sustainable competitive advantage with a focus strategy unless the organization has high entrance barriers—for example Rolls-Royce, Lamborghini, or Porsche, companies that serve a unique, high-end niche, and it is capital-intensive to enter this segment of the auto industry.

If an organization is a cost leader in a small market, it may have some protection because bigger organizations may not find the market segment profitable enough to focus on, especially if the industry is still maturing. The organization may be a good candidate to be acquired by a larger entity.

Disadvantages of Focus Strategy

Disadvantages

The disadvantages or pitfalls of this strategy include:

New Entrants: Similar to both overall cost leadership and differentiation, a focus strategy also has disadvantages that managers should watch for. Any profitable segment faces the likelihood that new entrants with other product offerings may decide to enter the niche. This is logical because an "uncrowded niche" with extraordinary performance potential would definitely attract organizations in related industries.

Better Service Necessary: Another challenge that focus organizations face is that they need to provide better service to the market segment than bigger organizations that serve multiple segments. In theory this should be easier for the focus organizations, but exceptional customer service is difficult to deliver all the time. To do so the human resource activities of the value chain should focus on hiring the right people, providing them with effective training, and having in place compensation and benefits programs and supervision to retain those once hired and trained. Better service also means investing in appropriate technologies so that service teams have access to the right information to make customer service decisions.

Erosion of Profits: When new entrants enter the markets to compete with focus organizations, the focus organizations need to exercise additional discipline to ensure that their profits don't erode because of rising costs.

- Combining Cost Leadership and Differentiation

Now that you have a good idea of each generic competitive strategy, think about how to combine all three into a high-performing organization.

Several well-known organizations, including Toyota, Dell Computers, and Walmart, have done this.

Let's consider Toyota to see what we can learn about executing the combination strategy successfully. Go to the Argosy University Online Library and search for the article: A Comparison of Competitive Strategies in Japan and the United States. This article provides an excellent summary of the many managerial innovations Toyota uses to excel and achieve sustainable competitive advantage.

Organizations such as Walmart, Dell Computers, and Toyota achieve this combination by scrupulously managing costs, innovating, and designing and delivering value to the customers to provide a differentiated experience with a low-cost structure.

Next, we will discuss how the industry or product life cycle stage affects an organization's generic competitive strategy.

As a product or industry life cycle matures, it becomes important for management to match the generic strategy to the stage in the life cycle to remain profitable.

The product life cycle often moves from product differentiation in the early stage of introduction to a more commodity-like product requiring significant cost reduction to remain profitable as commodization and price competition begin.

Industry and Firm Life Cycle

Industry and Product Life Cycle

The idea of industry and product life cycle intuitively makes sense to us as students because the idea of a life cycle is universal, especially among living things. Human beings, animals, and one-celled organisms all have life cycles. Therefore, the idea that products and industries have life cycles makes sense.

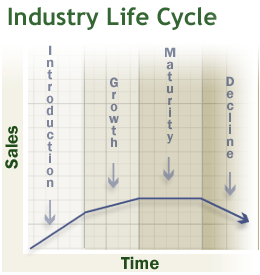

As applicable to industries, a life cycle refers to the stages of introduction, growth, maturity, and decline that occur during the life of an industry.

Think in terms of the life cycle of broad product lines such as personal computers, plasma televisions, long-distance telephone services, or copiers. Some industries die out, but industry life cycles are characterized by innovation and renewal, and are not destined to follow a "deterministic" pattern. It is easy to find many examples of product innovation and renewal starting another cycle of introduction, growth, maturity, and decline.

What is important about industry life cycles?

First, key strategic activities vary over the life cycle.

Questions such as the following vary depending on the life cycle stage:

How is value created for consumers or buyers?

Which generic strategy should industries use?

What functional strategies should industries deploy?

What goals and objectives are appropriate?

This adds complexity to the already demanding and challenging process of strategy formulation.

Let's learn about the strategic implication of each stage of the industry life cycle.

It is evident from the graphic that leaders and employees focus on different things during each life cycle stage.

Let's move on to discuss the different stages of the industry life cycle and their strategic implications in detail.

Introduction and GrowthIntroduction Stage

During the introduction stage the key activity is establishing the product in the marketplace. To do this, two functional areas of the organization are important, R&D and marketing.

