Reading Material attachedPART AAnswer the following questions about classification with complete sentences. 1. What do the following stand for:a. BISb. CFRc. DOCd. USCe. FMCf. CBPg. EARh. ITARi. AESj.

Classification FAQ https://www.usitc.gov/faqs/tariff_affairs_faqs.htm

Why do we classify products?

Assigning classification numbers to products is important as the trade in goods increases on a global scale. Numbers are not as easily "misinterpreted" or "mistranslated" as words. This was the first reason behind product classification. In order for it to work globally however, all countries need to use the same numbers for the same products. This is what led to the Harmonized Tariff Schedule. Harmonized meaning that all countries use it, at least the first 6 numbers.

The HTS (or HS) is used for imports and primarily to determine 1) what the product is and 2) determine what the import duty (tariff or tax) will be based on the country of export. The US also had a classification for exports, the Schedule B. This system was used to determine what was going OUT of the country and to compile the export statistics we use. In order to make it work, we needed to make sure that our import and export classifications were aligned in some way. What we see now is that the first 6 numbers of the HTS and the Schedule B are the same, with the final numbers being used for specific purposes that may differ between systems.

In a nutshell: Why do you need to know your HS (Harmonized System)/Schedule B number?

The HS number is needed to look up tariff rates

the Schedule B number is needed to complete the Shipper's Export Declaration

the HS number may be needed on shipping documents, including certificates of origin

the HS number is needed to determine whether a product qualifies for a preferential tariff under a Free Trade Agreement.

HS numbers can also be used for market research purposes, such as identifying foreign markets where your product is currently being exported.

Schedule B numbers are used by the Census Bureau to collect export data.

History: Back in the 1960's, major trading countries decided the world needed an internationally recognized system of tariff coding to facilitate global trade. Work on this classification system began in the early 1970's by the World Customs Organization (WCO Internationally the Harmonized System (HS) became effective on January 1, 1988. This system was designed as the "core" system allowing countries that adopted the coding to make subdivisions according to need and determine their own duty rates.

The HS is now used by most countries throughout the world for both import and export purposes. This directly facilitates trade in a variety of ways, and also maks it possible for government, academic and private economists and policy makers to more precisely analyze and respond to world, national, industry and company trade data.

Mastering tariff classification is a challenge, requiring not only systematic application of the General Rules of Interpretation (next section,) but also attention to the many notes found in the Harmonized System.

The General Rule of Interpretation

General Rules of Interpretation (GRI)

These are part of the legal text of the Harmonized System consisting of six governing principles to be successively applied in the classification process. These rules are what make it possible to classify any commodity, product or article of commerce, including countless items which are not listed by their common or scientific name.

Nations which have adopted the Harmonized System Convention are required to apply the GRIs without modification. The GRIs are part of the legal text of the HS tariff, are statutory provisions of law in most countries which have adopted the HS, and are intended to be consulted and applied each time merchandise is classified.

See HTSUS General Rules of Interpretationfor listing of the rules. The function and effect of each rule can be summarized as follows:

Rule 1 takes precedence over the remaining rules. It requires that classification be determined according to the terms of the HS headings and any relative section notes or chapter notes. If the texts of the headings and notes do not, by themselves, indicate the appropriate heading for the classification of merchandise, then it is to be determined by GRIs 2-6. This rule generally applies to articles that are specifically provided for or listed by name (sometimes referred to as eo nomine).

