Please Read Instructions: Identify revenue streams for the group's proposed solution, including the unit and volume being sold, and the price each unit will sell for. Outline sales projection conside

Strategic Business Proposal

For

For:

<Netflix>

<www.netflix.com>

Prepared On:

<Current Date>

Prepared By:

<Team Member Names>

Instructor Name:

<Instructor Name>

Executive Summary

Organizational Challenges

Three main organizational challenges Netflix is facing; subscriber growth, competition and rising content cost.

New subscriber development is as yet a fixated-on information point for Netflix financial specialists - and it could stay vexing as Netflix proceeds with its forceful surge into universal markets. Supporter development is a difficult to-conjecture metric in light of the quantity of moderately new Netflix markets, just as its dependence (to some degree) on the viral achievement of its shows, as Moody's Neil Begley disclosed to TheStreet in a meeting: "In a significant number of these nations they propelled just eighteen months back, and a great deal of the achievement is in how forcefully they market, and verbal," he said.

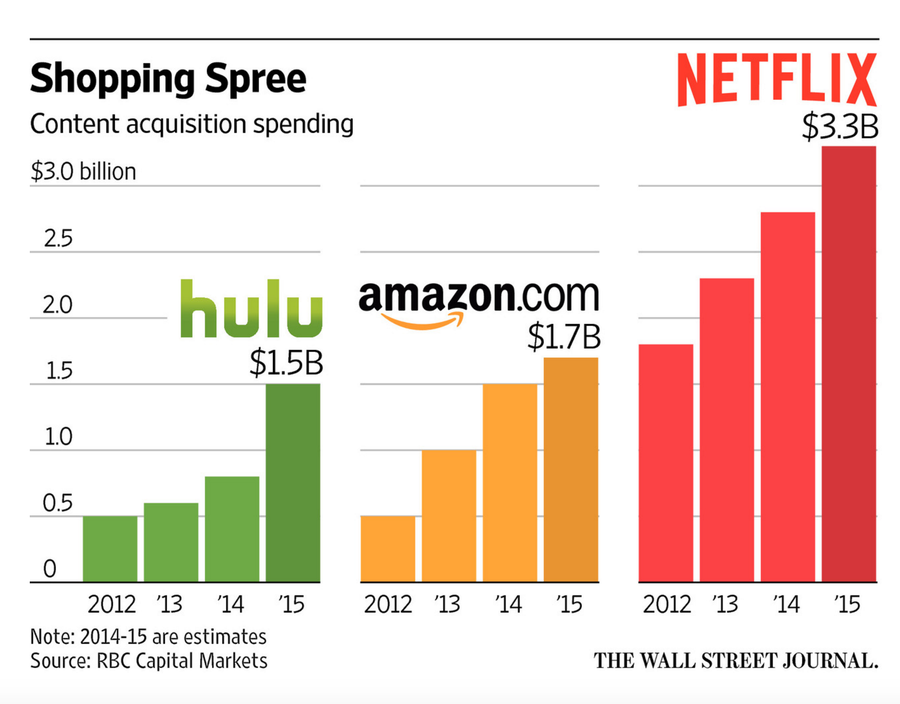

The biggest organizational challenge to Netflix is of the competitors. Growing competitors like Amazon Prime, Disney, HBO, YouTube etc. are a potential threat and a great challenge to Netflix. It is affecting its daily growth of subscribers and streaming. The potential for higher substance costs was exhibited as of late by the $100 million that Netflix supposedly paid to recharge it's permitting of 'Companions' through the finish of 2019 - up from the $30 million it had paid already.

However, it's not simply making or getting content that requires significant bucks to execute - it's likewise ensuring that substance gets seen. As Netflix expands its global extension one year from now, the expenses of propelling and advertising substance could likewise rise. As brought up by Pivotal in an ongoing exploration note, Netflix has north of $19 billion in spending responsibilities on content - and with Netflix as yet losing cash, it needs to show it can continue developing supporters at a rate that is comparable with the spending.

Proposed Solution

Netflix and Hulu should unite. I propose a merger, or, all the more decisively, that Netflix ought to obtain Hulu. Their all the more remarkable adversaries the country's link, satellite, and telephone organizations, also Amazon, Apple, and before long Google TV are hurrying to give Internet-empowered on-request TV and film administrations, something the two pioneers have done effectively for a couple of years at this point.