R&D establishes a product design that has compelling features and an added value that attracts consumers and motivates them to buy or try the product.

Marketing communicates the new product's "story" to the customers. Sales are low but growing, and the goal is to establish market share.

As you would expect, this stage is risky and expensive. The goal is to become the benchmark product that all others would be compared with—the standard.

There is a debate on whether or not being first—or having first-mover advantage—pays off in the long run. This is a complicated question, and the definitive answer is, "It depends."

Growth Stage

Strong sales through a rapid market growth rate characterize the second stage of the industry life cycle. Strong sales and profits attract competitors. Therefore, building brand awareness and loyalty is the challenge, and marketing and sales are both critical in the growth stage.

A strong distribution system and good customer service are key to solidify customer satisfaction with the product and the buying experience.

Efforts in the growth stage focus on building selective demand from the targeted customer segments so that the product or product line maximizes its potential with the right customers willing to pay the differentiation premium. Sales increase as new customers purchase the product, and loyal customers purchase again. The key challenge is to create consumer demand.

In both the introduction and growth stages, emphasis is not on process design, because driving strong efficiencies becomes paramount in maturity when process efficiency and cost effectiveness become drivers of profitability.

Maturity and DeclineMaturity Stage

In the maturity stage the industry growth rate slows, which heightens competition for market share. Rivalry becomes cutthroat. Organizations routinely use competitive weapons, such as price cutting, warranties, promotions, and financing incentives, to attract and retain customers who become increasingly price-sensitive as the product becomes more commodity-like. Fortune magazine called the rivalry in mature industries a "game of inches," which is an apt description.

In this stage sales within an industry become stagnant, and the focus moves to efficiency and cost cutting to maintain profits, which is challenging.

With stagnant growth rates the only way to grow is to take over the competitors' market share, and this is costly. As national markets mature, organizations look to grow internationally, which requires marketing expenditures to establish brands in new global markets while stringently managing manufacturing costs and cost of sales in domestic markets.

This is where the elements of both differentiation and overall cost leadership are required, again an added challenge and complexity for the organization's leaders and employees.

In the United States, consumer products such as laundry soap, televisions, automobiles, and beer are in the maturity stage.

Decline Stage

This stage begins when industry-wide profits and sales begin to fall because of changes in the general business environment.

Shifts in consumer preferences, technological advancements in substitute products or new products, demographics forces, and sociocultural factors may contribute to the decline-stage performance.

Industries or broad product classes in the decline stage face the possibility of being replaced. Examples include long-playing (LP) records being replaced by cassettes; cassettes, in turn, being replaced by compact discs (CDs); and CDs being replaced—to some degree—by digital music and downloads.

Four Basic Strategies

Four basic strategies are available to organizations with products in the decline stage:

Maintaining a product involves continuing the product without significantly lowering investments in the brand with the hope that competitors may elect to exit from the industry, reducing competitive pressures.

Harvesting requires that as much profit as possible be pulled from the product class while concurrently slashing costs to make this possible.

Exiting the market involves dropping the product class or line from the organization's portfolio of products. Eliminating it completely would affect a set of core customers significantly; therefore, the organization should make the decision to drop the product with consideration for how important the product is to the organization, how new products would satisfy its needs, and what the exit plan would look like.

Consolidation, where one organization acquires at a reasonable price the best of the remaining organizations in its industry, allows a smaller set of organizations to survive serving the customers' demand for the product. Reducing the number of competing organizations in an industry creates market power and the ability to be profitable—in theory—for those organizations that remain.

As options dwindle during the decline stage, every decision matters, and strategists analyze all four strategies to decide which is the best for their organization at that time.

Life Cycle QuestionnaireIn the next section you will move from business unit—level strategies to corporate strategies for growth and expansion.

The scenario you will work on—Harley-Davidson—is an excellent example of a multibusiness organization using several corporate-level strategies to grow and dominate in its industry.

Summary, Part 1

This module you moved forward from strategy analysis toward strategy formulation.

You learned about the three generic strategies presented by Michael Porter:

Overall Cost Leadership

Differentiation

Focus

You also discussed their advantages and disadvantages.

Then you analyzed the idea of combining overall cost leadership, differentiation, and focus strategies.

