Hi folks, I have one assignment for economics which is already done by one of you. Unfortunately its not complete because of graphs which i needed for each question. I want somebody to go throguh with

0

Online Shopping Retailers Taxations

Student’s Name:

Institution Affiliation:

Date:

Article summary

The articles discuss issues about taxation on Global Online companies such as Amazon. Australian government issued a notification directing oversees companies to collect tax on products under $1,000. Australian government noted that it intends to collect about $300 million revenues that will be utilized to creation of public amenities (Chung, 2018). On the other hand, Amazon claims that this move will only result to products sold in Australia to become very expensive compared to other countries. It further argues that a customer will find it cheaper to import commodities from America and pay shipping fee. For instance, Unicomp Ultra Classic Keyboard generally cost about $139 on Amazon.com however, on Amazon.com.au; the same product cost approximately $360 (Chung, 2018).

The author identifies ways through which Australian citizen can maneuver and ensure that they still enjoy low prices from Amazon. First, establishment of a Virtual Private Network that acts as middlemen for internet connection tricking streaming services such as Netflix into the assumption that one is currently in America. Secondly, creation of freight forwarding services by Australian Citizen can assist shoppers with address from America to ship products to customers to Australia for a fee (Chung, 2018). However, this method does not hinder one from getting charged with GST but ultimately one save up to ten percent on the cost.

The taxation decision by the Australian government to impose taxation burden to global online companies have seen companies such as Amazon increase their product cost. However, online sites such as eBay and Alibaba have claimed that they will not follow the path taken by amazon. It is noted that this will result to increased restrictions. It is argued that this move by the government denies Australian taxpayers options and choices that are available to many people globally (Chung, 2018). This is despite warning given by ATA to Senate on issues pertaining taxation, claiming that it would result to major online platforms to exit the Australian market. Taxation of online companies by the government is a clear indication that the government does not prioritize the citizen’s interests (Chung, 2018).

In conclusion, Amazon spokesman indicated that they had to reassess the company’s workability due to the legislation by the government where it will redirect all its Australian customers to Amazon.com.au. However, despite the measures taken by the government, Amazon has confirmed that Australian citizens will not be restricted to access Amazon’s US site but the company will only ship products bought to US addresses.

The Australian Taxpayers

According to the article, the author claims that the Australian taxpayers tend to punish Aussie consumers denying them the equality among other shoppers globally. Technically, the above statement is true as in the most cases the author of the article has indicated that the Australian citizens will pay more for products that cost cheaper on other online sites. The need for increasing tax revenue results to tax system complexity due to additional tax instruments (Vito & Zee, 2001). In addition, increment in tax revenues results to increment in tax rates thus decreasing efficiency. According to research, Australia has a high progressive social security system as well as tax system. However, the Australian citizens are said to pay a bit higher that the average American. This makes Australia as the second best country with a better quality of life in the world. The survey had to consider the three basic dimensions of human development; that is life expectancy, mean and standard of living. Overall Australia level of revenue from taxation is quite low when compared to other OECD nations. However, this does not necessary imply that the country has an equitable and efficient tax system (Vito & Zee, 2001).

Studies have indicated the country’s tax system in fact breaches taxation principles. For instance, the taxation system is not equitable when taxing different income types since it is inconsistent where a large proportion of the taxation revenue is attained from income and profits (Stokes & Wright, 2013). A research conducted in 2010 indicated that more than fifty percent of the revenue from tax was derived from income and profit taxation. This makes the country to have a slightly higher tax revenue and an over burden on wages and salary earners in all OECD countries (Stokes & Wright, 2013). Consequently, apart from the country having an inequitable and inefficient taxation system, the tax system is not easy to understand. Therefore, the lack of simplicity is evident from the fact that the Australian system is comprised of more than one hundred twenty five taxes and underpinning legislation referred to as Income Tax Assessment Act. This makes the taxation system of Australia to be the most complex and the least in provision of equity. Hence, the government should ensure that the have marginal income taxation rate making it more progressive by widening the tax brackets. In addition, the top tax marginal rate ought to be increased while earners on an average earning should not be imposed on a marginal tax rate more than thirty percent (Stokes & Wright, 2013).

