Please answer the questions on the worksheet as you read using the links and charts.

First, Watch the Video “Capitalism Hits the Fan” and fill out the worksheet. Then read this document and answer the questions as you go from the data provided and the embedded links. All questions you are expected to answer appear with a Q in front of them.

Q1. According to Economist Richard Wolff, what happened to wages and profits beginning in the 1970’s?

Wolff said there were three things that corporations did with their money:

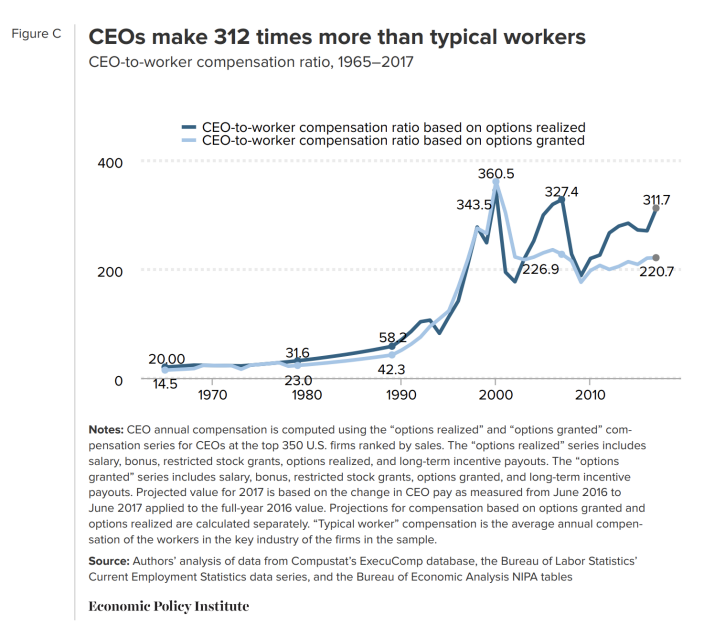

As the chart shows, in 1970, the average CEO made 20 times their typical worker. By 1990, they were making almost 60 times their typical worker, and by 2018, they were making over 300 times their typical worker. https://finance.yahoo.com/news/chart-ceos-make-312-times-typical-workers-220534807.html

As the chart below shows by the 1980’s mergers and acquisitions in the United States happened at unprecedented levels. https://seekingalpha.com/article/4068260-snapshots-of-merger-and-acquisition-activity

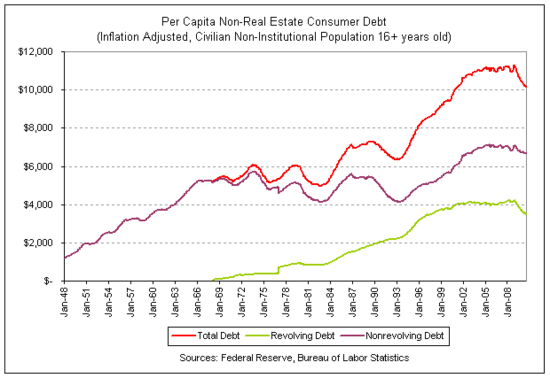

This chart should be startling. It shows that total debt has increased from around $1,186 per person in 1948 to $10,168 in 2010 for non-mortgage debt. Revolving debt is what we put on Credit cards and nonrevolving debt is the debt we incur for things like cars. According to Wolff, workers were able to increase their standard of living even though they weren’t being paid more by borrowing and because businesses had so much money, they are happy to lend it and earn interest. When was the last time you went to Best Buy or Amazon and before you checked out, you were asked if you wanted to open a credit card for that store? Loaning money is so profitable that companies will usually pay you (10% discount, etc.) to open a charge card. https://www.theatlantic.com/business/archive/2010/09/how-americans-love-affair-with-debt-has-grown/63552/

Richard Wolff is an economist and he didn’t talk about the 4th thing corporations did with their money. It is what we have spent a lot of time in this course looking at. They invested it in politics. They coordinated campaign contributions, hired lobbyists, began courting politicians, and executives. Sometimes, they even ran for office themselves. They also spent vast sums to establish “Think Tanks” to come up with research and data that justified their privileged place in society.

