Scenario: Background Basswood Furniture is owned and operated by Ian Smith as a sole proprietorship. Ian rents a storefront/gallery at 124 River Lane in Hemlock, PA, 18951. The store is open Monday th

Scenario: Background

Basswood Furniture is owned and operated by Ian Smith as a sole proprietorship. Ian rents a storefront/gallery at 124 River Lane in Hemlock, PA, 18951. The store is open Monday through Friday from 8 a.m. to 7 p.m. He has been in business for almost two years now. He specializes in creating custom furniture according to client specifications. The furniture is delivered and installed, if necessary, in the client’s home or business.

Ian has hired you to be a full-charge bookkeeper effective December 1. The previous bookkeeper left unexpectedly in November due to medical problems. Your wage will be $15.00/hour. Since the other bookkeeper left, Ian has been trying to get by with paying bills, employees, etc. However, he isn’t a trained bookkeeper. He needs someone who can get up to speed quickly doing the books manually (Ian doesn’t have accounting software), who understands bookkeeping intimately and is able to correct anything he has done in error, and who can maintain his books accurately in the future.

This is why he has hired you. Although you have no experience—this is your first job—you made a strong impression on Ian with your knowledge of bookkeeping. He was impressed with your graded project for Penn Foster, which you showed him during the interview process to obtain this position. Your immediate supervisor is Jeremy Gates, a CPA with the accounting firm Gates and Associates, Inc. Jeremy spends one or two days at the end of every quarter auditing the books. He is responsible for the accuracy of the books, year-end work, tax preparation, and financial advice. You’ll have access to Jeremy for any questions or problems you may have. This, coupled with your bookkeeping skills, make Ian confident that you’ll be able to perform well in the position of full-charge bookkeeper. Your duties will be to maintain the accounting records and produce financial statements at the end of each accounting period.

Basswood Furniture has three employees. Ian is paid a salary. The employees are paid on an hourly basis.

Billie Redmond, helper

Betty Gable, secretary/coordinator

You, the bookkeeper

Ian makes all of the sales and constructs the furniture with the help of Billie Redmond. Everyone is paid on a biweekly basis. Jeremy Gates bills Basswood Furniture for his services as its accountant.

Basswood Furniture operates on a calendar year, which ends December 31. The accounting periods are monthly, and Basswood Furniture uses an accrual basis.

Transactions are recorded in three journals:

General journal

Cash receipts journal

Cash disbursements journal

Any transactions that aren’t entered in the cash receipt or cash disbursement journals are entered in the general journal.

Journal entries can be posted to the G/L anytime during the course of a week, at your convenience. However, you’ve developed the good practice of making sure all entries are posted on a weekly basis. At the end of an accounting period, you must make absolutely sure that all journal entries have been posted to the G/L.

At the end of the accounting period, as part of the closing process, you’ll work with a 10-column worksheet. Use it to create a Pre-Adjusted Trial Balance, making adjusting journal entries and creating an Adjusted Trial Balance, from which an Income Statement will be created in a format that follows GAAP guidelines. Finally, a Post-Closing Trial Balance will be created, from which you’ll generate the company’s Balance Sheet.

Scenario: Financial Information

As the first order of business, although he doesn’t know how accurate some of the information is, Ian has provided you with the following financial information for the period ending November 20XX:

Chart of Accounts (Figure 1)

Trial Balance (Figure 2)

Customer list (Figure 3)

Schedule of Accounts Receivable (Figure 4)

Vendor list (Figure 5)

Schedule of Accounts Payable (Figure 6)

Schedules of vehicle depreciation (Figure 7)

Schedules of equipment depreciation (Figure 8)

Schedules of office furniture and equipment depreciation (Figure 9)

Payroll information (Figure 10)

Merchandise inventory valuation (Figure 11)

Office supplies inventory valuation (Figure 12)

This information will be used initially to set up the books of accounting for the period December 20XX. The balances in the G/L accounts reflect all transactions recorded through November 30 of the current year. These are the beginning balances for December 1, 20XX. The same details are true of the balances in the Accounts Payable (A/P) and Accounts Receivable (A/R) subsidiary ledgers. Be sure to indicate with a checkmark that you’ve done the posting in the posting reference columns of the ledgers when you open the books. No supporting documentation or calculations are necessary as the figures presented are assumed to be correct.

