Please use template attached to answer questions.

| Unit 6 | [AB204: Macroeconomics] |

Unit 6 Assignment

PART 1: Comparing Long-Run Economic Growth Rates of Countries

Use the Library and databases to conduct research to identify the key factors that determine long term economic growth. You can find the most up-to-date reports on the economic growth trends of different countries under the World Bank website linked below.

World Bank. (2017). World development indicators. Retrieved from http://data.worldbank.org/products/wdi

After you have conducted research and read the items listed above, access the “Data & Research” tab in the World Bank website and compare growth rates between two countries of your choice. Specifically, select one advanced economy (such as U.S., Germany, etc.), and select one developing economy (such as Angola, Bangladesh, etc.).

Download their data for five major economic indicators (2005–2014) such as the real GDP growth (annual %), and three major social indicators such as population. Then identify and describe possible factors that may explain the differences between the GDP growth rates and long-term economic growth of the advanced and developing economies for the countries you selected.

Diversity has become the characteristics of the majority of the countries in the world. Globalization and economic interdependence of countries calls for understanding and accommodating diversities. Economic development theories and empirical studies also widely discuss and debate the impacts of multiculturalism and diversity on economic growth and development. The positive roles of multiculturalism and diversity in economic growth and development are praised in democratic countries that have cultivated systems that accommodate and capitalize on diversities and multiculturalism (see the article below).

Economic benefits of cultural diversity. (n.d.). SGS Economics & Planning. Retrieved from https://www.sgsep.com.au/publications/economic-benefits-cultural-diversity

On the other hand, developing countries in Asia, Africa, and Latin America, cultural and religious diversities are the internal instability, polarization, conflicts, disintegration, etc., which have adverse impact on economic growth and development. Since the developing countries don’t have systems that effectively accommodate multiculturalism and diversity and dominant ethnic groups control power and resources, they lead to lack of equal opportunities and significant socioeconomic gaps in countries (see the links below for research examples on the issues for Latin America, Asia, and Africa).

Arocena, F., & Porzecanski, R. (n.d.). Ethnic inequality, multiculturalism and globalization: The cases of Brazil, Bolivia and Peru. Retrieved from http://www.multiculturalismoenuruguay.com/Docs/Articulos/IJCSArocena.pdf

Donnelly, R. (2015). Tensions and challenges in the management of diversity and inclusion in IT services multinationals in India. Human Resource Management, 54(2), 199–215. Retrieved from http://eds.a.ebscohost.com.lib.kaplan.edu/eds/pdfviewer/pdfviewer?sid=a3d4c10c-1830-41b7-8537-6f2b78193483%40sessionmgr4010&vid=7&hid=4205

Kivoto, E. (n.d.). Ethnic conflict and its impact on economic development in Africa: A case study of Kenya. Retrieved from http://www.academia.edu/11302119/ETHNIC_CONFLICT_AND_ITS_IMPACT_ON_ECONOMIC_DEVELOPM ENT_IN_AFRICA_A_CASE_STUDY_OF_KENYA

Discuss the value of recognizing and accommodating multiculturalism and diversity in a globalized economic environment and their roles in promoting long-run economic growth. In line with the developed and developing countries you selected for your research, discuss the benefits and challenges, and recommend solutions in regard to multiculturalism and diversity in the two countries and their impacts on the economy.

PART 2: Loanable Funds Market

1. Examine each of the following scenarios in the market for loanable funds. Explain the impacts on private savings, private investment spending, and the rate of interest under each of the following events. Assume the economy is autarky (closed) and it does not have trade and capital transactions (flows) with foreign countries.