Q2. https://www.opensecrets.org/overview/election-trends.php According to the chart that this link brings up, How much did the average winner of a congressional race spend?

House Senate

1990 ______ ________

2018 ______ ________

Q3. According to the chart on this link, https://www.opensecrets.org/federal-lobbying/summary Overall Lobbying expenditures increased from _______1998 to _______ in 2019.

A lot of money and effort has gone into building an ideology tying the problems of flat wages to government and its interference in business and politicians have been happy to oblige because those are the people who fund their campaigns.

As you watch this video please answer the questions below. https://www.youtube.com/watch?v=CKCvf8E7V1g

Q4. What is the one idea that the speaker (Nick Hanauer) says is dead wrong that he is going to talk about?

Q5. Since 1980 what has happened to the effective tax rate of the top 1%?

Q6. Why can’t rich people power the economy?

Q7. How much more money a year would a typical family earn if they had the same share of the nation’s income as they did in 1970?

Q8. Why does Hanauer say that taxing the rich is good and what should it be spent on?

Q9. Who are the real job creators according to Hanauer?

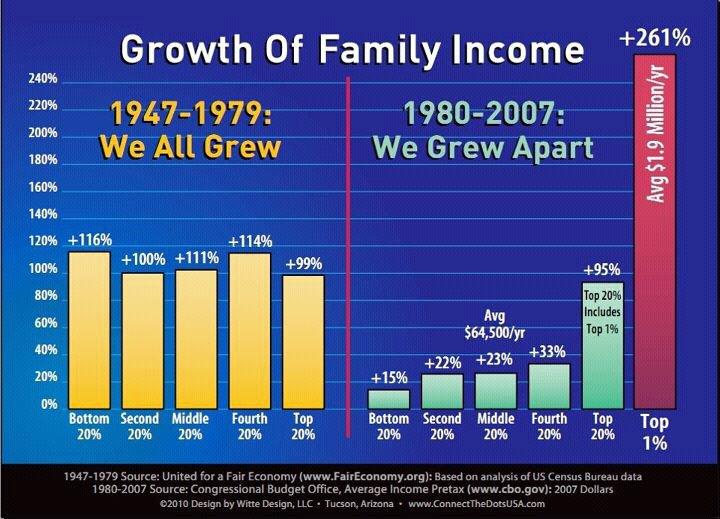

This chart shows what has happened in the United States over the last 80 years. In the period after World War II from 1947 to 1979, all income groups saw their income increase at roughly the same rate, so every income group saw their share of the nation’s income remain roughly the same. The poorest Americans saw their incomes double while the richest Americans saw their incomes double as well. Since 1980, the table tells a different story. In the 40 years since 1980, the poorest Americans have barely seen their incomes rise while all of the rise in incomes has accrued to the Wealthiest Americans. All the benefits of economic growth have gone to only the wealthiest and this has given rise to massive levels of inequality. The levels of inequality are unlike those that have existed in this country since the Gilded Age.

During the Gilded age from 1870s to the early 1900s, “as the nation’s aggregate wealth grew, so too did the number of people mired in poverty. In New York City, America’s largest and wealthiest city, two-thirds of its residents lived in cramped tenement apartments, many unfit for human habitation, while tens of thousands scrounged by in the streets. In 1890, muckraking social crusader Jacob A. Riis shone a light on the era’s grinding poverty with his shocking exposé, How the Other Half Lives: Studies among the Tenements of New York. It’s brimming with photos of people crammed cheek-to-jowl in dark, cluttered, airless quarters.