Rule 2 contains two sections which deal with the classification of goods that, as imported, are incomplete or unfinished, unassembled or disassembled, or composed of mixtures or combinations of materials or substances. Rule 2 (a) has two parts. The first deals with incomplete or unfinished goods by extending the heading that refers to a particular article to include the article in an incomplete or unfinished condition, provided it has the essential character of the complete or finished good (e.g., an unpainted ceramic statuette). The second part deals with unassembled or disassembled goods by providing that complete or finished goods presented in an unassembled or disassembled condition are to be classified in the same heading as the finished article of which they have "essential character." All unassembled or disassembled parts or components must be presented for entry at the same time (e.g., an unassembled bicycle containing all the parts and components necessary to build the bicycle). Rule 2 (b) governs the classification of mixtures and combinations of materials and substances by extending the heading that refers to a material or substance to include mixtures or combinations of that material or substance with other materials and substances; and governs the classification of goods consisting of two or more materials or substances by extending the heading to goods of a given material or substance to include goods consisting wholly or partly of that material or substance. This applies only if another heading does not refer to the goods in their mixed or composite state. If the addition of another material or substance deprives the imported good of the character of the kind mentioned in the heading being considered, one must resort to GRI 3. In other words, if mixtures and combinations of materials and substances, and goods consisting of more than one substance, are potentially classifiable under two or more headings upon initial consideration, they must be classified according to GRI 3.

Rule 3 provides for classification of goods that are "prima facie" (or when initially considered) classifiable under two or more headings. In such cases, goods are classified according to this rule based on three criteria, taken in order: Rule 3 (a) provides that goods should be classified in the heading that provides the most specific description, name being more specific than class, and a description that more clearly identifies a product being more specific than one which is less complete. Furthermore, when two or more headings each refer to only one of the materials or substances in mixed or composite goods, or to only some of the articles included in a set offered for retail sale, those headings are regarded as equally specific, even if one gives a more complete description of the goods, one must resort to (b). Rule 3 (b) deals with mixed goods, composite goods, and sets offered for retail sale potentially classifiable in more than one heading (e.g., the good consists of two or more different ingredients, materials, components or articles and no heading provides for the good as a whole). Such goods are classified according to the ingredient, material, component or article that gives the good its "essential character." If no one ingredient, material, component or article is found to impart "essential character" to the good, one must resort to (c). Rule 3 (c) provides that when goods cannot be classified by Rule 3 (a) or (b), the goods should be classified in the heading that occurs last in numerical order from among those equally considered.

Rule 4 applies when goods cannot be classified according to Rules 1-3. This rule requires that the goods are to "be classified under the heading appropriate to the goods to which they are most akin." In evaluating "kinship," description, character, purpose or intended use, designation, production process and the nature of the goods should be considered. Since Rules 1-3 will cover the classification of most goods, this rule should be applied very infrequently.

Rule 5 has two sections which deal with containers presented with the articles for which they are intended. Rule 5 (a) deals with long-term use cases, boxes and similar containers when presented with the articles for which they are intended. If they are the type of container normally sold with the article (e.g., a musical instrument case sold with the instrument), the container is classified with the article. This rule does not apply to containers that give the imported article its essential character (e.g., a silver dish containing sweets) which are classified under the heading for the container. Rule 5 (b) provides that containers not intended to be reused (e.g., containers holding food products) are classified with the articles they contain. This rule does not apply to packaging materials or containers suitable for repetitive use (e.g., metal drums) which are classified separately from their contents.

Rule 6 prescribes that, for legal purposes, Rules 1-5 govern classification at the subheading level within the same heading. Once the appropriate heading has been identified, goods are classified in the subheading that most specifically describes them (in accordance with GRI 1-5).

HTS Framework

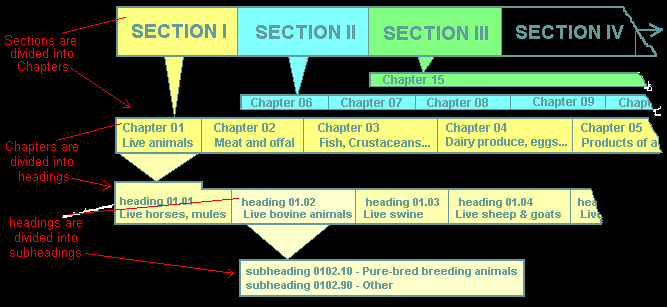

Most people refer to it as the Harmonized System (HS) or Harmonized Tariff System (HTS) The structure as a whole is also referred to as the nomenclature or the customs tariff. Any of these terms may be used.