| Basswood Furniture | |

| Number | Title |

| 100 | Cash—Business Checking |

| 107 | Petty Cash |

| 110 | Accounts Receivable |

| 120 | Merchandise Inventory |

| 125 | Office Supplies Inventory |

| 140 | Prepaid Rent |

| 170 | Vehicles |

| 170.1 | Accumulated Depreciation—Vehicles |

| 180 | Equipment |

| 180.1 | Accumulated Depreciation—Equipment |

| 185 | Office Furniture and Equipment |

| 185.1 | Accumulated Depreciation—Office Furniture and Equipment |

| 200 | Accounts Payable |

| 210 | Payroll Payable |

| 211 | Federal Income Tax Payable |

| 212 | Social Security Tax Payable |

| 213 | Medicare Tax Payable |

| 214 | State Income Tax Payable |

| 215 | City Income Tax Payable |

| 221 | FUTA Tax Payable |

| 222 | SUTA Tax Payable |

| 230 | Sales Tax Payable |

| 300 | Ian Smith, Capital |

| 300.1 | Ian Smith, Drawing |

| 401 | Sales Revenue |

| 401.1 | Sales Returns and Allowances |

| 401.2 | Sales Discounts |

| 500 | COGS—Cost of Goods Sold |

| 505 | Purchases |

| 505.1 | Purchase Returns and Allowances |

| 505.2 | Purchase Discounts |

| 510 | Payroll Expense |

| 515 | Payroll Tax Expense |

| 520 | Advertising Expense |

| 525 | Rent Expense |

| 530 | Office Supplies Expense |

| 535 | Telephone Expense |

| 540 | Utilities Expense |

| 550 | Supplies Expense |

| 560 | Miscellaneous Expense |

| 570 | Depreciation Expense |

| 580 | Cash Short and Over |

| 590 | Expense and Revenue Summary |

| Basswood Furniture: | |||||

| Acct. No. | Title | Debit | Credit | ||

| 100 | Cash—Business Checking | 18,513.18 |

| ||

| 107 | Petty Cash | 500.00 |

| ||

| 110 | Accounts Receivable | 17,986.00 |

| ||

| 120 | Merchandise Inventory | 31,500.00 |

| ||

| 125 | Office Supplies Inventory | 347.23 |

| ||

| 140 | Prepaid Rent | 2,000.00 |

| ||

| 170 | Vehicles | 48,000.00 |

| ||

| 170.1 | Accumulated Depreciation—Vehicles |

| 16,624.86 | ||

| 180 | Equipment | 23,500.80 |

| ||

| 180.1 | Accumulated Depreciation—Equipment |

| 14,361.60 | ||

| 185 | Office Furniture and Equipment | 6,125.04 |

| ||

| 185.1 | Accumulated Depreciation—Office Furn. and Equip. |

| 3,743.08 | ||

| 200 | Accounts Payable |

| 5,004.00 | ||

| 210 | Payroll Payable |

| 0.00 | ||

| 211 | Federal Income Tax Payable |

| 722.00 | ||

| 212 | Social Security Tax Payable |

| 627.44 | ||

| 213 | Medicare Tax Payable |

| 146.74 | ||

| 214 | State Income Tax Payable |

| 310.69 | ||

| 215 | City Income Tax Payable |

| 101.20 | ||

| 221 | FUTA Tax Payable |

| 1,050.56 | ||

| 222 | SUTA Tax Payable |

| 7,091.28 | ||

| 230 | Sales Tax Payable |

| 3,750.00 | ||

| 300 | Ian Smith, Capital |

| 94,938.80 | ||

| 300.1 | Ian Smith, Drawing | 0.00 |

| ||

| 401 | Sales |

| 0.00 | ||

| 401.1 | Sales Returns and Allowances | 0.00 |

| ||

| 401.2 | Sales Discounts | 0.00 |

| ||

| 500 | COGS—Cost of Goods Sold | 0.00 |

| ||

| 505 | Purchases | 0.00 |

| ||

| 505.1 | Purchase Returns and Allowances |

| 0.00 | ||

| 505.2 | Purchase Discounts |

| 0.00 | ||

| 510 | Payroll Expense | 0.00 |

| ||

| 515 | Payroll Tax Expense | 0.00 |

| ||

| 520 | Advertising Expense | 0.00 |

| ||

| 525 | Rent Expense | 0.00 |

| ||

| 530 | Office Supplies Expense | 0.00 |

| ||

| 535 | Telephone Expense | 0.00 |

| ||

| 540 | Utilities Expense | 0.00 |

| ||

| 550 | Supplies Expense | 0.00 |

| ||

| 560 | Miscellaneous Expense | 0.00 |

| ||

| 570 | Depreciation Expense | 0.00 |

| ||

| 580 | Cash Short and Over | 0.00 |

| ||

| 590 | Expense and Revenue Summary | 0.00 |

| ||

| TOTALS | 148,472.25 | 148,472.25 | |||

| Basswood Furniture: | |

| Account Number | Customer |

| AR-010 | Elizabeth Dante, 264 Landon Lane, Antigua, PA 15935 |

| AR-020 | Liya Designs, 13 Spruce Street, Archwood, PA 17514 |

| AR-030 | Yu Wei Creations, 91 Nittany Drive, Lansdale, PA 13956 |

| AR-040 | Capital Hardware, 87 Ridge Road, Anton, PA 12893 |

| AR-050 | The Antique Shoppe, 659 Market St, Sommerville, PA 15302 |

| AR-060 | Michael’s Furniture, 284 Carter Lane, Hanson, PA 14761 |

| AR-070 | Kenny Refinishing, 73 Tomey Avenue, Brighton, PA 16688 |

| AR-080 | Sam Little, 7 Ebony Drive, Adams, PA 14475 |

| AR-090 | Jim and Pearl Jones, 92 Weston Ave., Carverton, PA 18346 |

| AR-100 | Andy Mellow, 467 Reinhold Lane, Mountain Bend, PA 11321 |

| AR-110 | Quality Furniture, 101 Chester Drive, Birchwood, PA 19834 |

| AR-120 | Donna Bigelow, 901 Washington Lane, Appleton, PA 16572 |

| Basswood Furniture: | ||

| Account Number | Customer | $ Amount |

| AR-010 | Elizabeth Dante | 1,234.00 |

| AR-020 | Liya Designs | 7,580.00 |

| AR-030 | Yu Wei Creations | 6,437.00 |

| AR-040 | Capital Hardware | 0.00 |

| AR-050 | The Antique Shoppe | 350.00 |

| AR-060 | Michael’s Furniture | 0.00 |

| AR-070 | Kenny Refinishing | 925.00 |

| AR-080 | Sam Little | 425.00 |

| AR-090 | Jim and Pearl Jones | 125.00 |

| AR-100 | Andy Mellow | 50.00 |

| AR-110 | Quality Furniture | 0.00 |

| AR-120 | Donna Bigelow | 860.00 |

| Total | $ 17,986.00 | |

| Basswood Furniture: | |

| Account Number | Vendor |

| AP-010 | Hemlock Gas and Electric Co., Hemlock, PA 18953-6174 |

| AP-020 | The Home Improvement Center, 91 Arch St, Benton, OH 65714 |

| AP-030 | Carol’s Wood Supplies, 6 Lane Way, Canton, NJ 35741 |

| AP-040 | Atlantic Telephone Co., Hemlock, PA 18952-6143 |

| AP-050 | Woodworker Supplies, 4 Tennison Drive, Benning, NC 43852 |

| AP-060 | Everything Wood, 608 Rider Avenue, Capta, CA 93412 |

| AP-070 | Sally’s Fabrics, 593 Eleanor Road, TN 34687 |

| AP-080 | Two Guys Hardware, 29 Huntington Dr, Allenwood TN 26579 |

| AP-090 | Penn Furnishings, 84 Oakwood Avenue, Allenwood, TN 26579 |

| AP-100 | Cheryl Wood Designs, 802 Corning St, Palmerton, PA 11682 |

| AP-110 | Tom Baker, 53 Union Street, Hemlock, PA 18951 |

| AP-120 | Wood Imaginations, P.O. Box 461, Elkington, MN 43167 |

| AP-130 | Gates and Associates, Inc., 149 Elk Dr, Hemlock, PA 18953 |

| Basswood Furniture: | |||

| Account Number | Vendor | $ Amount | |

| AP-010 | Hemlock Gas and Electric Co. | $ 0.00 | |

| AP-020 | The Home Improvement Center | 353.00 | |

| AP-030 | Carol’s Wood Supplies | 631.00 | |

| AP-040 | Atlantic Telephone Co. | 0.00 | |

| AP-050 | Woodworker Supplies | 1,621.00 | |

| AP-060 | Everything Wood | 750.00 | |

| AP-070 | Sally’s Fabrics | 0.00 | |

| AP-080 | Two Guys Hardware | 75.00 | |

| AP-090 | Penn Furnishings | 0.00 | |

| AP-100 | Cheryl Wood Designs | 480.00 | |

| AP-110 | Tom Baker | 130.00 | |

| AP-120 | Wood Imaginations | 964.00 | |

| AP-130 | Gates and Associates, Inc., | 0.00 | |

| Total | $ 5,004.00 | ||

| Schedules of Vehicle Depreciation | ||

| Make: Ford | Model: Econoline Van | Year: 20XX |

| Purchase Date: 02/01/20XX |

| Purchase Price: $48,000 |

| Method of Depr.: Straight-Line |

| # of Years: 4 |

| Salvage Value: $10,000 |

| Depr. Per Period: $791.66 |

| Period | Year 1 | Depreciation | Accumulated | Book Value | Posted |

|

|

|

|

| 48,000.00 |

|

| 2/28 | 791.66 | 791.66 | 47,208.34 | YES | |

| 3/31 | 791.66 | 1583.32 | 46,416.68 | YES | |

| 4/30 | 791.66 | 2374.98 | 45,625.02 | YES | |

| 5/31 | 791.66 | 3166.64 | 44,833.36 | YES | |

| 6/30 | 791.66 | 3958.3 | 44,041.70 | YES | |

| 7/31 | 791.66 | 4749.96 | 43,250.04 | YES | |

| 8/31 | 791.66 | 5541.62 | 42,458.38 | YES | |

| 9/30 | 791.66 | 6333.28 | 41,666.72 | YES | |

| 10/31 | 791.66 | 7124.94 | 40,875.06 | YES | |

| 10 | 11/30 | 791.66 | 7916.6 | 40,083.40 | YES |

| 11 | 12/31 | 791.66 | 8708.26 | 39,291.74 | YES |

| 12 | 1/31 | 791.66 | 9499.92 | 38,500.08 | YES |

| Period | Year 2 | Depreciation | Accumulated | Book Value | Posted |

|

|

|

| 9499.92 | 38,500.08 |

|

| 13 | 2/28 | 791.66 | 10291.58 | 37,708.42 | YES |

| 14 | 3/31 | 791.66 | 11083.24 | 36,916.76 | YES |

| 15 | 4/30 | 791.66 | 11874.9 | 36,125.10 | YES |

| 16 | 5/31 | 791.66 | 12666.56 | 35,333.44 | YES |

| 17 | 6/30 | 791.66 | 13458.22 | 34,541.78 | YES |