The unsettling implication of all this poverty? That America was losing its republican character and becoming more like a European nation with a population of haves and have-nots locked into fixed classes. Poet Walt Whitman captured the wider economic anxiety in a speech he delivered in 1879. For more than 20 years Whitman had written poems brimming with optimistic paeans to America and its people (“I hear America singing”), but now the great bard was worried. “If the United States, like the countries of the Old World, are also to grow vast crops of poor, desperate, dissatisfied, nomadic, miserably-waged populations…then our republican experiment, notwithstanding all its surface-successes, is at heart an unhealthy failure.” Note Whitman‘s reference to “surface successes.” He was urging his audience to look beneath the gilding to see the threat facing the nation.

Another anxiety-inducing threat: growing wealth inequality. Never before had so few people accumulated such vast wealth in so short a time span. Industrialists like John D. Rockefeller and Andrew Carnegie and financiers like J. P. Morgan and Jay Gould amassed stupendous fortunes. By 1890, the top 1 percent of the U.S. population owned 51 percent of all wealth. The top 12 percent owned an astounding 86 percent. The lower 44 percent of U.S. population—almost half the country—owned just 1.2 percent…

…Perhaps more disturbing than all the conspicuous consumption—a term coined in the late Gilded Age by sociologist Thorstein Veblen—was the public’s growing awareness that with great wealth came the power to bend democracy to their will. Industrialists used their influence to lobby lawmakers to adopt policies favorable to big business and hostile to organized labor.” https://www.history.com/news/second-gilded-age-income-inequality

While watching this clip please answer the questions below. https://www.youtube.com/watch?v=QPKKQnijnsM

Q10. How close are Americans estimations of wealth inequality in the US to the reality?

Q11. How close are American’s Ideal wealth distribution to the actual? (Top one versus top 20)

Q12. The narrator says, “Socialism doesn’t work”. Why? Do you agree?

Q13. How many stacks does the top one percent have?

Q14 The top 1% has _________ % of all the wealth while the bottom 80% has? _________%.

Q15. The top 1% receives ______% of all income today while in 1976 they received______%.

Q16. The Top 1% owns _____% of stocks, bonds, and mutual funds while the bottom 50% own _____%.

Q17. The average worker has to work _____________________to earn what their CEO earns in 1 hour?

The ideology that sees job creators as the center of the economic world is called neoliberalism. “Neoliberalism sees competition as the defining characteristic of human relations. It redefines citizens as consumers, whose democratic choices are best exercised by buying and selling, a process that rewards merit and punishes inefficiency. It maintains that “the market” delivers benefits that could never be achieved by planning.

Attempts to limit competition are treated as inimical to liberty. Tax and regulation should be minimised, public services should be privatised. The organisation of labour and collective bargaining by trade unions are portrayed as market distortions that impede the formation of a natural hierarchy of winners and losers. Inequality is recast as virtuous: a reward for utility and a generator of wealth, which trickles down to enrich everyone. Efforts to create a more equal society are both counterproductive and morally corrosive. The market ensures that everyone gets what they deserve.

We internalise and reproduce its creeds. The rich persuade themselves that they acquired their wealth through merit, ignoring the advantages – such as education, inheritance and class – that may have helped to secure it. The poor begin to blame themselves for their failures, even when they can do little to change their circumstances.” The consequence of this Ideology is the inequality we see in America today. https://www.theguardian.com/books/2016/apr/15/neoliberalism-ideology-problem-george-monbiot

Our Framers saw inequality as a problem.

As Thomas Jefferson said, "I am conscious that an equal division of property is impracticable. But the consequences of this enormous inequality producing so much misery to the bulk of mankind… The earth is given as a common stock for man to labor and live on."

Or James Madison, "In every political society, parties are unavoidable. A difference of interests, real or supposed, is the most natural and fruitful source of them. The great object should be to combat the evil: 1. By establishing a political equality among all. 2. By withholding unnecessary opportunities from a few, to increase the inequality of property, by an immoderate, and especially an unmerited, accumulation of riches. 3. By the silent operation of laws, which, without violating the rights of property, reduce extreme wealth towards a state of mediocrity, and raise extreme indigence towards a state of comfort."

Even Adam Smith, “The Father of Capitalism” agreed. "All for ourselves and nothing for other people seems, in every age of the world, to have been the vile maxim of the masters of mankind."