The module also discussed the industry life cycle, which includes the following stages:

Introduction

Growth

Maturity

Decline

In Module 3, Part 2 you will learn about the corporate strategies that multibusiness corporations competing in multiple competitive environments with several business units use.

Corporations such as Disney elect to own businesses that are related, such as theme parks and resorts, movies, retail, and television. This is called related diversification, which has many advantages such as market power, revenue enhancement, and economies of scope.

Other corporations own a diverse set of business units to gain financial synergy.

You will also learn about the methods used to achieve related or unrelated diversification.

Module 3 Overview, Part 2

Work individually to gather information to determine when international expansion is a viable diversification strategy and how to enter new global markets.

Know when and how to apply e-business strategies to grow a business.

Identify the variety of strategies that can be used by firms to enter global markets.

Apply a global market entry approach to an individual firm.

Determine how an e-business strategy can improve competitive position.

Leverage Internet and e-business capabilities.

Determine how to create value in global markets.

Apply ethical reasoning and ethical principles throughout the strategic management process.

In Module 3, Part 1 you learned about the competitive strategies used by single business unit firms such as Southwest Airlines. You were introduced to a business unit of a multibusiness firm such as Disney.

These generic competitive strategies are:

Overall cost leadership

Differentiation

Focus-overall cost leadership and focus-differentiation

We also explored how strategies must change during the life cycle of a firm. The key message is that the imperatives necessary for success must change to match the characteristics of each stage.

This module we will explore the corporate strategy of multibusiness firms by asking questions such as:

How do multibusiness corporations, typically the larger and more complex ones, grow?

How is managing a "portfolio" of businesses different from managing a single line of business?

How are synergies created among the businesses in the portfolio?

What motivates leaders to acquire or add new businesses?

How do related and unrelated diversification strategies differ, and in which conditions should each be implemented?

- Introduction to Diversification

![Assignment 2: LASA 1Business Unit AnalysisDirections: Create a Feasibility Study for Harley-Davidson using the following outline:Part I: Differentiation StrategiesThe analysis of current strategy and 8]()

The Challenging Path to Successful Diversification

The history of business diversification is littered with many failed attempts to find predicted synergies and provide solid returns to shareholders through a strategy of multibusiness diversification.

There are many reasons for the spotty track record of this corporate strategy, including overpaying for an acquisition. One such example is the case of Charles Schwab's acquisition of U.S. Trust. This acquisition did not succeed because Charles Schwab did not do a careful analysis of the operations of the acquired business to uncover the incompatibilities of computer systems, business processes, corporate cultures, and orientation to goals.

Synergy and greater returns to shareholders are the two main goals of diversification.

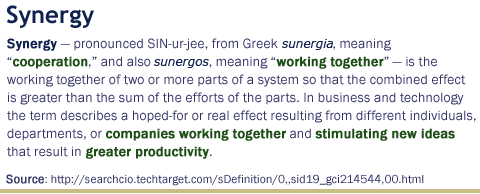

It is critical that there is synergy between processes, systems, culture, and goals, and the firm's capabilities for successful growth and diversification. The word "synergy" is one of the most overused words in the business glossary. There are a number of definitions, and the one from CIO magazine is useful:

![Assignment 2: LASA 1Business Unit AnalysisDirections: Create a Feasibility Study for Harley-Davidson using the following outline:Part I: Differentiation StrategiesThe analysis of current strategy and 9]()

From the point of view of strategy, the above definition is good and can be summarized as "working together." "Working together" in a corporation designed around the concept of related diversification achieves its synergy across the business units, while a corporation executing a corporate strategy of unrelated diversification seeks its synergy hierarchically.

Each type of diversification—related and unrelated—will be described in the sections to follow.

Related Diversification

Click to download transcript

Related diversification is successful when firms are able to achieve:

Economies of scope

Market power

Related Diversification: Economies of Scope

Economies of scope refer to the ability of a firm to build on the key horizontal relationships across its businesses by leveraging its core competencies and sharing activities.

Core competencies are those things that a firm does exceptionally well that reflect the collective learning experiences of the organization.

Let's take a look at the Walt Disney Company, which is a vivid example of related diversification and synergy.

Disney leverages its core competency of creating amazing entertainment experiences based on its strong history of creativity and storytelling. It also shares activities across its business groups.

On the Disney Web site are the colorful and familiar images of Disney's main creative asset—its characters.