Considering the above statement, the prices of the products sold on online sites will increase due to the government change of the taxation system and this decreases the efficiency level within the economy. In an economic policy, focal trade-offs lies between equity and efficiency and as a result, policies that result to increment in equity and the redistribution of income tend to be affected by taxation. According to taxation theories, it is crucial to understand the role played by various optimization frictions and how they impact different patterns. As a result, it is crucial to understand the role played by the various optimization factors on taxation. Behavioral responses by taxpayers will often result to reduction in the ability for taxpayer making declaring their sales.

Rationale behind Online shopping platform

Online shopping is an electronic commerce where consumers can purchase goods and services over the internet via a web browser. Online shopping has drastically become popular considering that it provides an easy way for one to shop at the comfort of their home. For the last few decades, many companies have turned to online shopping platform due to the many advantages that are associated with the platform. Online shopping improvises the business-to consumer method where a customer can access the company’s products via a web browser. In addition, with advancement in technology online shopping platforms allows customers search for specific products and there are various methods of payment available for consumers. Internet has continued to shape human lives and it has become indispensable feature of our lives. One of the main advantages of online shopping is increased customer satisfaction. However, in order for a company to measure the level of their customer satisfaction based on online shopping will often involve determining the success and failures of e-commerce.

E-commerce has been in existences for quite some time and since its invention, many business have benefited. Many companies have been incorporating e-commerce through the use of electronic data interchange using proprietary private valued-added networks (VANs) as a communication medium. As a result, this form of technology tended to be quite expensive for small sized businesses to explore. However, as technology continue to advance, more and more sophisticated applications have been developed that ensures that e-commerce is accessible by many business globally. Since 1993 when the Internet and World Wide Web began to become popular, many companies started to incorporate the new phenomena into their business and as a result defined the new e-commerce. The internet has made it much easier and cheaper for companies and consumers to interact and conduct commercial transactions as opposed to the traditional form of doing business, in addition, it has opened up new markets for business to explore considering that the internet is not affected by geographical boundaries.

E-commerce or online shopping is considered as a form of direct market of non-store companies. This new concept of shopping has captured the eye of many business due to its general recognition that online shopping is an alternative channel alongside traditional offline retail channels such as physical retail stores. In most cases, companies will tend to prefer to use online shopping when the companies has already had an established product name and reputations. However, a large scope of the correctness of the Internet for advertising will depend on the features of the products and services that is been advertised (Chung, 2018). According to a study conducted by Professor Rajiv, there are two types of products that are advertised and sold over the internet. The first category is products that customers do not need to see before they purchase and can be evaluated using just pictures and text. Such products included but not limited to computers, canned goods, compact discs among others. As a result, companies that deal with such products continue to explore the advantages of online shopping resulting to increased sales and revenue (Chung, 2018). The second group are products that are referred to as experience products that customer prefer to touch and see before they purchase them. This type of products include clothes and groceries. As a result, this form of products although have found themselves in the internet are not suitable for online shopping as the information about the product may not be sufficient enough for the customer to make a justified conclusion (Niels, 2010).

The rationale behind the idea of online shopping is determined by factors such as convenience, time saving, search features, and the ability to compare products and prices. Further, apart from accessing a variety of products in one platform, online shopping has shaped the global market as it is quite easy to purchase products from a different country and have it delivered to you many kilometers away (Einav, Liran, Knoepfle, Levin, & Sundaresan, 2014). As a result, online shopping has made the markets more efficient. First, online shopping has allowed retailers and online retailers to cut their overhead cost such as rent hence able to provide products at a fair price. In addition, unlike the tradition method of shopping that was limited to a particular time, online shopping allows customers shop at any time of the day with no limits. In most cases, customers will prefer to shop online since they have choices and access to more information thus influencing their purchasing decision. As a result, consumer’s saves time as online shopping provides a more convenient location to access products easily. In addition, online shops have a low operation cost resulting to low prices compared to traditional form of business.

Australian Retailers efficiency

Taxation has for the Brick-and-mortar retailers have been collected by states globally with such taxation bills been exempted for companies that did not have a physical address such as online shopping retailers. As a result, such companies have continued to enjoy huge profits. In Australia the taxation of online shopping companies have been received with mixed reactions by the citizens. For many decades, store and traditional retailers have faced stiff competitions due to the increase in online shopping thus resulting to them been declared bankrupt (Agrawal & Fox, 2015). Therefore, the move by the government will coincidentally impact the traditional retailers in many ways. First, the playing ground between the retailers and the online companies will be leveled as both will be obligated to declare and submit their taxes to the states. Therefore, I agree that the move to impose tax to online shopping will result to traditional retailers been more efficient.