| 18 | 7/31 | 791.66 | 14249.88 | 33,750.12 | YES |

| 19 | 8/31 | 791.66 | 15041.54 | 32,958.46 | YES |

| 20 | 9/30 | 791.66 | 15833.2 | 32,166.80 | YES |

| 21 | 10/31 | 791.66 | 16624.86 | 31,375.14 | YES |

| 22 | 11/30 | 791.66 | 17416.52 | 30,583.48 |

|

| 23 | 12/31 | 791.66 | 18208.18 | 29,791.82 |

|

| 24 | 1/31 | 791.66 | 18999.84 | 29,000.16 |

|

| Period | Year 3 | Depreciation | Accumulated | Book Value | Posted |

|

|

|

| 18999.84 | 29,000.16 |

|

| 25 | 2/28 | 791.66 | 19791.5 | 28,208.50 |

|

| 26 | 3/31 | 791.66 | 20583.16 | 27,416.84 |

|

| 27 | 4/30 | 791.66 | 21374.82 | 26,625.18 |

|

| 28 | 5/31 | 791.66 | 22166.48 | 25,833.52 |

|

| 29 | 6/30 | 791.66 | 22958.14 | 25,041.86 |

|

| 30 | 7/31 | 791.66 | 23749.8 | 24,250.20 |

|

| 31 | 8/31 | 791.66 | 24541.46 | 23,458.54 |

|

| 32 | 9/30 | 791.66 | 25333.12 | 22,666.88 |

|

| 33 | 10/31 | 791.66 | 26124.78 | 21,875.22 |

|

| 34 | 11/30 | 791.66 | 26916.44 | 21,083.56 |

|

| 35 | 12/31 | 791.66 | 27708.1 | 20,291.90 |

|

| 36 | 1/31 | 791.66 | 28499.76 | 19,500.24 |

|

| Period | Year 4 | Depreciation | Accumulated | Book Value | Posted |

|

|

|

| 28499.76 | 19,500.24 |

|

| 37 | 2/28 | 791.66 | 29291.42 | 18,708.58 |

|

| 38 | 3/31 | 791.66 | 30083.08 | 17,916.92 |

|

| 39 | 4/30 | 791.66 | 30874.74 | 17,125.26 |

|

| 40 | 5/31 | 791.66 | 31666.4 | 16,333.60 |

|

| 41 | 6/30 | 791.66 | 32458.06 | 15,541.94 |

|

| 42 | 7/31 | 791.66 | 33249.72 | 14,750.28 |

|

| 43 | 8/31 | 791.66 | 34041.38 | 13,958.62 |

|

| 44 | 9/30 | 791.66 | 34833.04 | 13,166.96 |

|

| 45 | 10/31 | 791.66 | 35624.7 | 12,375.30 |

|

| 46 | 11/30 | 791.66 | 36416.36 | 11,583.64 |

|

| 47 | 12/31 | 791.66 | 37208.02 | 10,791.98 |

|

| 48 | 1/31 | 791.98 | 38000.00 | 10,000.00 |

|

| Schedules of Equipment Depreciation | |||||

| Items: (Initial Investment) |

| ||||

| Table saw | Compound miter saw | ||||

| Band saw | Scroll saw | ||||

| Router table | Drill press | ||||

| Lathe | Planer | ||||

| Dust collection system | Work benches | ||||

| Invoice itemized misc equipment |

| ||||

| Purchase Date: 01/01/20XX | Purchase Price: $23,500.80 | ||||

| Method of Depr.: Straight-Line | # of Years: 3 | ||||

| Salvage Value: $0.00 | Depr. Per Period: $652.80 | ||||

| Period | Year 1 | Depreciation | Accumulated | Book Value | Posted |

|

|

|

|

| 23,500.80 |

|

| 01/31 | 652.80 | 652.80 | 22,848.00 | YES | |

| 02/28 | 652.80 | 1,305.60 | 22,195.20 | YES | |

| 03/31 | 652.80 | 1,958.40 | 21,542.40 | YES | |

| 04/30 | 652.80 | 2,611.20 | 20,889.60 | YES | |

| 05/31 | 652.80 | 3,264.00 | 20,236.80 | YES | |

| 06/30 | 652.80 | 3,916.80 | 19,584.00 | YES | |

| 07/31 | 652.80 | 4,569.60 | 18,931.20 | YES | |

| 08/31 | 652.80 | 5,222.40 | 18,278.40 | YES | |

| 09/30 | 652.80 | 5,875.20 | 17,625.60 | YES | |

| 10 | 10/31 | 652.80 | 6,528.00 | 16,972.80 | YES |

| 11 | 11/30 | 652.80 | 7,180.80 | 16,320.00 | YES |

| 12 | 12/31 | 652.80 | 7,833.60 | 15,667.20 | YES |

| Period | Year 2 | Depreciation | Accumulated | Book Value | Posted |

|

|

|

| 7,833.60 | 15,667.20 |

|

| 01/31 | 652.80 | 8,486.40 | 15,014.40 | YES | |

| 02/28 | 652.80 | 9,139.20 | 14,361.60 | YES | |

| 03/31 | 652.80 | 9,792.00 | 13,708.80 | YES | |

| 04/30 | 652.80 | 10,444.80 | 13,056.00 | YES | |

| 05/31 | 652.80 | 11,097.60 | 12,403.20 | YES | |

| 06/30 | 652.80 | 11,750.40 | 11,750.40 | YES | |

| 07/31 | 652.80 | 12,403.20 | 11,097.60 | YES | |

| 08/31 | 652.80 | 13,056.00 | 10,444.80 | YES | |

| 09/30 | 652.80 | 13,708.80 | 9,792.00 | YES | |

| 10 | 10/31 | 652.80 | 14,361.60 | 9,139.20 | YES |

| 11 | 11/30 | 652.80 | 15,014.40 | 8,486.40 |

|

| 12 | 12/31 | 652.80 | 15,667.20 | 7,833.60 |

|

| Period | Year 3 | Depreciation | Accumulated | Book Value | Posted |

|

|

|

| 15,667.20 | 7,833.60 |

|

| 01/31 | 652.80 | 16,320.00 | 7,180.80 |

| |

| 02/28 | 652.80 | 16,972.80 | 6,528.00 |

| |

| 03/31 | 652.80 | 17,625.60 | 5,875.20 |

| |

| 04/30 | 652.80 | 18,278.40 | 5,222.40 |

| |

| 05/31 | 652.80 | 18,931.20 | 4,569.60 |

| |

| 06/30 | 652.80 | 19,584.00 | 3,916.80 |

| |

| 07/31 | 652.80 | 20,236.80 | 3,264.00 |

| |

| 08/31 | 652.80 | 20,889.60 | 2,611.20 |

| |

| 09/30 | 652.80 | 21,542.40 | 1,958.40 |

| |

| 10 | 10/31 | 652.80 | 22,195.20 | 1,305.60 |

|

| 11 | 11/30 | 652.80 | 22,848.00 | 652.80 |

|

| 12 | 12/31 | 652.80 | 23,500.80 | 0.00 |

|

| Schedules of Office Furniture and Equipment Depreciation | |

| Items: (Initial Investment) | |

| (2) Computers | Printer |

| Invoice itemized computer software | (2) Desks |

| (2) Filing cabinets | (2) Chairs |

| Telephone/answering/fax machine | Copier |

| Invoice itemized misc items | Telephone |

| Purchase Date: 01/01/20XX | Purchase Price: $6,125.04 |

| Method of Depr.: Straight-Line | # of Years: 3 |

| Salvage Value: $0.00 | Depr. Per Period: $170.14 |

| Period | Year 1 | Depreciation | Accumulated | Book Value | Posted |

|

|

|

|

| 6,125.04 |

|

| 01/31 | 170.14 | 170.14 | 5,954.90 | YES | |

| 02/28 | 170.14 | 340.28 | 5,784.76 | YES | |

| 03/31 | 170.14 | 510.42 | 5,614.62 | YES | |

| 04/30 | 170.14 | 680.56 | 5,444.48 | YES | |

| 05/31 | 170.14 | 850.70 | 5,274.34 | YES | |

| 06/30 | 170.14 | 1,020.84 | 5,104.20 | YES | |

| 07/31 | 170.14 | 1,190.98 | 4,934.06 | YES | |

| 08/31 | 170.14 | 1,361.12 | 4,763.92 | YES | |

| 09/30 | 170.14 | 1,531.26 | 4,593.78 | YES | |

| 10 | 10/31 | 170.14 | 1,701.40 | 4,423.64 | YES |

| 11 | 11/30 | 170.14 | 1,871.54 | 4,253.50 | YES |

| 12 | 12/31 | 170.14 | 2,041.68 | 4,083.36 | YES |

| Period | Year 2 | Depreciation | Accumulated | Book Value | Posted |

|

|

|

| 2,041.68 | 4,083.36 |

|

| 01/31 | 170.14 | 2,211.82 | 3,913.22 | YES | |

| 02/28 | 170.14 | 2,381.96 | 3,743.08 | YES | |

| 03/31 | 170.14 | 2,552.10 | 3,572.94 | YES | |

| 04/30 | 170.14 | 2,722.24 | 3,402.80 | YES | |

| 05/31 | 170.14 | 2,892.38 | 3,232.66 | YES | |

| 06/30 | 170.14 | 3,062.52 | 3,062.52 | YES | |

| 07/31 | 170.14 | 3,232.66 | 2,892.38 | YES | |

| 08/31 | 170.14 | 3,402.80 | 2,722.24 | YES | |

| 09/30 | 170.14 | 3,572.94 | 2,552.10 | YES | |

| 10 | 10/31 | 170.14 | 3,743.08 | 2,381.96 | YES |

| 11 | 11/30 | 170.14 | 3,913.22 | 2,211.82 |

|

| 12 | 12/31 | 170.14 | 4,083.36 | 2,041.68 |

|

| Period | Year 3 | Depreciation | Accumulated | Book Value | Posted |

|

|

|

| 4,083.36 | 2,041.68 |

|

| 01/31 | 170.14 | 4,253.50 | 1,871.54 |

| |

| 02/28 | 170.14 | 4,423.64 | 1,701.40 |

| |

| 03/31 | 170.14 | 4,593.78 | 1,531.26 |

| |

| 04/30 | 170.14 | 4,763.92 | 1,361.12 |

| |

| 05/31 | 170.14 | 4,934.06 | 1,190.98 |

| |

| 06/30 | 170.14 | 5,104.20 | 1,020.84 |

| |

| 07/31 | 170.14 | 5,274.34 | 850.70 |

| |

| 08/31 | 170.14 | 5,444.48 | 680.56 |

| |

| 09/30 | 170.14 | 5,614.62 | 510.42 |

| |

| 10 | 10/31 | 170.14 | 5,784.76 | 340.28 |

|

| 11 | 11/30 | 170.14 | 5,954.90 | 170.14 |

|

| 12 | 12/31 | 170.14 | 6,125.04 | 0.00 |

|

| PAYROLL INFORMATION Employee: Ian Smith Status: Married Number of Allowances Claiming: 4 Additional Amount Withheld: $ 0.00 Wage/Salary: $2,500.00 (Salary) YTD Earnings: $60,000.00 Employee: Betty Gable Status: Single Number of Allowances Claiming: 0 Additional Amount Withheld: $ 0.00 Wage/Salary: $12.50/hr YTD Earnings: $16,500.00 Employee: Billie Redmond Status: Married Number of Allowances Claiming: 3 Additional Amount Withheld: $ 0.00 Wage/Salary: $17.00/hr YTD Earnings: $29,920.00 Employee: Janet Adams Status: Married Number of Allowances Claiming: 2 Additional Amount Withheld: $ 0.00 Wage/Salary: $15.00/hr YTD Earnings: $24,900.00 Additional Payroll Information: Hourly employees are paid time-and-one-half for overtime hours. Any hours worked over 40 hours for the week qualify for overtime pay. Hourly employees are paid double time for any hours worked over 60 hours for the week and for working on holidays. Currently, employees are responsible for their own insurance. |

