Amity Campus Uttar Pradesh India 201303 ASSIGNMENTS PROGRAM: MBA IB SEMESTER-III Subject Name Study COUNTRY Roll Number (Reg.) Student Name : Risk...

Amity Campus

Uttar Pradesh

India 201303

ASSIGNMENTS

PROGRAM: MBA IB

SEMESTER-III

| Subject Name : Risk and Insurance in International Trade |

| Study COUNTRY :LESOTHO |

| Roll Number (Reg.No.) :IB01572014-2016036 |

| Student Name :MABOHLOKOA MOKHELELI |

INSTRUCTIONS

Students are required to submit all three assignment sets.

| ASSIGNMENT | DETAILS | MARKS |

| Assignment A | Five Subjective Questions | 10 |

| Assignment B | Three Subjective Questions + Case Study | 10 |

| Assignment C | Objective or one line Questions | 10 |

Total weightage given to these assignments is 30%. OR 30 Marks

All assignments are to be completed as typed in word/pdf.

All questions are required to be attempted.

All the three assignments are to be completed by due dates and need to be submitted for evaluation by Amity University.

The students have to attached a scan signature in the form.

Signature : _________________________________

Date : _________________________________

( √ ) Tick mark in front of the assignments submitted

| Assignment ‘A’ | | Assignment ‘B’ | | Assignment ‘C’ | |

Risk and Insurance in International Trade

Assignment A

Answer the following questions:

Q1: Briefly explain what is risk. Also enumerate different types of risks and ways of assessing risk.

Briefly explain what risk is.

ANSWER

Risk refers to a situation where outcome are uncertain. In other words risk occurs whenever there is a variation in the actual outcome and expected value. In Business if there is a variation between the actual and the expected value, business suffers a loss, therefore the term risk is also used to describe the expected losses or the variation from the actual outcome.

Also enumerate different types of risks and ways of assessing risk.

ANSWER

Business Risk :

Most of the business organizations have to constantly face the following types of situations:

fluctuation in the price of the product or raw material

non payment by the buyer

change in interest rate on loan

suppliers not meeting delivery schedules

consumers switching to the competitors

new entrants in the market

change in policy and regulations

Business risk is therefore classified into price risk, credit risk, and pure risk.

Price Risk :

Price risk refers to uncertainty over total of cash flows due to possible changes in output and input prices. Output price risk refers to the risk of changes in the prices that a firm can demand for its goods and services. Input price risk refers to the risk of changes on the prices that firm must pay for labor, materials and other inputs to its production process.

Price risk can be classified into commodity price risk, exchange rate risk, interest rate risk.

Credit Risk:

The risk that a firm is exposed to due to delay or non-payment by the parties to whom it has lend money

Pure Risk:

Apart from the price and credit risk business organizations are exposed to other risky situations like:

1. The risk of reduction in the value of business assets due to physical damage, theft, and expropriation.

2. The risk of legal liability for damages for harm to customer supplier shareholders and other parties.

3. The risk associated with injury, death, illness or disability to workers

Ways of assessing risk.

ANSWER

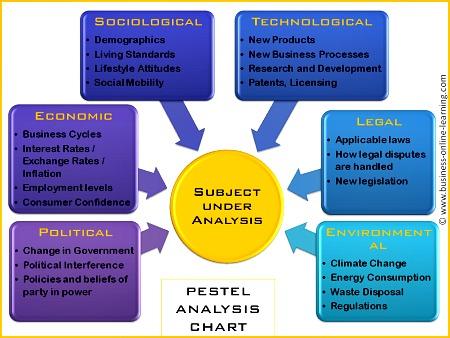

PEST Analysis

PEST analysis stands for "Political, Economic, Social, and Technological analysis" and describes a framework of macro-environmental factors used in the environmental scanning component of strategic management. Some analysts added Legal and rearranged the mnemonic to SLEPT; inserting Environmental factors expanded it to PESTEL or PESTLE, which is popular in the UK.

The Model's Factors

Political factors are how and to what degree a government intervenes in the economy. Specifically, political factors include areas such as tax policy, labour law, environmental law, trade restrictions, tariffs, and political stability. Political factors may also include goods and services which the government wants to provide or be provided (merit goods) and those that the government does not want to be provided (demerit goods or merit bads). Furthermore, governments have great influence on the health, education, and infrastructure of a nation.

Economic factors include economic growth, interest rates, exchange rates and the inflation rate. These factors have major impacts on how businesses operate and make decisions. For example, interest rates affect a firm's cost of capital and therefore to what extent a business grows and expands. Exchange rates affect the costs of exporting goods and the supply and price of imported goods in an economy.