That inequality is corrosive to a society is not new. It was known as far back as Plato: "The form of law which I propose would be as follows: In a state which is desirous of being saved from the greatest of all plagues -- not faction, but rather distraction -- there should exist among the citizens neither extreme poverty nor, again, excessive wealth, for both are productive of great evil . . . Now the legislator should determine what is to be the limit of poverty or of wealth."

"The growing divide between wealth and poverty, between opportunity and misery, is both a challenge to our compassion and a source of instability. We must confront it.” George W. Bush our 43rd president understood the problems of Inequality as well.

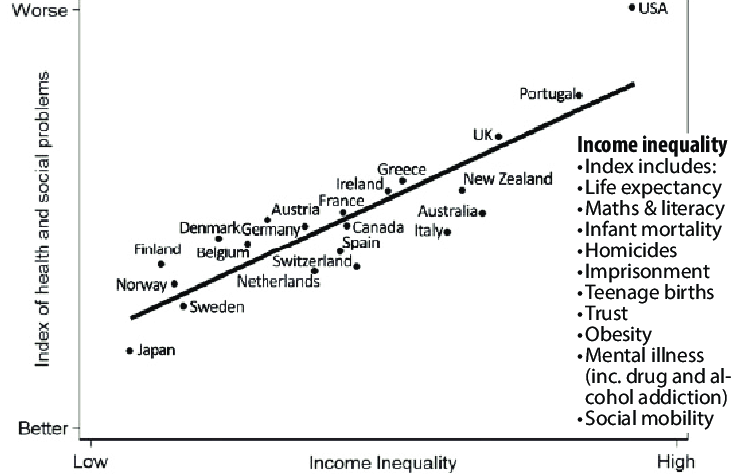

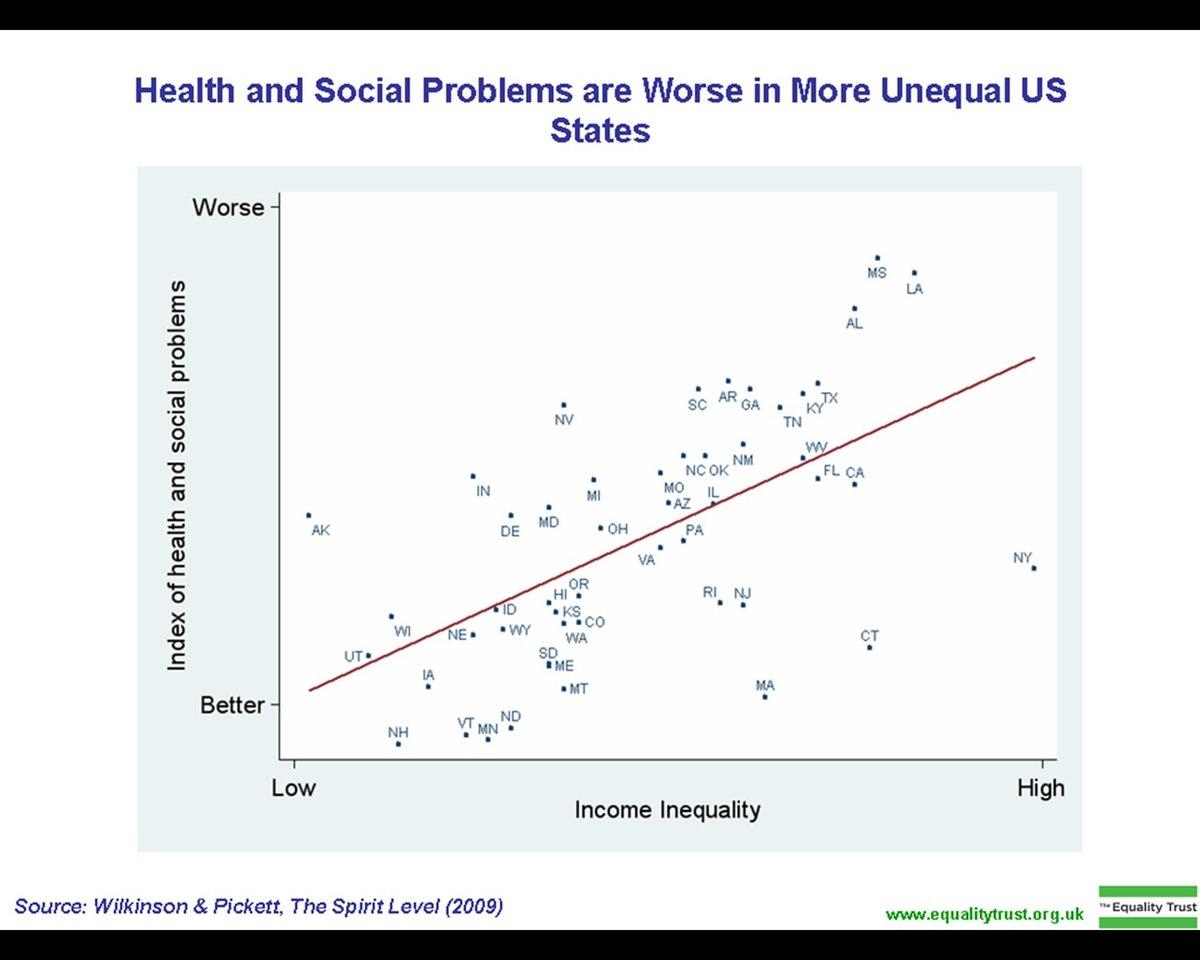

Today, we have data to demonstrate the problems of inequality. Please watch this video http://www.ted.com/talks/lang/en/richard_wilkinson.html and answer the questions below.

Q18. What is the paradox of life expectancy between and within countries?

Q19. How does the speaker explain the paradox?

Q20. How is inequality related to child wellbeing?

Q21. What does the speaker say about the importance of “national income and economic growth” in industrialized democracies”?

Q22. How is inequality related to trusting other people?

Q23. Where does the speaker say you should go if you want to live the “American Dream”?

Q24. What does the data the speaker uses say about the quality of life in a country and income inequality?

Q25. What are the two ways that the Speaker says countries and states get to lower inequality?

Q26. In comparing English and Swedish infant mortality, what point is the speaker trying to make?