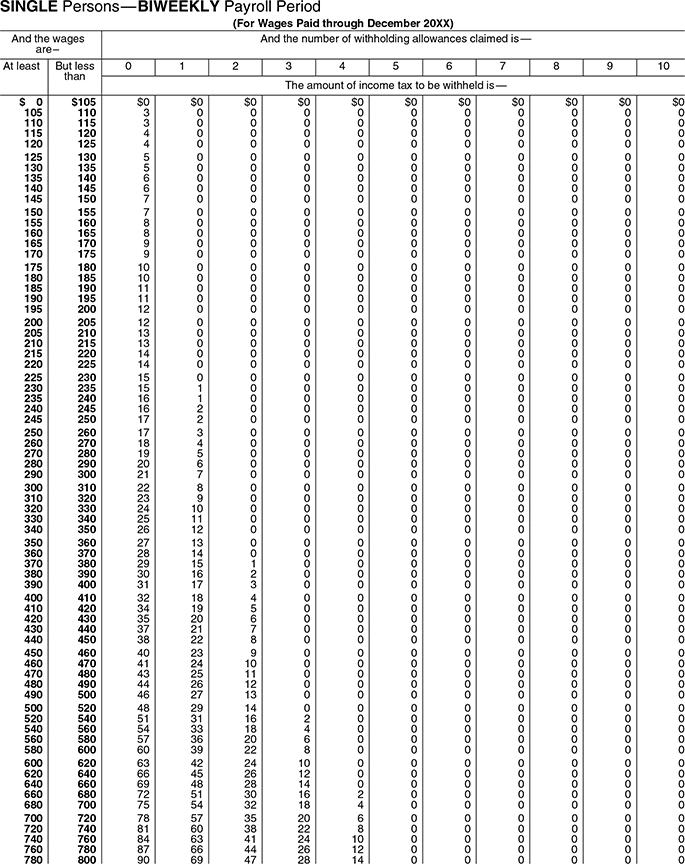

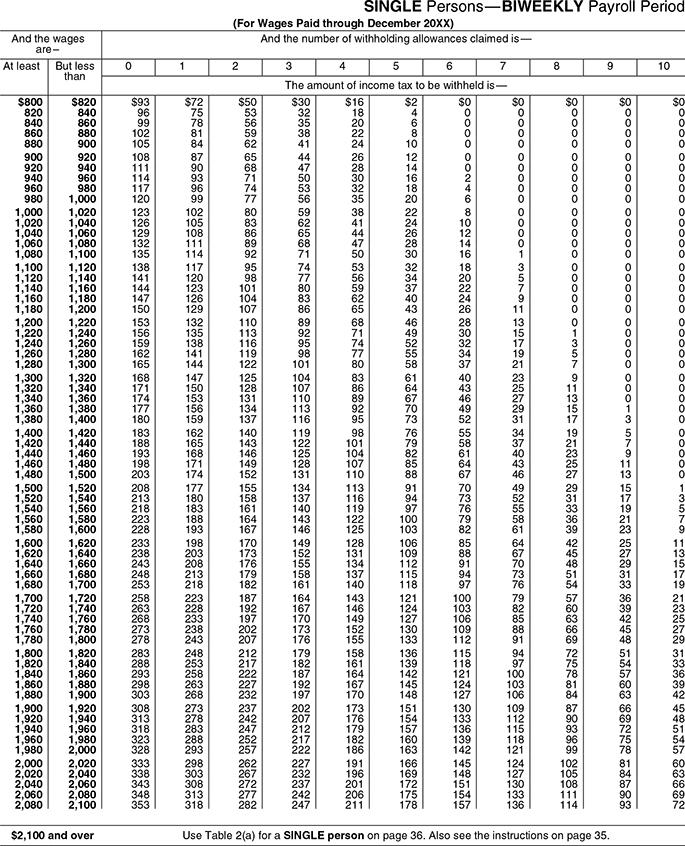

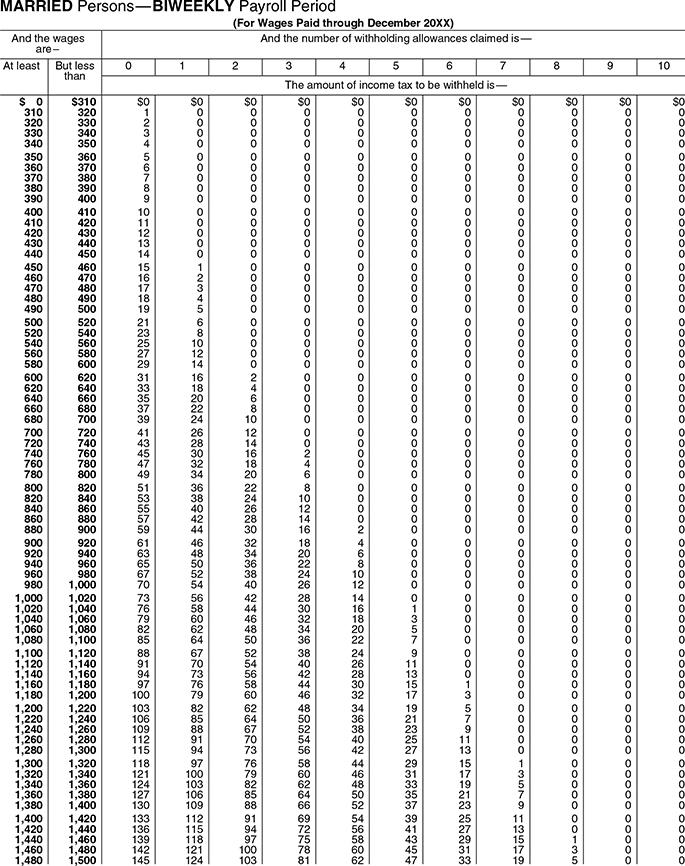

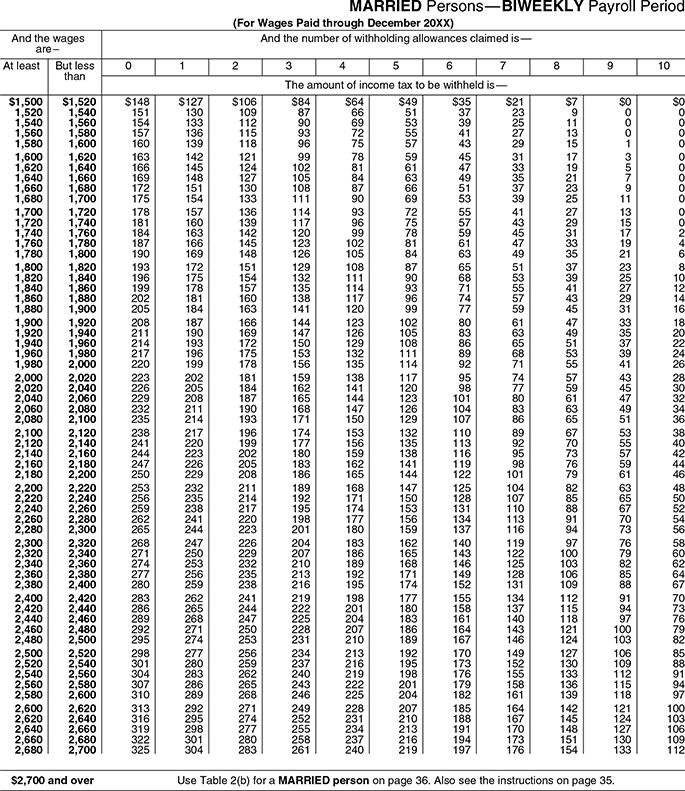

Use the following tax tables for Federal Withholding Tax from the current year Circular E:

FWT:

| Payroll Information: |

| SWT: Pennsylvania Income State Tax Percentage: 3.07% LWT: Hemlock Local Withholding Tax Percentage: 1.00% FICA: Social Security Tax Percentage: Employee: 6.02% on all earnings Employer: 6.02% on all earnings Note: The 6.02% is not the same as the 6.2% that was used in the Payroll lesson. Be sure to use the 6.02% in your calculations instead. (The government does change tax percentages and will notify the business when they do. This is an example of a tax percentage change. Use the correct percentage in your calculations.) Medicare Tax Percentage: Employee: 1.45% up to $106,800 in earnings Employer: 1.45% up to $106,800 in earnings FUTA: The FUTA tax percentage is 0.8% of the first $7,000 of wages per year SUTA: The SUTA tax percentage is 5.4% of the first $7,000 of wages per year |

| Merchandise Inventory Valuation | ||||

| Item No. | Description | No. of Items | Amount | Total Amount |

| DR-0003 | Dining Room Set | $ 2,500.00 | $ 5,000.00 | |

| DRS-0005 | Dining Room Set | $ 2,125.00 | $ 4,250.00 | |

| DRS-0009 | Dining Room Set | $ 3,455.00 | $ 6,910.00 | |

| TBL-0023 | Table | $ 65.00 | $ 260.00 | |

| TBL-0037 | Table | $ 85.00 | $ 255.00 | |

| CHR-0002 | Chairs – 4 set | $ 90.00 | $ 270.00 | |

| CHR-0005 | Chairs – 6 set | $ 120.00 | $ 720.00 | |

| ETB-0003 | End Table | $ 45.00 | $ 135.00 | |

| ETB-0006 | End Table | $ 55.00 | $ 220.00 | |

| MGR-0004 | Magazine Rack | $ 15.00 | $ 75.00 | |

| WNR-0001 | Wine Rack | $ 125.00 | $ 250.00 | |

| LMP-0003 | Lamp | $ 65.00 | $ 325.00 | |

| CTB-0007 | Coffee Table | $ 90.00 | $ 540.00 | |

| RCH-0001 | Rocking Chair | $ 85.00 | $ 340.00 | |

| DRS-0002 | Dresser – 8 Drawer | $ 235.00 | $ 705.00 | |

| DRS-0001 | Dresser – 10 Drawer | $ 275.00 | $ 275.00 | |

| DRS-0004 | Dresser – 12 Drawer | $ 295.00 | $ 295.00 | |

| BRM-0002 | Bedroom Set | $ 3,250.00 | $ 6,500.00 | |

| BRM-0003 | Bedroom Set | $ 3,675.00 | $ 3,675.00 | |

| HTC-0004 | Hutch | $ 125.00 | $ 500.00 | |

| Total inventory value |

|

|

| $ 31,500.00 |

| Office Supplies Inventory Valuation | |||

| Description | No. of Items | Amount | Total Amount |

| Legal Pads – 12 PK | $ 8.95 | $ 35.80 | |

| Copy Paper – Case | $ 35.99 | $ 143.96 | |

| Roller Pens – Dz | $ 12.49 | $ 49.96 | |

| Wood Pencils – Dz | 20 | $ 1.69 | $ 33.80 |

| Permanent Marker – Dz | $ 6.99 | $ 13.98 | |

| Correction Fluid – Dz | $ 1.30 | $ 1.30 | |

| Highlighter – DZ | $ 7.99 | $ 15.98 | |

| Plain Envelopes – Box | $ 6.99 | $ 13.98 | |

| Clasp Envelopes – Box | $ 13.99 | $ 13.99 | |

| Receipt Book | $ 12.24 | $ 24.48 | |

| Total Inventory Value |

|

| $ 347.23 |

Cash—the Business Checking account is used for all transactions (including payroll). Everything is paid for by check with the exception of petty cash. (Petty cash is an amount of cash that has been set aside for small purchases that you wouldn’t write a check for, i.e., the purchase of a 50 cent newspaper.)

Petty Cash remains at an imprest amount of $500.00. (Imprest means the balance, once set, remains the same. The amount of the cash plus the total of the receipts should always equal the imprest amount.)

Accounts Receivable terms are decided on an account-by-account basis, with the default being 2/10, n30. Each week, the Schedule of Accounts Receivable is reviewed for collection purposes. Ian has a good rapport with his clients, having developed a good name for himself. Credit applications are taken, checked, and approved by Ian before setting up an account.

Merchandise Inventory is the cost of furniture that has been made and not sold yet. It’s all furniture that’s not custom ordered. All material costs are tracked for each individual furniture item and recorded as Merchandise Inventory. Labor and overhead costs aren’t included in the valuation. These are taken into account when the furniture is marked up to its sale price. The Specific ID inventory method is used to value the inventory. At the end of each period, a physical inventory (specific ID) is taken for control purposes. When an item from Merchandise Inventory is sold, the sale is recognized with a journal entry and an additional journal entry is made to transfer the furniture item that was sold out of Merchandise Inventory to COGS.

However, a large portion of the business is custom-made furniture that requires a 50% down payment, with the remaining balance payable upon delivery (unless credit has been extended to the client). Each custom order is assigned a job number. Sales Revenue is recognized with each payment, and all material costs are expensed to Purchases using that job number.

Office Supplies Inventory consists of supplies used in the general course of business. It uses a periodic inventory method. At the end of each period, a physical inventory is taken and the value of the inventory is determined. The book value of the inventory is then adjusted to that physical amount.

Prepaid Rent is paid at the beginning of each year in the amount of $12,000.00 for the 12-month period.

Vehicles, Equipment, and Office Furniture and Equipment are depreciated according to a Schedule of Depreciation approved by or provided by Jeremy Grant. Any asset purchases will be put to one of these accounts and reported to Jeremy at the end of each quarter. Depreciation entries are made at the end of each period according to the schedules.

A/P is paid on time within the grace period unless otherwise specified to take advantage of discounts. Each week, the Schedule of Accounts Payable will be reviewed by Ian for payment of invoices.

Payroll is calculated on a biweekly basis. The payment is made on the following Friday. Due to Janet Adams leaving the company, no accrual entry was made at the end of November 20XX.

Federal Withholding Taxes (941 Form), which includes FWT, Social Security, and Medicare, are paid on or before the fifteenth of the month for the previous month.

State Withholding Taxes and City Withholding Taxes are paid on or before the twentieth of the month for the previous month.

