I need assistance with my Assignment

HSA 312 XT81/H01/01

MANAGED HEALTH CARE

SPRING 2020 L. EITEL

OVERVIEW 3: FEBRUARY 25, 27, AND MARCH 2

KEY ISSUES AND CHALLENGES IN THE U.S. HEALTH INSURANCE INDUSTRY: 2000 THROUGH 2010

SUMMARY - HEALTH INSURANCE IN THE UNITED STATES: THE MANAGED CARE BACKLASH AND ITS AFTERMATH – U.S. HEALTH INSURANCE 2000 THROUGH 2010

Dominant Form of insurance: Managed Health Insurance.

Whereas more restrictive HMOs and POS plans dominated health plan enrollment in the 1990s (though not exclusively so), after 2000 PPOs (Preferred Provider Organizations), and employer self-insured health plans which act like PPOs, have dominated. Also, the 29% of health plan enrollees in employer-based health insurance are in Consumer Directed Health Plans – these are usually also PPOs.

Other Forms of Insurance: Residual Indemnity/Service plans exist, but their role is very small.

Key Characteristics of the Period: Putting the Burden of Controlling Health Care Expenditures on the Backs of Employees

The message of the Managed Care Backlash was that health plan members of employer-based group health plans and clinical providers wanted less health plan control and interference in the choice of provider, test, Specialty Care Physician consults, and other Personal Health Care Goods and Services.

Employers and health insurance plans took that message to mean that employees should have larger provider networks from which to choose, and less interference and medical management from the insurance plans themselves.

Since employers and insurers would have less control over certain aspects of health insurance, they believed that employees should take on a larger share of responsibility for keeping premiums low, for keeping down increases in National Health Expenditures, and for ensuring that they and their clinical providers made informed choices about the necessity and appropriateness of various tests, Specialty Physician consultation, and other medical interventions.

In other words, employers and health insurance plans were willing to embrace more patient cost-sharing along with greater patient use of web-based provider price (and if possible quality) information. All these ideas were compatible with the idea of Consumer Directed Health Plans with high deductibles.

Employers:

Worked with insurance companies of all kinds to move their employees into Preferred Provider Organizations.

PPOs (although they were Managed Health Insurance plans) did not require that employees have a Primary Care Practitioner, interfered less with patient and provider decisions about the site and type of treatment or other medical intervention (diagnostic imaging tests, for instance), and gave members much more choice of physician, hospital, and other providers.

Also liked PPOs because they were often subject to less State regulation, and were much more flexible in terms of coming up with health insurance benefits plans which would meet the preferences and cost-saving concerns of employers.

Increasingly self-insured. Up until the 2000s only very large employers self-insured. As of 2018 about 61% of employees with employer-based group health insurance have benefit plans which are fully or partially self-insured.

Employers are drawn to self-insured status because it gives them more flexibility in setting the health benefits covered by the plan, takes them out from under State regulation (they are minimally regulated by the Federal government), and they are not subject to State health insurance premium taxes.

Functionally, employers run these like PPOs, but this arrangement gives them more control over benefits and expenditure. Employers hire TPAs (Third Party Administrators) as hired guns to handle medical management, paying bills, putting together provider networks, etc.

If they offered their employees traditional insurance plans (not self-insured benefits), they offered high deductible PPO plans, or Federally qualified Consumer Directed Health Plans. In any case, they moved more of their employees into plans where the employees had to pay much more in terms of out-of-pocket expenses, thus taking the financial burden and responsibility from the employer.

Insurers:

Worked with employers as indicated above to move employees from HMOs and POS plans (only about 22% of workers with employer-based group health insurance are in such plans now. That has been the case since the early 2000s.)

They moved the employees to PPOs, with fewer restrictions, more provider choice, and more cost-sharing.

With the advent of Federally approved Consumer Directed Health Plans with high deductibles, they worked with employers to move more health plan enrollees into those, or at least created PPOs with high deductibles, even if they were not formally Consumer Directed Health Plans.

In some instances, acted as Third-Party Administrators for employer self-insured health benefits plans.

Even in their HMO and POS products, were less restrictive in the scope of their provider networks and in the extent to which they medically managed clinical care.

In other words, put much more of the financial risk associated with the plans they administered on health plan enrollees.

Functionally denied health insurance to individuals with preexisting conditions.

Used Rescissions to shore up their profits on individual health insurance plans. (Using technicalities to cancel their insurance contracts with relatively health individuals who started making active use of their individual health insurance policies.)

Used small business Purges to shore up their profits on small business health insurance plans. (Ending their relationship with small businesses who were not profitable by making huge increases in premiums at the time of renegotiating the health insurance contract.)

In 2003 Congress gives a boost to high deductible health plans and greater out-of-pocket spending by some employees by creating Federally approved Consumer Directed Health Plans.

In 2006, Massachusetts addresses the problems of affordable access to and coverage for Personal Health Care Services by implementing a State level version of what would become the insurance provisions of the Affordable Care Act of 2010.

Key Problems of the Period: The Situation on the Eve of the 2008 Presidential Election

From 2000 through 2004/2005 National Health Expenditures grew from year to year at rates higher than the 5-6% of the 1990s. When those rates of increase did start to go down, it was very likely because of people losing health insurance coverage, having increased levels of cost sharing if they did have insurance, or experiencing more limited benefit packages if they were in self-insured employer health benefits plans.

Individuals and Small Businesses were increasingly having trouble obtaining and keeping affordable comprehensive health insurance. Individuals with pre-existing conditions found it increasingly difficult to get any health insurance. Insurance company policies with respect to Rescissions and Purges only made this situation worse.