The chart below shows the framework or outline of the HS.

The HS is divided into sections.

The sections are subdivided into chapters (the first two numbers)

The chapters are subdivided into headings (the first 4 numbers)

The headings are subdivided into subheadings (the first 6 numbers)

Most sections and chapters have "notes" which provide mandatory instructions for classifying goods.

There are also subheading notes regarding classification within subheadings.

The General Interpretative Rules provide the overall context for classification.

"Navigation" through the elements is governed by the General Rule of Interpretation. There are 21 sections, 97 chapters, about 1250 headings and 5000 subheadings within the "core" harmonized system

HS Sections

The Harmonized System is divided into 21 sections (numbered in roman numerals) each covering a group of commodities which would be the normal production of a given industrial sector.

For example:

Sections I to IV cover the agricultural and food sectors.

Section V is for basic mineral products.

Section VI is for chemical products.

Section XI covers textiles and apparel.

Section XVI is for machinery and electrical equipment, including computers.

Section XVII includes all vehicles, including spacecraft (!)

(Have a look to grasp the scope but do not memorize!)

| SECTION | SECTION NAME | CHAPTER |

| Live animals; animal products | 1 - 5 | |

| II | Vegetable products | 6 - 14 |

| III | Animal or vegetable fats and oils and their cleavage products; prepared edible fats; animal or vegetable waxes | 15 |

| IV | Prepared foodstuffs; beverages, spirits and vinegar; tobacco and manufactured tobacco substitutes | 16 - 24 |

| Mineral products | 25 - 27 | |

| VI | Products of the chemical or allied industries | 28 - 38 |

| VII | Plastics and articles thereof; rubber and articles thereof | 39 - 40 |

| VIII | Raw hides and skins, leather, furskins and articles thereof; saddlery and harness; travel goods, handbags and similar containers; articles of animal gut (other than silk-worm gut) | 41 - 43 |

| IX | Wood and articles of wood; wood charcoal; cork and articles of cork; manufactures of straw, of esparto or of other plaiting materials; basketware and wickerwork | 44 - 46 |

| Pulp of wood or of other fibrous cellulosic material; waste and scrap of paper or paperboard; paper and paperboard and articles thereof | 47 - 49 | |

| XI | Textiles and textile articles | 50 - 63 |

| XII | Footwear, headgear, umbrellas, sun umbrellas, walking-sticks, seat-sticks, whips, riding-crops and parts thereof; prepared feathers and articles made therewith; artificial flowers; articles of human hair | 64 - 67 |

| XIII | Articles of stone, plaster, cement, asbestos, mica or similar materials; ceramic products; glass and glassware | 68 - 70 |

| XIV | Natural or cultured pearls, precious or semi-precious stones, precious metals, metals clad with precious metal, and articles thereof; imitation jewellery; coin | 71 |

| XV | Base metals and articles of base metal | 72 - 83 |

| XVI | Machinery and mechanical appliances; electrical equipment; parts thereof; sound recorders and reproducers, television image and sound recorders and reproducers, and parts and accessories of such articles | 84 - 85 |

| XVII | Vehicles, aircraft, vessels and associated transport equipment | 86 - 89 |

| XVIII | Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; clocks and watches; musical instruments; parts and accessories thereof | 90 - 92 |

| XIX | Arms and ammunition; parts and accessories thereof | 93 |

| XX | Miscellaneous manufactured articles | 94 - 96 |

| XXI | Works of art, collectors' pieces and antiques | 97 |

HS Chapters

As much as it was possible, chapters were numbered in a sequence that tries to follow the degree of transformation of materials and goods.

Raw materials are in lower chapter numbers; finished goods are in higher numbers.

Looking at chapters on the Chapter and Heading List that you downloaded earlier, you will notice the upwards evolution:

Live chicken is in Chapter 1.

A breast of chicken (raw) is in Chapter 2.