FUTA and SUTA are paid on a yearly basis, and are due on or before the end of January of the next year.

Sales Tax is due on or before the twentieth of the month for the previous month. Currently, no clients are tax exempt. A client will need to provide a valid Sales Tax Exemption Certificate to be kept on file in order for Basswood Furniture not to charge sales tax.

Ian Smith will inform you as to when and how much capital he will withdraw from the company.

Expense and Revenue Summary is the same as Income Summary and is used as a wash, or pass-through, account. (A wash or pass-through account is an account whose balance should always be zero. In the closing process, the revenues, expenses, and withdraw account amounts are transferred into the expense and revenue summary account and then immediately transferred out to the capital account, keeping the balance in the expense and revenue summary account at zero. The balances are “passed through” the account.)

TipsAll forms and documentation for the project are provided in the Documents and Forms booklet. Documents will be referred to by form number, which appears in the upper left-hand corner of the document. An ample supply of blank forms has been provided to complete the project. If you feel you’ve made a mess of the books and wish to start all over but don’t have enough blank forms, then use notebook or copy paper. The lines on the paper don’t matter as long as the format is correct. No additional forms will be provided. There are enough forms to complete the project as intended. (If desired, make copies of the blank forms and documents before beginning the project.)

When doing math for the project, try not to use a hand-held calculator unless you absolutely have to. Instead, use a printer calculator, or better yet, an Excel spreadsheet. Enter the figures to be added in one column and sum them up. Do the same thing again in a second column. Both totals should match. If they don’t, enter the figures a third time and sum them up. Two out of the three totals should match. Don’t just assume that the matching totals are correct. Go back over the columns to see why the totals were different in the first place.

Using a hand-held calculator and just adding up the figures in a column one time leads to very error-prone results. Bookkeeping is designed to have debits always equal credits. Whether the entry you made is right or wrong is irrelevant when it comes to debits equaling credits. If you make a wrong entry, you should have a wrong debit that’s the same as the wrong credit. A bookkeeper who is always “off” isn’t accurate and won’t have work for long. Therefore, use a printer calculator or Excel spreadsheet so you can see what you entered, and run the numbers more than once.

Part B—Specific Instructions Steps for Completing the ProjectThe following are the specific steps for completing the project. It’s assumed that you’ve obtained the knowledge to complete the steps from your previous coursework. For example, when working with the payroll steps, it’s assumed that you know how to do payroll. (Only the data will be presented.) If you’re not sure as to what you should do with the payroll information, go back over your lessons and workbooks relating to payroll.

While the instructions provided lead you step-by-step through the process of an accounting period from start to finish, if you’re not sure what to do next or where you are in the process, then call and speak with an instructor. Remember, the instructors can help with the process, but not the specifics of the project. Instructors can’t help with what journal entries to make, how to make calculations, etc.

At this point, you should have read through this assignment thoroughly, and have a good understanding of what needs to be done to complete the project. Doing this will go a long way towards making the project easier for you. You’re now ready to begin.

Fill out an Employee’s Withholding Allowance Certificate (Form 1) for yourself. Every new employee must fill out this form and sign it when hired to determine how much federal withholding tax will be held from the employee’s paycheck. For purposes of this project, on Line 3 you’ll select “Single” for your marital status. On Line 5, you’ll use 0 (zero) allowances. No additional amount will be withheld on line 6.

Create the A/R accounts in the Accounts Receivable Subsidiary Ledger. In the Subsidiary Ledger, locate the section of blank forms for the Accounts Receivable. Write in the account name and account number on a blank form for each A/R account. Enter in the beginning balances for each account. Make sure the total of the beginning balances in the subsidiary ledger matches the balance of the A/R account on the G/L Trial Balance.

Do the same for the Accounts Payable Subsidiary Ledger accounts.

Open the G/L accounts by locating the section in the General Ledger booklet, entering the account name and account number on each blank form. Enter the beginning balances from the G/L Trial Balance in each account. Make sure the total of the debits for the beginning balances in the G/L accounts matches the total of the debits on the trial balance and that the total of the credits matches the total of the credits on the trial balance.

Enter the balance in the Cash G/L account in the Balance Brought Forward field of the check register, toward the end of the Documents and Forms booklet next to Check No. 2260.

Process the transactions for the month of December laid out in the following section, making journal entries, posting to the G/L accounts, and completing the forms or paperwork where necessary.

Thursday, December 1, 20XX

Received a bill (Form 2) from Hemlock Gas and Electric Co. in the amount of $137.89 on account. Make the journal entry for receipt of the bill and post to the proper G/L and subsidiary accounts.

Received a bill (Form 3) from the Atlantic Telephone Co. in the amount of $232.64 on account. Make the journal entry for receipt of the bill and post to the proper G/L and subsidiary accounts.

Received Check No. 268 (Form 4) in the amount of $7,580.00 for payment in full from Liya Designs. Make the journal entry for receipt of the check and post to the proper G/L and subsidiary accounts.

Friday, December 2, 20XX

Received Check No. 1231 (Form 5) in the amount of $6,437.00 for payment in full from Yu Wei Creations. Make the journal entry for receipt of the check and post to the proper G/L and subsidiary accounts.

Complete a deposit ticket (found in the Documents and Forms booklet), dating it December 2, 20XX, and include the checks received from Liya Designs and Yu Wei Creations. On the back of each check, to endorse the checks for deposit, you would write “For Deposit Only, Account # 309921” and then take the deposit to the FCU (Federal Credit Union) where Basswood Furniture does its banking. (Naturally, since this is a simulation, you won’t actually make a deposit.) Record the amount deposited in the Check Register. Total the amount in the check register.

Verify the posting of all of the journal entries to the G/L accounts and subsidiary accounts for the week. Verify the amount on the check register is the balance in the G/L Cash account. Any discrepancies need to be corrected.

Monday, December 5, 20XX

Wayne Shriver and Ian met today to discuss making custom dining room, living room, and bedroom sets. The contract amount is for $28,500.00 (including sales tax), to be delivered by the end of the month (December 31). Contracts are kept by Ian. Wayne gave Ian Check No. 10178 in the amount of $14,250.00 (Form 6) for the 50% down payment, with the remainder to be paid in full upon delivery. This will be Job #132 for reference purposes. The down payment will be used to cover the purchase of the materials needed. The down payment, even though it’s not the full amount of the sale, will be recognized as revenue with a journal entry. (If the final payment isn’t received, the furniture won’t be delivered and the furniture will then become merchandise inventory.)

Note: This transaction can be difficult to figure out what journal entry(s) need to be made. The best way to think about it is two-fold. First, think about making a journal entry for the sale. Do not be concerned about the cash. Make the journal entry for the sale on account. Then make a journal entry for the receipt of the cash and apply it against the account. After the receipt of the cash, there's still a balance owed left on the account. This is why it's easier to think of this transaction by making two journal entries instead of combining them into one. This is no different than, as an example, someone buying a sweater for $100 on account. Then two weeks later that customer sends a partial payment for $30 in the mail. In thinking about the Wayne Shriver transaction, a journal entry is made for the sale on account, with the only difference being that instead of two weeks later receiving a partial payment, the "deposit" is the partial payment and is being received almost immediately instead if two weeks later in the mail.Received Check No. 501 (Form 7) in the amount of $200.00 for partial payment from Sam Little. Make the journal entry for receipt of the check and post to the proper G/L and subsidiary accounts.

Billie Redmond sold one wine rack to Michael’s Furniture in the total amount of $1,325.00 on account (Form 8). Make a journal entry to record the sale and make a journal entry to remove the cost of the wine rack from inventory and put it to COGS. You should also adjust the Merchandise Inventory Valuation whenever you make a journal entry that affects the Merchandise Inventory account. This acts as a check. The balance on the valuation should be the balance of the G/L account. Both should be the same balance as the inventory valuation when a physical inventory is done at the end of the accounting period.

Tuesday, December 6, 20XX

Billie Redmond went to Tom Baker to purchase the materials needed for the Shriver furniture (Job #132). The total invoice amount for the purchase was $5,700.00 (Form 9). The purchase was made on account. Make the journal entry for the purchase of the materials to the Purchase G/L account.

Tuesday is the day Ian likes to cut checks for payment of A/P accounts. First thing in the morning, you print out the Schedule of Accounts Payable and put it on his desk so he can decide which ones he would like to have paid. You also write on the schedule the balance that’s in the checking account based on the amount in the check register. Today, Ian would like you to pay the balances in the following accounts:

Hemlock Gas and Electric Co.

The Home Improvement Center

Atlantic Telephone Co.

Two Guys Hardware

Cheryl Wood Designs

Beginning with Check No. 2260, write consecutive checks for each A/P account in the correct amount, adjust the check register accordingly, and place the checks on Ian’s desk for his signature. When he returns the checks to you, you’ll mark the invoices as paid and mail a copy of the invoices with the checks to the vendors. (For purposes of this project, it has been assumed that you have the invoices making up the amounts in the accounts and that they’re correct, even though you don’t have the details for November 20XX.) Make the correct journal entries for payment of the accounts and post to the proper G/L and subsidiary accounts.

Wednesday, December 7, 20XX

Ian sold one end table for cash in the total amount of $291.50 to Jack Williams (Form 10). Make a journal entry to record the sale and make a journal entry to remove the cost of the end table from inventory and move it to COGS.

Betty Gable went to an office supplies store on her lunch break with Ian’s approval and purchased a printer cartridge for the office copier using her own cash. The purchase was in the total amount of $31.79. You’ll reimburse her from petty cash using a Petty Cash Voucher (Form 11). Complete the voucher. (You would normally attach the receipt to the voucher and file it in the petty cash box and have Betty sign the voucher.) Record the voucher on the Petty Cash Payments Record found in the Documents and Forms booklet under the correct account.

Received Check No. 421 (Form 12) in the amount of $860.00 for payment in full from Donna Bigelow. Make the journal entry for receipt of the check and post to the proper G/L and subsidiary accounts.

Thursday, December 8, 20XX

Ian met with Janet Martinez. She signed a contract for a custom-built table and chair to be used in her hallway. The amount was $1176.60 (including sales tax). The furniture is to be delivered in one week. Janet paid cash in full (Form 13). This will be Job #133 for reference purposes. Make the journal entry for the sale and post to the proper G/L accounts.