The spread of Consumer Directed Health Plans and other high deductible health insurance plans within PPOs meant that those with employer-based group health insurance were increasingly likely to have to pay more out of pocket for needed Personal Health Care Goods and Services, and use their health benefits less, even to the detriment of their health.

Overall Americans were having trouble getting affordable health insurance, faced having to pay more out of pocket, and faced the prospect (especially if they worked in small businesses) of not being able to enroll for employee-based group health insurance.

Insurance rates grew nationally and locally, so that on a given day a substantial percentage of Americans had no health insurance of any kind. (Conservatively 14% to 16%.)

As the Great Recession unfolded in 2008, and accelerated in September 2008, uninsurance rates grew even greater, and more and more Americans went without health insurance.

Managed Health Insurance Plans continued to dominate the market for employer-sponsored insurance that was provided by employers who were not self-insured:

Preferred Provider Organizations dominated this part of the health insurance market – throughout this period they accounted for close to 60% of that market (in terms of covered lives).

Classic HMOs and Point of Service Plans covered (by 2014) only about 20-21% of that market.

All three types of Managed Health Insurance Plans (especially HMOs and POS plans) DID THE FOLLOWING:

Opened up their networks; and

Loosened their controls over utilization of key aspects of personal health care services (less emphasis on Primary Care Practitioner gatekeeping, fewer limitations on the use of Specialty Care Practitioners, fewer controls on the use of diagnostic imaging, for example).

There was a substantial increase in the number of employers who WERE SELF-INSURED: By 2013 almost 60% of employees were insured fully or partly via self-insured employers.

Self-Insurance offered a number of benefits to Employers: Flexibility in terms of benefits, greater employer control over health services expenditures for their employees, and less State control and regulation (ERISA preemption) made these arrangements more popular among employers. Also, Employers did not have to pay State taxes on insurance premiums;

The largest growth was among employers with over 5000 employees, and employers with 1000-4999 employees;

However, even employers with 200-999 employees started (though to a lesser extent) to choose this arrangement.

Employers offered fewer insurance plan options to their employees, especially firms with fewer than 1000 employees.

There WAS a growing focus on the Financial Management of Risk, as had been the case under Indemnity and Service Plans through the 1970s.

THE GROWING CONSENSUS OF EMPLOYERS, INSURANCE PLANS, SOME PUBLIC AUTHORITIES, AND TO A CERTAIN EXTENT THE HEALTH CARE POLICY COMMUNITY, WAS THAT IF EMPLOYERS AND HEALTH INSURANCE PLANS COULD NOT CONTROL QUALITY AND EXPENDITURE LEVELS AS THEY HAD IN THE 1990s, then the burden of cost control would have to fall on employees/plan members.

EMPLOYEES could have less restrictive networks and fewer restrictions on their access to providers, tests, and treatments, but would have to pay for greater choice and lessened health plan control with significantly higher out-of-pocket expenditures.

From 2003, there was a rapid expansion of Consumer Directed Health Plans (CDHPs: High Deductible/Low Premium plans with Health Savings Accounts and substantial employee out-of-pocket expenditure). 22% of employees with employer-sponsored health insurance are currently covered by such plans.

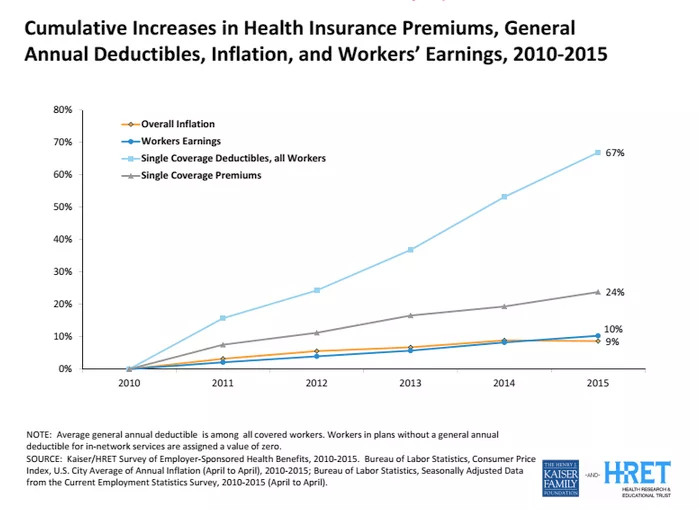

There has been a movement toward High Deductible/High Cost Sharing PPOs which are not CDHPs – especially since 2010.

There were the beginnings of growth in Employee/Plan Member Out-of-Pocket Expenditures as a percentage of total National Health Expenditures, and of the Employee/Plan Member deductibles and cost sharing. There was also a reduction in the Employers’ percentage contribution to total health insurance premiums.

Employers and Health Insurance Plans began to use Reference Pricing and Tiered Hospital Networks as ways of directing Employee/Plan Member choice of providers and treatments.

Health Insurance Plans made increasing and extensive use of marginally legal methods (Rescissions in the Individual Insurance markets, Purges in the Small Business Insurance markets, discrimination against people with Preexisting Conditions in both of those markets) to reduce their financial liabilities and reduce their Medical Loss Ratios, but with the effect of increasing the percentage of Americans who, on any given day, did not have health insurance.

Annual (year-to-year) increases in National Health Expenditures were again substantial, at least from 2000 through 2005 or 2006, and at the same time the percentage of u.s. citizens who were Uninsured on any given day rose substantially.

managed competition, supported by public authorities, gains recognition as a tool for reducing the increasingly high percentage of employees in small businesses and individuals/Families who did not have, and could not afford, decent health insurance for personal health care services.

Massachusetts obtained a Federal waiver and in 2006 undertook a statewide Managed Competition experiment to make reasonably priced basic health insurance available to individuals and small businesses in Massachusetts.

9