In small print on the Corporate Information page, there is a statement about Disney's mission, "Find out about people, initiatives, and opportunities at the world's premier entertainment company."

Diversification Example—Walt Disney

In the center of the Corporate Information page are blinking advertisements featuring Disney's current entertainment mix produced by the four business segments of Disney, which are:

Media networks, which include ABC TV, ESPN, and Disney content sold on iTunes, including some award-winning programming. It also includes new business joint ventures with the BBC and others.

Parks and resorts, which include new attractions, such as Everest, created by the Disney Imagineer to celebrate the 50th anniversary of theme parks.

Studio entertainment, which includes the movie companies, Touchstone and Walt Disney Productions. Touchstone was created to produce PG-13 and R-rated films with more grown-up themes such as Casanova and Annapolis. Walt Disney Productions produces Disney's traditional family- and children-friendly fare.

Consumer products, which include all Disney characters sold via licensing, in retail, in films, in games, or through Disney's online Web site.

Core Competencies

Core Competencies of a Firm

According to several strategy books, core competencies are those things that a firm does exceptionally well that reflect the collective learning experiences of the organization.

For instance, Disney does creativity and entertainment exceptionally well. It applies these core competencies to all that it does and shares these skills across business groups.

For core competencies to create value for customers and synergy across business units, they must:

Create exceptional value and portray as strength relative to the market competition. Few companies can rival the ongoing creativity of Disney, and none demonstrate it across as many entertainment channels.

Share the core competency across the business units in a meaningful way. For instance, in Disney's case creative content is shared and used by all the four business groups. A wonderful example is the Disney theme park ride, Pirates of the Caribbean, which was made into an award-winning movie in 2003 starring Johnny Depp. It was a blockbuster and paved the way for two sequels. In addition to movie and DVD sales, the characters have been licensed into multiple products and the movie will be aired countless times on Disney TV and ABC.

Ensure that the core competency is difficult for competitors to copy, imitate, or find substitutes for. The Disney franchise is known around the world, and "the mouse" is an iconic brand. This 83-year-old company seems to be wired into the DNA of most U.S. citizens and with the Internet; there are theme parks in China, Japan, and France; and has a large U.S. export of popular culture in the form of movies, television, music, and video games; the Disney brand is impossible to imitate.

Sharing Activities

In related diversification, firms are able to achieve economies of scope by transferring accumulated skills and expertise across business units, which pays off in two key ways:

Enables cost savings by sharing activities, such as optimization of the supply chain and joint purchasing.

Enables revenue enhancement and differentiation through sharing activities to increase brand recognition and differentiation, allowing premium pricing of products

Market Power

Related Diversification through Market Power

Market power accrues to firms in several ways:

Through pooled negotiating power—horizontal relationships

Through ownership of related businesses—vertical integration

Pooled Negotiating Power

When a corporation has multiple-yet-related businesses in its portfolio, it can pool its purchasing power and wield it with suppliers and customers, and thwart competitors that lack its market clout.

Buying power is only one way in which pooled negotiating power is expressed.

A business unit of a strong company, such as Nestle or GE, has the support of a "deep-pocketed" parent corporation that can help fund marketing campaigns needed to bring less well-heeled rivals to the brink of bankruptcy, at times causing them to exit the industry, or force a competitor to sell itself to a stronger firm.

This dynamic result in industry consolidation is a form of market power.

Vertical Integration

Vertical integration is yet another way market power is achieved. It represents an expansion of a firm's market power by acquiring a firm's inputs either forward in its supply chain, closer to the end customer, or backward by acquiring suppliers, which lowers the firm's overall cost structure.

While there are obvious benefits of gaining access to a secure source of important inputs, the new technologies possessed by the acquired firm, new business segments, and easier procurement, there are also risks.

The risks boil down to:

loss of flexibility and speed in responding to changes in the external environment

increasing the cost of overhead and capital expenditures

rising administrative costs due to additional business complexity

imbalances in the firm's extended value chain.

Unrelated Diversification

Unrelated diversification is implemented by corporations for a different set of reasons, including the financial and hierarchical benefits derived from the relationship between corporate management and each business unit. This relationship has been dubbed the "parenting advantage."

The first goal of the parent company management is to create shareholder value through the mix of businesses in the corporate portfolio.

