You must complete the Projected Income Statement Template which is located on the Excel Spreadsheet you used to complete the Sources and Uses of Funds Statement. Complete the green areas that apply to

CONFIDENTIAL

[Dave and Jacky Delicious Incorporation]

Business Plan

Prepared May 19th, 2020

Table of Contents

Executive Summary 1

Opportunity 1

Expectations 1

Opportunity 3

Problem & Solution 3

Target Market 3

Competition 3

Execution 4

Marketing & Sales 4

Operations 4

Milestones And Metrics 5

Company 6

Overview 6

Team 6

Financial Plan 7

Forecast 7

Financing 9

Statements 10

Appendix 13![]()

Profit and Loss Statement 13

Balance Sheet 15

Cash Flow Statement 17

Executive Summary Opportunity Problem SummarySolution Summary

Competition

Why Us?

Target Market

McDaniel, Lamb, and Hair (2013)define a target market as a group of potential customers that an organization wants to sell its goods and services. The group consists of specific customers to who a firm directs its marketing strategies and efforts. Consumers who are in the same target market share the same features such as buying power, incomes, geography, and demography. Successful selling is partially associated with knowing to whom an organization will appeal and ultimately buy its goods or services. This is the reason businesses spend a significant amount of money and time to determine and monitor their target markets.

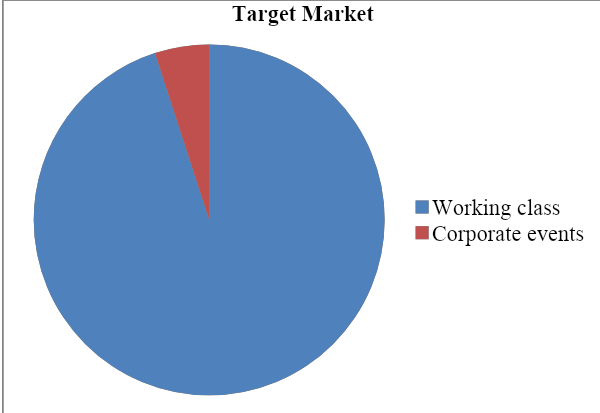

Dave and Jacky Delicious Incorporation will focus on corporate and working class individuals who appreciate high quality hamburger. The working class individuals will range from administrative personnel who will constitute a big percentage of the market, to education personnel who appreciate good quality burgers made from grass fed beef. The corporate segment will consist of individuals who want to replenish lost energy during a hard day’s work. The company’s most significant group of potential clients is those in urban areas who normally prefer healthy tasty burgers made of natural beef. These are potential clients who want convenience and availability.

The target customers do not want to waste their time sitting in restaurants waiting for burgers, but appreciate quality products at reasonable price.Dave and Jacky Delicious Incorporation will also appeal to local corporations looking for catering services. This target market exists in Cambridge city, Massachusetts. Data from the United States Census Bureau indicates that 69.6 percent of individuals aged 16 years and above are in civilian labor force (U.S. Census Bureau, 2020).The biggest industries in Cambridge City, Massachusetts are educational services, professional, scientific, and technical services, healthcare and social assistance, mining, quarrying, and oil and gas extractions. Others include utilities, and finance and insurance (Data USA, 2020).

Figure 1: Proportion of Dave and Jacky Delicious Target Market

The company’s target marketing strategy will be focused on ensuring that the right products are made available to the right target customers. To do so, the entity will ensure that its product prices take into account customer’s budgets, and that they appreciate the product and aware that it exists. The marketing will focus on quality in every aspect, every promotion, and publication. Dave and Jacky Delicious calls for development of good relationships with suppliers, retailers, as well as distributors to support its business. Most importantly, the company will make regular visits to these areas in order to ensure that it is meeting their expectations.