Social factors include the cultural aspects and include health consciousness, population growth rate, age distribution, career attitudes and emphasis on safety. Trends in social factors affect the demand for a company's products and how that company operates. For example, an aging population may imply a smaller and less-willing workforce (thus increasing the cost of labor). Furthermore, companies may change various management strategies to adapt to these social trends (such as recruiting older workers).

Technological factors include ecological and environmental aspects, such as R&D activity, automation, technology incentives and the rate of technological change. They can determine barriers to entry, minimum efficient production level and influence outsourcing decisions. Furthermore, technological shifts can affect costs, quality, and lead to innovation.

Environmental factors include weather, climate, and climate change, which may especially affect industries such as tourism, farming, and insurance. Furthermore, growing awareness to climate change is affecting how companies operate and the products they offer--it is both creating new markets and diminishing or destroying existing ones.

Legal factors include discrimination law, consumer law, antitrust law, employment law, and health and safety law. These factors can affect how a company operates, its costs, and the demand for its products.

SWOT Analysis

Another technique for assessing a borrower‘s competitive position is SWOT analysis. This is a structured assessment of the:

S Strengths

W Weaknesses

Opportunities

T Threats

That the company faces in successfully conducting its business.

Strengths and weaknesses are internal to the company and relate to the quality of its products, the abilities of its management, the experience of skills amongst its staff, operational flexibility, cost structures, etc.

Opportunities and threats are external to the company, and relate to the markets, competition, and environmental influences such as government regulation and economic changes.

SWOT analysis is a simple technique which can only be used at a fairly superficial level but which can help focus on pertinent factors. Laying out the SWOT analysis in a table format makes it easier to summarize and reach a judgement.

Porter’s risk assessment matrix

Another model enabling the assessment of company risks and operating risks in the economy is Michael Porter‘s Risk Assessment Matrix. This matrix positions a company within its operational context. The company is surrounded by the operational elements which can subject its ongoing operations to risk, namely:

New competitors – any company can lose market share to competitors and needs to be aware of developments which may affect it.

Market demand for its products – a shift in consumer perceptions or

needs can impact the demand for the company‘s products.

Product substitution is another risk – customers may become disenchanted

with one product and favour an alternative (e.g. buses instead

of trains).

Stable and reasonably priced flow of raw materials necessary to its

manufacturing process is another risk which can impact the company‘s

ongoing operations

These are all risks that are non-financial but which can impact a company‘s ongoing operations. These risks moreover are situated within a larger macro-economic context – environmental (the economy, social issues, political perceptions, and demographics which affect the social climate and impact consumer demand) and political (taxation, government regulation, licensing, and tariffs). Understanding company risk therefore requires placing the company within this risk matrix in order to identify and appreciate pertinent risks.

Q2: Explain the meaning and importance of marine insurance. Briefly discuss various documents required for insurance.

Explain the meaning and importance of marine insurance.

ANSWER

The exporter may suffer loss if the cargo is damaged due to an accident or any other circumstances during transportation of goods from the port of loading to the port of discharge. He can protect himself against this kind of loss by taking insurance cover against such risks. This kind of insurance is known as cargo insurance or marine insurance.

Thus cargo insurance is an insurance policy to protect against loss of or damage to goods while they are being transported. Cargo insurance is also known as marine cargo insurance and is effective in all the three cases whether the goods have been transported via sea, land or air.

Marine insurance contract is an agreement whereby the insurance company (insurer) undertakes to indemnify the, owner (insured) of a ship or cargo against risks which are incidental to marine adventure.

Importance of marine insurance

ANSWER

In the commercial age of today marine insurance has become most important insurance in the field of insurance. The importance of marine insurance is described below in detail.

1. Importance of Marine Insurance For The Individual

A person has to import goods from another country which is located on the other side of sea for his business. While carrying goods from other side of sea businessman may have to face dacoits or goods may be damaged because of sinking of ship into the water. So businessman has to experience economic loss. By the result of loss person may be discouraged to engage in business. But when one insures his/her property in marine insurance does not have to face with economic problem because marine insurance provides compensation to the insured against the loss of property.

2. Importance Of marine Insurance For Shipowner

Expensive ship may be destroyed due to different types of risks on the marine venture. Shipowner may have to experience with larger amounts of loss due to the destruction of the ship. Marine insurance provides compensation of loss to the shipowner . So, marine insurance is important insurance for shipowner.

