CASE ANALYSIS PAPER I have attached the file for the take-home paper. As this is a group paper I just you to do key issues, internal assessment, and external assessment. 2 and half page. You will nee

A05

Executive Summary

Best Buy Co Inc. is an American based largest multi-channel consumer electronic retailer; majority sales are conducted through traditional brick and mortar structure. Due to consumer demand shifting towards e-retailing and declining margins, they have recently introduced “Renew Blue” strategy. The focus of this strategy is to address the issues regarding declining margins and to regain the market share. The company provides superior technical service through geek squad team which is considered their sustainable distinctive competency. Furthermore they have made partnerships with big electronic manufacturers due to which their 300 square feet stores are opened under one roof of Best Buy. The idea behind is to give customers choice of comparing electronic products with superior technical service so that they can choose the product which best fits their needs.

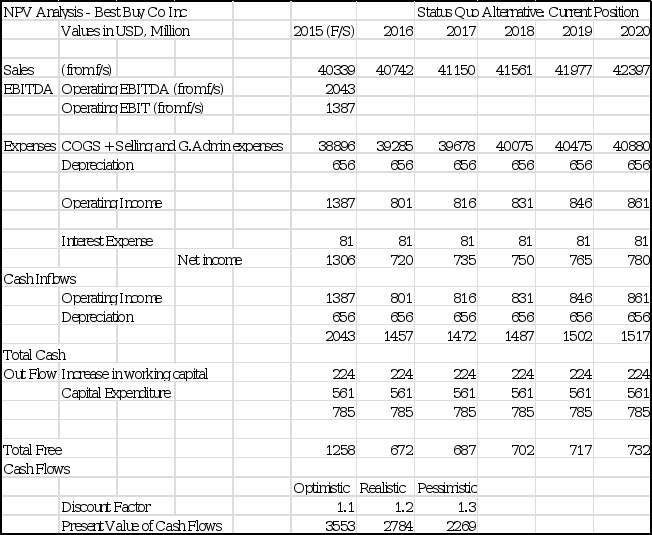

The recommended strategy to further improve their margins and market share is to create new e-marketplace and increase percentage of sales conducted online. This option will provide its customers an opportunity to trade on their website. As the company is already involved in e-retailing, this will be an expansion to the online sales operations. Increase in the demand towards e-retailing will allow company to reach American mass market. It would be wise to pursue broad differentiation and low cost strategy. The cost of this project will be low and at the same time company will enjoy long term benefits. In order to finance this project the company will use equity as they have improved their financial performance and are in stable position. Over the next five years, NPV analysis results show that company will benefit 3617 million dollar under realistic conditions but could be as high as 4797 million dollars and as low as 2849 million dollars under optimistic and pessimistic conditions. These results show that in all circumstances the company will be in benefit so it is better to go forward with this option.

External Assessment

The consumer electronic market is a largely mature, fragmented and highly competitive industry. Traditional brick and mortar structure is negatively impacted by the new e-retailing model. E-retailers are taking away the market share from the brick and mortar structure companies. Main reason behind this is the increase in internet usage and day to day technological advances. Vertical integration is common in retail business and the need for economies of scale is brought on by the growth of the internet, which has reshaped the industry’s competitive structure in terms of distribution and selling of consumer electronic products.

This new e-retailing model is fastest growing model and is expected to increase by 3.3 percent in North America by the year 2019 (Exhibit 1). There is an opportunity for the traditional big box stores to penetrate this new online structure by investing and creating advanced information technology systems. The new online sector accounts for around 20 percent of total consumer electronic market sales (Exhibit 1). E-retailing of consumer electronic products is in growth stage and to remain profitable companies are eager to adopt this new model by creating user friendly online websites where customers can place orders easily without any hassle. This will be the success factor for the future competitive market. This new model provides its customers convenience of shopping online without going to physical stores and at the same time provides opportunity to compare quality products and buy at a low price.