Industry Analysis A higher number of Americans consider eating out as fun. The restaurant’s industry portion of food dollars has more than doubled from 25 percent in 1955 to at least 51 percent in 2019 (Khandelwal, 2019). The National Restaurant Association (2019) projected sales to hit more than $860 billion in 2019, representing 4 percent of the United States gross domestic product. The association also expected the industry to employ more than 15 million individuals in 2019, which accounted for nearly 10 percent of the country’s working population. The National Restaurant Association (2019) associates several factors with the growth of the United States restaurant industry, including better hospitality, variety of cuisines, as well as rising income. Restaurants have become an integral component of people’s lifestyles. Khandelwal (2019) posits that data from the United States Bureau of Labor Statistics found that households with yearly income of more than $70,000 contributed to more than 60 percent of revenue spending in the year 2018. Nearly 40 percent of households in the country had annual income of at least $70,000, which implies that 40 percent of households were responsible for more than 60 percent of restaurant spending. The number of higher income households has increased over the years, which has partially contributed to the significant growth of the restaurant industry’s revenues. While people have been eating in restaurants for many years, the industry continues to experience significant changes. Home deliveries and take-out services have grown significantly in the recent years. Majority of restaurants have recorded massive growth in delivery sales since 2017. Thus, many operators are providing delivery options in order to capture the growth trend. For instance, McDonald has decided to expand the number of outlets offering food delivery. Technology has also changed the way customers order and pay for goods and services. The use of self order kiosks and mobile applications provide customers ease of ordering. Thus, restaurant operators are increasingly embracing technological innovations to drive sales growth (Khandelwal, 2019). The shift in customer preferences for healthy foods has also impacted the restaurant industry. The National Restaurant Association survey of 2019 found that 61 percent of consumers order more healthy foods than before. In addition, a rising interest in vegetarian food has led to an increase in plant related packaged food providers. For instance, Beyond Meat uses food outlets or restaurants as some of the channels for selling its products (NRA, 2019). Between 2015 and 2020, the quick service restaurants or fast food restaurants industry has witnessed shifting consumer preferences as well as a saturated food service environment that has low prices. Nonetheless, compared with other accommodation sector’s operators, quick service restaurants have performed better from 2015 to 2020 due to low prices as well as convenience they offer. The popularity of quick service restaurants has also boded very well for the fast food restaurants industry, enabling the industry to have high revenue growth despite decreasing profitability. However, intense competition has forced operators in the industry to emphasize low prices in order to attract consumers. Industry growth will slow down over the next five years up to 2025 even as the United States economy continues to grow. Competition will remain high, which will contribute much of the fast food restaurant industry’s expected tepid growth. Even though no severe revenue decreases are expected, operators will operate in a slow growth business environment as many of the industry segments have hit saturation point. Therefore, successful restaurant operators will have to adapt to ever changing consumer preferences as the fast food concept continues to evolve to include a variety of options (IBISWorld, 2020). Competition Current Alternatives Dave and Jacky Delicious Incorporation has many competitors, each scrambling for a share of the market. The company is aware that it is up against large burger chains and independently owned fast food restaurants in the area. Among its competitors include McDonalds, KFC, Burger King, Subway, Pizza Hut. McDonald’s Incorporation is one of the world’s most favorite fast food chains. There is no doubt that it has revolutionized and transformed the fast food industry. The company deals with various products such as hamburgers, cheeseburgers, French fries, and milkshakes. The entity has served fish, fruits, and smoothies, as well as salads (Bhasin, 2018). KFC is one of Dave and Jacky Delicious Incorporation direct competitors as it specializes in fried chicken and hamburgers. In addition to fried chicken and hamburgers, the organization also offers French fries, chicken fillet burgers, salads, and soft drinks. Its fried chicken is considered as one of the best in the world and the company’s slogan “Finger Lickin’ Good” demonstrates how good it is in what it does. Burger King, a subsidiary of Restaurant Brands International, is one of the world’s largest fast food joints. Headquartered in Florida, the company’s menu of hot dogs, hamburgers, French fries, desserts, and soft drinks, as well as chicken are loved worldwide. With its massive revenue stream, the company is a force to reckon with in the industry (Bhasin, 2018). Subway Company is among the fastest growing brands in the fast food restaurant industry. As at 2017, the company had approximately 45,000 outlets in more than 110 countries. The organization primarily offers a submarine sandwich referred to as the sub. However, it also offers paninis, doughnuts, salad, muffins, and wraps, as well as cookies. It also sells gluten-free bread and brownies. Subways focus on offering health conscious products. Pizza Hut is known for its Italian-American cuisine. Its menu also includes desserts, Buffalo wings, pizza, plus pasta. The company generates the majority of the company sales through pizza sales with the organization considered as the world’s best pizza chain. Its pizza varieties consist of thin and crispy, stuffed crust, hand tossed, Sicilian, as well as pan pizza (Bhasin, 2018). Our Advantages Clearly, Dave and Jacky Delicious must have competitive strategies that differentiate it from its rivals in order to make sure that what it offers and does matches customer expectations. The company recognizes the need to become the best place for hamburgers in Cambridge City and its environs. The company is not in the rush to offer cheap hamburgers, but in growing recognition that caring services and high quality ingredients are essential for competitive advantage. In this regard, the company will produce its products from antibiotic, hormone free natural Angus beef produced locally. The company will emphasize on sustainability made locally produced grass fed beef. The company will also strive toward delivering desirable experiences for consumers through its product packaging, cooking process, and staff uniform that reflects a modern way of food service. Overall, Dave and Jacky Delicious recognizes the need to add value through innovation, make the process of visiting the restaurant less routine, enhance in-house experience, and lead on social media platforms for competitive advantage. Marketing & Sales Marketing PlanExecution

It will take approximately 7 months to execute this business plan. During this period, Jacky and Dave will play significant roles including market research, preparation of business plan, application of legal documents and insurance, identification of suitable business location, and renovation of facilities for business success. Other activities include buying of equipment, materials, and inventory, application of loan, and promotional activities.

Strategy and Implementation Summary

Dave and Jacky Delicious’ strategy is anchored on providing a strong customer value proposition in the market. The company seeks to offer the Cambridge City area with new choices in hamburgers options. The company is building an effective marketing structure that will be used to eventually reach a wide target market in the same hamburger offering. It focuses on meeting the needs of middle class residents as well as local companies in the area. In addition, the company intends to use different types of marketing communications to reach its target market as well as raise their awareness of Dave and Jacky Delicious Company, and its hamburger service offerings. Moreover, the company will use bootstrap marketing strategy to promote its brand, products, and services. Email marketing, use of chatbots, use of social media, use of samples and coupons, and going to the grassroots can be helpful throughout the Cambridge City area. Adequate funding is already projected to cover for promotion expenses.