So, income inequality has negative consequences for societies. Not just for the poor but for the wealthy as well. Countries with less inequality are generally safer, healthier, more trusting places to live with more opportunity to move up. Since WWII, social pathologies in the United States have been increasing and politicians have attributed it to all manner of causes including moral decay and the decline of the family. Yet if the analysis presented above is correct, those things are consequences of a more stressed out society where hard work doesn’t give you a chance to make your life better. As Wilkinson said, there is no one way to get there. Sweden has a high tax, high redistribution society while Japan, has a culture that frowns on excessive wealth, where companies are seen as families and thus they start with lower inequality.

Q27. According to the chart, what happened to inequality in the three countries between 1972 and 2004?

Watch this video https://www.youtube.com/watch?v=th3KE_H27bs and answer the questions below.

Q28. Why does Nick Hanauer say the rich are doing so well?

Q29. What Hanauer says we could adopt policies that do 3 things but we don’t. What are those 3 things?

a.

b.

c.

Q30. Nick Hanauer says neoliberal economics has gotten it wrong. How?

Q31. What are the three assumptions of neoliberal economics and how are they wrong?

a.

example:

b.

example:

What does Hanauer say is the reason CEO salaries have risen at the expense of workers?

c.

example:

Q32. What does Hanauer say that science tells us about Human Nature?

Q33. Is that the view of Hamilton or Jefferson?

Q34. What does Hanauer say is the “New Economics” explanation for prosperity?

Q35. How is competition reconceived in the “New Economics”

Q36. What are the 5 rules that Hanauer identifies to create a more prosperous, equitable, and sustainable society?

a.

b.

c.

d.

e.