The increase in competition between big box stores and e-retailers has led big box structure companies in financial distress. Market share is largely taken away by big e-retail companies in the consumer electronic industry; because of the economies of scale e-retailers have traditional stores are not able to compete on ever falling prices of consumer electronic products (Exhibit1). The key success factor to deal with this threat would be to improve inventory management and inventory turnover. Other major threat faced by big box physical stores is that e-retailers are growing their operations on the expenses of these traditional stores, because of their showrooming characteristics (Exhibit 1). To deal with this problem brick and mortar retailer should provide exceptional customer and technical service in addition to low price quality products.

Internal Assessment

The mission and vision statement of Best Buy Co Inc. is to fulfil the unmet needs of its customers by providing superior customer service and technical support. Best Buy is the largest multi-channel consumer electronic retailer in the North America. It provides retailing service through big box physical stores and online e-retailing. The moto of Best Buy is “Expert service Unbeatable price”. Major products that company sells are consumer electronic products, computing and mobile phones, home appliances, and entertainment electronic products.

The sustainable distinctive competency of Best Buy is their 24-hours technical support and the in-store shopping environment which they provide to its customers through Geek Squad team (Exhibit 2). These specialists are highly trained and are considered one of the important pillars of the organization and are being utilized as sustainable competitive advantage. They help customers in identifying their needs and recommend them which product will be better choice for them. Moreover, they provide after sales technical service regarding the products. If for any reason product is not working they help their customers in finding feasible solutions.

The distinctive competency of Best Buy is their customer service which they provide to their customers on multi-channels which include big box stores and online retailing (Exhibit 2). The superior customer service on multi-channels is the reason behind the recovery from the past four year financial crisis and is considered temporary competitive advantage. This service has made Best Buy one of the top sellers of consumer electronic products and has made company strong enough to compete with its competitors.

The weakness of the company is its inability to transfer the data of in-store customers to online setting (Exhibit 2). In-store customers make the majority of the revenue of the company which makes it important that their data should be easily transferable to online setting of the company. If company in future invests in information technology this should be its one of top priorities. This weakness can be turned to the strength of the company which will make it easier to reach out new customers and follow up loyal customers online.

The strength of Best Buy is the convenient location of its big box physical stores which has made possible to meet and understand customer needs face to face more easily (Exhibit 2). This strength has given the edge to Best Buy over its online competitors, because by having physical stores customers can touch the tangible electronic products and compare it at the same time. This showrooming with addition to price matching policy is considered competitive parity, which has enabled company to make on time speedy deliveries at low price to customers.

Internal Assessment: Financial performance and Future Financial Capacity

Best Buy’s financial information resembles that of a mature company in the corporate lifecycle. Over the past four-year of declining profit margins they finally recovered and profit margins started to grow from -2.71 % in year 2012 to 3.06% in year 2015 (Exhibit 1). The increase in profit was largely attributed to “Renew Blue” strategy of the company, in which they focused more on improved customer service and relationships with suppliers. Company improved inventory management and days sales outstanding ratio with an impressive collection of accounts receivable, in year 2013 it took them around 23 days but year 2015 showed improved collection period and company reduced collection period by half to 11 days (Exhibit 3).

Furthermore, the comparison of ROE , ROA, D/E and D/A of year 2015 with past four year shows company has recovered from the past financial crises and has improved its financial performance in year 2015 which as a result has made company in the stable position (Exhibit 3). But still company is not in good financial position. The reasons behind these improvements are that company exited from China, Europe and closed down unprofitable stores which were adding up the expenses rather than revenues and giving more financial distress to company. These improvements in financial capacity will allow company in the future to run its operations efficiently and profitably. At the same time company can generate capital and borrow capital from financial institutions to invest in new upcoming projects as company is in stable position it can pay off its future liabilities if the trend continues to increase at same pace.