Strategy Pyramids

Dave and Jacky Delicious Company’s strategy is to show the market that it produces excellent hamburger and convenient accessibility. In order to execute this strategy, the company will be located in an easily accessible area with high human traffic. Moreover, the company will also deliver its products through various food catering service outlets in the region. The company is not offering cheap products but uses competitive pricing strategy and high quality products for competitive advantage. Through sidewalk advertising signs and coupons, the company will involve the community in understanding that the company will donate part of its proceeds through annual contest games.

Value Propositions

Dave and Jacky Delicious Company’s facility offers value proposition in the sense that customers do not have to look for packing space, queue to order for products, pay for premium price, or look for a place to sit. The company’s concept is that a customer places an order and drives away with high quality products at an affordable price, without wasting time in the process.

Competitive Edge

Dave and Jacky Delicious Company competitive edge include: location, reasonable pricing, and high quality products. The company is located in a commercial hub in Cambridge City, which is the busiest location in the town. The nearest hamburger restaurant is nearly a 25 minute drive. There are at least 500 corporations in the neighborhood. Regarding product quality, the company produces high quality products in a take-out environment that saves customers much time. In particular, the company will produce its hamburgers from locally produced natural Angus beef. Concerning competitive pricing, Dave and Jacky’s policy is to buy the latest state of the art equipment for production purposes that reduces cost of production.

Marketing Strategy

Dave and Jacky Delicious Company’s marketing strategy centers on developing an identity that defines the organization’s target market in terms that benefit its retail as well as corporate customers. Since the company’s target market comprises middle class residents in Cambridge City and local corporations located in the area, their vital needs are quality, price, service, and delivery. One of the main points of Dave and Jacky Delicious marketing strategy is to focus on a target market that does not only understand these needs, but is also willing to pay a reasonable price for their fulfillment.

Factors such as industry and market trends of similar businesses in the United States show that high demand for hamburger will continue in the foreseeable future. Specifically, quick service restaurants have reported better performances in the past 5 years between 2015 and 2020 because of low prices plus convenience they offer (IBIS World, 2020). The owner’s experiences in running similar businesses indicate that advertising expenses can overwhelm start up businesses. Thus, the company will adopt a bootstrap marketing strategy for simple, creative, as well as cost effective marketing. Cost effective utilization of marketing funds is a major source for the company’s success. Pistol, Epure, and Bucea-Manea-Ţoniş (2016) indicate that bootstrap marketing strategy is inexpensive and a business can use the strategy to target a wide market, engage customers, enhance customer experience, increase profitability, and enhance growth.

Promotion and Distribution Strategies

Dave and Jacky Delicious’ long term promotion goal is to have enough visibility in the market in order to generate interest from potential investors and leverage its product line outside Cambridge City. It will use various marketing tools such as email marketing, use of chatbots, use of social media, use of samples and coupons, and going to the grassroots to reach its potential customers. Regarding distribution strategy, Dave and Jacky Delicious is a quick service restaurant that will be located in a high traffic area in the city. The company will also distribute its products via fast food chains in the area.

Marketing Programs

To reach out its potential customers, the firm will use a combination of techniques such as social media marketing, direct mail marketing, distinctive building, and distinctive logo. The company will use various social media platforms such as Facebook, Twitter, and Instagram to promote its offerings, share significant information, and to interact with its customers. Patrutiu-Baltes (2016) indicates that e-mail marketing is less expensive means to promote products, boosting brands, as well as staying in touch with clients. Dave and Jacky Delicious will sign up for an email marketing service to collect email addresses, send targeted messages, and track customer responses. Regarding distinctive logos, the business will have a sideway sign with its logo that promotes its products and services. The company will also use a dinner style building for its take-out facility and distributors. The distinctive building will be easy to recognize.

Pricing Strategy

Dave and Jacky Delicious’ target customers are particularly sensitive to service delivery and value. Thus, the company will ensure that its customers perceive its prices and services as of good value. It will offer high quality products at reasonable prices and not the lowest price in the region. The company is aware of the fact that some businesses use pricing strategies for competitive advantage. Therefore, it will have a competitive pricing strategy but not rely on price to overshadow other key advantages of doing business with the organization such as quality, on time delivery, and convenience. The company also recognizes the impact of price flexibility for business success. In this regard, it will offer discounts to reduce prices during slow-sale periods in order to reduce idle capacity and increase capacity usage.

Sales PlanSales Strategy

Since Dave and Jacky Delicious is a start up, it is vital to prove its worth to local customers for it to earn respect as well as business. Most importantly, owners must enhance the business brand image apart from its products and services. The business must also enhance its delivery and service abilities. Dave and Jacky Delicious’ sales strategy is anchored on the belief that the company will experience regular flow of customers because of its convenient location. The initiative is to convert first timers into long term customers through formidable customer relationships. The long term customers will recommend the business products to others. It will cost the company less money in order to attract and convert first time customers into loyal ones. Thus, the company’s sales activities will focus on ensuring that existing customers are happy. Customer centric service will be a key requirement for the company’s employees. All employees will be empowered to ensure that they can effectively address customer requests and problems.

