9-1 Final Project Submission: Case Study Analysis Assignment Submit your case study analysis. It should be a complete, polished artifact containing all of the main elements of the final product. It sh

ANALYSIS 6

Milestone Two: The First of SOX Compliance

Name: Yvonne Saunders- Batchue

Southern New Hampshire University

Date: September 5, 2019

The vice president (VP) and chief audit executive described the company as a likely candidate for a material weakness in the first year of SOX compliance. What were the elements critical to the company's decisive success in its first year of compliance?

Compliance with Sox may be a disgusting job for companies. The Sarbanes – Oxley 302, 401,404, 409 and 802 sections are one of the most relevant sections of the Compliance Act.

The financial sector from the whole company division was merged into one centralized reporting centre during the first year of enforcement by Trinity.

Oracle financials substituted Trinity's four overall packages, and Trinity's annual compliance cost of 0,5 million SOXs is predicted to be saved from the project (Schultze, 2011).

The creation of the accounting service center was also a main factor in Trinity's first year of implementation. The design of ASC provides routine, organizational and centralized facilities for large-scale transaction handling such as accounting, payroll and AP (Schultze, 2011).

Define a material weakness and explain the material weaknesses that are specific to Trinity.

In the case study and accounting norms studies (e.g. the Public Company Accounting Oversight Board (PCAOB)).

As stated, Section 302 deals with' Corporate Financial Reporting Responsibility' and inner inspection accreditation. The evaluation of inner checks is listed in Section 404. Important inner checks are followed to prepare precise and credible financial reports.

Policy and processes for the suitable division of responsibilities to minimize the probability of fraud occurring deliberately

Employees trained to carry out their tasks

Sound practice for staff to carry out their responsibilities and functions

A scheme which guarantees that financial operations are authorized and recorded properly

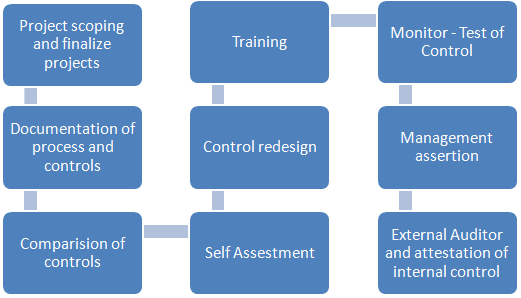

Describe the factors that made Trinity a success by illustrating the flow processes of the organization both in a narrative and process flowchart.

Trinity has succeeded primarily in complying with SOX by initiating an early attempt to correct its economic reporting schemes. Every company unit worked separately and independently before the correction. Trinity management quickly noticed that there was a need for further formality and merged its 22 company units into one company system. From that stage on, the leadership of Trinity has been prepared to evaluate present controls and verify whether these controls comply with SOX.

The factors which made the Trinity to successful in SOX

References

Sarbanes-Oxley compliance. (2003). Retrieved September 4, 2016, from Sarbanes-Oxley Compliance, SARBANES-OXLEY ACT 2002

Schultze, U. (2011, October 04). The Sox Compliance journey at Trinity Industries. Retrieved September 5, 2016, from Journal of Information Technology Cases, https://bb.snhu.edu/bbcswebdav/pid-1378078-dt-announcement-rid-38222876_1/courses/ACC-675-X5049_16TW5/The%20SOX%20Compliance%20journey%20at%20Trinity%20Industries.pdfIn-line

The Importance of Internal Controls in Financial Reporting and Safeguarding Plan Assets. Retrieved September 5, 2016, from aicpa.org, http://www.aicpa.org/InterestAreas/EmployeeBenefitPlanAuditQuality/Resources/PlanAdvisories/DownloadableDocuments/Plan_AdvisoryInternalControls-lowres.pdfIn-

SOX 404 guide: Beginning your evaluation: Step 3. Retrieved September 5, 2016, from SEC, https://www.sec.gov/info/smallbus/404guide/evaluation3. “SOX 404 guide

Auditing standard no. 5. (2010, April ). Retrieved September 6, 2016, from PCAOB, https://pcaobus.org/Standards/Auditing/Pages/Auditing_Standard_5.aspxIn-