Current Strategies

Best Buy utilizes the hybrid of focused differentiation and focused low cost leadership strategy. It does everything possible to increase its efficiency of low price model. Company achieves this by having partnerships with major consumer electronics manufacturers, which includes small stores of manufacturers inside big box stores. As this industry is mature and considered seasonal, customer segments targeted include urban trendsetters, upscale suburban, empty nesters and Middle America. Company’s multi-channel retailing model of big box stores and e-retailing and vertical integration strategy, allows it to reach customers easily and provide them low price products with superior customer service. The global standardization strategy used in North American market allows it to reduce its costs of providing service to its loyal customers, which as result has improved the brand image. These are the basis on which it competes with its competitors and has made company strong player in the industry.

Key issue(s) of the case

Consumer demand is shifting towards e-retailing due to the increase in internet usage therefore the traditional competence of Best Buy which is in-store retailing is at risk. Majority of customers are looking towards e-retailer to make purchases online because of the convenience of time saving and low price advantage. The major issue faced by the Best Buy is the increase in the competition from its e-retailing competitors. Due to the technology advancements, new electronic products are entering market more quickly due to which current products are becoming obsolete more quickly. Other threat to this industry is ever falling prices of consumer electronics products. This industry is highly competitive and fragmented all retailers are offering low price quality products. The increase in internet usage has allowed e-retailers to take away the market share from the tradition brick and mortar stores, which has resulted in negative financial impacts on these big box stores. There is need of change in strategy as soon as possible as e-retailing is still in growing phase as only twenty percent of retail sales are done online and still there is space where company can make its place. It is better to change strategy from focused to broad differentiation and offer more products to customers with superior service.

Implementable Strategic Alternatives

Best Buy could focus their efforts on changing its focus strategy to broad differentiation with hybrid of low cost leadership by creating new e-market place in North America (Exhibit 5). They can expand their services and product lines to capture broad market. Furthermore, this new e-market place will allow customers to trade on the website, the function of Best Buy would be to provide them technological advanced channel with superior customer service. In terms of revenue generation company can charge big manufactures on the percentage of sales basis and customers will be not charged. As company already has good brand image they can also generate revenues by providing e-marketing services to big manufacturers. Company warehouses can be utilized for the distribution purposes. The placement in the value chain will be combination of retailer and distributor. This alternative will provide strong foundation for competition with its competitors. Once successful this alternative can be used as the base for global e-commerce expansion.

Alternatively the company can focus its efforts on expansion to Chinese mass market in alliance with Chinese biggest e-retailer Ali Baba Group and pursue focused differentiation strategy (Exhibit 6). This will allow company to slowly enter the mass market which will make easier to capture big Chinese cities one by one. Best Buy will function as the retailer and technical service provider for the consumer electronics products division of the Ali Baba Group. This alternative will require continuous investments of two hundred million dollars on yearly basis for five years. These investments will be used to open small stores in shopping malls so that brand is visible in the new market. Arguably China is the biggest market in terms of population that means it is difficult to capture whole market at once but on the other hand company can divide China in different regions or cities and can capture one by one. Alliance with Ali Baba will help company share resources and economies of scale which will enable effective distribution of products.

Criteria and Evaluation of Alternatives by Criteria

The two new alternatives will be evaluated based on couple of criteria which include NPV, ability to mitigate the environmental threats and risks involved.

If Best Buy choses to focus on creating new e-marketplace in North America, they would be able to play on level field with its e-retailing competitors which are taking its potential market share. This alternative will give company edge over its competitors because of multi-channel model of retail and service provider. The risk factor is considerably low since Best Buy has existing online retailing in the North American market this will be an extension to the online operations. Furthermore this alternative is least risky, as it is more profitable than status quo and Chinese market expansion alternative under both realistic and pessimistic conditions (Exhibit 9).

The second alternative to enter Chinese mass market in alliance with Ali Baba group would be considered slightly riskier because of past experience which has not been good. Management will be reluctant to pursue this option because of their prior hypothesis bias. Financially this option is also profitable under both optimistic and pessimistic conditions but management would not be willing to go back to market from which they have exited in last five years (Exhibit 10). Although global standardization strategy was to blamed which did not work in Chinese market. Due to this recent bad experience which also played important role in company’s financial distress. This option will require time to get approved from top management.