Sales Forecasts

Table 1 shows the company’s sales forecast for the first three years. Being a new entity, sales for the first six months will be slow. However, a steady growth will happen as the months go by. Profitability is expected to happen during the second half of the first year of operation. The company expects to sell 110,000 units during the year 2020-2021 and earn more than $1.33 million dollars in sales. The sales units are expected to increase by 30 percent each year while unit price per unit for each product is expected to increase by 10 percent per annum. This will increase total revenue to approximately $1.39 million and $1.44 million, respectively. Direct cost is expected to account for 42 percent of total sales.

Table 1: Sales Forecast

| Sales Forecast |

| 2020-2021 | 2021-2022 | 2022-2023 | ||||

| Unit sales |

|

|

|

| ||||

| To Yuma Deluxe | 20000 | 20600 | 21218 | |||||

| Saddles deluxe | 20000 | 20600 | 21218 | |||||

| Sauces | 10000 | 10300 | 10609 | |||||

| Coffee | 10000 | 10300 | 10609 | |||||

| Tea | 15000 | 15450 | 15914 | |||||

| Desserts | 15000 | 15450 | 15914 | |||||

| Juices | 20000 | 20600 | 21218 | |||||

| Total Unit Sales |

| 110000 | 113300 | 116699 | ||||

| Unit Prices |

|

|

|

| ||||

| To Yuma Deluxe | $20 | $20.2 | $20.40 | |||||

| Saddles deluxe | $20 | $20.2 | $20.40 | |||||

| Sauces | $6 | $6.1 | $6.12 | |||||

| Coffee | $7 | $7.1 | $7.14 | |||||

| Tea | $7.50 | $7.6 | $7.65 | |||||

| Desserts | $8 | $8.1 | $8.16 | |||||

| Juices | $8.50 | $8.6 | $8.67 | |||||

| Sales |

|

|

|

|

| |||

| To Yuma Deluxe | $400,000 | $416,120 | $432,890 | |||||

| Saddles deluxe | $400,000 | $416,120 | $432,890 | |||||

| Sauces | $60,000 | $62,418 | $64,933 | |||||

| Coffee | $70,000 | $72,821 | $75,756 | |||||

| Tea | $112,500 | $117,034 | $121,750 | |||||

| Desserts | $120,000 | $124,836 | $129,867 | |||||

| Juices | $170,000 | $176,851 | $183,978 | |||||

| Total Sales |

| $1,332,500 | $1,386,200 | $1,442,064 | ||||

| Direct Unit Cost |

| 2020-2021 | 2021-2022 | 2022-2023 | ||||

| To Yuma Deluxe | $ 8.50 | $8.54 | $8.59 | |||||

| Saddles deluxe | $8.50 | $8.54 | $8.59 | |||||

| Sauces | $2 | $2.01 | $2.02 | |||||

| Coffee | $2.50 | $2.51 | $2.53 | |||||

| Tea | $3.00 | $3.02 | $3.03 | |||||

| Desserts | $3.50 | $3.52 | $3.54 | |||||

| Juices | $4.00 | $4.02 | $4.04 | |||||

| Direct Cost of Sales |

|

|

| |||||

| To Yuma Deluxe | $170,000.00 | $175,975.50 | $182,161.04 | |||||

| Saddles deluxe | $170,000.00 | $175,975.50 | $182,161.04 | |||||

| Sauces | $20,000.00 | $20,703.00 | $21,430.71 | |||||

| Coffee | $25,000.00 | $25,878.75 | $26,788.39 | |||||

| Tea | $45,000.00 | $46,581.75 | $48,219.10 | |||||

| Desserts | $52,500.00 | $54,345.38 | $56,255.61 | |||||

| Juices | $80,000.00 | $82,812.00 | $85,722.84 | |||||

| Total Direct Cost of Sales | $562,500.00 | $582,271.88 | $602,738.73 | |||||

Equipment & Tools After taking six months looking for a convenient area, the owners decided to rent a commercial space in Cambridge, Massachusetts. The capital will be used to acquire kitchen equipment, inventory, legal fees, packaging and other materials, rent, advertisement, inventory on hand, and legal expenses as indicated in table 1. Kitchen inventory will consist of necessary tools and accessories required for hamburger production and service facility. They include:

- Utensils such as cooking utensils, cutting guide, and rocker knives as well as wheel cutters

- Food preparation attire and equipment such as aprons, gloves, blender, trays, mixers, and storage containers, condiment bottles, tableware, glassware, pans, and cleaning equipment and supplies.

- Burger tools such as hamburger press burger maker, meat tenderizer pounder, meat grinder, burger cookbook, salt and pepper mill duo, pocket thermometer, burger seasoning, BBQ spatula, and griddle pan.

Milestones

Table 2 indicates vital start-up program milestones, with starting dates and ending dates, personnel in charge, as well as budget for each milestone. The schedule indicates Dave and Jacky Delicious emphasis on effective planning for implementation.

