Need as mentioned in the document.

[1 point] Consider a hypothetical economy produces only three goods: X, Y and Z as is it given in the data below.

| Year | Price | Quantity | Price | Quantity | Price | Quantity | |||

| Year 1 | $100 | $10 | $5 | ||||||

| Year 2 | $110 | $12 | 10 | $4 | |||||

Calculate the nominal GDP for Year 1 and Year 2

Compute the percentage of growth in nominal GDP from Year 1 to Year 2.

Using Year 1 as the base year, calculate the real GDP for Year 2.

What is the GDP deflator for Year 2?

What was the inflation rate between Year 1 and Year 2?

[0.5 Point] The best measure for comparing a country’s aggregate output over time is

Nominal GDP.

Real GDP.

Nominal GDP per capita.

Real GDP per capita.

Average GDP per capita.

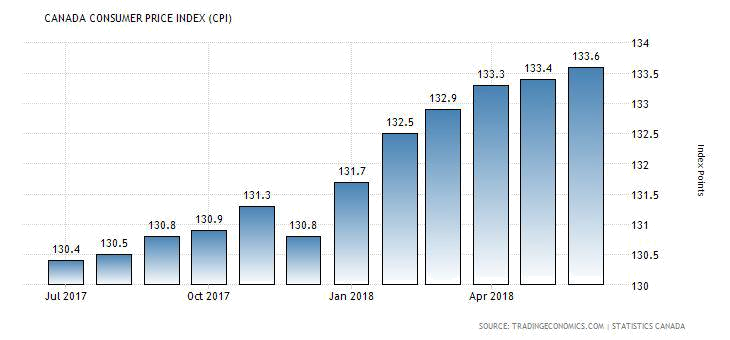

[1 Point] According to the Statistics Canada, Price Index CPI in Canada increased to 133.60 Index Points in June from 133.40 Index Points in May of 2018 (See the figure below). Consumer Price Index CPI in Canada averaged 61.14 Index Points from 1950 until 2018, reaching an all time high of 133.60 Index Points in June of 2018 and a record low of 12.10 Index Points in January of 1950. Calculate the inflation rate from June 2017 to June 2018.

[0.5 Point] Which of the following transactions will be included in GDP for the United States?

Coca - Cola builds a new bottling plant in the United States.

Delta sells one of its existing airplanes to Korean Air.

Ms. Moneybags buys an existing share of Disney stock.

A California winery produces a bottle of Chardonnay and sells it to a customer in Montreal, Canada.

An American buys a bottle of French perfume in Tulsa.

A book publisher produces too many copies of a new book; the books don’t sell this year, so the publisher adds the surplus books to inventories.

[1 Point] Consider a hypothetical open economy with a government spending (G) of 1,500, Taxes (T) are 1,000, Consumption (C) is given by the equation C = 250 + 0.75 (Y – T), Investment (I) is given by the equation I = 1,000 – 50 r, where r is the real interest rate in

percent and Net Export(NX) is given by the equation NX = 500- 500ɛ, and real interest rate

r* = 5. . Given this information about the components of the GDP, answer the following questions based on this information (Hint: Y= C+I+G+NX, Where Y stands for the national income (GDP))

In this economy, solve for national saving, investment, the trade balance and the equilibrium exchange rate.

Suppose now that G rises to 1,250. Solve for national saving, investment, the trade balance and the equilibrium exchange rate. Explain what you find.

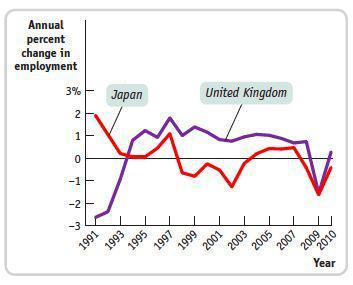

[1 Point] The accompanying figure shows the annual rate of growth in employment for the United Kingdom and Japan from 1991 to 2010. (The annual growth rate is the percent change in each year’s employment over the previous year. Comment on the business cycles of these two economies. Are their business cycles similar or dissimilar?