Billie placed an order with Everything Wood for the purchase of exotic wood for Janet Martinez. Everything Wood faxed a copy of the invoice for approval and acceptance (Form 14) of the invoice on account. They’ll ship the wood overnight. Make the journal entry for the receipt of the invoice and post to the proper G/L and subsidiary accounts.

Ian felt the need for a better air ventilation/dust collection system. He went over to Rocker Woodcraft to purchase a system, taking Check No. 2265 with him. He brought back the dust collection system and the invoice from Rocker Woodcraft (Form 15). He wrote the check in the amount of $750.00 as partial payment, with the remaining to be billed to Basswood Furniture on account. The dust collection system is an asset. Its useful life will be three years, with a residual value (salvage value) of zero. Record the journal entry for the invoice in the correct G/L accounts and create a new subsidiary ledger account for Rocker Woodcraft. Create a Schedule of Depreciation for the asset, assuming straight-line depreciation. (The purchase of the system is being made on the eighth of the month. According to GAAP, because the purchase is made before the fifteenth of the month, the depreciation of the asset can be recognized from the beginning of the month. Therefore, for depreciation purposes, at the end of the accounting period, you’ll recognize one month’s worth of depreciation for December as if the asset was purchased on the first of the month.) At the end of the accounting period, you’ll provide Jeremy Gates with the asset information and schedule so that he can review it and make any changes if necessary.

Friday, December 9, 20XX

The following time cards were given to you during the week for you to calculate the payroll for the period ending 12/02/20XX.

| Time Card | |

| Name: | Ian Smith |

| P/E: | 12/2/XX |

|

| |

| Date | Hours Worked |

| 11/21 |

|

| 11/22 |

|

| 11/23 |

|

| 11/24 |

|

| 11/25 |

|

| 11/28 |

|

| 11/29 |

|

| 11/30 |

|

| 12/1 |

|

| 12/2 |

|

| Total Hours |

|

| Salary | $ 2,500.00 |

| Time Card | ||

| Name: | Billie Redmond | |

| P/E: | 12/2/XX | |

|

| ||

| Date | Hours Worked | |

| 11/21 | 8.0 |

|

| 11/22 | 8.0 |

|

| 11/23 | 8.0 |

|

| 11/24 | 8.0 | Holiday |

| 11/25 | 8.0 |

|

| 11/28 | 8.0 |

|

| 11/29 | 8.0 |

|

| 11/30 | 8.0 |

|

| 12/1 | 8.0 |

|

| 12/2 | 8.0 |

|

| Total Hours | 80.0 |

|

| Time Card | ||

| Name: | Betty Gable | |

| P/E: | 12/2/XX | |

|

| ||

| Date | Hours Worked | |

| 11/21 | 8.0 |

|

| 11/22 | 8.0 |

|

| 11/23 | 8.0 |

|

| 11/24 | 8.0 | Holiday |

| 11/25 | 8.0 |

|

| 11/28 | 8.0 |

|

| 11/29 | 8.0 |

|

| 11/30 | 8.0 |

|

| 12/1 | 8.0 |

|

| 12/2 | 8.0 |

|

| Total Hours | 80.0 |

|

| Time Card | ||

| Name: | Yourself | |

| P/E: | 12/2/XX | |

|

| ||

| Date | Hours Worked | |

| 11/21 | 0.0 |

|

| 11/22 | 0.0 |

|

| 11/23 | 0.0 |

|

| 11/24 | 0.0 | Holiday |

| 11/25 | 0.0 |

|

| 11/28 | 0.0 |

|

| 11/29 | 0.0 |

|

| 11/30 | 0.0 |

|

| 12/1 | 8.0 |

|

| 12/2 | 8.0 |

|

| Total Hours | 16.0 |

|

Complete an Employee Earnings Record for each employee and the Payroll Register for the payroll period using the payroll information provided to you by Ian on the first day you went to work for him. Write a check payable to each employee for their net pay, beginning with Check No. 2266, and complete the attached check register. Place the checks on Ian’s desk for his signature and distribution to the employees. Ian will also be informing the employees that since the next pay date is December 23 and the business will be closed for the holiday, checks will be distributed on Monday, December 26 instead of December 23. Make and post the journal entry for the employees’ payroll. Make and post the journal entry to record the additional payroll expense to the employer for the employer’s portion of Social Security, Medicare, FUTA, and SUTA using the tax expense account.

Make the deposit for the week. Complete a deposit ticket for the checks received from Wayne Shriver, Sam Little, and Donna Bigelow, plus the cash received during the week for cash sales. Record the amount deposited in the Check Register. Total the amount in the check register.

Verify the posting of all of the journal entries to the G/L accounts and subsidiary accounts for the week. Verify the amount on the check register is the balance in the G/L Cash account. Any discrepancies need to be corrected.

Monday, December 12, 20XX

Received Check No. 511 (Form 16) in the amount of $225.00 for payment in full from Sam Little. Make the journal entry for receipt of the check and post to the proper G/L and subsidiary accounts.

Received Check No. 42 (Form 17) in the amount of $925.00 for payment in full from Kenny Refinishing. Make the journal entry for receipt of the check and post to the proper G/L and subsidiary accounts.

Billie sold two end tables and a coffee table to Quality Furniture in the total amount of $996.40 on account (Form 18). Make a journal entry to record the sale and make a journal entry to remove the cost of the furniture from inventory and move it to COGS. Post to the G/L.

Billie drove to Carol’s Wood Supplies and purchased on account (Form 19) materials to build the following items for merchandise inventory: 2 each DSK-0001 Desk and BCS-0001 Bookcase, and 1 FLK-0001 Footlocker. Record the items in inventory, make a journal entry for the purchase on account, and post it to the G/L.

Ian discussed advertising and marketing with John Powell from Powell Marketing, Inc. During the meeting, Ian wanted you to write out a check to Powell Marketing, Inc. in the amount of $1,325.00 for billboard advertising during the rest of the month of December. You wrote Check No. 2270 for that amount, using it as the invoice and receipt. After adjusting the check register, you then made a journal entry and posted it to the G/L.

Tuesday, December 13, 20XX

Tuesday is the day to cut checks for payment of A/P accounts. You print out the Schedule of Accounts Payable and give it to Ian so he can decide which accounts to pay. You also write on the schedule the balance that’s in the checking account based on the check register. Today, Ian would like you to pay the balances in the following accounts:

Carol’s Wood Supplies (only the amount in the account as of the end of November)

Woodworker Supplies

Everything Wood (only the amount in the account as of the end of November)

Wood Imaginations

Beginning with Check No. 2271, write a check for each account in the correct amount, adjust the check register accordingly, and place the checks on Ian’s desk for his signature. When he returns the checks to you, you’ll mark the invoices as paid and mail a copy of the invoices with the checks to the vendors. (For purposes of this project, it has been assumed that you have the invoices making up the amounts in the accounts and that they’re correct even though you don’t have the details for November 20XX.) Make the correct journal entries for payment of the accounts and post to the proper G/L and subsidiary accounts.

Due to the excellent performance of the company this year, Ian has decided to give each employee (including himself) a bonus of $1,500.00. (You will also get a bonus even though you haven't been with the company for very long.) He has instructed you to issue a special payroll tomorrow. (A bonus amount is treated the same a gross pay amount.)

Pete Schwab, a friend of Ian’s, stopped in the shop to see Ian. On his way out, Billie helped Pete load a dining room set into Pete’s truck. Ian presented you with a check (Form 20) in the amount of $9,155.75 from Pete as payment in full for the purchase of DRS-0009 Dining Room Set. The dining room set retails for $17,275.00; however, Ian gave Pete a 50% discount. Make a journal entry to record the sale (don’t forget about the discount) and make a journal entry to remove the cost of the furniture from inventory and move it to COGS. Post the entries to the G/L.

Wednesday, December 14, 20XX

Prepare the payroll for the holiday bonus. (Use the bi-weekly Federal Withholding Chart for FWT.) Write a check payable to each employee for their net pay, beginning with Check No. 2275, and complete the attached check register. Place the checks on Ian’s desk for his signature and distribution to the employees. Make and post the journal entry for the employees’ payroll. Make and post the journal entry to record the additional payroll expense to the employer for Social Security, Medicare, FUTA and SUTA.

Received Check No. 149 (Form 21) in the amount of $125.00 for payment in full from Jim and Pearl Jones. Make the journal entry for receipt of the check and post to the proper G/L and subsidiary accounts.

Clean-It-Rite cleaning service performed the monthly cleaning of the offices and shop. Ian paid the invoice (Form 22) with Check No. 2279 in the amount of $275.00. Make the journal entry as a miscellaneous expense and post the entry to the G/L.

Delivered custom furniture for Janet Martinez on Job #133.

Thursday, December 15, 20XX

Tomorrow, Ian is treating all employees and their families to a holiday party. Therefore, daily work that would normally be done tomorrow will need to be completed today.

Federal payroll withholding taxes need to be paid by the fifteenth of the month for the previous month’s withholdings. The federal withholding tax (commonly referred to as the 941 Tax) consists of the FWT withheld from the employees and FICA. It’s submitted using Form 8109. FICA is made up of the Social Security and Medicare withholdings from the employees and the matching amounts from the employer. The amount to be paid is for the previous month—November 20XX. Look at the entries made in the G/L accounts to determine the amounts that need to be paid. (Don’t just look at the balance in the accounts. If you assume the balance of the G/L account is the amount to be paid, you’ll be incorrect. Most likely, the balance includes a payroll entry for the current month along with the balance from the previous month. Once a mistake is made, it can take up to two years of going back and forth with the government to get the error corrected.)

Complete Form 8109 (Form 23), writing in the amount of the deposit and the company’s EIN number, which is 40-37462. (Form 8109 acts as a deposit slip for the tax. When you complete the form and write the check, you’ll take it to the bank to make the deposit—“deposit” in this case meaning a withdrawal from your checking account and deposit into the government’s account.) Color in the tilted oval next to “941” as the Type of Tax and the quarter that the tax period pertains to (November is in the fourth quarter). Write Check No. 2280, payable to “U.S. Treasury,” for the amount to be deposited. Be sure to write the EIN, type of tax, and tax period on the check. This deposit must be stamped by the fifteenth of the month. This is a high priority, since today is the fifteenth. Waiting until tomorrow will incur substantial penalties and interest.

Make the bank deposit, including the checks and/or cash received during the week. Record the amount deposited in the Check Register. Total the amount in the check register.