Q37. How does Hanauer say we can get a new economics?

So, in his answer to the first question, Nick Hanauer says 2 things. First, he says giving all his money away doesn’t really matter much. This is the collective action problem that we talked about when we talked about free riders. Even if he paid more taxes, he is only a small part of the problem and the rest of the “rich” could continue to be rapacious. Hanauer says that instead, he wants to use his wealth to build alternative narratives and pass laws that require all rich people to pay more taxes and higher wages. America once had a progressive Tax system. It does not anymore.

Q38. Using your book, please explain what a progressive tax system is?

Q39. Explain what a regressive tax system is.

Using this link https://www.nytimes.com/interactive/2019/10/06/opinion/income-tax-rate-wealthy.html answer the following questions. The percentages are the percent of a person’s income paid in total taxes (federal, state, and local). These include not only income taxes, but also sales taxes, property taxes, excise taxes, and others.

Q40. In 1950, the poorest 10th of Americans paid about ____% in total taxes while the top 400 taxpayers paid ____%.

Q41. In 1980, the poorest 10th of Americans paid about ____% in total taxes while the top 400 taxpayers paid ____%.

Q42. In 2018 the poorest 10th of Americans paid about ____% in total taxes while the top 400 taxpayers paid ____%.

How can this be? Well, it turns out that most taxes in the United States are regressive or flat. Let’s take social security taxes as an example. Every American pays Social Security and Medicare taxes on their earnings. Wages are taxed at 6.2% for Social Security and 1.45% for Medicare. A person earning the median wage in Texas (17.84 an hour) would earn $37,107.20 a year and would pay $2300.65 in Social Security taxes and $538.05 in Medicare taxes for a total of $2838.70. These are called “payroll taxes” so they are taken out before you ever get your check. But what would someone who is the CEO of the company that median wage worker works for pay in payroll taxes? If the CEO makes 300 times what that median worker makes, then the annual salary for the CEO would be 11,132,160. You would then think that the CEQ would pay 6.2% of that 11 million, which is 690,193,92 in Social Security taxes and 1.45% of the income in Medicare which is $161,416.32 making their total payroll taxes 851,610.24. But in fact, you would be wrong. That CEO would have $8,239.80 deducted for social security and Medicare. How can this be? Well, social security taxes are capped at the first $132,900 of income. This means that 92% of Americans pay payroll taxes on all their income and the 8% wealthiest Americans only pay payroll taxes on part of their income. So, the median worker in our example pays 7.65% of their income in payroll taxes but the CEO pays 0.074% of his/her income in payroll taxes making the payroll tax regressive. In fact, it could be even worse. If a husband and wife both work, and the wife earns 90,000 a year as a mid- level manager and the husband earns 90,000 a year running a small business, then they would each pay $6885 in payroll taxes for a total of $13,770. As a family earning $180,000 a year, they would pay $5,531 dollars more than the CEO who has a stay at home wife or husband in payroll taxes even though they earn $10,952,000 less.

Sales tax is another regressive tax because poor and middleclass families tend to spend everything, they earn to pay for the expenses of living and therefor they pay sales tax on most of their income. In fact, 40% of American adults do not have the ability to cover a $400 emergency with savings, cash, or a credit card they could quickly pay off. Almost half of Americans spend every dime they earn on daily living expenses. Therefore, state and local taxes, which rely on sales tax, tend to be heavily regressive. The table to the left shows the average state taxes paid by the poorest 20% of each state’s residents and the top 1%.

Q43. In which state do poor people pay the highest percentage of their income in taxes?

Q44. In Texas, the poorest 20% pay _____% of their income in taxes and the wealthiest 1% pay ______%.

So, when all taxes are taken into account, our system actually taxes the wealthiest people at a lower rate than everyone else. This is a direct result of changing income tax rates while raising other types of taxes at all levels of government. When politicians talk about cutting taxes, they almost always talk about cutting income taxes.