Recommendation and Implementation

Best Buy should immediately focus on creating new innovative e-marketplace in North America to remain profitable in fragmented consumer electronic market. This is viable alternative as company is already conducting e-retailing sales which are growing around 20 percent quarterly. This will require further improvements and expansion in their information technology department which will allow its customers to buy and sell on this new channel. Next, the company should focus whether they should outsource this new channel or expand their existing e-retailing model. Due to limited information given about this in the case study I am assuming they will expand their existing e-retailing model rather than outsourcing. Alternatively, third party service providers can be used to maintain and update this system. Furthermore, this initiative is assumed to require one hundred million dollars of initial investment to develop the new e-commerce channel. This will allow them to gain more economies of scale.

The company will get benefits of changing its strategy from focused differentiation to broad differentiation by selling more product lines other than consumer electronic products. This will allow company to target broad market and will fulfil the unmet needs of customers, which is company’s mission statement. Brand image of company in North American market will help them get success in the business as majority of their customers are already aware of their quality products and services.

Limitations and Critique of Recommendations

The limitations of creating new e-market place could be that this might shift in-store customers to online setting, and can result in no gain position. As the motive of the recommendation is to increase market share and compete with e-retailers, this might turn way around because the biggest rival Amazon already has this type of model. Our strategy is to imitate this model before it is late. Best Buy might have to close down more unprofitable stores which can create negative perception in the market that company is fully moving from in-store setting to online setting. Company have to maintain traditional physical big box store model and show this new model is addition, because of change in buying practices of customers.

External Environment: Exhibit 1

Opportunities

“… North America compound…. is projected to increase to 3.3 percent through 2019” (Pg. 6).

“… electronics industry is projected to reach a value of $620 billion by 2016, an increase of 20.6 percent over 2011 figures” (Pg. 6).

“… online sector accounts for approximately 20 percent of all consumer electronic sales” (Pg. 7).

Threats

“Another distinctive trend in the consumer-electronics industry is that of ever-falling prices” (Pg. 6).

“… many of Amazon’s gains appear to have come largely at Best Buy’s expense” (Pg. 10).

These quotations are taken directly from the Best Buy Co Inc. case to support the opportunities and threats which are apparent within the industry.

Internal Assessment VRIO analysis: Exhibit 2

| Value Chain Activities | Specific Attributes Along the Value Chain | V | R | I | W/S/DC/SDC | O | Competitive Implication: Likely to have |

|

|

|

|

|

|

|

|

|

| Physical Stores | Number of physical stores and Convenient locations | Yes | No | Strength | Yes | Competitive Parity | |

| Distribution | Speedy flex delivery | Yes | No | Strength | Yes | Competitive Parity | |

| Sales | In-Store and Online | Yes | No | Strength | Yes | Competitive Parity | |

| Customer Service | Trained Employees | Yes | Yes | No | Dc | Yes | Temporary competitive advantage |

| Technical Support | Geek Squad 24 hours | Yes | Yes | Yes | SDC | Yes | Sustainable Competitive Advantage |

| Information Technology | Customer Data difficult to transfer to online setting | No | Weakness | Competitive Disadvantage |

The exhibit above shows the criteria used to identify the Best Buy’s strengths and weaknesses. Strengths of the best buy include their physical stores, distribution system, and sales. One of the major weaknesses is the incapability of transferring in store customer data to online setting. This weakness can be overcome by having improved information technology systems, which can be costly one time investment but it will provide long term benefits.

