Instructions Diagram from Kloos, et al. (2012) For this task you will write a paper listing at least five important social problems or issues facing your community or society. Then choose one of the

ACCT&201 Week 3 Homework

1. Using the notion that the accounting equation (Assets = Liabilities + Stockholders' Equity) must remain in balance, indicate whether each of the following transactions is possible.

| |||||||||||||

2. Hokies uses the following accounts:

|

|

|

|

| Accounts Payable | Equipment | Accounts Receivable |

| Cash | Supplies | Utilities Expense |

| Prepaid Rent | Rent Expense | Service Revenue |

| Common Stock | Notes Payable | Retained Earnings |

| Salaries Payable | Salaries Expense | Dividends |

Required:

Indicate which accounts should be debited and which should be credited for the following transactions of Hokies company.

| |||||||||||||||||||||||||||||||||||||||||||||||||

3. Below is a list of typical accounts.

Required:

For each account, indicate (1) the type of account and (2) whether the normal account balance is a debit or credit.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

4. Below is a list of activities for Jayhawk Corporation.

Required:

Select from the activities of Jayhawk Corporation whether the transaction increases, decreases, or has no effect on assets, liabilities, and stockholders' equity. The first item is provided as an example.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

5. Below is a list of activities for Purple Cow Incorporated.

Required:

For each activity, indicate the impact on the accounting equation. After doing so for all transactions, ensure that the accounting equation remains in balance. The first item is provided as an example. (Decreases to account classifications should be entered as a negative.)