Table 2: Milestone

| Milestones | Start date | End date | Budget | Personnel | |

| Market research | 2/1/2020 | 4/30/2020 | $500 | Jacky | |

| Business Plan | 5/1/2020 | 6/15/2020 | $250 | Dave | |

| Legal documents | 6/15/2020 | 8/30/2020 | $1,500 | Jacky | |

| Insurance | 6/15/2020 | 8/1/2020 | $2,000 | Jacky | |

| Finding location | 6/15/2020 | 7/30/2020 | $5,000 | Dave | |

| Facility renovation | 8/5/2020 | 8/31/2020 | $2,000 | Dave | |

| Buy equipment | 8/5/2020 | 8/15/2020 | $29,000 | Jacky | |

| Buy inventory and material | 8/16/2020 | 8/31/2020 | $10,500 | Jacky | |

| Loan | 5/15/2020 | 6/15/2020 | $35,000 | Dave | |

| Promotion activities | 9/1/2020 | 9/30/2020 | $2,000 | Dave | |

| Other activities | 7/1/2020 | 7/30/2020 | $5,000 | Dave |

|

- Jacky Simpson

- Dave Simpson

Investor

It is pertinent to ensure that before incorporation the company must raise adequate capital. Thus, an investor is essentially an important aspect for the company. The investor has a significant role to play as he or she will generate capital for the company. Specifically, the investor will provide $20,000 needed to build and grow the business. These funds will cover various expenses including marketing, overhead costs, product development, as well as other resources needed to increase revenue.

Legal Advisor

The legal advisor will help the owners establish a clear relationship with one another. It is important to make clear deals with co-owners, contractually, in order to avoid future conflicts. A legal advisor can help establish roles and responsibilities of owners and investors, remuneration, percentage of ownership in a company, and cash contributed by owners. A legal advisor will also play a major role in establishing the business structure or model. Getting legal advice can help owners understand the benefits and shortcomings of a private limited liability company and align their goals with the company. In Addition, the legal advisor will offer advice about intellectual property protection, developing a standard contract document, and tax issues.

Accountant

For organizations, finances are complex and confusing. In this regard, Dave and Jacky Delicious Incorporation will seek the services of an accountant to manage the company’s financial records, transactions, and accounts. Taxes present significant pain for start-ups, especially due to ever changing taxation laws. There are many variables from business registration to the type of deductions that an organization makes. As the company’s financial strategy becomes more complicated, it will be important to employ an accountant to align the organization’s taxation process. An accountant will also prepare payroll, ensure accuracy of financial documents, prepare and maintain financial reports, provide guidance on cost reduction, offer guidance on revenue growth and profit maximization. The accountant will also conduct forecasts and risk analysis assessments.

Start-Up SummaryIt is estimated that the company will require $135,000 in start-up cost, out of which owners and investors will contribute $100,000. Jacky and I will provide more than 50 percent of total start up cost. In particular, we will contribute $80,000, each contributing $40,000. An investor is welcome to take part in the organization’s capital by contributing $20,000 and would be offered 20 percent ownership of the company capital. The investor’s fund will be used to purchase equipment and cater for part of start up costs. For the remaining $35,000 additional funding required to cover the start-up cost, Dave and Jacky plan to apply for a five year loan to meet cash flow requirements. The company will use the borrowed money to purchase equipment based on a list that the company will supply to the lending organization. The loan will be repaid in equal monthly installments for a five year period. For conservative reasons, the company estimates its annual interest to be 12 percent. Nonetheless, it will negotiate actual interest rate and borrowing terms with the lending institution.

Start-Up Funding

Start-Up Cost

| Expenditure | Amount |

| Kitchen inventory | $7,000 |

| Packaging material | $2,000 |

| Kitchen equipment | $25,000 |

| Insurance | $2,000 |

| Legal fees | $1,500 |

| Rent | $5,000 |

| Promotion | $2,000 |

| Other equipment | $4,000 |

| Business sign | $2,000 |

| Permits | $1,000 |

| Office supplies | $1,500 |

| Renovations | $2,0 00 |

| Total Expenses | $55,000 |

| Assets | |

| Cash | $15,000 |

| Start up inventory | $15,000 |

| Current assets | $10,000 |

| Long term assets | $40,000 |

| Total start-up cost | $135,000 |

Financial Plan Financial estimates indicate that Dave and Jacky Delicious will have a healthy financial position over the next three fiscal years. In the beginning, business will be financed by a capital investment of $80,000 from Dave and Jacky, $20,000 from an investor, and $35,000 by a 3 year term loan that will attract an interest of 5 percent per annum. The company will use cash flow generated from operations to refinance the bank loan. In the future the company will seek debt funding for expansion purposes and business growth.

Break Even Analysis

For the company’s break even analysis, it is assumed that the organization will incur a running cost of $29,900 per month consisting of fixed costs such as wages, supplies, repairs, advertising, travel, legal, rent, telephone, utilities, and insurance. The entity needs to sell about 4,672 units for $11 per month in order to break even in the first month. This is based on the assumption that the average variable cost per unit is $4.60.

| Break Even Analysis | ||

| Monthly break even units | 4,672 | |

| Monthly revenue break even | 51,391 | |

| Assumptions | ||

| Average per unit revenue | $ 11.00 | |

| Average per unit variable cost | $ 4.60 | |

| Estimated monthly fixed cost | $29,900.00 |

Given that this is a three year plan financial projections for more than three years are considered irrelevant at this time. Financial indicators, especially ratio analysis, show that the business will be profitable, will meet both its short term and long term financial obligations, and utilize its resources efficiently.

|

| | | | |

The organization’s financial performance is based on conservative assumptions because of current economic uncertainties. Through judgment and estimations, owners have chosen options that are less likely to overstate the company’s income and assets.