Chicken cacciatore (cooked in tomato sauce) is in Chapter 16.

Also

Iron ore is in Chapter 26.

Steel plate is in Chapter 72.

A cruise ship (made of steel plate) is in Chapter 89.

One of the keys to becoming efficient at classification is a good knowledge of the structure of the chapters.

This is what helps us make a first opinion of where to begin to classify a given merchandise.

If you will be classifying on a regular basis, we recommend that you make a photocopy of the first two pages of the Chapter and Heading List and that, for a few weeks, you carry it with you and read it at least once a day to memorize the structure.

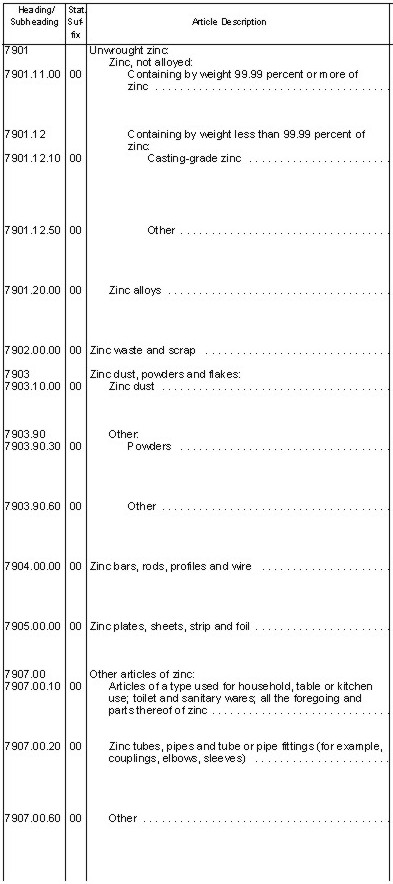

e Divided into Headings

A heading comprises 4 digits. The first two are the chapter number, the next two are the actual heading number within the chapter.

The illustration for Chapter 79 shows only the headings and their respective descriptions. The picture on the right is a cropped page from the HTSUS (harmonized tariff system of the US) showing the full 10 digit tariff item number including the heading, subheading and statistical suffix for shipments of these articles into the U.S., and their descriptions. In all national Harmonized Systems we will only be using the first six digits for this training, which are international.

| Chapter 79 ZINC AND ARTICLES THEREOF Headings: 7901 Unwrought zinc 7902 Zinc waste and scrap 7903 Zinc dust, powders and flakes 7904 Zinc bars, rods, profiles and wire 7905 Zinc plates, sheets, strip and foil 7907 Other articles of zinc | |

Whenever possible within a chapter the heading numbering reflects the degree of transformation of materials and goods.

The example above reflects that numbering:

01 is rough, unwrought.

04 has been transformed into bars.

07 has been further transformed into an article of zinc.

The text of the headings is one of the main elements of the HS, as we will soon demonstrate.

HS Subheadings

Headings are Divided into Subheadings

Subheadings are not born equal!

Headings are divided into subheadings which form the final part of a full six-digit classification.

In the excerpt below, a steel door lock for an automobile is classified in Heading 83.01 and in Subheading 8301.20.

|

|

There are one-dash subheadings and two-dash subheadings. We will refer to them in this course as dashes, even though they may only be represented by tabs in whatever HS book you are referencing.

If you only have tabs, you may have a hard time determining where the tabs fall, it is easiest to use a ruler on the page or pages to see where the paragraphs line up.

Two-dash subheadings are divisions of one-dash subheadings.

One-dash Subheading Example

In the excerpt below, subheadings 41, 42 and 49 are two-dash subheadings subservient to the "unnumbered" subheading "Other mountings, fittings and similar articles" which would have been Heading 8302.40 if not further divided.

|

|

A steel hinge for the door of a building is to be classified at 8302.10 (not 8302.41) because one must first find a suitable one-dash subheading before venturing to two-dash.