In many ways, this is fundamentally unfair and as a country we have chosen to tax this way. There is a lot of misinformation peddled about the tax system and any talk about raising taxes is immediately met with “research” and misinformation.

Last year, Representative Alexandria Ocasio-Cortez said it would be a good idea to raise the top tax rate to 70%. It was immediately met with tweets and articles like this.

Scott Walker

@ScottWalker

Explaining tax rates before Reagan to 5th graders: “Imagine if you did chores for your grandma and she gave you $10. When you got home, your parents took $7 from you.” The students said: “That’s not fair!” Even 5th graders get it.

9:39 AM · Jan 15, 2019·Twitter for iPhone

Now, responses to AOC like these from Scott Walker, Governor of Wisconsin and 2016 Republican presidential candidate and Steve Scalise, the 2nd ranking Republican in the House of Representatives are interesting. Cortez called for the top marginal tax rate to go to 70% on incomes above 10,000,000 a year. It seems to me either Scalise and Walker are dumb, or they are intentionally misleading citizens. Surely, they understand how the income tax system works.

https://www.vox.com/policy-and-politics/2019/1/7/18171975/tax-bracket-marginal-cartoon-ocasio-cortez-70-percent

Q45. What are deductions?

Q46. How do brackets work?

Q47. Applying the logic of tax brackets, if a 70% tax bracket was created for incomes above $10,000,000 and Our CEO earned an $11,000,000 salary, how much would be taxed at 70%?

Please read this article and answer the questions below. https://www.nytimes.com/2019/01/05/opinion/alexandria-ocasio-cortez-tax-policy-dance.html?action=click&module=RelatedLinks&pgtype=Article

Q48. In the article, who does the author say supports AOC’s 70% top marginal tax rate Idea?

Q49. What does the Author say happened to the United States economy when we had a high to marginal tax rate?

Q50. Why does the author say a 100% top marginal rate is a bad idea?

Q51. According to the article, who has done research to support the idea that lowering taxes on the wealthy has “huge beneficial effects” on the economy?

Q52. What does the chart in the article say about economic growth and tax rates?

Why does the economy grow better when tax rates are high? Because when tax rates are high, the elites don’t pay themselves as much. The chart below shows what happens to the top 1% of earners when the top marginal tax rates are high. The yellow line shows the top marginal income tax rate while the pink bars show the percentage of all income that went to the top 1%.

The 16th Amendment was passed in 1913 and allowed the federal government to levy taxes on incomes. Before 1913, federal government revenues came mainly from taxes on goods—tariffs on imported products and excise taxes on items like whiskey. The burden of these taxes fell heavily on working Americans, who spent a much higher percentage of their income on goods than rich people did (a regressive tax). In 1894, the Democrats succeeded in passing a 2-percent income tax on those earning $4,000 or more a year, less than 1 percent of the population at the time. Unlike the Civil War income tax, this one was not graduated. Everyone with an income over $4,000 paid the same 2-percent tax rate. This type of income tax is sometimes called a "flat tax."

Opponents of the new income tax claimed that it was a socialistic confiscation of wealth by the federal government. Barely a year after it was enacted, the Supreme Court declared the tax unconstitutional. In a 5-4 ruling, the high court decided that the income tax was forbidden by Article I, Section 9, of the Constitution. This prohibits direct taxes on individuals unless apportioned on the basis of the population of each state. The majority of justices ruled against the 1894 tax law even though the Supreme Court had earlier upheld the similar Civil War income tax. As the progressive reform movement began to gain strength in response the excesses of the Gilded Age at the turn of the century, interest in the income tax revived.

Rep. Cordell Hull introduced the first income tax law under the newly adopted Sixteenth Amendment. He proposed a graduated tax starting with a 1-percent rate for incomes between $4,000 and $20,000 increasing to a top rate of 3 percent for those earning $50,000 or more. Since the average worker earned only about $800 a year, few people actually had to pay any federal income tax. Less than 4 percent of American families made an annual income of $3,000 or more. Deductions and exemptions further shrank the pool of taxpayers. Nevertheless, the federal government collected $71 million that first year. Millionaire John D. Rockefeller alone paid an estimated $2 million. https://www.crf-usa.org/bill-of-rights-in-action/bria-11-3-b-the-income-tax-amendment-most-thought-it-was-a-great-idea-in-1913.html

Q53. According to the chart above, what happened to the income of the top 1% when top marginal tax rates were raised in 1917?

