Hi plz paraphrase the highlited part of the uploaded file, the content is already there, just need it paraphrased.

ABSTRACT

The purpose of this survey is to study the relationships and interdependencies between cost types and the level of production by product group. Subject of the review are organizations from the nourishment business part in the district, with the object of delivering and preparing meat and meat items. The technique utilized in this investigation empowers to break down the adjustments in the normal fixed, normal factors, and normal aggregate and negligible costs, how influence the minor and normal item. Because of these cost-creation interdependencies, the basic focuses identified with expanding, diminishing and negative return of expenses of generation of meat and meat items are recognized and broke down. . Albeit no predictable interceding job of entomb parental pressure was discovered, one little dyadic aberrant impact showed that maternal burdensome side effects were identified with progressively fatherly over responsive control by means of uplifted degrees of bury parental pressure experienced by the two guardians. These outcomes give new help to the possibility of interdependency among guardians and explicitly bolster the fathering helplessness theory. Likely, this examination illuminates clinical practice by demonstrating that family mediations intending to improve child rearing should focus on explicit character qualities influencing child rearing conduct and receive a dyadic methodology including the two guardians, particularly when focusing on fatherly child rearing Happily, logical and philosophical investigations of psyche are striking a chord as encapsulated, enactive, encultured, and inserted in social and specialized systems, and as a development not constrained to the limits of the individual life form. Mental marvels are half and halves of occasions in the head and occasions on the planet to which they are regularly coupled, not least of which are with other individuals. There are shared and corresponding ramifications of this externalism for various religious topics

Introduction

In the course of recent years, money related markets have turned out to be progressively worldwide. The slow disassembling of administrative hindrances and the presentation of further developed innovation, especially in information handling and media communications, have called for new market structures and practices. Resource and obligation the board has progressively turned into an all-around coordinated capacity and the issuance of global protections is regularly utilized as a substitute for increasingly customary financing channels. These improvements are to be invited to the extent that the expanded degree of rivalry is required to prompt a productive assignment of capital, both broadly and universally, lower-cost money related administrations and new methods for supporting danger. In any case, they additionally present another administrative test in verifying money related dependability. It was the 1987 overall financial exchange crash specifically which featured the deficiencies of an administrative structure still to a great extent dependent on old institutional divisions and national locales. In the globalized security advertises, the principle challenge for the two financial specialists and strategy creators is to exploit and advance productivity upgrading parts of market connection, while containing and controlling the unfortunate destabilizing impacts. In light of these market improvements, a developing assortment of research has endeavored to set up the nature and the degree of the relationship between national securities exchanges. The early writing, be that as it may, simply indicated whether there were profits by worldwide portfolio expansion, overlooking the issue of how the level of capital market combination may really influence these broadening benefits generation, the taste qualities of the crude materials, and the other part – with the attributes of the area/the state of the material premise, the potential for remodel and rebuilding of the organizations, the accessible HR, the state of framework, the advancement of exchange and appropriation

ANALYSIS OF THE INTERDEPENDENCES BETWEEN COSTS AND PRODUCTION

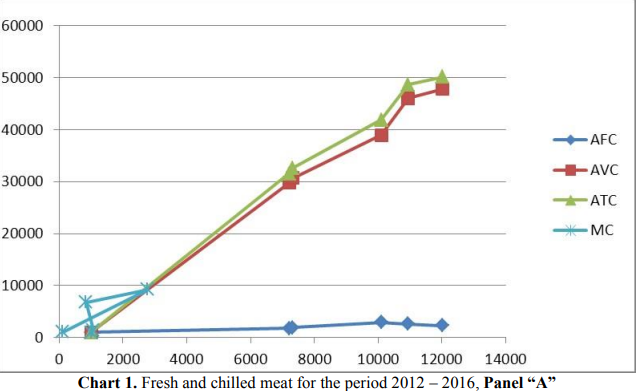

The quantitative measurements of the dependences between the types of costs and the production of fresh and chilled meat are In the course of recent years, money related markets have turned out to be progressively worldwide. The slow disassembling of administrative hindrances and the presentation of further developed innovation, especially in information handling and media communications, have called for new market structures and practices. Resource and obligation the board has progressively turned into an all around coordinated capacity and the issuance of global protections is regularly utilized as a substitute for increasingly customary financing channels. These improvements are to be invited to the extent that the expanded degree of rivalry is required to prompt a productive assignment of capital, both broadly and universally, lower-cost money related administrations and new methods for supporting danger. In any case, they additionally present another administrative test in verifying money related dependability. It was the 1987 overall financial exchange crash specifically which featured the deficiencies of an administrative structure still to a great extent dependent on old institutional divisions and national locales. In the globalized security advertises, the principle challenge for the two financial specialists and strategy creators is to exploit and advance productivity upgrading parts of market connection, while containing and controlling the unfortunate destabilizing impacts. In light of these market improvements, a developing assortment of research has endeavored to set up the nature and the degree of the relationship between national securities exchanges. The early writing, be that as it may, simply indicated whether there were profits by worldwide portfolio expansion, overlooking the issue of how the level of capital market combination may really influence these broadening benefits generation, the taste qualities of the crude materials, and the other part – with the attributes of the area/the state of the material premise, the potential for remodel and rebuilding of the organizations, the accessible HR, the state of framework, the advancement of exchange and appropriation

. On the off chance that externalism is valid for the engineering that enables us to see, recall, reason, or use language, at that point it is valid for the procedures that the design actualizes. The outer structures can be as liable to convey the data pertinent to achieving an undertaking, and to the degree that they are controlled and changed by the life form to achieve those errands, they can be said to be portions of the procedure. For instance, a causal clarification of how you increase multidigit numbers (or even include them) would need to incorporate (for a large portion of us) a stack of paper, and the little techniques like "conveying" that you need to do, to clarify how the augmentation is practiced, and to clarify how you get it More specifically, the only market that appears not to influence the markets m the other two countries is the Given the extent of the market interrelations identified, the question arises as to whether these results can be used to earn abnormal profits. To address this inquiry, a precise learning of exchange costs among business sectors and trade hazard is required. One market can be utilized to anticipate other markets' profits. These measurements can be determined as .Results uncover that past developments can just clarify a little level of profits, running business sector financial specialists liable to attempt exchange all the more explicitly, the main market that shows up not to impact the business sectors m the other two nations is the German prospects showcase. In any case, the German spot market influences each market considered. Given the degree of the market interrelations recognized, the inquiry emerges with respect to whether these outcomes can be utilized to gain strange benefits. To respond to this inquiry, an exact learning of exchange costs among business sectors and trade hazard is required. Be that as it may, uncensored R' evaluations can give a rough proportion of the degree to which past data m one market can be utilized to foresee other markets' profits. These measurements can be determined. Results uncover that past advancements can just clarify a little level of profits, running the German fates advertise.'' Given that regularly exchange costs speculators

Reference

Abhyarikar, A.H. (1995), 'Return Volatility Dynamics in the FTSE 100 Stock Index and Stock Index Futures Market ..Journal of Futures Market, Vol. 15, Xo. 4 (June), pp. 457-58

Barresi, J., and C. Moore. 1996. “Intentional Relations and Social Understanding.” Behavioral and Brain Sciences 19:107–54

Harre, Rom. 1984. Personal Being: A Theory for Individual Psychology. Cambridge, Mass.: Harvard Univ. Press.

McCulloch, Gregory. 2003. The Life of the Mind: Essay on Phenomenological Externalism. New York: Routledge