Financial Assessment: Exhibit 3

|

| Formulas |

|

|

|

| ||

|

|

| 2012 | 2013 | 2014 | 2015 | ||

| Profit Margin | Net income / net sales | -2.71% | -1.15% | 1.31% | 3.06% | ||

| Return on Assets | Net income / total assets | -7.69% | -2.63% | 3.80% | 8.08% | ||

| Return on Equity | Net income/ equity | -32.79% | -14.41% | 16.84% | 24.68% | ||

| Leverage | ROE - ROA | -25.10% | -11.78% | 13.04% | 16.60% | ||

| Current Ratio | Current assets / current liabilities | 1.16 | 1.11 | 1.41 | 1.51 | ||

| Acid Test | Current assets-Avg inv / current liabilities | 0.39 | 0.42 | 0.57 | 0.66 | ||

| Inventory Turnover | Cost of goods sold / Avg Inventory | N/A | 3.10 | 5.23 | 5.93 | ||

| Days Sales Outstanding | (Avg Accounts Receivable / (sales/365)) | N/A | 23.82 | 18.03 | 11.71 | ||

| Debt to Assets | Total liabilities / total assets | 76.60% | 81.77% | 71.55% | 67.26% | ||

| Debt to Equity | Total liabilities / total equity | 327.37% | 448.42% | 251.56% | 205.43% | ||

| Net Working capital ratio | Net working capital / total assets | 0.09 | 0.07 | 0.22 | 0.26 | ||

| Accounts receivable turnover | Sales / Avg accounts receivables | N/A | 15.33 | 20.24 | 31.17 | ||

| Total assets turnover | sales / total assets | 2.84 | 2.28 | 2.90 | 2.64 | ||

All numbers used to calculate ratios above are in US dollars derived from Best Buy Co Inc. Balance sheet and Income statement. Most of the ratios shown above are in improving trend with the exception of Debt to Assets, Debt to Equity, Days Sales Outstanding, which shows company is in stable position.

Current Strategies and Their Implementation: Exhibit 4

Name of the business Strategy: Best Buy utilizes the hybrid of focused differentiation and focused low cost leadership strategy.

Customer Needs: Best Buy sells different consumer electronic products such as TVs, Laptops, Home Appliances, Cameras, Cell phones and provides technical support services for electronic products through Geek Squad, in the North American market which include America, Canada and Mexico.

Customer Groups: The consumer electronic market is segmented based on the age, gender, and discretionary income of the customers. The customer segments of Best Buy include Urban Trendsetters, Upscale Suburban, Empty Nesters and Middle America.

Basis for Competition: The basis for competition of Best Buy is their hybrid business strategy through which it provides latest consumer electronic products at lowest price with great customer service through big box physical stores and online sales. The price matching policy with addition to 24-hours technical support through well trained Geek Squad specialists. The high cost for building big box physical stores works as barriers to entry.

Corporate Strategies: Best Buy adds value in the product through forward vertical integration corporate strategy, and make product accessible to customers. The consumer electronics products are distributed to final customers through best buy.

Placement in the Value Stream: Best Buy is the one of the top retailers of consumer electronic products, through which consumer electronic products are sold. For example majority of Apple, Samsung, Sony, Microsoft products are sold through this retailer.

Global Strategies: Right now Best Buy only operates in two countries outside USA which are Canada and Mexico by having big box physical stores and online. The global strategy used by Best Buy is the global standardization strategy.

Major Functional Strategies: Major functional strategies of Best Buy include partnerships and relationships with its vendors. Other functional strategy recently announced by Best Buy is 300 square feet licensed stores openings at speciality retailers for e.g. Macy’s.

Implementation: Best Buy has multi-channel structure, composed of brick and click stores. Brick and mortar store include physical big box stores and click channels include online sales through its website where orders can be placed 24-hours but with less available technical support from its technical staff.

Comprehensive Structure of a Strategic Alternative: Exhibit 5

Name of the Alternative or Strategic Goal Identifier: Hybrid of Low cost and broad differentiation strategy by creating new e-commerce market place in North America

Customer Needs: Continue selling consumer-electronic products and allow people to resale or trade their used or new products at best available market. Broad range of products in addition to consumer-electronic, to name a few new product lines furniture, best-selling hardcover books, e-books, apparel, toys, health and beauty products.

Customer Groups: North American Mass market

Basis for Competition: Broad differentiation of the products with online technical support available 24-hours.

Corporate Strategies: forward vertical integration.