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

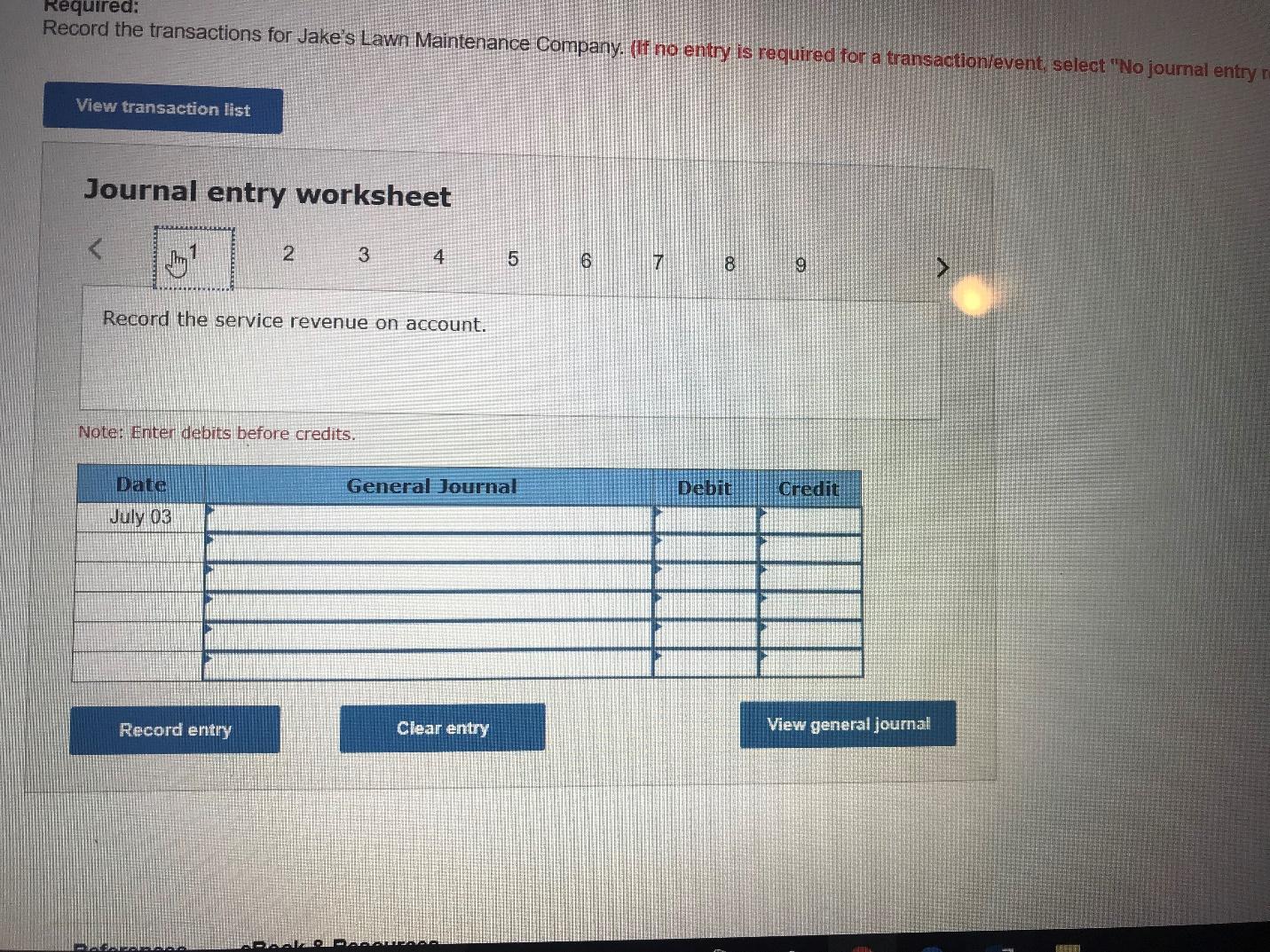

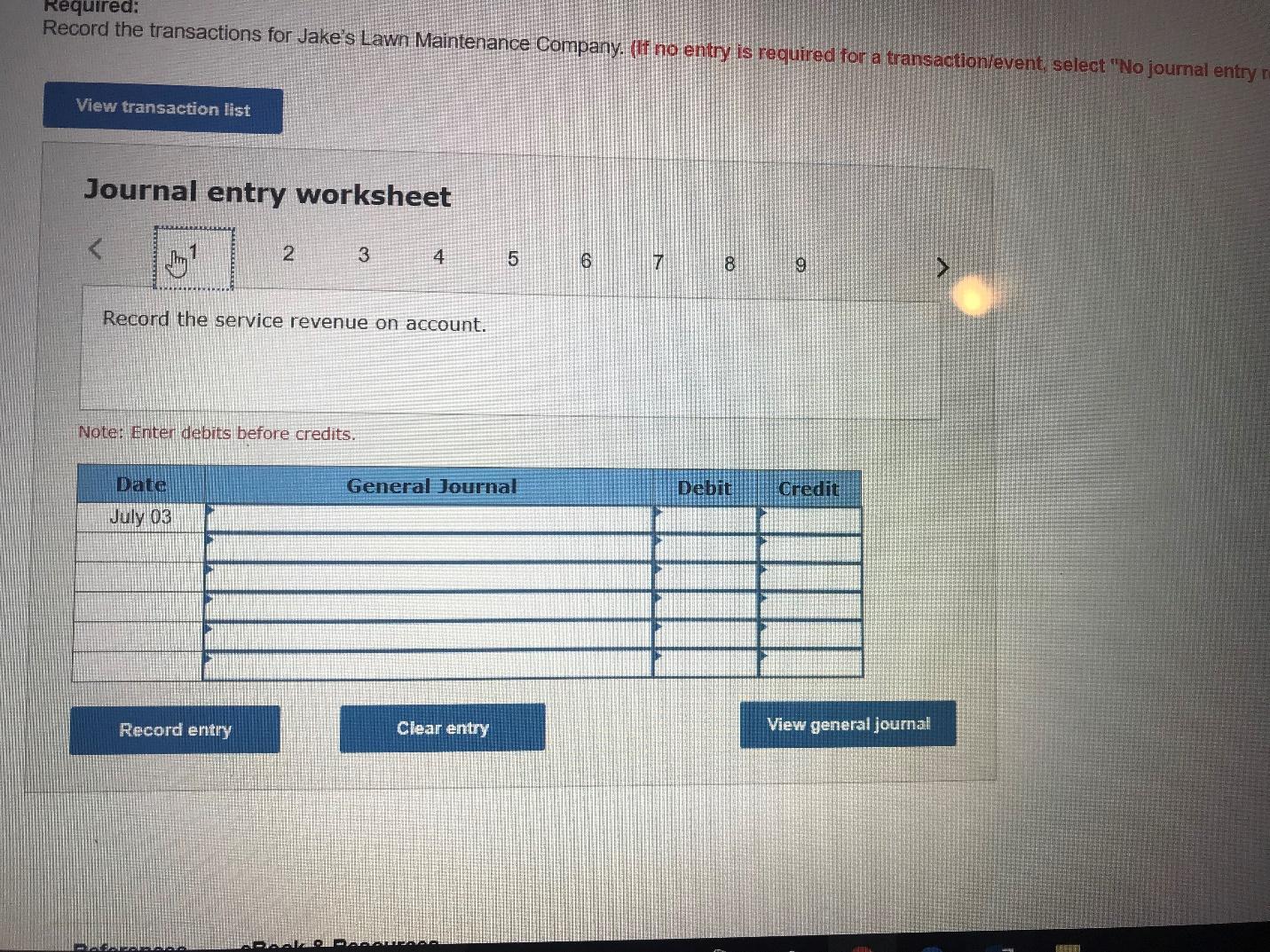

6. Jake owns a lawn maintenance company, and Luke owns a machine repair shop. For the month of July, the following transactions occurred.

July 3 Jake provides lawn services to Luke’s repair shop on account, $500.

July 6 One of Jake’s mowers malfunctions. Luke provides repair services to Jake on account, $450.

July 9 Luke pays $500 to Jake for lawn services provided on July 3.

July 14 Luke borrows $600 from Jake by signing a note.

July 18 Jake purchases advertising in a local newspaper for the remainder of July and pays cash, $110.

July 20 Jake pays $450 to Luke for services provided on July 6.

July 27 Luke performs repair services for other customers for cash, $800.

July 30 Luke pays employee salaries for the month, $300.

July 31 Luke pays $600 to Jake for money borrowed on July 14.

Required:

Record the transactions for Jake’s Lawn Maintenance Company. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

7. Please look at question 6 and answer this question.

Required:

1. Record each transaction for Luke's Repair Shop. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

8. 2. Using the format shown below, enter the impact of each transaction on the accounting equation for each company. (Decreases to account classification should be entered as a negative.)

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

9.

Consider the recorded transactions below.

|

|

| Debit | Credit |

| 1. | Accounts Receivable | 8,400 |

|

|

| Service Revenue |

| 8,400 |

|

|

|

|

|

| 2. | Supplies | 2,300 |

|