3. Importance Of Marine Insurance For Freight.

Freight insurance is also included under the marine insurance. Freight refers to the revenue that a cargo ship earns or the money which is paid to the shipowner for transportation of goods from one part to another. If businessman does not pay freight of his goods to the shipowner, shipowner may have to experience economic loss. If such types of loss occurs insurance company indemnifies the shipowner to marine insurance. Marine insurance is very important for the freight.

4. Importance Of Marine Insurance For Cargo Owner

A businessman wants to be secured for his goods. Especially countries which are located on the other side of sea , businessman may have to use marine venture. Marine insurance keeps them away from worry and fear or all responsibility of cargo owner is transferred to the hand of insurance company that provides compensation to the cargo owner if loss occurs.

5. Importance Of Marine Insurance For The Government

International trade has been increased due to the marine insurance. As international trade increases government also can receive economic profit. Government increases revenue by including extra income tax. Marine insurance is important for the government also.

Briefly discuss various documents required for insurance.

ANSWER

In modern insurance practices, an exporter will usually come across the following types of insurance documents:

Insurance Policy

The insurance policy sets out all the terms and conditions of the contract between the insurer and the insured.

Certificate of Insurance

The certificate of insurance is an evidence of the insurance but it does not set out the details of the terms and conditions of the insurance. It is also known as Cover Note.

Insurance Broker's Note

Insurance broker's note is a broker's notice that an insurance has been placed pending the production of a policy or certificate. Since it does not contain any details of the insurance said to be effected, it is not considered to be an evidence of insurance contract.

Q3: Explain Country Risks and Interest Rate Risks. Enumerate measures to manage Interest Rate Risks.

Explain Country Risks and Interest Rate Risks.

ANSWER

Country Risks

When an organization is trading with the other countries of the world their businesses are exposed to risk due to uncertain political and economic environment in the country.

Country Risk refers to the possibility that economic and political conditions, or an event in a foreign country, could adversely impact an institution‘s exposure in that country. Country risk is higher with longer term investments and direct investments, which are investments not made through a regulated market or exchange.

Country risk is not limited solely to international lending operations, but it also effects companies other activities such as overseas investments, guarantees/bonds, foreign exchange contracts etc. Moreover companies outsourcing arrangements such as electronic data processing, electronic banking or any consultancy/management services, with overseas counter parties, also carry inherent country risk.

Types of Country Risk

Country risk can be broadly classified into sovereign, transfer/convertibility and contagion risk.

Sovereign risk

Sovereign risk denotes a foreign government‘s capacity and willingness to repay its direct and indirect (i.e. guaranteed) foreign currency obligations. Sovereign risks signify that a foreign government will default on its loan or fail to honor other business commitments because of a change in national policy. A country asserting its prerogatives as an independent nation might prevent the Repatriation of a company or country's funds through limits on the flow of capital, tax impediments, or the nationalization of property.

Transfer/Convertibility risk

Transfer/Convertibility risk arises if changes in government policies, or any event, result in a barrier to free conversion or movement of foreign exchange across countries. Under such conditions, a borrower may not be able to secure foreign exchange to service its external obligations. Where a country suffers economic or political problems, leading to depletion of its foreign currency reserves, the borrowers in that country may not be able to convert their funds from local currency into foreign currency to repay their external obligations.

Contagion risk

Contagion risk refers to the possibility that any adverse economic or political factor in one country has an impact on other countries in that region.

Country Risk Rating

Country Risk ratings summarize the conclusion of the risk analysis process. Ratings are important as they provide a framework for establishing exposure limits. As stated earlier, institutions are given a choice either to use external ratings or establish their own country risk ratings framework. The institutions that have significant cross border exposure; greater analytical resources and access to better information may opt for the later. These institutions should consider external rating as an input for their internal ratings. Ratings should be reviewed semi-annually or more frequently if the situation warrants.

Interest Rate Risks

ANSWER

Interest rate risk is the risk that arises for bond owners from fluctuating interest rates. How much interest rate risk a bond has depends on how sensitive its price is to interest rate changes in the market. The sensitivity depends on two things, the bond's time to maturity, and the coupon rate of the bond.

Interest rate risk analysis is almost always based on simulating movements in one or more yield curves using the Heath-Jarrow-Morton framework to ensure that the yield curve movements are both consistent with current market yield curves and such that no riskless arbitrage is possible. The Heath-Jarrow-Morton framework was developed in the early 1991 by David Heath of Cornell University, Andrew Morton of Lehman Brothers, and Robert A. Jarrow of Kamakura Corporation and Cornell University.