The initial choices for the hinge are:

- Hinges

- Castors

- Other mountings, fittings and similar articles for motor vehicles

- Other mountings, fittings and similar articles

- Hat-racks, hat-pegs, brackets and similar fixtures

- Automatic door closer

The fact that we are classifying a hinge puts it square into 8302.10, regardless of the "tempting" wording of 8302.41.

Two-dash Subheading Example

In this table, find the subheading for a steel door stop for a building.

|

|

The initial choices for the door stop are:

- Hinges

- Castors

- Other mountings, fittings and similar articles for motor vehicles

- Other mountings, fittings and similar articles

- Hat-racks, hat-pegs, brackets and similar fixtures

- Automatic door closer

The door stop makes it to 8302.41.

Here is how it looks in the HSTUS. I have used colored lines to show the tabs and how a straight edge can help show how the paragraphs line up.

Familiarize yourself with this subheading hierarchy.

Some headings are not subdivided. They have no subheadings.

As an example, have a look at Headings 83.03 and 83.04 in your HS Book. In such instances the full six-digit classification of a good ends with two zeros.

Based on this example, the six-digit classification of a fireproof steel safe would be 8303.00.

Steps to Classifying

Steps to Classifying

Description of goods

The first information about the goods that you have to classify will usually come from a supplier's invoice or customs form. Unfortunately, often you need to know what the product is made from and what it will be used for.

| The description on such documents is very often insufficient to find the proper classification. For instance, a description reading: 12 chairs, model Sleekline #16A is certainly not sufficient to find a classification as you can see on the excerpt at right. You will have to know the constituent materials of the chairs, whether they are upholstered or not, etc. You would also need to know the use or purpose. |

|

|

Customs laws, customs regulations or customs directive demand that descriptions on invoices be detailed enough to fully classify goods. Compliance, however, is very poor. Traders claim that such descriptions would be hard to achieve with computer-generated invoices, would take too much space, etc.

Seeing Goods "as Presented"

Goods are to be classified as presented -- that is, in the state and condition that they are in, when presented for classification.

Your first task is to look at what you are classifying globally. Is it a collection of unrelated goods or does it form a whole?

Some goods will form a whole by virtue of a specific rule:

A guitar and its case, presented together: By virtue of Rule 5, the case will be classified with the guitar.

A guitar case, presented alone: This will be classified as a case.

Goods put up in sets or kits for retail sale, as presented, form a whole. You will have to use Rule 3 to find the one heading under which to classify an assortment of many things. Keep in mind, however, that they must "be put together to meet a particular need or activity." You may have to classify everything separately.

A shipment of spare parts, as presented, does not form a whole. Each item will have to be classified separately. Unless, of course, there are precisely the number of parts to assemble something that would then have the "essential character" of a machine (General Rule 2(a)).

|

Excess articles must be classified separately. If there were 8 pneumatic tires presented with this vehicle, 4 would be classified with the vehicle and 4 would be classified separately, as tires.

Invoices with a long listing are a common pitfall for new classifiers. Make sure that you know what is "presented" for classification. Is it a list of parts or is it a whole?

We once witnessed this poor lad who spent two and a half days finding classifications for each of the 2987 lines of a 60 page invoice. When he got to the last page of the invoice he noticed a line for "Assembly and Labor" with an amount equivalent to 35 percent of the whole invoice. Upon inquiring, he found out that the whole invoice was for one machine, all classified under one subheading. The manufacturer makes his invoices that way because each machine is made to the customer's specification.

The Schedule B

The Schedule B represents the export classification codes for the US. As with the HS numbers they come in the form of XXXX.XX.XXXX with the first 6 numbers aligned with the HS numbers. Here is an article that explains the difference between the two:

Article

Because the Schedule B has a search engine (link provide in the Useful Links section) it is often easier to try to find the heading and subheading using the schedule B and then switch over to the HTS site. Instructions for using the search engine is next

How to search for Schedule B number - https://www.census.gov/foreign-trade/data/video022.html