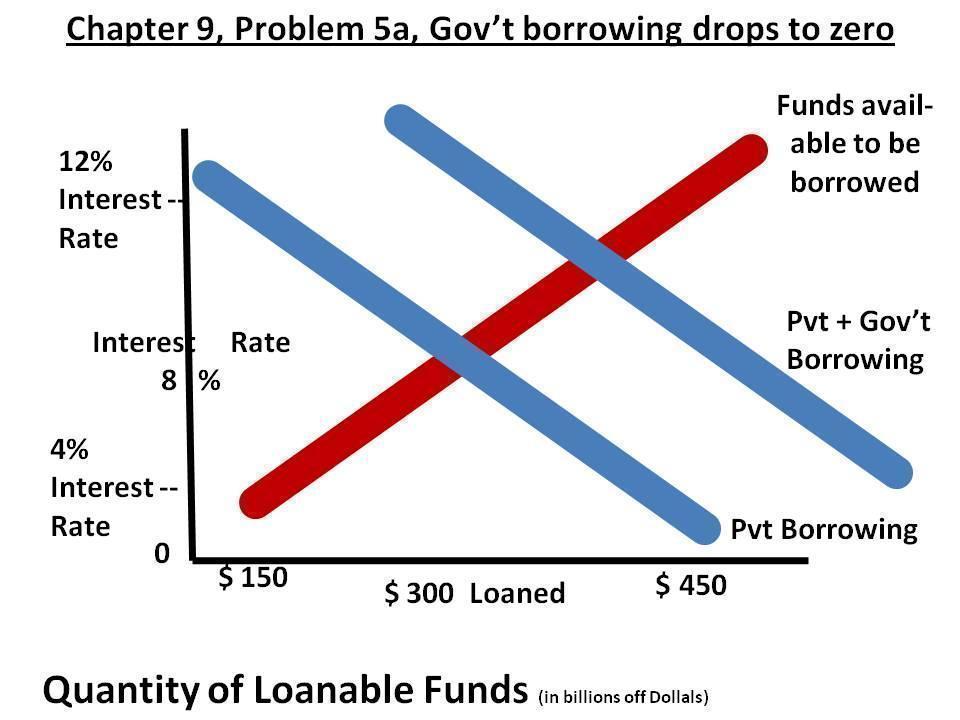

a. Assume the government balances its budget and reduces the size of its deficit to zero. (Refer to the graph below). What is its impact on private savings, private investment spending, and the rate of interest?

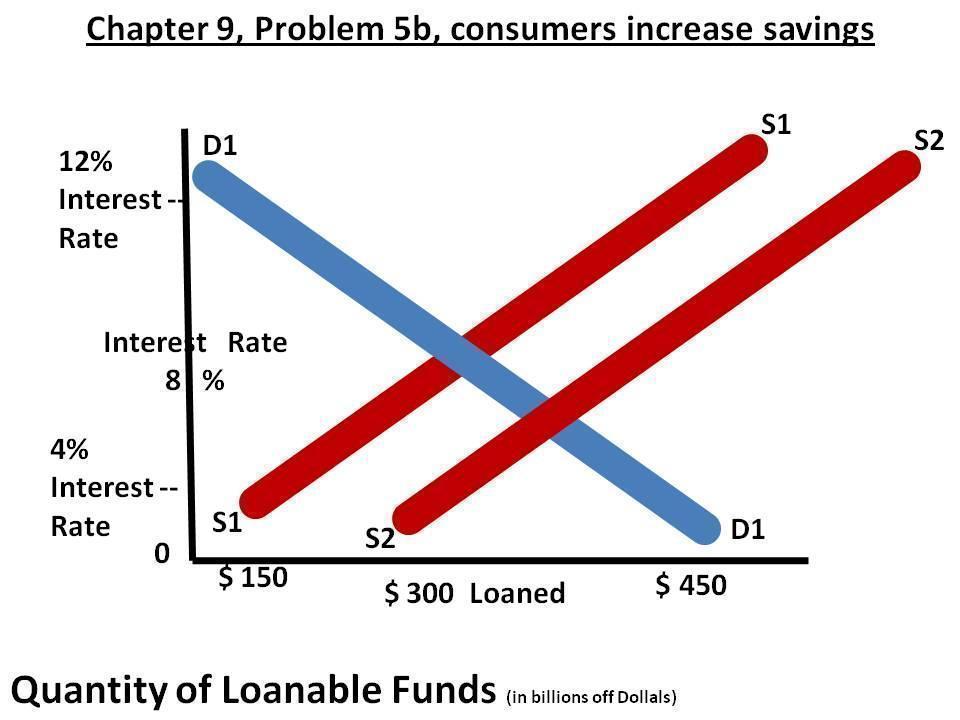

b. Suppose the consumers decide to save more money, at the given rate of interest. Then assume the budget is balanced and the deficit is zero (refer to the graph below). What is the impact of this scenario on private savings, private investment spending and the rate of interest?

v.6.9.17 3 of 3