|

| Accounts Payable |

| 2,300 |

|

|

|

|

|

| 3. | Cash | 10,200 |

|

|

| Accounts Receivable |

| 10,200 |

|

|

|

|

|

| 4. | Advertising Expense | 1,000 |

|

|

| Cash |

| 1,000 |

|

|

|

|

|

| 5. | Accounts Payable | 3,700 |

|

|

| Cash |

| 3,700 |

|

|

|

|

|

| 6. | Cash | 1,100 |

|

|

| Deferred Revenue |

| 1,100 |

|

| |||

Required:

Post each transaction to T-accounts and calculate the ending balance for each account. The beginning balance of each account before the transactions is: Cash, $3,400; Accounts Receivable, $4,200; Supplies, $400; Accounts Payable, $3,500; Deferred Revenue, $300. Service Revenue and Advertising Expense each have a beginning balance of zero.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

10. Below are the account balances of Bruins Company at the end of November.

| Accounts | Balances | Accounts | Balances | ||

| Cash | 40,000 | Common Stock | 50,000 | ||

| Accounts Receivable |

| 50,000 | Retained Earnings |

| 35,000 |

| Supplies |

| 1,100 | Dividends |

| 1,100 |

| Prepaid Rent |

| 3,000 | Service Revenue |

| 65,000 |

| Equipment |

| ? | Salaries Expense |

| 30,000 |

| Accounts Payable |

| 17,000 | Rent Expense |

| 12,000 |

| Salaries Payable |

| 5,000 | Interest Expense |

| 3,000 |

| Interest Payable |

| 3,000 | Supplies Expense |

| 7,000 |

| Deferred Revenue |

| 9,000 | Utilities Expense |

| 6,000 |

| Notes Payable |

| 30,000 |

|

|

|

|

| |||||

Required:

Prepare a trial balance by placing amounts in the appropriate debit or credit column and determining the balance of the Equipment account.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||