Online sales taxation will give states the authority to demand online retailers to collect sales taxes on purchases. However, this move indicates that the money collected is actually collected from consumers indirectly rather than the businesses. This is because, the companies will have to factor in the sales taxes in their total cost. On the issue pertaining to total surplus of an economy, the issue is quite difficult to determine due to the many factors that impact the economy. The economy of a country will often be influenced by factors such as sales taxes and retail store employment. Technically, all sales ought to be taxed and the fact that online retailers used to bypass this aspect, taxation of such platforms will result to more revenue collection (Niels, 2010). In addition, increased online shopping has resulted to low employment levels as a result no disposable income by citizens. Taxation of online retailers will result to increment in total surplus in the economy thus the government has enough funds to spend on improvements of public amenities such as roads and hospitals.

Short run and Long run Consequences

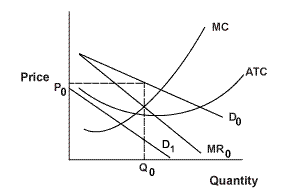

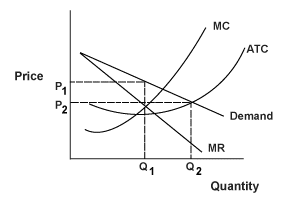

Taxation of the online retailer’s sales will have both short run and long run impacts to the country’s domestic retailers. First, in the short run, domestic retailers will enjoy more clients as products sold online will tend to be quite expensive when compared to retail products. In addition, the market will be associated with a situation where companies will continue to sell their products until their marginal revenue (MR) equals marginal cost (MC). At this point domestic retailers will enjoy maximum profits (Niels, 2010). It is important to note that during the short run an increase in demand will result to increase in output and the reverse is true. The market equilibrium in the short run is defined to be a where the price and quantity of output results to utility maximization due to demand. In addition, the supply in the short run is derived by choosing the available inputs thus maximizes profits.

In the long run, the market will start to experience changes ins prices and if the market prices fall below the total average cost of the company, companies will start incurring losses. To avoid such a scenario many companies will result to changing their company sizes.

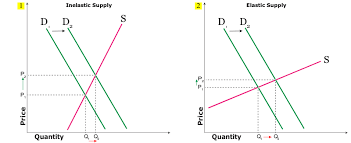

In such a scenario, if the demand of product increases, many companies will tend to increase their prices in the long run forcing the supply curve to slope upwards.

In a scenario where companies decrease their cost, the demand will tend to increase companies result to increasing their products thus lowering their costs hence savings enjoyed by consumer in the long run. Also, elasticity will often be lower in the short run as opposed to the long run. This is because in the short run, there are changes that are quite challenging to produce that are not difficult to make in the long run. When considering the demand curve, customer tend to make lifestyle choices while on the supply curve, the producers have ample time to make progress in their company output.in addition, it is easier to change the demand of a product in the long run as opposed to the short run.

In the short run, more customers will tend to have more disposable income due to many of them shifting their shopping habit to the local retailers due to increased prices of products purchased online.

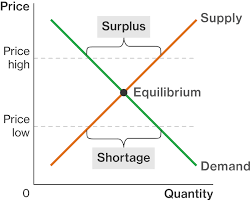

At Price 1, consumers will tend to have a low demand considering that the P1 is above the equilibrium price (p). Any price that is above the equilibrium price results to a surplus in the market since the demand is low compared to what producers are producing. On the other hand, when the price of the products reduces to below the equilibrium price, the demand for products tends to increase resulting to a shortage since the producers are not able to produce goods at that low prices.

ReferencesAgrawal, D., & Fox, W. (2015). Sales taxes in an e-commerce generation. SSRN Working Paper.

Chung, F. (2018, June 1). 'Turnbull’s online shopping tax punishes Aussie consumers’: How to avoid the Amazon rip-off. Business Retail, pp. 1-6.

Einav, Liran, Knoepfle, D., Levin, J., & Sundaresan, N. (2014). Sales Taxes and Internet Commerce. American Economic Review, 1-26.

Niels, J. (2010). Imperfect Tax Competition for Profits, Asymmetric Equilibrium, and Beneficial Tax Havens. Journal of International Economics, 253-264.

Stokes, A., & Wright, S. (2013). Does Australia Have A Good Income Tax System. Intenational Business and Economics Research Journal, 533-542.

Vito, T., & Zee, H. (2001). Tax Policy for Developing Countries. International Monetary Fund Publication.