There are a number of standard calculations for measuring the impact of changing interest rates on a portfolio consisting of various assets and liabilities. The most common techniques include:

1. Marking to market, calculating the net market value of the assets and liabilities, sometimes called the "market value of portfolio equity"

2. Stress testing this market value by shifting the yield curve in a specific way.

3. Calculating the value at risk of the portfolio

4. Calculating the multiperiod cash flow or financial accrual income and expense for N periods forward in a deterministic set of future yield curves

5. Doing step 4 with random yield curve movements and measuring the probability distribution of cash flows and financial accrual income over time.

6. Measuring the mismatch of the interest sensitivity gap of assets and liabilities, by classifying each asset and liability by the timing of interest rate reset or maturity, whichever comes first.

7. Analyzing Duration, Convexity, DV01 and Key Rate Duration.

Enumerate measures to manage Interest Rate Risks.

ANSWER

Forwards

A forward contract is the most basic interest rate management product. A Forward Rate Agreement is based on the idea of a forward contract, where the determinant of gain or loss is an interest rate. Under this agreement, one party pays a fixed interest rate and receives a floating interest rate equal to a reference rate. The actual payments are calculated based upon a notional principal amount and paid at intervals determined by the parties. FRAs are always settled in cash.

Futures

A futures contract is similar to a forward, but provides the counterparties with less risk than a forward contract, namely a lessening of default and liquidity risk, due to the inclusion of an intermediary.

Swaps

Just like it sounds, a swap is an exchange. More specifically, an interest rate swap looks a lot like a combination of FRAs and involves an agreement between counterparties to exchange sets of future cash flows. The most common type of interest rate swap is a plain vanilla swap, which involves one party paying a fixed interest rate and receiving a floating rate, and the other party paying a floating rate and receiving a fixed rate.

Options

Interest rate management options are option contracts whose underlying security is a debt obligation. These instruments are useful in protecting the parties involved in a floating rate loan, such as adjustable-rate mortgages (ARMs). A grouping of interest rate calls is referred to as an interest rate cap; a combination of interest rate puts is referred to as an interest rate floor. In general, a cap is like a call and a floor is like a put.

Embedded options

Many investors encounter interest management derivative instruments via embedded options. The issuer of your callable bond is insuring that if interest rates decline, they can call in your bond and issue new bonds with a lower coupon.

Caps

A cap, also called a ceiling, is a call option on an interest rate. An example of its application would be a borrower going long, or paying a premium to buy a cap and receiving cash payments from the cap seller (the short) when the reference interest rate exceeds the strike rate of the cap. The payments are designed to offset interest rate increases on a floating-rate loan.

If the actual interest rate exceeds the strike rate, the seller pays the difference between the strike and the interest rate multiplied by the notional principal. This option will "cap", or place an upper limit, on the interest expense of the holder. The interest rate cap is actually a series of component options, or "caplets," that exist for each period the cap agreement is in existence. A caplet is designed to provide a hedge against a rise in the benchmark interest rate, such as the London Interbank Offered Rate (LIBOR), for a stated period.

Floors

Just as a put option is considered the mirror image of a call option, the floor is the mirror image of the cap. The interest rate floor, like the cap, is actually a series of component options, except that they are put options and the series components are referred to as "floorlets". Whoever is long the floor is paid upon maturity of the floorlets if the reference rate is below the strike price of the floor. A lender uses this to protect against falling rates on an outstanding floating-rate loan.

Collars

A protective collar can also be used in the management of interest rate risk. Collaring is accomplished by simultaneously buying a cap and selling a floor (or vice versa), just like a collar protects an investor who is long a stock.

Q4: Give a brief overview of International Payment Methods. What do you understand by Bill of Lading and Bill of Exchange?

Give a brief overview of International Payment Methods.

ANSWER

There are 3 standard ways of payment methods in the export import trade international trade market:

1. Clean Payment

2. Collection of Bills

3. Letters of Credit L/c

1. Clean Payments

In clean payment method, all shipping documents, including title documents are handled directly between the trading partners. The role of banks is limited to clearing amounts as required. Clean payment method offers a relatively cheap and uncomplicated method of payment for both importers and exporters.

There are basically two type of clean payments:

Advance Payment

In advance payment method the exporter is trusted to ship the goods after receiving payment from the importer.

Open Account

In open account method the importer is trusted to pay the exporter after receipt of goods. The main drawback of open account method is that exporter assumes all the risks while the importer get the advantage over the delay use of company's cash resources and is also not responsible for the risk associated with goods.