The key assumptions include:

It is assumed that the economy will recover slowly in the next three years and that there will be no economic depression

It is assumed that banks will issue loans at 5 percent per annum

It is assumed that the company will sell 15 percent of its products on credit

It is assumed that inventories will take between 15 and 20 days in store

Corporate tax rate will remain at 30 percent per annum

The company is expected to earn monthly revenue of $111,042 out of which cash sales will be $94,385 and credit sales will be $16,656.

Expenses by MonthThe company is expected to incur $86,199 in the first month of operation, with the monthly expense increasing to $95,699 in the second month of operation and hitting $96,949 in each month of the second half of the year.

Net Profit (or Loss) by YearThe company expects to earn net profit of $87,689 in the first year of operation, $112,488 in the second year of operation, and $138,388 in the third year of operation.

Financing Use of Funds| Uses of Funds: |

|

| Land |

|

| Building | 5,000 |

| Equipment + packaging + supplies + long term assets | 72,500 |

| Inventory | 22,000 |

| Improvements | 2,000 |

| Deposits | 15,000 |

| Working Capital | 18,500 |

| Additional Expansion Growth |

|

| Total Uses of Funds | 135,000 |

| Sources of Funds |

|

| Owner’s Equity | 80,000 |

| Personal Loan |

|

| Business Loan | 35,000 |

| Other Sources | 20,000 |

| Total Sources of Funds | 135,000 |

Dave and Jacky Delicious is expected to make profits in the first year of its operation, with profits rising over the next two years as it establishes and increases its customer base.

| Dave and Jacky Delicious: Income Statement | |||

| Revenue | Year 1 | Year 2 | Year 3 |

| Gross Sales | 1332500 | 1386200 | 1442064 |

| Less: Sales Returns and Allowances | 66625 | 69310 | 72103 |

| Net Sales | 1265875 | 1316890 | 1369961 |

|

|

|

|

|

| Cost of Goods Sold |

|

|

|

| Beginning Inventory | 0 |

|

|

| Add: Purchases | 0 |

|

|

| Inventory Available | 0 | 0 | 0 |

| Less: Ending Inventory | 0 |

|

|

| Cost of Goods Sold | 562500 | 582271.88 | 602738.73 |

|

|

|

|

|

| Gross Profit (Loss) | 703375 | 734618.1 | 767222.07 |

|

|

|

|

|

| Expenses |

|

|

|

| Advertising | 5200 | 5200 | 5200 |

| Amortization | 0 |

|

|

| Bad Debts | 33313 | 34655 | 36052 |

| Bank Charges | 0 | 0 | 0 |

| Charitable Contributions | 126588 | 131689 | 136996 |

| Commissions | 0 | 0 | 0 |

| Contract Labor | 0 | 0 | 0 |

| Depreciation | 0 | 0 | 0 |

| Dues and Subscriptions | 0 | 0 | 0 |

| Employee Benefit Programs | 0 | 0 | 0 |

| Insurance | 2000 | 2000 | 2000 |

| Interest | 586 | 586 | 586 |

| Legal and Professional Fees | 19500 | 19500 | 19500 |

| Licenses and Fees | 1000 | 1000 | 1000 |

| Miscellaneous | 36000 | 36000 | 36000 |

| Office Expense | 31500 | 31500 | 31500 |

| Payroll Taxes | 36000 | 36000 | 36000 |

| Postage |

|

|

|

| Rent | 60000 | 60000 | 60000 |

| Repairs and Maintenance | 62000 | 60000 | 60000 |

| Supplies |

|

|

|

| Telephone | 11000 | 12000 | 12000 |

| Travel | 11000 | 12000 | 12000 |

| Utilities | 60000 | 60000 | 60000 |

| Vehicle Expenses |

|

|

|

| Wages | 120000 | 120000 | 120000 |

| Total Expenses | 615686 | 622130 | 628834 |

|

|

|

|

|

| Net Operating Income | 87689 | 112488 | 138388 |

|

|

|

|

|

| Other Income |

|

|

|

| Gain (Loss) on Sale of Assets | 0 | 0 | 0 |

| Interest Income | 0 | 0 | 0 |

| Total Other Income | 0 | 0 | 0 |

|

|

|

|

|

| Net Income (Loss) | 87689 | 112488 | 138388 |

Projected Balance Sheet

Dave and Jacky Delicious Company expects to have a healthy financial position and a healthy net worth. The organization does not expect to have any problems meeting its financial obligation as long as it manages to achieve its objectives.

