3 case studies

Case study 1:

Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota. Dan Dority, the company’s geologist, has just finished his analysis of the mine site. He has estimated that the mine would be productive for eight years, after which the gold would be completely mined. Dan has taken an estimate of the gold deposits to Alma Garrett, the company’s financial officer. Alma has been asked by Seth to perform an analysis of the new mine and present her recommendation on whether the company should open the new mine.

Alma has used the estimates provided by Dan to determine the revenues that could be expected from the mine. She has also projected the expense of opening the mine and the annual operating expenses. If the company opens the mine, it will cost $850 million today, and it will have a cash outflow of $75 million nine years from today in costs associated with closing the mine and reclaiming the area surrounding it. The expected cash flows each year from the mine are shown in the following table. Bullock Mining has a 12 percent required return on all of its gold mines.

Construct a spreadsheet to calculate the payback period, internal rate of return, modified internal rate of return, and net present value of the proposed mine.

Based on your analysis should the company open the mine? Explain in detail the different measures which you have calculated for this case. Specifically, provide an explanation of payback period, IRR, MIRR and NPV. Also, explain how business’ use these for decisions and the potential advantages/disadvantages of each.

In your 2-3 page analysis, be sure to thoroughly answer the questions presented with a strong supporting rationale. Your paper should be formatted in APA style with a title page.

Case study 2:

You recently graduated from college, and your job search led you to East Coast Yachts. Because you felt the company's business was seaworthy, you accepted a job offer. The first day on the job, while you are finishing your employment paperwork, Dan Ervin, who works in Finance, stops by to inform you about the company's 401(k) plan. A 401(k) plan is a retirement plan offered by many companies. Such plans are tax- deferred savings vehicles, meaning that any deposits you make into the plan are deducted from your current pretax income, so no current taxes are paid on the money. For example,assume your salary will be $50,000 per year. If you contribute $3,000 to the 401(k) plan, you will pay taxes on only $47,000 in income. There are also no taxes paid on any capital gains or income while you are invested in the plan, but you do pay taxes when you with-draw money at retirement. As is fairly common, the company also has a 5 percent match.This means that the company will match your contribution up to 5 percent of your salary, but you must contribute to get the match. The 401(k) plan has several options for investments, most of which are mutual funds. A mutual fund is a portfolio of assets. When you purchase shares in a mutual fund, you are actually purchasing partial ownership of the fund's assets. The return of the fund is the weighted average of the return of the assets owned by the fund, minus any expenses. The largest expense is typically the management fee, paid to the fund manager. The management fee is compensation for the manager, who makes all of the investment decisions for the fund. East Coast Yachts uses Bledsoe Financial Services as its 401(k) plan administrator. Here are the investment options offered for employees:

Company Stock

One option in the 401(k) plan is stock in East Coast Yachts. The company is currently privately held. However, when you interviewed with the owner, Larissa Warren, she informed you the company was expected to go public in the next three to four years. Until then, a company stock price is simply set each year by the board of directors.

Bledsoe S&P 500 Index Fund

This mutual fund tracks the S&P 500. Stocks in the fund are weighted exactly the same as the S&P 500. This means the fund return is approximately the return on the S&P 500, minus expenses. Because an index fund purchases assets based on the composition of the index it is following, the fund manager is not required to research stocks and make investment decisions. The result is that the fund expenses are usually low. The Bledsoe S&P 500 Index Fund charges expenses of .15 percent of assets per year.

Bledsoe Small-Cap Fund

This fund primarily invests in small-capitalization stocks. As such, the returns of the fund are more volatile. The fund can also invest 10 percent of its assets in companies based outside the United States. This fund charges 1.70 percent in expenses.

Bledsoe Large-Company Stock Fund

This fund invests primarily in large- capitalization stocks of companies based in the United States. The fund is managed by Evan Bledsoe and has outperformed the market in six of the last eight years. The fund charges 1.50 per- cent in expenses.

Bledsoe Bond Fund

This fund invests in long-term corporate bonds issued by U.S.– domiciled companies. The fund is restricted to investments in bonds with an investment grade credit rating. This fund charges 1.40 percent in expenses.

Bledsoe Money Market Fund

This fund invests in short-term, high–credit quality debt instruments, which include Treasury bills. As such, the return on the money market fund is only slightly higher than the return on Treasury bills. Because of the credit quality and short-term nature of the investments, there is only a very slight risk of negative return. The fund charges .60 percent in expenses.

What advantages do the mutual funds offer compared to the company stock?

Assume you decide you should invest at least part of your money in large-capitalization stocks of companies based in the United States. What are the advantages and disadvantages of choosing the Bledsoe Large-Company Stock Fund compared to the Bledsoe S&P 500 Index Fund?