Here the leadership provides a number of key factors:

assistance and expertise in corporate budgeting

formulation of strategies

allocation of resources

top-notch corporate services such as legal, human resources, supply chain management, and compliance

The corporate management also advises business units on the acquisitions made by a business unit, ensuring due diligence and verification of analysis.

Parent corporations acquire businesses that are in need of a so-called makeover.

The executive leadership at the corporate level then performs the following functions:

Asset Restructuring: The parent company restructures the business units it purchases by selling off unprofitable product lines, which is known as asset restructuring. This process includes closing nonperforming units and improving the product quality, manufacturing efficiency, and sales and customer service.

Capital Restructuring: When the parent company restructures the debt-equity mix, the process is termed as capital restructuring.

Management Restructuring: The parent company may get rid of nonperforming managers, which is known as management restructuring.

These functions are carried out by the parent company to do whatever is needed to turn performance around and increase revenues and earnings.

Reasons for Diversification

Is managing business risk a reason for unrelated diversification?

Conventional wisdom states that two reasons why corporate leaders engage in unrelated diversification is to manage the risks associated with business cycles and seasonality.

The idea is that revenues and earnings are more stable if the corporate portfolio of business units takes these risk factors, besides others, into account.

For instance, in the late 20th century, the tobacco companies were under assault by states' attorneys across the United States who filed lawsuits claiming that the companies knew of and failed to act on the health risks associated with tobacco. Prior to the onslaught of these lawsuits, Phillip Morris Tobacco, now Altria, operated as a single business company in the tobacco industry. Beginning in 1985 with the acquisition of Kraft Foods, it began purchasing businesses outside the tobacco industry.

It has currently diversified into four distinct industries:

the food industry

the tobacco industry, both domestic and global

the financial services industry

the brewing industry

It is evident that diversification broadened the corporation's holdings away from the then risky tobacco industry into the more stable food industry, initially with General Foods and next with Kraft Foods.

Kraft Foods may be spun off into a separate company, thereby freeing it of the risk from lawsuits against Philip Morris. It seems logical that risk reduction was one of the motivations of Philip Morris when it began its unrelated diversification through acquisition.

Methods of Achieving Diversification

How Is Diversification Achieved?

There are three major approaches to how firms diversify, each of which presents different management challenges. Let's learn about the approaches in detail.

Mergers and Acquisitions: When firms diversify through mergers and acquisitions, the assets and competencies of another firm are purchased—sometimes through hostile means and in competition with another firm. Mergers and acquisitions typically present the most challenge because this diversification approach requires the integration of cultures, systems, processes, and people.

One of the most effectively managed mergers was the acquisition—some still like to call it a merger—of Pillsbury by General Mills. To its credit, General Mills took its time with the process of integration. This was helped by the fact that Pillsbury's headquarters were in downtown Minneapolis, Minnesota, and General Mills' headquarters are located about 15 miles due west in a second-tier suburb. People had time to get used to the merger and move offices to General Mills.

The human resources teams worked together to assess the employees of Pillsbury, seeking to place them in jobs where their talents could be utilized. Often, it is the acquired firm's employees who suffer the most in an acquisition and are most likely to be laid off due to job or position duplication. Waiting a year and working together allowed wiser choices to be made about placement of people. The natural attrition that occurred within that year allowed a good number to be retained. General Mills is a good place to work.

In 2005 it ranked 58th in Fortune magazine's 100 Best Places to Work. By 2009, it dropped a bit to 99th.

Joint Ventures

Joint Ventures or Strategic Alliances: When firms diversify through joint ventures or strategic alliances, the resources and competencies of the firms in the venture or alliance are pooled to make a stronger presence in the marketplace.

Strategic alliances and joint ventures are typically undertaken because firms have complementary core competencies. One firm may be great in product development and the other in global marketing, so an alliance becomes a way to take advantage of new products in new global markets.

Coordination and developing a mutually satisfying legal contract covering every possible legal exigency that excellent lawyers can imagine are two areas that can pose a challenge.

Communication systems, role conflicts, and egos can also get in the way.

Alliances and ventures are sometimes corporate courtship periods preceding a full-blown merger. Managing alliances can, however, prove difficult, as the example of Toys "R" Us and Amazon.com illustrates.