| Company Name: Dave and Jacky Delicious | |||

| Assets | Year 1 | Year 2 | Year 3 |

| Current Assets: |

|

|

|

| Cash | 54,973 | 63,500 | 85,500 |

| Investments | 39,000 | 39,000 | 39,000 |

| Inventories | 25,000 | 30,000 | 25,000 |

| Accounts receivable | 10,000 | 25,000 | 7,500 |

| Pre-paid expenses | 30,000 | 10,000 | 10,000 |

| Other | 7,027 | 6,000 | 0 |

| Total Current Assets | 166,000 | 173,500 | 167,000 |

|

|

|

|

|

| Fixed Assets: | Year 1 | Year 2 | Year 3 |

| Property and equipment | 69,000 | 84,000 | 90,000 |

| Leasehold improvements | 0 | 0 | 0 |

| Equity and other investments | 0 | 0 | 0 |

| Less accumulated depreciation | 0 | 0 | 0 |

| Total Fixed Assets | 69,000 | 84,000 | 90,000 |

|

|

|

|

|

| Other Assets: | Year 1 | Year 2 | Year 3 |

| Goodwill | 0 | 0 | 0 |

| Total Other Assets | 0 | 7,500 | 15,000 |

|

|

|

|

|

| Total Assets | 235,000 | 265,000 | 272,000 |

|

|

|

|

|

| Liabilities and Owner's Equity |

|

|

|

| Current liabilities: | Year 1 | Year 2 | Year 3 |

| Accounts payable | 10,000 | 15,000 | 5,000 |

| Accrued wages | 0 | 0 | 0 |

| Accrued compensation | 0 | 0 | 0 |

| Income taxes payable | 0 | 0 | 2,500 |

| Unearned revenue | 0 | 0 | 0 |

| Other | 0 | 0 | 0 |

| Total Current Liabilities | 10,000 | 15,000 | 7,500 |

|

|

|

|

|

| Long-term Liabilities: | Year 1 | Year 2 | Year 3 |

| Bank Loan | 35,000 | 50,000 | 45,500 |

| Total Long-term Liabilities | 35,000 | 50,000 | 45,500 |

|

|

|

|

|

| Owner's Equity: | Year 1 | Year 2 | Year 3 |

| Investment capital | 100,000 | 100,000 | 100,000 |

| Accumulated retained earnings | 90,000 | 100,000 | 135,000 |

| Total Owner's Equity | 190,000 | 200,000 | 235,000 |

|

|

|

|

|

| Total Liabilities and Owner's Equity | 235,000 | 265,000 | 288,000 |

Some profitable organizations end up filing for bankruptcy due to cash flow deficiencies. Hence, Dave and Jacky Delicious Company will strive to have enough cash on hand in order to meet its payment obligations as well as be prepared for unexpected emergencies. Cash flow projections indicate that the business can generate positive cash flows in the first 12 months of operations and adequate cash reserves. In addition to cash inflows and cash outflows, the organization will focus on having enough cash reserves for contingencies. Moreover, management will invest idle funds in government securities, and other suitable trading securities.

| Twelve-month Cash Flow Statement |

|

| Dave and Jacky Delicious |

|

|

|

| Fiscal Year Begins: | Sep-20 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

|

| Pre-Startup EST | Sep-20 | Oct-20 | Nov-20 | Dec-20 | Jan-21 | Feb-21 | Mar-21 | Apr-21 | May-21 | Jun-21 | Jul-21 | Aug-21 | Row Totals | |||||||||

| Beginning Cash on Hand | 100,000 | 52,600 | 76,470 | 90,841 | 104,461 | 98,082 | 91,702 | 85,323 | 78,443 | 71,564 | 64,684 | 57,805 | 70,926 | 70,926 | |||||||||

| CASH RECEIPTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

| Cash Sales | 94,385 | 94,385 | 94,385 | 94,385 | 94,385 | 94,385 | 94,385 | 94,385 | 94,385 | 94,385 | 94,385 | 94,385 | 1,132,625 | ||||||||||

| Collections fm CR accounts | 16,656 | 16,656 | 16,656 | 16,656 | 16,656 | 16,656 | 16,656 | 16,656 | 16,656 | 16,656 | 16,656 | 16,656 | 199,875 | ||||||||||

| Loan/ other cash inj. | 35,000 |

| 35,000 | ||||||||||||||||||||

| TOTAL CASH RECEIPTS | 35,000 | 111,042 | 111,042 | 111,042 | 111,042 | 111,042 | 111,042 | 111,042 | 111,042 | 111,042 | 111,042 | 111,042 | 111,042 | 1,367,500 | |||||||||

| Total Cash Available | 135,000 | 163,642 | 187,512 | 201,883 | 215,503 | 209,123 | 202,744 | 196,364 | 189,485 | 182,605 | 175,726 | 168,847 | 181,968 | 1,438,426 | |||||||||

| CASH PAID OUT |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

| Purchases (merchandise) | 2,500 | 10,000 | 15,000 | 15,750 | 15,750 | 15,750 | 15,750 | 15,750 | 15,750 | 15,750 | 15,750 | 15,750 | 15,750 | 185,000 | |||||||||

| Purchases (packaging) | 500 | 5,000 | 7,500 | 7,500 | 7,500 | 7,500 | 7,500 | 7,500 | 7,500 | 7,500 | 7,500 | 7,500 | 7,500 | 88,000 | |||||||||

| Purchases (equipment+other equipment) | 29,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 89,000 | |||||||||

| Gross wages (Withdrawals) | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | 120,000 | ||||||||||

| Payroll expenses (taxes, etc.) | 3,000 | 3,000 | 3,000 | 3,000 | 3,000 | 3,000 | 3,000 | 3,000 | 3,000 | 3,000 | 3,000 | 3,000 | 36,000 | ||||||||||

| Outside services | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,500 | 1,500 | 1,500 | 1,500 | 1,500 | 1,500 | 15,000 | ||||||||||

| Supplies (office & oper.) | 1,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 31,500 | |||||||||

| Repairs & maintenance | 2,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 62,000 | |||||||||

| Advertising | 400 | 400 | 400 | 400 | 400 | 400 | 400 | 400 | 400 | 400 | 400 | 400 | 400 | 5,200 | |||||||||