2. Payment Collection of Bills in International Trade

The Payment Collection of Bills also called ―Uniform Rules for Collections‖ is published by International Chamber of Commerce (ICC) under the document number 522 (URC522) and is followed by more than 90% of the world's banks.

In this method of payment in international trade the exporter entrusts the handling of commercial and often financial documents to banks and gives the banks necessary instructions concerning the release of these documents to the Importer. It is considered to be one of the cost effective methods of evidencing a transaction for buyers, where documents are manipulated via the banking system.

There are two methods of collections of bill:

Documents Against Payment D/P

In this case documents are released to the importer only when the payment has been done.

Documents Against Acceptance D/A

In this case documents are released to the importer only against acceptance of a draft.

3. Letter of Credit L/c

Letter of Credit also known as Documentary Credit is a written undertaking by the importers bank known as the issuing bank on behalf of its customer, the importer (applicant), promising to effect payment in favor of the exporter (beneficiary) up to a stated sum of money, within a prescribed time limit and against stipulated documents. It is published by the International Chamber of Commerce under the provision of Uniform Custom and Practices (UCP) brochure number 500.

Various types of L/Cs are :

Revocable & Irrevocable Letter of Credit (L/c)

A Revocable Letter of Credit can be cancelled without the consent of the exporter. An Irrevocable Letter of Credit cannot be cancelled or amended without the consent of all parties including the exporter.

Sight & Time Letter of Credit

If payment is to be made at the time of presenting the document then it is referred as the Sight Letter of Credit. In this case banks are allowed to take the necessary time required to check the documents. If payment is to be made after the lapse of a particular time period as stated in the draft then it is referred as the Term Letter of Credit.

Confirmed Letter of Credit (L/c)

Under a Confirmed Letter of Credit, a bank, called the Confirming Bank, adds its commitment to that of the issuing bank. By adding its commitment, the Confirming Bank takes the responsibility of claim under the letter of credit, assuming all terms and conditions of the letter of credit are met.

Payment Collection Methods

Payment Collection Against Bills also known documentary collection as is a payment method used in international trade all over the world by the exporter for the handling of documents to the buyer's bank and also gives the banks necessary instructions indicating when and on what conditions these documents can be released to the importer.

Collection Against Bills is published by International Chambers of Commerce (ICC), Paris, France. The last updated issue of its rule was published on January 1, 1966 and is known as the URC 522.

It is different from the letters of credit, in the sense that the bank only acts as a medium for the transfer of documents but does not make any payment guarantee. However, collections of documents are subjected to the Uniform Rules for Collections published by the International Chamber of Commerce (ICC).

What do you understand by Bill of Lading and Bill of Exchange?

ANSWER

Bill of Lading is a document given by the shipping agency for the goods shipped for transportation form one destination to another and is signed by the representatives of the carrying vessel. Bill of landing is issued in the set of two, three or more. The number in the set will be indicated on each bill of lading and all must be accounted for. This is done due to the safety reasons which ensure that the document never comes into the hands of an unauthorized person. Only one original is sufficient to take possession of goods at port of discharge so, a bank which finances a trade transaction will need to control the complete set. The bill of lading must be signed by the shipping company or its agent, and must show how many signed originals were issued. It will indicate whether cost of freight/ carriage has been paid or not:

"Freight Prepaid" : Paid by shipper "Freight collect" : To be paid by the buyer at the port of discharge The bill of lading also forms the contract of carriage.

To be acceptable to the buyer, the B/L should:

Carry an "On Board" notation to showing the actual date of shipment, (Sometimes however, the "on board" wording is in small print at the bottom of the B/L, in which cases there is no need for a dated "on board" notation to be shown separately with date and signature.)

Be "clean" having no notation by the shipping company to the effect that goods/ packaging are damaged.

The main parties involve in a bill of lading are:

Shipper: The person who send the goods.

Consignee: The person who take delivery of the goods.

Notify Party: The person, usually the importer, to whom the shipping company or its agent gives notice of arrival of the goods.

Carrier: The person or company who has concluded a contract with the shipper for conveyance of goods

The bill of lading must meet all the requirements of the credit as well as complying with UCP 500. These are as follows:

The correct shipper, consignee and notifying party must be shown.

The carrying vessel and ports of the loading and discharge must be stated.

The place of receipt and place of delivery must be stated, if different from port of loading or port of discharge.

The goods description must be consistent with that shown on other documents.

Any weight or measures must agree with those shown on other documents.