The returns on the Bledsoe Small-Cap Fund are the most volatile of all the mutual funds offered in the 401(k) plan. Why would you ever want to invest in this fund? When you examine the expenses of the mutual funds, you will notice that this fund also has the highest expenses. Does this affect your decision to invest in this fund?

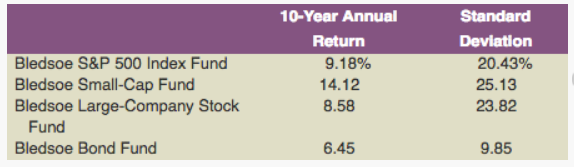

A measure of risk-adjusted performance that is often used is the Sharpe ratio. The Sharpe ratio is calculated as the risk premium of an asset divided by its standard deviation. The standard deviations and returns of the funds over the past 10 years are listed here. Calculate the Sharpe ratio for each of these funds. Assume that the expected return and standard deviation of the company stock will be 16 percent and 65 percent, respectively. Calculate the Sharpe ratio for the company stock. How appropriate is the Sharpe ratio for these assets? When would you use the Sharpe ratio? Assume a 3.2 percent risk-free rate.

What portfolio allocation would you choose? Why? Explain your thinking carefully.

Case Study 3:

Stephenson Real Estate Company was founded 25 years ago by the current CEO, Robert Stephenson. The company purchases real estate, including land and buildings, and rents the property to tenants. The company has shown a profit every year for the past 18 years, and the shareholders are satisfied with the company’s management. Prior to founding Stephenson Real Estate, Robert was the founder and CEO of a failed alpaca farming operation. The resulting bankruptcy made him extremely averse to debt financing. As a result, the company is entirely equity financed, with 11 million shares of common stock outstanding. The stock currently trades at $48.50 per share.

Stephenson is evaluating a plan to purchase a huge tract of land in the southeastern United States for $45 million. The land will subsequently be leased to tenant farmers. This purchase is expected to increase Stephenson’s annual pretax earnings by $10 million in perpetuity. Kim Weyand, the company’s new CFO, has been put in charge of the project. Kim has determined that the company’s current cost of capital is 10.5 percent. She feels that the company would be more valuable if it included debt in its capital structure, so she is evaluating whether the company should issue debt to entirely finance the project. Based on some conversations with investment banks, she thinks that the company can issue bonds at par value with a coupon rate of 7 percent. Based on her analysis, she also believes that a capital structure in the range of 70 percent equity⁄30 percent debt would be optimal. If the company goes beyond 30 percent debt, its bonds would carry a lower rating and a much higher coupon because the possibility of financial distress and the associated costs would rise sharply. Stephenson has a 40 percent corporate tax rate (state and federal).

If Stephenson wishes to maximize its total market value, would you recommend that it issue debt or equity to finance the land purchase? Explain.

Review Stephenson's market value balance sheet before it announces the purchase.

Suppose Stephenson decides to issue equity to finance the purchase.

What is the net present value of the project?

Review Stephenson's market value balance sheet after it announces that the firm will finance the purchase using equity. What would be the new price per share of the firm's stock? How many shares will Stephenson need to issue to finance the purchase?

Review Stephenson's market value balance sheet after the equity issue but before the purchase has been made. How many shares of common stock does Stephenson have outstanding? What is the price per share of the firm's stock?

Review Stephenson's market value balance sheet after the purchase has been made.

Suppose Stephenson decides to issue debt to finance the purchase.

What will the market value of the Stephenson company be if the purchase is financed with debt?

Review Stephenson's market value balance sheet after both the debt issue and the land purchase. What is the price per share of the firm's stock?

Which method of financing maximizes the per-share stock price of Stephenson's equity?

In a 2-3 page analysis, answer the questions provided at the end of the case study. Be sure to support your analysis with appropriate calculations and critical thought.

STEPHENSON REAL ESTATE RECAPITALIZATION

Market value balance sheet before the land purchase is:

| Market value balance sheet | |||||

| Assets | $533,500,000 |

| Equity | $533,500,000 | |

|

| Total assets | $533,500,000 |

| Debt & Equity | $533,500,000 |

Market value balance sheet after purchase of land:

Note, to calculate the NPV of the project, you must perform a calculation to determine the earnings they will receive from this purchase

| Market value balance sheet | |||||

| Old assets | $533,500,000 |

| |||

|

| NPV of project | enter value |

| Equity | enter value |

|

| Total assets | Sum total |

| Debt & Equity | Sum total |

After calculating the new market balance sheet with the purchase of land using equity, you will then need to calculate the change in stock value and how much stock would need to be issues to purchase the land.

The remaining questions will follow a similar format in which you create Market Value Balance Sheets and calculations.