| Car, delivery & travel | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 11,000 | |||||||||||

| Accounting & legal | 1,500 | 1,500 | 1,500 | 1,500 | 1,500 | 1,500 | 1,500 | 1,500 | 1,500 | 1,500 | 1,500 | 1,500 | 1,500 | 19,500 | |||||||||

| Rent | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 60,000 | ||||||||||

| Telephone | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 11,000 | |||||||||||

| Utilities | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 60,000 | ||||||||||

| Insurance | 2,000 | 2,000 | |||||||||||||||||||||

| Taxes (real estate, etc.) | 2,750 | 2,750 | 2,750 | 2,750 | 2,750 | 2,750 | 2,750 | 2,750 | 2,750 | 2,750 | 2,750 | 2,750 | 33,000 | ||||||||||

| Interest | 49 | 49 | 49 | 49 | 49 | 49 | 49 | 49 | 49 | 49 | 49 | 49 | 586 | ||||||||||

| Other expenses (Business sign) | 2,000 | 2,000 | |||||||||||||||||||||

| Other (permits) | 1,000 | 1,000 | |||||||||||||||||||||

| Other (specify) | |||||||||||||||||||||||

| Miscellaneous | 30,000 | 30,000 | 30,000 | 30,000 | 30,000 | 30,000 | 30,000 | 30,000 | 30,000 | 30,000 | 30,000 | 30,000 | 360,000 | ||||||||||

| SUBTOTAL | 42,400 | 86,199 | 95,699 | 96,449 | 96,449 | 96,449 | 96,449 | 96,949 | 96,949 | 96,949 | 96,949 | 96,949 | 96,949 | 1,191,786 | |||||||||

| Loan principal payment | 972 | 972 | 972 | 972 | 972 | 972 | 972 | 972 | 972 | 972 | 972 | 972 | 11,667 | ||||||||||

| Capital purchase (specify) | 40,000 | 40,000 | |||||||||||||||||||||

| Other startup costs | |||||||||||||||||||||||

| Reserve and/or Escrow | 20,000 | 20,000 | 20,000 | 20,000 | 20,000 | 20,000 | 20,000 | 140,000 | |||||||||||||||

| Owners' Withdrawal | |||||||||||||||||||||||

| TOTAL CASH PAID OUT | 82,400 | 87,171 | 96,671 | 97,421 | 117,421 | 117,421 | 117,421 | 117,921 | 117,921 | 117,921 | 117,921 | 97,921 | 97,921 | 1,383,453 | |||||||||

| Cash Position (end of month) | 52,600 | 76,470 | 90,841 | 104,461 | 98,082 | 91,702 | 85,323 | 78,443 | 71,564 | 64,684 | 57,805 | 70,926 | 84,047 | 54,973 | |||||||||

Exit Strategy

No matter how good an organization is, it must have an exit strategy. Dave and Jacky Delicious primary aim is to provide the most appropriate option that protects investor’s interest while at the same time maintaining the organization’s potential growth, liquidity, as well as profitability. Typically, an investor fears being locked into an organization that does not indicate any sign of going public or filing for bankruptcy. In this regard, the organization is open to discuss with investors about various exit strategies at the time of incorporation. The options include: initial public offering, acquisition terms, liquidation terms, selling to friendly buyers, preferred stocks that are redeemable at the holder’s option, and convertible preferred stock. Others include anti-dilution measures and buyback after the first 3 years.

ReferencesBhasin, H. (2018, September 3). Top 13 McDonald’s competitors. Marketing91. Retrieved from https://www.marketing91.com/mcdonalds-competitors/

Data USA.(2020). Cambridge, MA. Retrieved from https://datausa.io/profile/geo/cambridge-ma/

IBISWorld.(2020, April).Fast food restaurants industry in the US-market research report. Retrieved from https://www.ibisworld.com/united-states/market-research-reports/fast- food-restaurants-industry/

Khandelwal, R. (2019, September 26). The restaurant industry: An overview. Market Realist. Retrieved from https://marketrealist.com/2019/09/the-restaurant-industry-an-overview/

Kotler, P., & Armstrong, G. (2017).Principles of marketing (17thed.). Upper Saddle River, NJ: Pearson education.

McDaniel, C. D., Lamb, C. W., & Hair, J. F. (2013). Marketing (12thed.). Mason, OH: South- Western Cengage Learning.

National Restaurant Association. (2019). Growth in higher-income households bolsters restaurant sales. Washington, D.C.: Author. Retrieved from https://restaurant.org/Articles/News/Growth-in-higher-income-households

Patrutiu-Baltes, L. (2016). Inbound Marketing-the most important digital marketing strategy. Bulletin of the Transilvania University of Brasov. Economic Sciences. Series V, 9(2), 61-68

Pistol, L., Epure, M., & Bucea-Manea-Ţoniş, R. (2016). Web-marketing strategy for SMEs. Procedia of Economics and Business Administration, 1, 128-137.

United States Census Bureau. (2020). Quick facts: Cambridge city, Massachusetts. Retrieved from https://www.census.gov/quickfacts/cambridgecitymassachusetts

Profit and Loss Statement (Annual Detail)

Balance Sheet (With Monthly Detail)

Balance Sheet (Annual Detail)

Cash Flow Statement (With Monthly Detail)

Cash Flow Statement (Annual Detail)