Internally Funded Growth: When firms diversify through internal funds into new products, markets, or technologies, it is known as internally funded growth.

Internally funded growth is the most natural way for a successful company to grow, assuming the firm has the financial vitality and skills to develop new products, enter new markets, and scale its operations effectively and efficiently. MetaSwitch is a firm that has succeeded in internally funded growth.

Corporate Ethics in Value Creation

Managerial Motives and Value Creation

While discussing how corporate leaders and employees expand businesses, we have been assuming that all decisions are made rationally without the influence of personalities, hidden agendas, and power politics. This is, however, not the case.

Corporate leaders are first and foremost human beings who are subject to the full range of personality-driven decision making that people are subject to in other parts of their lives.

Now, we are not talking about grossly unethical behavior such as the scandals with Enron or WorldCom. Rather, we are discussing human motives such as big egos and greed, often coupled with the widely held myth that "growth for the sake of growth is good."

The iconic image of Michael Douglas playing the character Gordon Gecko in the 1987 film Wall Street epitomized by the statement, "Greed is good," captures all that can go wrong when big egos and huge returns collide.

Even more grounded leadership can succumb to the illusion that "growth for the sake of growth" is a wise strategy. It can be rightly said that in some instances, it is not. In fact, at times it can begin a death spiral for a firm, leading to suboptimal performance and ultimately bankruptcy.

It is easy to see why this myth survives and thrives.

Growth is favored because:

The firms are seeking corporate rankings.

The analysts want to determine the growth in market share, revenues, and both operating and net income.

The executives link compensation and stock options to corporate size.

Boards now have greater responsibilities since the enactment of new governance laws and requirements, so it will be interesting to watch whether egos are tempered and the myth that growth is always good wanes somewhat.

Corporate Ethics in Value Creation Continued

Corporate Ethics in Value Creation

In all corporate decisions, the ethics imperative is essential.

Some of the most visible and painful issues that evolve from corporate strategies pertain to the restructuring of jobs and downsizing that often results when business units are merged. The ethics of plant closures in manufacturing has received a significant amount of press ink.

Ford and General Motors (GM) have both been in the spotlight as each struggles with the impact of global competition, slow response to the move to hybrid cars, reliance on sale of sport utility vechicles and trucks, and bloated cost structures due to many historic factors.

Many U.S. firms, from Disney to Citicorp to Coca-Cola to GE and beyond, have been scrutinized by watchdog groups such as Responsible Shopperfor their behavior in a range of activities from marketing, mergers and acquisitions, human resource practices, environmental degradation, the treatment of animals, and much more.

It is eye opening for a business major to see how activist stakeholders challenge the business strategies of firms and how closely they are monitored. It is one reason why firms need to monitor the external environment for possible threats and opportunities.

As part of your business plan for Harley-Davidson, you will address the potential issues faced by the firm and the industry as a whole, and develop a Code of Ethics for Harley-Davidson.

Summary, Part 2

This module section we took our thinking up a level of analysis to the corporation and reviewed the myriad ways in which corporations grow and some of the challenges encountered along the way.

A distinction was made between using related versus unrelated diversification to expand a business.

Related diversification, typified by the Walt Disney Corporations, emphasizes growth through economies of scope and increasing market power through horizontal relationships and vertical integration.

Horizontal relationships entail sharing capabilities across business units by optimizing the supply chain, sharing talent, sharing best practices, and leveraging ideas and resources.

Vertical integration is defined as owning businesses forward and backward in the supply chain, providing greater control over inputs and profits.

Unrelated diversification is where there is no common theme across the business units. It derives its benefits from the "parenting advantage" provided by the corporate parent. Serving as advisors, resource allocates, change agents, and more, the parent corporation uses its financial and hierarchical clout to shape and mould the business units into high-performing entities.

Finally, you learned that diversification—related or unrelated—unfolds in three ways:

Mergers and acquisitions

Strategic alliances and joint ventures, which may morph into acquisitions after proving their viability and potential

Internal growth

The Internet and e-business spawned many new business models—some widely successful and others huge flops—but their power to reach customers and deliver value is unprecedented.

Next module, you will look at how firms mobilize to grow globally and also how the digital economy, especially the Internet, has transformed business, providing many opportunities and challenges for growth.

You will also learn about leveraging e-business capabilities.