Shipping marks and numbers and /or container number must agree with those shown on other documents.

It must state whether freight has been paid or is payable at destination.

It must be dated on or before the latest date for shipment specified in the credit.

It must state the actual name of the carrier or be signed as agent for a named carrier.

A Bill of Exchange is a special type of written document under which an exporter ask importer a certain amount of money in future and the importer also agrees to pay the importer that amount of money on or before the future date. This document has special importance in wholesale trade where large amount of money involved.

Following persons are involved in a bill of exchange:

Drawer: The person who writes or prepares the bill.

Drawee: The person who pays the bill.

Payee: The person to whom the payment is to be made.

Holder of the Bill: The person who is in possession of the bill.

On the basis of the due date there are two types of bill of exchange:

Bill of Exchange after Date: In this case the due date is counted from the date of drawing and is also called bill after date.

Bill of Exchange after Sight: In this case the due date is counted from the date of acceptance of the bill and is also called bill of exchange after sight.

Q5: What is the scope of coverage of Transport Insurance? How is transport risk managed?

What is the scope of coverage of Transport Insurance?

ANSWER

Scope of Coverage

The following can be covered for the risk of loss or damage:

Cargoimport, export cross voyage dispatched by sea, river, road, rail post, personal courier, and including associated storage risks.

Good in transit (inland).

Freight service liability.

Associated stock.

However there is still a number of general exclusion such loss by delay, war risk, improper packaging and insolvency of carrier. Converse for some of these may be negotiated with the insurance company. The Institute War Clauses may also be added. Regular exporters may negotiate open cover. It is an umbrella marine insurance policy that is activated when eligible shipments are made. Individual insurance certificates are issued after the shipment is made. Some letters of Credit will require an individual insurance policy to be issued for the shipment, while others accept an insurance certificate.

How is transport risk managed?

ANSWER

Traditionally, risk management has focused on two primary causes of concern, natural and manmade disasters. Natural disasters include a wide range of events, such as floods, earthquakes, forest fires, tornados, hurricanes, and avalanches. The prevailing attitude has been that these events are acts of God‖ and there are limitations on what one can do to prevent incident occurrence. Consequently, the majority of risk management attention in these circumstances has been focused on mitigating the consequences of these incidents when they do occur. Man-made disasters pose a different problem, both in terms of risk tolerance and the focus of risk management attention. Whether due to human error, poor design or faulty technology, man-made disasters are associated with the failure on the part of an individual or organization to make the appropriate decisions that adequately protect human health, property and the environment. Hence, society‘s risk tolerance for man-made events is much lower than for natural disasters and there is greater public scrutiny applied to how these risks are managed. Moreover, since the event is manmade, risk management attention and resources are devoted to both incident prevention and mitigating the consequences of the incident should it occur.

Assignment B

The Case of the Never Ending Scope CreepIn 1999, the XY Department of the Federal Government reviewed its Year 2000 Date Turnover Computer Risks and found that its outdated computer systems for managing public clients needed replacing. A business case was prepared for funding the replacement while at the same time implementing some improvements. The total budget requested was $2.3 million.

In view of a shortage of funds around at the time, government did not approve this amount. Only $1.5 million was authorized. However, the XY Department accepted this amount after they decided that they could maybe do the work for around the $1.5 m.

Accordingly, a project was scoped and planned, with specific milestones for implementing the hardware and, subsequently the software, across 87 sites within its jurisdiction. A final completion date of 30th June 2001 was projected. The original business case had loosely identified some risks to the project that were also included in the project plan. A project steering committee was established, with the department chief (CEO) as the sponsor, and representation by influential managers with differing outcome needs to suit their particular work environment. The project commenced in July 1999.

In view of the shortfall on its original budget request, the committee decided not to employ a project manager. Instead it assigned this responsibility to its Finance Manager, who would undertake the work along with his normal duties.

A Company, called "Good Programs" was contracted to supply the software and assist in the implementation. This company recognized the marketing opportunities of this project, as the XY Department was its biggest client in the region. As a result, they offered, free of charge, many more features that were not in the original scope, provided the department allowed them to be, in essence a research and development (R&D) site. This would assist Good Programs to more readily sell their products elsewhere around the world, while providing the XY Department with additional functionality and benefits.

Initially, the steering committee met regularly, but as new versions of the resulting software were being implemented regularly, meetings became less frequent and Good Programs were left to do more and more of the day to day management of the new version implementations.

