FEDERAL TAXATION CLASS- ASSIGNMENT It assignment requires you to net capital gains and losses, present the tax formula, and calculate tax liability. The assignment is due almost on one week from toda

GENERAL INSTRUCTIONS

Download the PDF document attached to this assignment.

Using the taxpayer information provided, use the capital gain netting process and tax formula to determine the taxpayer’s taxable income. Next, calculate the taxpayer’s income tax liability.

PRESENTATION

A sample solution has been provided, and I suggest that you format your submission similarly. If your solution is illegible, i will not be awarded no points. Your solution must:

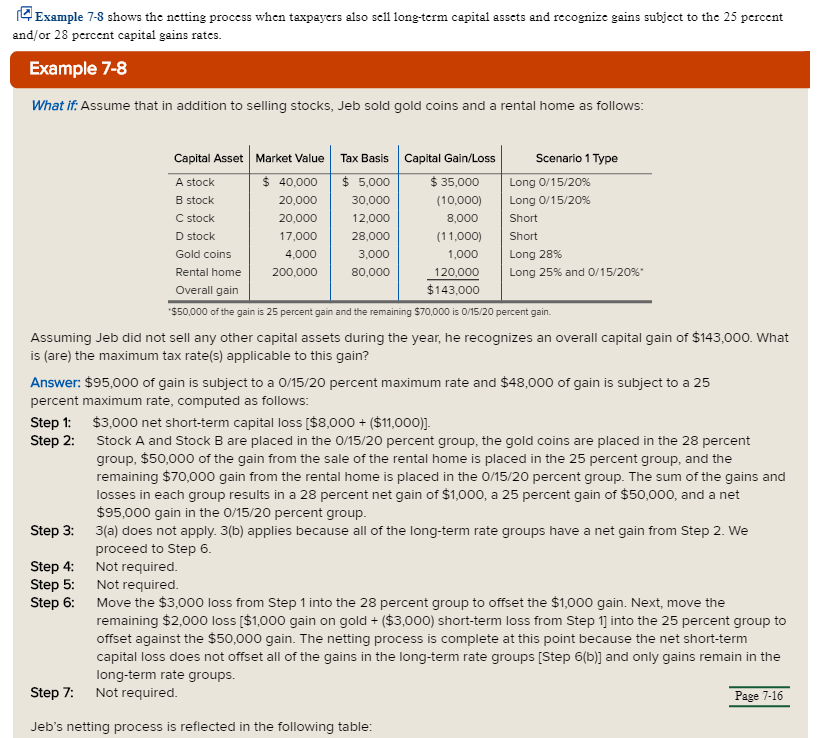

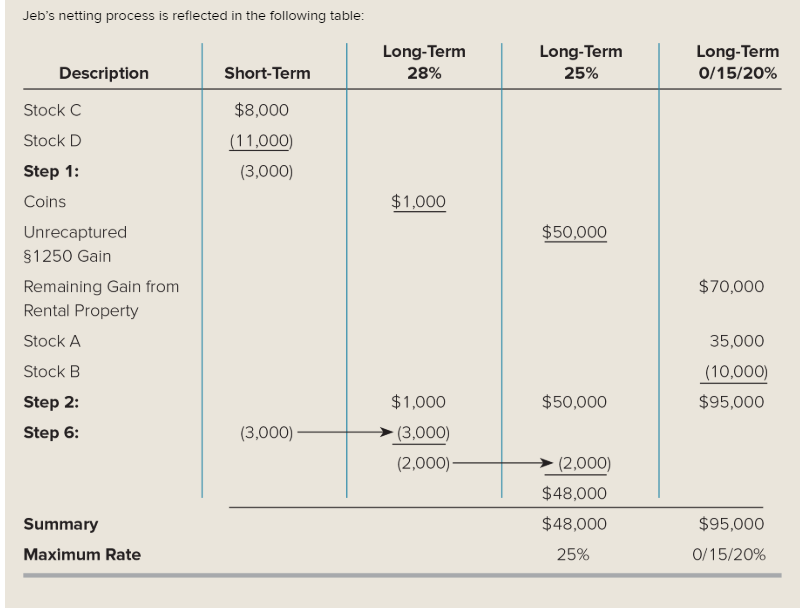

Present the netting of capital gains and losses (see Example 7-8 on page 7-16 of the text)

Present the taxpayer’s taxable income by applying the tax formula

Present the calculation of the taxpayer’s income tax liability in a way that allows me to see your work

Include the following signed academic integrity statement. Electronic statements may be signed by typing my full name. “”Yanil A. Gonzalez Batista”

“On my honor, I have neither received nor given any unauthorized assistance on this assignment”

Assignment – CASE

INSTRUCTIONS:

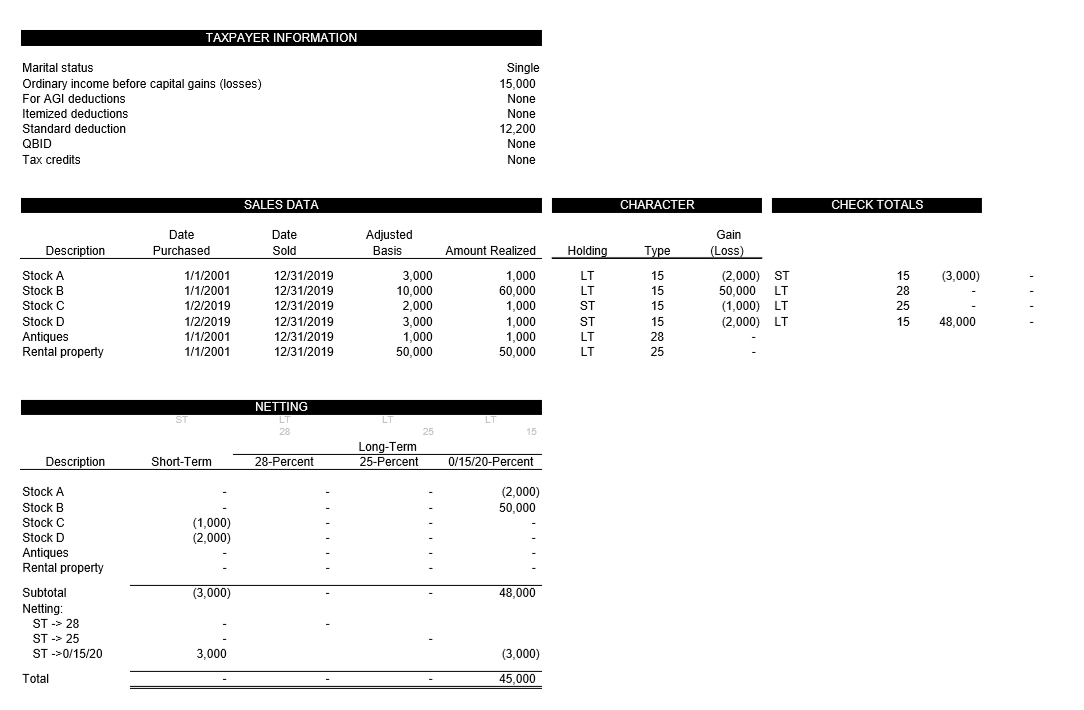

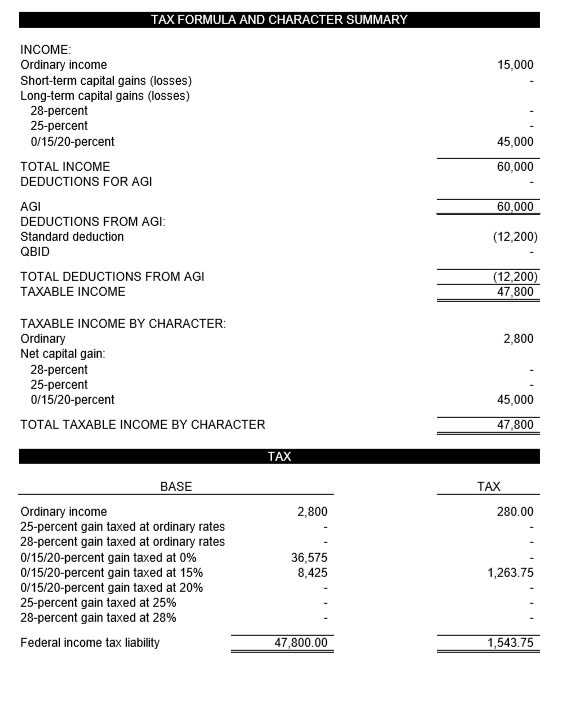

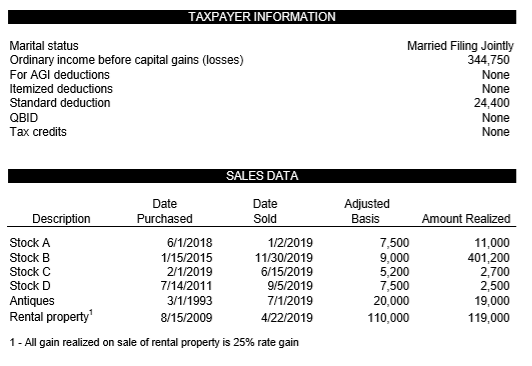

Using the taxpayer information and sales data below, net any capital gains and losses, apply the capital gain netting process, use the tax formula to determine the taxable income, and calculate the taxpayer's tax liability for the 2019 taxable year. Note that all gain realized on the sale of the rental property is 25-percent rate gain. See the sample solution provided for the recommended presentation. Your solution must show the netting process and tax liability calculations. Solutions that do not show work will not be awarded credit.

Sample solution