Placement in the Value System: Combination of retailer and distributor

Other: Implementation will require time as this project will require investment also for creating new e-market place.

Key issue(s) Addressed by this Alternative: Expansion into e-commerce business and can help compete with major North American competitors e.g. Amazon and Walmart and at the same time this can help in taking back market share from online competitors.

Feasibility Justification for this Strategic Alternative

Environmental Opportunity: If successful this will help in gaining economies of scale in North American market, next step will be to penetrate global markets.

Present Corporate Attributes relevant and sufficient to this alternative: Brand image of Best buy and physical presence in North American market.

Missing and/or insufficient Corporate Attributes: Difficulty to manage business to business e-commerce model due to lack of big data storage centers.

Comprehensive Structure of a Strategic Alternative: Exhibit 6

Name of the Alternative or Strategic Goal Identifier: Alliance with Ali Baba group with expansion to Chinese market.

Customer Groups: Chinese Mass Market

Basis for Competition: Focused low cost due to quality products and customer service

Corporate Strategies: Strategic Alliance

Placement in the Value System: Retailer

Other: Implementation may require signing alliance with Ali Baba group due to different organizational culture and geographic region.

Key issue(s) Addressed by this Alternative: Expansion into new developing markets.

Feasibility Justification for this Strategic Alternative

Environmental Opportunity: Growth in developing Asian markets.

Environmental Threats, Risks: Government regulations and political instability in the region.

Present Corporate Attributes relevant and sufficient to this alternative: Past experience of Chinese mass market and superior technical service.

Missing and/or insufficient Corporate Attributes: Lack of physical store presence.

Assumptions and Justifications: Exhibit 7

The values used for calculating NPV of status-quo alternative were taken from the Best Buy’s financial reports, 2015 and couple of assumptions were made for future projections. The current position’s revenue is expected to increase by one percent each year on average. Expenses are also expected to increase by one percent for the following years, since company has already reduced its expenses by exiting from Chinese and European markets in addition they have closed unprofitable stores. Depreciation, interest expenses, increase in networking capital and capital expenditure are assumed to be constant at the 2015 level. These assumptions will remain constant because I have assumed that company have already forecasted 10 years, because they have introduced “Renew Blue” strategy. Most often big companies do forecast for upcoming years, then they implement strategy accordingly to reach their goal.

For first alternative which is to create new e-market place, the following assumptions were made. Revenue will increase by two percent for the upcoming year 2016 and then once e-marketplace has started operating on full scale after year 2016 for the upcoming years it will generate revenues three percent for each subsequent years. Expenses for the two upcoming years will increase by two percent then after year 2017 they will increase by three percent for the subsequent years. I have assumed this alternative will require one time additional investment of around hundred million dollars to build new e-marketplace this capital expenditure will occur in year 2016 and this will be depreciated for 25 years using straight line method. This will be paid by the using equity or long term financial loans. Equity which has improved from past years and now company is in position to finance its upcoming projects as they have cut extra unnecessary costs.

For second alternative which is to enter Chinese market in alliance with Ali Baba Group, I have assumed revenues will increase by five percent and expenses will increase by four and half percent each year. This alternative will require company to build warehouses in one of the big cities of China for e.g. Shanghai. This will require additional capital expenditure of two hundred million each year. The depreciation cost will increase by additional four million per year for subsequent years. This investment is necessary to enter in Chinese market this will help company cover one big city one by one and have physical presence in China. The 25% costs will be paid with the partnership with the Ali Baba Group and rest will be paid by taking loans from banks or by issuing common shares.

Exhibit 8

Exhibit 9

Exhibit 10

Implementation Plan: Exhibit 11

Create new e-marketplace

Improvements and expansion in their information technology department.

Focus whether they should outsource this new channel or expand their existing e-retailing model.

Third party service providers can be used to maintain and update this system.

Assumed to require one hundred million dollars of initial investment to develop.

Benefits of changing its strategy from focused differentiation to broad differentiation by selling more product lines other than consumer electronic goods.

Majority of their customers are already aware of their quality products and services.

26