These new versions were developed after consultation with the various individual managers to accommodate requested new features with little consultation amongst all of the managers. All the XY Department and steering committee had to do was to identify problems with the software and to make the system testers available for new versions. However, the effect was an unanticipated overhead for the department.

Sometime after the original project was scoped and commenced, both the original CEO and finance manager had been moved out of the department and new officers have been appointed.

At this time, the new CEO has been advised that about $185,000 more is needed for the project, which is not in his current budget. The original project has not been signed off, indeed, it is evident that it has not been completed. The new CEO of the department is not sure of the original scope of the project, what aspects have been implemented, nor what has been spent for which parts. There do not seem to be any reliable reports available as to original scope, scope changes, schedule or budget.

The CEO is concerned that the project has become more of a career than a project, with version 16.5 of the client management system now being tested with yet more features. In addition, there are some past software problems that are still outstanding. Nevertheless, Good Systems have promised that problems will be fixed in the next version ... .

You are a senior consultant with PM Right Track (PMRT), a competent project management consulting company. The CEO has called you in for advice. The information is brief, but this is all the information that he and the new finance manager are able to provide. The CEO's mandate to you is to:

Report and Compare your assessment of the current project status.

Recommend improvements to the XY Department's future project management practices.

If a very similar project had to be done again, what attributes and/or skill sets would you recommend in selecting a project manager?

Assignment C

Choose the right option:

1. Suppose the project has many hazards that could easily injure one or more persons and there is no method of avoiding the potential for damages. The project manager should consider __________ as a means of deflecting the risk.

abandoning the project

buying insurance for personal bodily injury

establishing a contingency fund

establishing a management reserve

not acknowledging the potential for injury

2. Risk Management includes all of the following processes except:

Risk Monitoring and Control

Risk Identification

Risk Avoidance

Risk Response Planning

Risk Management Planning

3. When should a risk be avoided?

When the risk event has a low probability of occurrence and low impact

When the risk event is unacceptable -- generally one with a very high probability of occurrence and high impact

When it can be transferred by purchasing insurance

A risk event can never be avoided

4. All of the following are financial risks which may be faced by business organizations EXCEPT

interest rate risk.

commodity price risk.

product liability risk.

currency exchange rate risk.

5. Which of the following is not an example of personal risk?

Earning risk

Medical expenses

Longevity risk

Worker Injury

6. _____________ risk refers to uncertainty over total of cash flows due to possible changes in output and input prices.

Personal

Pure

Price

Credit

7. Which of the following is not an object of risk management?

Identify all potential risks.

Identify high-impact/high priority risks.

Document risk identification and analysis process.

Assume risk

8.All of the following are disadvantages of using insurance EXCEPT

There is an opportunity cost because premiums must be paid in advance.

Considerable time and effort must be spent selecting and negotiating coverages.

It results in considerable fluctuations in earnings after a loss occurs.

Attitudes toward loss control may become lax.

9. Which of the following types of loss exposures are best met by the use of avoidance?

low-frequency, low-severity

low-frequency, high-severity

high-frequency, low-severity

high-frequency, high-severity

10. What is the methods of handling risk ?

avoidance

loss control

retention

noninsurance transfers

insurance

11. Which of the following is not part of risk management process?

identify and evaluate frequency and severity of losses

choosing and implementing risk management methods

Shelving a business plan due to high risk

monitoring the performance and suitability of the methods.

12. Risk avoidance means:

Measures are taken to eliminate loss exposure

Measures are taken to reduce loss severity

Insurance has been purchased and risk transferred to an insurance company

Is not a useful risk management tool.

13. Business firms face liability lawsuits when their :

Products injure consumers

Customers steal their inventory

Unions go on strike

Attorney fails to file legal document

14. The principle of indemnity provides that

Insurance premium rates must be neither too high nor too low

The insured should be paid for the loss he or she suffered and no more no less

The insured shall be paid exactly the face amount of the policy

People who cause accidents should pay for the loss that results

Only indemnity companies may issue contracts of indemnity

15. Principle of Insurable interest refers to

All facts should be disclosed to insurer

The amount of interest to be paid by the insurer

No person can enter into a valid contract of insurance unless he has insurable interest in the object

None of the above

16. Institute cargo Clause C covers loss of or damage to the goods caused by

Fire or explosion

Theft, pilferage and non-delivery

Fresh and/or rain and/or river water damage.

Hook, oil, mud, acid and damage by other cargo.