Pennsylvania Sales Tax is to be remitted to the state by the twentieth of every month in the amount collected for the previous month—in this case, November 20XX. Just as you did with remitting the federal payroll taxes for the previous month, you need to look at the entries in the G/L account and determine the total amount that was collected for the month of November. Complete the PA Dept. of Revenue Sales Tax Collection Bureau form (Form 24). Use it to make the journal entry and post the entry to the G/L. Payment of the sales tax will be done electronically through the government’s Web site. In the checkbook, void Check No. 2281 and complete the check register showing the payment to the “PA Dept. of Revenue—ETF” for the amount of the remittance. (ETF stand for “Electronic Transfer Funds.”)

Verify the posting of all of the journal entries to the G/L accounts and subsidiary accounts for the week. Verify that the amount on the check register is the balance in the G/L Cash account. Any discrepancies need to be corrected.

Friday, December 16, 20XX

The holiday party was wonderful. The only work required for the day is to reimburse Ian $187.50 for the receipts he provided you for having the party catered, out of petty cash.

Create a petty cash voucher (Form 25) and make the entry to the Petty Cash Payments Record.

December 19–23, 20XX

The business is closed for the week before Christmas.

Monday, December 26, 20XX

The following time cards were given to you during the week for you to calculate the payroll for the period ending 12/16/20XX.

Complete an Employee Earnings Record and the Payroll Register for the payroll period ending 12/16/XX. Write a check payable to each employee for their net pay, beginning with Check No. 2282, and complete the attached check register. Place the checks on Ian’s desk for his signature and distribution to the employees. Make and post the journal and the additional payroll tax expense to the employer.

| Time Card | |

| Name: | Ian Smith |

| P/E: | 12/16/XX |

|

| |

| Date | Hours Worked |

| 12/5 |

|

| 12/6 |

|

| 12/7 |

|

| 12/8 |

|

| 12/9 |

|

| 12/12 |

|

| 12/13 |

|

| 12/14 |

|

| 12/15 |

|

| 12/16 |

|

| Total Hours |

|

| Salary | $ 2,500.00 |

| Time Card | ||

| Name: | Billie Redmond | |

| P/E: | 12/16/XX | |

|

| ||

| Date | Hours Worked | |

| 12/5 | 8.0 |

|

| 12/6 | 8.0 |

|

| 12/7 | 8.0 |

|

| 12/8 | 8.0 |

|

| 12/9 | 8.0 |

|

| 12/12 | 8.0 |

|

| 12/13 | 8.0 |

|

| 12/14 | 8.0 |

|

| 12/15 | 8.0 |

|

| 12/16 | 8.0 |

|

| Total Hours | 80.0 |

|

| Time Card | ||

| Name: | Betty Gable | |

| P/E: | 12/16/XX | |

|

| ||

| Date | Hours Worked | |

| 12/5 | 8.0 |

|

| 12/6 | 8.0 |

|

| 12/7 | 8.0 |

|

| 12/8 | 8.0 |

|

| 12/9 | 8.0 |

|

| 12/12 | 4.0 |

|

| 12/13 | 4.0 |

|

| 12/14 | 4.0 |

|

| 12/15 | 4.0 |

|

| 12/16 | 8.0 |

|

| Total Hours | 64.0 |

|

| Time Card | ||

| Name: | Yourself | |

| P/E: | 12/16/XX | |

|

| ||

| Date | Hours Worked | |

| 12/5 | 8.0 |

|

| 12/6 | 8.0 |

|

| 12/7 | 8.0 |

|

| 12/8 | 8.0 |

|

| 12/9 | 8.0 |

|

| 12/12 | 8.0 |

|

| 12/13 | 8.0 |

|

| 12/14 | 8.0 |

|

| 12/15 | 8.0 |

|

| 12/16 | 8.0 |

|

| Total Hours | 80.0 |

|

Ian met with Fran Ogilvy from The Capitol Media Group, Inc. about television advertising for the next quarter, January 1 through March 31, 20XX. Ian wrote Check No. 2286 in the amount of $8,725.00 to The Capitol Media Group, Inc. in payment of the invoice (Form 26) for the prepaid advertising. You’ll need to create a new G/L account #145 for Prepaid Advertising. Journalize and post the entry, completing the check register.

Reimburse the petty cash by writing Check No. 2287 for the total amount of the receipts in the Petty Cash Payments Record, making the check payable to “Cash.” Journalize the entry from the Petty Cash Payments Record and post it to the G/L accounts. Cash the check at the FCU and replenish the cash in the petty cash box. The amount of cash in the box should be the imprest amount.

Tuesday, December 27, 20XX

Print out the Schedule of Accounts Payable and give it to Ian so he can decide which accounts to pay. You also write on the schedule the balance that’s in the checking account based on the check register. Ian has decided not to pay any of the A/P this week.

Received Check No. 631 (Form 27) in the amount of $1,234.00 for payment in full from Elizabeth Dante. Make the journal entry for receipt of the check and post to the proper G/L and subsidiary accounts.

Received Check No. 11304 (Form 28) in the amount of $350.00 for payment in full from The Antique Shoppe. Make the journal entry for receipt of the check and post to the proper G/L and subsidiary accounts.

Wednesday, December 28, 20XX

Received Check No. 172 (Form 29) in the amount of $50.00 for payment in full from Andy Mellow. Make the journal entry for receipt of the check and post to the proper G/L and subsidiary accounts.

Delivered the custom furniture to Wayne Shriver for Job #132 (Form 30). Received payment for the invoice (Form 31) with Check No. 10769 in the amount of $14,250.00. Since the down payment was already received and a journal entry already made to recognize that portion of the sale, make the journal entry for receipt of the check and post to the proper G/L accounts.

Ian wishes to make a withdrawal from his capital account. He presents you with a memo (Form 32) for the withdrawal. You make Check No. 2288 payable to Ian Smith in the amount of $5,000.00 and use the memo to create and post the journal entry to the G/L.

Thursday, December 29, 20XX

Liya Adams from Liya Designs stopped by the store to return an end table. The cost to make the custom-built end table was $150.00. This end table will be added to Merchandise Inventory as Item No. ETB-0012. Ian agreed to issue her a credit memorandum (Form 33) and she agreed that the credit could be put on her account. Make the journal entry for the credit memorandum and post to the proper G/L and subsidiary accounts.

Note: This can be a difficult entry to make. You need to think through the transactions and the journal entries made to be able to come up with the correct journal entry. This is where using T-accounts as a tool helps. First, a sale was made that was on account. The cost of the materials for the custom-built furniture was paid for with a check and put against purchases to have the expenses match the revenues. These transactions occurred in November. The accounting period was closed and the profit transferred to the capital account. Then in December, the receivable was paid for with a check. Now the item is being returned and being entered into inventory. Instead of a check or cash, a credit to her account is being given.

This is a two-step process:Make a journal entry for the return of the item purchased.

Make a journal entry to add the item back into Merchandise Inventory.

Friday, December 30, 20XX

Today is the last working day in the accounting period. Therefore, there are a few things that need to be done to be able to close out the accounting period.

Note: For most businesses, the tasks will be similar. For example, physical inventories need to taken. However, each business will have its own set of tasks that will need to be done. Also, just because it’s the last day of the month doesn’t mean that the financial statements for the period end will be completed on that day. They’ll usually be completed sometime into the next period, depending upon the size of the business and the amount of work involved.

You inform Betty that she needs to take a physical inventory of all the merchandise that’s on hand, including the item number, a description of the item, and how many of the item are physically present. When she returns the form with the inventory, you’ll extend the costs of the merchandise and use it as your merchandise inventory valuation. This amount should be the same amount as the balance in the Merchandise Inventory account in the G/L. If it’s not the same, the discrepancy must be looked into and a correction made.

Note: The reason Betty, the secretary, is taking the inventory is for control purposes. If Billie takes the inventory, it’s too easy for her to put down the quantity of an item as, say, six, when only five are physically there because she stole one. This is only one small part of the control systems that accountants learn when getting their education.

You inform Billie that she needs to take a physical inventory of all of the office supplies that are on hand. When she returns the form with the inventory, you’ll extend the costs of the office supplies and use it as your office supplies valuation.

The following time cards were given to you during the week for you to calculate the payroll for the period ending 12/30/20XX. Since the employees won’t be paid for the pay period ending 12/30/20XX until January 6, 20XX, this information will be needed to make a payroll accrual adjusting entry when creating the financial statements and closing out the accounting period.

Note: When using timecards, on holidays, employees will have a tendency to write 8.0 hours to make sure they will be paid for the holiday even though they will have the day off as a paid holiday. As a bookkeeper doing payroll, it's your responsibility to know what employees should be paid for regardless of what they put on their timecards. For Basswood, the business is closed and no one works on holidays. The employees will be paid straight time for the 8 hours as holiday pay. Only if they actually work those days (in the workplace you will know this by being informed about the situation) would the employee get paid time and a half or double time, depending upon what is warranted.

| Time Card | |

| Name: | Ian Smith |

| P/E: | 12/30/XX |

|

| |

| Date | Hours Worked |

| 12/19 |

|

| 12/20 |

|

| 12/21 |

|

| 12/22 |

|

| 12/23 |

|

| 12/26 |

|

| 12/27 |

|

| 12/28 |

|

| 12/29 |

|

| 12/30 |

|

| Total Hours |

|

| Salary | $ 2,500.00 |

| Time Card | ||

| Name: | Billie Redmond | |

| P/E: | 12/30/XX | |

|

| ||

| Date | Hours Worked | |

| 12/19 | 8.0 | Holiday |

| 12/20 | 8.0 | Holiday |

| 12/21 | 8.0 | Holiday |

| 12/22 | 8.0 | Holiday |

| 12/23 | 8.0 | Holiday |

| 12/26 | 8.0 |

|

| 12/27 | 8.0 |

|

| 12/28 | 8.0 |

|

| 12/29 | 8.0 |

|

| 12/30 | 8.0 |

|

| Total Hours | 80.0 |

|

| Time Card | ||

| Name: | Betty Gable | |

| P/E: | 12/30/XX | |

|

| ||

| Date | Hours Worked | |

| 12/19 | 8.0 | Holiday |

| 12/20 | 8.0 | Holiday |

| 12/21 | 8.0 | Holiday |

| 12/22 | 8.0 | Holiday |

| 12/23 | 8.0 | Holiday |

| 12/26 | 4.0 |

|

| 12/27 | 4.0 |

|

| 12/28 | 4.0 |

|

| 12/29 | 4.0 |

|

| 12/30 | 8.0 |

|

| Total Hours | 64.0 |

|

| Time Card | ||

| Name: | Yourself | |

| P/E: | 12/30/XX | |

|

| ||

| Date | Hours Worked | |

| 12/19 | 8.0 | Holiday |

| 12/20 | 8.0 | Holiday |

| 12/21 | 8.0 | Holiday |

| 12/22 | 8.0 | Holiday |

| 12/23 | 8.0 | Holiday |

| 12/26 | 8.0 |

|

| 12/27 | 8.0 |

|

| 12/28 | 8.0 |

|

| 12/29 | 8.0 |

|

| 12/30 | 8.0 |

|

| Total Hours | 80.0 |

|

Make the bank deposit. Record the amount deposited in the Check Register. Total the amount in the check register.