Q54. What happened to the income of the top 1% when the top marginal tax rate was lowered in the 1920’s.

Q55. What happened to the incomes of the top 1% when the top marginal tax rate was high in the 1930s-1950s.

Q56. What happened to the incomes of the top 1% when the top marginal tax rates were lowered after 1960?

Now some may say. “of course, their incomes went down when government is taking their money through taxes.” That, however, would be an inaccurate interpretation because the chart examines pre-tax income not after-tax income. It might also be tempting to say they weren’t making as much money because the economy wasn’t doing well because the “job creators” were being taxed too much. But we know from the article you just read and from Richard Wolff that it is incorrect. The chart below shows real GDP growth from the end of the great Depression to 2019. It is hard to say that the post 1960 period had slower growth than pre1960. If anything, the opposite is true.

So how can we account for the change? Why do increasing taxes on the wealthy cause them to earn less? It is because they choose to. In effect High marginal tax rates causes the wealthy to pay themselves less money. Will a CEO take a pay raise from 10,000,000 to 11,000,000 if he knows he won’t see very much of the increase? Probably not. He/she may decide they would like to do something else with the money the companies is making besides give it to the government. Maybe, they might build the new factory in the US and or pay their workers a decent wage. Why would they do that? There is less incentive to pay low wages and export jobs to China if making more money just gives it to the government. In fact, this is exactly what happened in the 1940’s and 1950’s. There are benefits to the company as well from paying workers more. In the “Wealth of Nations”, Adam Smith said “The liberal reward of labour, as it encourages the propagation, so it increases the industry of the common people. The wages of labour … like every other human quality, improves in proportion to the encouragement it receives….Where wages are high, accordingly, we shall always find the workmen more active, diligent, and expeditious, than where they are low.” The reality is that if we want a prosperous, sustainable, and equitable society for all Americans, a society closer to what we tell ourselves America is, then we need the deal with the issue of income inequality. Raising taxes on the wealthiest Americans is a good way to do that and it will not materially impact that person’s life. As Adam Smith the father of capitalism said, "The necessaries of life occasion the great expense of the poor. They find it difficult to get food, and the greater part of their little revenue is spent in getting it. The luxuries and vanities of life occasion the principal expense of the rich . . . . It is not very unreasonable that the rich should contribute to the public expense, not only in proportion to their revenue, but something more than in that proportion" and "It must always be remembered, however, that it is the luxuries, and not the necessary expense of the inferior ranks of people, that ought ever to be taxed.“

The wealthy are wealthy because they work hard, but they are also wealthy because they were fortunate enough to live in America. As Warren Buffet said, "I personally think that society is responsible for a very significant percentage of what I've earned. If you stick me down in the middle of Bangladesh or Peru or someplace, you'll find out how much this talent is going to produce in the wrong kinds of soil."

As James Madison wrote “In every political society, parties are unavoidable. A difference of interests, real or supposed, is the most natural and fruitful source of them. The great object should be to combat the evil: 1. By establishing a political equality among all. 2. By withholding unnecessary opportunities from a few, to increase the inequality of property, by an immoderate, and especially an unmerited, accumulation of riches. 3. By the silent operation of laws, which, without violating the rights of property, reduce extreme wealth towards a state of mediocrity, and raise extreme indigence towards a state of comfort. 4. By abstaining from measures which operate differently on different interests, and particularly such as favor one interest at the expence of another. 5. By making one party a check on the other, so far as the existence of parties cannot be prevented, nor their views accommodated. If this is not the language of reason, it is that of republicanism.” http://press-pubs.uchicago.edu/founders/documents/v1ch15s50.html