Assignment 8BU330 Accounting for Managers Directions: Be sure to make an electronic copy of your answer before submitting it for grading. Unless otherwise stated, answer in complete sentences, and

Assignment 8

BU330 Accounting for Managers

Directions: Be sure to make an electronic copy of your answer before submitting it for grading. Unless otherwise stated, answer in complete sentences, and be sure to use correct English spelling and grammar. Sources must be cited in APA format. Your response should be four (4) pages in length; refer to the "Assignment Format" page for specific format requirements.

Part A: Financial Statement Analysis

The following information relates to Harris Corporation.

| Account | Current year | Prior year |

| Net sales (all credit) | $520,125 | $499,500 |

| Cost of goods sold | $375,960 | $353,600 |

| Gross profit | $144,165 | $145,900 |

| Income from operations | $ 95,500 | $ 79,900 |

| Interest expense | $ 23,500 | $ 19,500 |

| Net income | $ 57,600 | $ 51,600 |

| Cash | $ 30,600 | $ 15,900 |

| Accounts receivable, net | $ 33,800 | $ 23,200 |

| Inventory | $ 42,000 | $ 30,300 |

| Prepaid expenses | $ 2,000 | $ 1,500 |

| Total current assets | $ 108,400 | $ 70,900 |

| Total long-term assets | $ 62,000 | $ 38,000 |

| Total current liabilities | $ 46,000 | $ 41,600 |

| Total long-term liabilities | $ 20,000 | $ 22,700 |

| Common stock, no par, 3,000 shares, value $50/share | $ 30,000 | $ 30,000 |

Required:

What is the acid-test ratio for the current year?

What is the inventory turnover for the current year?

What is days' sales in receivables for the current year?

What is the book value per share of common stock for the current year?

What is the price-earnings ratio for the current year?

What is the rate of return on total assets for the current year?

What is the times-interest-earned ratio for the current year?

What is the current ratio for the current year?

Part B: Sustainability and Business Value

The following questions relate to Gluck Metal Works.

a. Gluck Metal Works stamps sheet metal into blanks that are used in a variety of consumer products. The average cost for sheet metal is $100 per ton. Gluck's waste disposal company charges $55 per ton to dispose of manufacturing waste. The stamping process currently employed by Gluck generates an average of 120 tons of waste per month.

What is the annual cost of stamping waste, including both the materials cost and the disposal cost?

$223,200

$18,600

$144,000

$79,200

b. Gluck Metal Works stamps sheet metal into blanks that are used in a variety of consumer products. The average cost for sheet metal is $85 per ton. Gluck's waste disposal company charges $65 per ton to dispose of manufacturing waste. The stamping process currently employed by Gluck generates an average of 150 tons of waste per month.

What is the net amount Gluck would save per year if stamping waste could be sold to a recycler for $33 per ton?

$12,750

$117,000

$176,400

$59,400

c. Gluck Metal Works stamps sheet metal into blanks that are used in a variety of consumer products. The average cost for sheet metal is $80 per ton. Gluck's waste disposal company charges $70 per ton to dispose of manufacturing waste. The stamping process currently employed by Gluck generates an average of 170 tons of waste per month.

Gluck has developed a new system that would increase the efficiency of its stamping process. The new system has an annual cost of $50,000, but would reduce stamping waste by 50%, the remaining waste would be sold to a recycler for $35 per ton. What is the net savings if Gluck implements this new system?

$210,100

$260,100

$142,800

$35,700

Part C: Calculating Costs

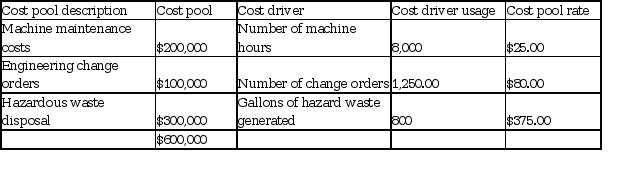

Serenity Now Industries manufactures custom fiberglass hulls for luxury yachts and pleasure boats. The current cost accounting system uses machine hours to allocate manufacturing overhead to each job. Serenity estimates that in the coming year it will incur $600,000 in manufacturing overhead costs and use 8,000 machine hours.

Depending on the specifications requested by the customer, the hull may use hazardous chemicals that incur greater disposal costs. Serenity's traditional accounting system includes the cost of hazardous waste disposal in with total manufacturing overhead. Serenity is planning to implement an activity based costing system to more accurately assign hazardous waste disposal costs to each job.

Expected usage and costs for manufacturing overhead are as follows:

During the year, Yacht #633 was started and completed:

| DM cost per lb. | $55 |

| Lbs. of DM used on job | 170 |

| DL cost per hr. | $20.00 |

| DLH used | 50 |

Requirements:

Calculate the cost of Yacht #633 using the Serenity's current method of allocating manufacturing overhead.

Calculate the cost of Yacht #633 using the proposed activity based costing system. How is this information useful to an environmental management accounting (EMA) system?