Verify the posting of all of the journal entries to the G/L accounts and subsidiary accounts for the week. Verify the amount on the check register is the balance in the G/L Cash account. Any discrepancies need to be corrected.

Monday, January 2, 20XX

You’ll begin to close out the end of the accounting period for December. To do this you’ll be using the blank forms in the Documents and Forms booklet. You’ll use the Worksheet and then use the forms provided for creating the financial statements.

On Friday, December 30, you should have made sure that you posted all the entries in your journal to the G/L accounts. If this hasn’t been done, then you must do it now. Once done, total the balances in the G/L accounts.

Create a 10-column Worksheet. (Review the lessons for Financial Reports along with the associated accounting practices in the workbook for completing the Worksheet if you’re unsure as to what you need to do.) The first two columns should be labeled Trial Balance. The next two should be labeled Adjustments. The next are Adjusted Trial Balance, Income Statement, and Balance Sheet. Each set of columns will have a debit and a credit column. Down the left side of the worksheet list all the G/L accounts and put their balances in the appropriate debit or credit column under Trial Balance. These are your Pre-Adjusted Trial Balance figures. Foot (total) the debit column and credit column. Your debits must equal your credits.

If your debits don’t equal your credits, then you’ve made a technical error somewhere. This error must be corrected before you can go any further. Often this is just a math error. (This is why it was suggested you use a printer calculator or Excel spreadsheet, to help you find math errors.) Subtract the two totals and come up with a figure. Then scan your work, looking through the journals and the general ledger accounts to see where the mistake may be.

Note: You should not start the project over. This is a waste of time, and can lead to further errors. If the error can’t be found by carefully looking over your work, then follow the procedure laid out below.

DEBITS EQUALING CREDITS ERROR DETECTION PROCEDUREIt’s important to realize that debits not equaling credits has nothing to do with whether the journal entries made are right or wrong. As an example, let’s say you pay rent in the amount of $1,100.00. The entry for this should be a debit to Rent Expense for $1,100.00 and a credit to Cash for $1,100.00. However, for whatever reason, the journal entry made is a debit to Rent Expense for $1,010.00 and the credit to Cash for $1,010.00. While this entry is wrong because it should be for $1,100.00, that’s irrelevant. The debit of $1,010.00 is equal to the credit of $1,010.00. Debits equaling credits is purely a mechanical/technical issue unrelated to the correctness of the journal entry made. Therefore, focus on the numbers while following these steps:

Get several different-colored highlighters and make a copy of the journals.

Set the original journals aside. You’ll use them only to make the correction when you’ve found a mistake.

Look at each journal entry. Look to see that the first entry has a debit equal to the amount of the credit. If they’re the same or equal for a multiple-line entry, take a yellow highlighter and highlight those numbers. Continue doing this for each and every journal entry. When you come across a journal entry that has multiple line items, such as the payroll entry, do the math several times when adding up the debit or credit. Do each and every journal entry this way. Don’t just add up the debits on the page and the credits on the page to see that they equal. You need to look at each journal entry.

If you find an error, correct the original copy of the journal and the associated G/L account. If the error is in the amount that makes your debits equal your credits, then you’re finished. If not, then you must continue on. Remember, just like a bank reconciliation, if you’re off by some amount there may be multiple errors that net out to that amount. Therefore, if you’re still off, keep looking.

If you’ve gone through all of the journals and have highlighted all the journal entries but haven’t found the error, then you’ll need to make a copy of the General Ledger. Put the original aside.

Using the copy of the highlighted journals and the copy of the G/L, take a different colored highlighter and begin checking the posting of the journal entries to the G/L accounts.

This time, you’re not looking at each entry. Instead, you’re looking at each line item of each entry. Look at your first journal entry and the first line item, which should be a debit (it should be a debit because when making correct journal entries, the debits are listed first before the credits) and look at the G/L account to which it was posted. Is it on the debit side of the account? Is it the same exact number? If the answer to these two questions is yes, then highlight the number in the journal and the number in the ledger signifying that it’s correct. Go through each and every line item in each and every journal entry, highlighting when the posting is correct.

If an error is found, correct it on the original. Again, if the correction brings the total debits back in line to equal your credits, you should be finished. If not, you must keep looking.

If you highlight all of the journal entries and their associated postings to the G/L accounts and haven’t found the error, it’s time to do the math to get the balances in the G/L accounts. In a G/L account, add up the debits several times. Add up the credits several times. Subtract one from the other, giving you a balance. Whichever total figure was greater, the debit or the credit, the balance goes on the greater side. If the balance is correct, then place a checkmark next to the figure. If an error was made, correct it on the original copy of the G/L.

If no error to the balances of the G/L accounts has been found, make a copy of the Worksheet and set the original aside. Get out another colored highlighter and begin with the first G/L account. Verify that the balance of the debit or the credit has been transferred to the Worksheet correctly—that is, it’s on the correct debit or credit side and in the correct amount. If so, then highlight the G/L account balance and the figure on the Worksheet. If not, make the correction on the original. If the correction brings the total debits back in line to equal your credits, you’re finished. If not, you must continue.

If you’ve highlighted all of the figures on the Worksheet, the last thing to do is to foot the debits and credits on the Worksheet several times for accuracy. The total amounts should be equal.

If you focus and follow this procedure, you should be able to find the error or errors and correct them.

Sometimes, you can get to the end of this procedure and still have your debits not equal the credits. If this happens, then you not only made an error when you were originally doing the books, but you also then made an error somewhere in doing the procedure and you should go back through it again, making fresh copies of the original books.

There’s no excuse for the debits not equaling the credits. This is the fundamental, underpinning rule of bookkeeping. Debits equaling credits goes a long way toward preventing “cooking the books.” It’s the foundation of financial statements and the basis of the accounting equation. The accounting equation is found on the Balance Sheet, and if it doesn’t balance, something is wrong and the statement has no credibility. If the financial statements are fudged to bring them into balance, this opens up the company to legal liabilities.

Assuming that the debits equal the credits in the Trial Balance columns of the Worksheet, making adjusting/ correcting entries is the next step in the process of closing out the period. In the workplace it’s usually the controller/accountant who handles the worksheet, making the adjusting journal entries, creating the financial statements, and making the entries to close out the accounting period. You’re doing these procedures to become familiar with the process. It’s also possible that the company will need financial statements for its own internal use. Instead of paying a CPA to create financial statements that will never be seen outside the company, they’ll look to you (especially if you’re a full-charge bookkeeper), to create those financial statements.

To make adjustments, look at each G/L account to make sure it’s correct. You start at the top of the Trial Balance and work your way down, account by account. If an adjusting entry does need to be made, it should be dated on the last day of the period (12/31/XX for the project) to have it go into the correct accounting period.

Is the G/L Cash—Business Checking account balance the same as the Check Register? If not, an adjusting entry might need to be made to correct the discrepancy.

The reason for the word “might” is because the Check Register must be reconciled to the Bank Statement for the period. In the workplace, you would do a bank reconciliation and make adjusting entries for things like service charges, NSF charges, errors in amounts, etc. However, for this project, we’re assuming that the balance in the Check Register is the same balance on the Bank Statement and no adjusting entry is needed if your G/L Cash account has the same balance as the Check Register. If not, then an entry would need to be made to correct the error. What you don’t do is go back and change the incorrect entry. Instead, you should make the adjusting entry with an explanation of the error and what this adjusting journal entry is doing to correct it. This is what you do whenever you’re correcting an error. You never just go back and change the original entry. Doing this violates GAAP.Is the Petty Cash imprest amount $500.00? If yes, then no adjusting entry needs to be made.

Create an Accounts Receivable Subsidiary Ledger Trial Balance. This is nothing more than a listing of the A/R accounts and the balances in those accounts with a total amount, similar to a G/L Trial Balance (T/B). (The same will be done for the Accounts Payable Subsidiary Ledger and G/L A/P account.) Are the balances in the Accounts Receivable Subsidiary Ledger Accounts correct? If not, then the error needs to be found and an adjustment made. If yes, is the total balance of the Subsidiary Ledger the same as the balance in the G/L A/R account? If so, then no adjusting entry needs to be made. If not, then the error needs to be found and an adjustment made.

Extend the value (calculate the total amount) of the Merchandise Inventory from the physical inventory Betty gave you as the Merchandise Inventory Valuation. This amount should be the same as the amount in the G/L Merchandise Inventory account. If not, an adjustment should be made. Note: Before making that adjusting entry, go back over the transactions for the month and look at those that affected Merchandise Inventory. At the beginning of the period, the amount in the G/L account was the same as the physical inventory at the end of the accounting period in November. Therefore, whenever an item was taken out of or put into the physical inventory, a journal entry should have been made to Merchandise Inventory. The balance in the account should have always matched the physical inventory because Basswood Furniture uses the specific ID method of inventory. (Specific ID is used when you can specifically account for each item. For example, in a car lot that has 10 cars in inventory, you know each specific car’s VIN. When the 2011 Cadillac gets sold, you know exactly which one should be removed from inventory and its cost. It’s not useful for something like keeping an inventory of M&Ms. How do you know which bag is sold or stolen?)

Extend the value of the Office Supplies Inventory from the physical inventory Billie gave you. The Office Supplies Inventory Valuation comes to $178.46. (You’re not being given the specific breakdown of the physical inventory. You’ll just use the figure of $178.46 as the value of the physical inventory. You don’t need to create the Office Supplies Inventory Valuation for the project.) Adjust the Office Supplies Inventory to the correct amount.

Rent was prepaid at the beginning of the year. Using the information provided to you when you first started working, make an adjustment to the Prepaid Rent.