17. Which policy covers all risks of loss of or damage to the goods insured and is the widest cover

Institute Cargo Clause A

Institute Cargo Clause B

Institute Cargo Clause C

War and Strikes, Riots and Civil Commotion (SRCC) Clause

18. Principle of Causa Proxima implies that

the insurer becomes liable to pay for loss if the insured peril or risk is the proximate cause of loss

the contracts of insurance only indemnify a loss resulting from risk covered under the Policy

the insurer becomes liable to pay for loss if the insured peril or risk is the exact cause of loss

the insurer becomes liable to pay for loss irrespective of the cause of loss

19. Maritime perils are cause due to

faults in loading, keeping, carrying and unloading of the cargo

acts of God or man made events

war including civil war, revolution, rebellion etc.

strikes, lock-outs, labour disturbances, riots, civil commotion

20. Which document sets out all the terms and conditions of the contract between the insurer and the insured

Certificate of Insurance

Insurance Broker's Note

Insurance Policy

None of the above

21. A country that analyzes the probability of: (1) an uprising, (2) the election of a socialist nationalizing government, and (3) the stability of per capita income, is engaging in:

factor risk analysis.

political situation analysis.

country risk analysis.

consumer purchasing power analysis.

22. Which of the following statements is true?

A tax increase is never the result of political forces and can therefore not be considered a political risk.

Political risk is confined to third world countries.

One form of political risk is government measures to improve the competitiveness of national companies.

All of the above.

23. Which of the following statements is true?

Expropriation of assets by communist governments is a form of micro political risk.

In 2004, government X, which had been providing preferential treatment to countries in the A region, provided equal opportunities to manufacturers across the world. This is a case of micro-political risk.

In 2006, the producers of widgets in Germany lobbied their government to impose tariffs on imports of widgets. This is a case of macro political risk.

All of the above

24. Which of the following is not a factor that an MNE must be acquainted with when dealing with a foreign government?

Their culture.

Their policy objectives.

Their levers of power.

None of the above.

25. Which of the following is a Berlin-based organization that produces reports on corruption each year?

The Business Ethics Bureau.

Transparency International.

Corruption Watchdog.

Corruption Monitor.

26. World Banks’ subsidiary that guarantees against non-commercial risks is

MIGA

IDA

IRBD

IFC

27. Which of the following is a ECA in Africa?

African Export-Import Bank

Arab Investment & Export Credit Guarantee Corporation

Corporación Andina de Fomento

European Bank for Reconstruction and Development

28. Credit Insurance is beneficial to the exporter as it facilitates:

Effective management of interest rate fluctuations

Offering more competitive credit terms to new customers.

Effective management of foreign currency fluctuations

Offering more competitive credit terms to banks

29. Which of the following tool will not help a company in minimizing its bad debt

Confirmed LC

debt purchase

credit insurance.

Hedging

30. In case of undisclosed factoring

client's customers are not notified of the factoring arrangement.

client's customers are notified of the factoring arrangement.

client is notified of the factoring arrangement.

Client is not customers are not notified of the factoring arrangement.

31. Purchasing of an exporter’s receivables at a discount price by paying cash is known as

Factoring

Forfeiting

Hedging

Arbitration

32. Forfeiting is beneficial to banks because :

Lower credit administration and credit follow up

It helps in maintaining liquidity

It helps bank to offer competitive interest rates

Increases assets base

33. Which of the following is not characteristic of factoring

Factoring is possible in case of bad debts.

Credit rating is mandatory.

It is a method of offbalance sheet financing.

Cost of factoring is never equal

34. In case of Forfeiting exporter has to bear the following cost :

Commitment fee

Interest

Commission

Dividends

35.Liquidity risk pertains to timing mismatches between cash inflows and outflows is known as

gap risk

Commercial risk

Personal risk

Business Risk

36.In Gap Analysis If the difference between the assets and liabilities which mature or are re-priced during that interval is positive

there will be a net cash deficit

there will be no change in net cash

there will be a net cash surplus

None of the above

37.A combination of interest rate puts is referred to as an

interest rate cap

interest rate floor

Call

Put

38. LIBOR stands for

Liberal Interbank Offered Rate

London Interbank Offered Rate

Liberal Interbank Offered Ratio

Liberal Interbank Official Rate

39. Put option is considered the mirror image of a

call option

floor

cap

CollaR

40. In plain vanilla swap

one party paying a fixed interest rate and receiving a floating rate and the other party paying a floating rate and receiving a fixed rate.

one party pays and receives a fixed interest rate and the other party paying a floating rate and receiving a fixed rate

Both parties pay and receive fixed interest rate

Both parties pay and receive floating interest rate