The joined organization could offer a compellingly modest elective that is certain to draw in those of us who are tired of forking over a fortune to the link fellow consistently. At the end of the day, everybody. This is the ideal time for HuFlix before contenders start acting responsibly and before Hulu and Netflix harm each other with the immediate crash course they're on. Hulu spent the late spring gradually seeing its Plus membership offering, which, for $9.99 every month, will let individuals observe full periods of their preferred shows on the iPad, iPhone, and such gadgets as Sony and Vizio TVs and Blu-beam players. Sound recognizable? Around 66% of Netflix's 15 million clients presently utilize the website's moment gushing support of watch motion pictures and TV shows on a wide assortment of media players, home theaters, Internet-empowered TVs, and game consoles.

During the previous hardly any months, Netflix has included a large number of new films and TV scenes to its index of gushing titles; truth be told, the organization evaluates that its mail business will top in 2013, and soon it will spend more on permitting bargains than it does on postage. Inside the following scarcely any years, if there's no merger, Netflix and Hulu will be for all intents and purposes unclear contenders. Hulu, specifically, probably won't endure a clash with the Netflix behemoth. Hulu was based on the guarantee of moment satisfaction at no charge, so what number of its 44 million month to month one of a kind clients (spilling more than 1 billion recordings every month, as per comScore) is it prone to enroll to Hulu Plus? Two percent? That is more than $100 million in yearly membership income, yet it can't contrast and Netflix's $2 billion yearly run rate and it won't fulfill speculators if Hulu follows through on its announced IPO plans.

In the interim, consider how Hulu could change your Netflix participation. Notwithstanding the customary DVD plan, endorsers would get an extended spilling list of current TV shows — something Netflix has had the option to do just in restricted portions. With Hulu, you'd have the option to play the shows on the most extensive conceivable exhibit of gadgets. The new firm could at present keep Hulu's free, advertisement bolstered part; it would be an extraordinary wellspring of additional income for Netflix and would let the organization acquaint its image with new clients.

The table on the accompanying page examines key stages of Netflix's worldwide methodology: Netflix has the potential to dominate the following period of amusement dispersion, yet they should absolutely defeat snags to do as such. Generally, one can see that new wonders made open doors for the achievement of new companies; as broadcasting supplanted radio.

2: Environmental ScanInternal Strengths & Weaknesses

Internal Strengths and Weaknesses

Popular and Original Content

With such high numbers, Netflix has a simple time anticipating content from numerous nations. The huge presentation is promising for organizations. Netflix frequently gets TV arrangements that have been dropped and left to decay. They make "continuations" or new seasons a long time after the first show finished. Like with Gilmore Girls, which had a Netflix extraordinary side project. Netflix initially spilled more seasoned shows like Friends, yet inside the most recent couple of years, has begun making their own unique substance. A significant number of which have become animating victories including Orange Is the New Black and Stranger Things. Not exclusively were these shows created with fascinating premises, you're ready to marathon watch the arrangement, as opposed to compelled to stand by every week for another scene like with customary TV programs. They're additionally fanning out additional into outside shows.

Global Streaming Approach

Netflix made a second season for a Japanese unscripted TV drama called Terrace House that has been a hit with global watchers. They've proceeded to recharge the arrangement a few times, permitting individuals who may never make a trip to these nations to get an impression. Also, shockingly, individuals are adoring it. They are basically the greatest brand name, and the main organization numerous clients consider when they hear the expression spilled content. This sort of introduction joined with their client base, permitted them to make their own arrangement. Marathon watching. This is an unimaginably engaging element to the huge number of individuals that needed to trust that another scene will be discharged.

No ad Policy

Expanding Operational expenses. The drawback of delivering your own substance at scale is that the creation costs go over the rooftop. The financial plan for 2018 as per the business analyst was around 13 billion dollars. Non-accommodating on the earth. Netflix has assembled a great deal of negative exposure since it has probably the most minimal positioning in ecological mindfulness contrasted with other large organizations like Amazon and Facebook. Not completely claiming the copyrights. This implies after a specific timeframe; the substance isn't only found on Netflix and clients can see it on a wide range of sites. Expanding its valuing.

Increasing Cost Membership Cost

Despite the fact that the cost is reasonable, Netflix has expanded since they initially propelled their administration. Most clients are worried about the possibility that the cost is going to increment again and again. The goal of the theory is to recommend the most reasonable demand-side-platform accomplices for the case organization, Pixel ads Media. The examination task is to investigate the key highlights of demand-side-platforms: their interfaces, revealing, streamlining capacities, bolster groups' proficiency, and joining prospects. Likewise, short depictions of the de-mand-side-platforms are provided. Desk research is implemented and auxiliary information is gathered from dependable sources. This technique is picked as it is considered the best way to get dependable data about the theme before managing the organizations.

Criticism surveys are dissected, and data concerning the required highlights are extricated and changed in an advantageous structure in order to see their solid and powerless perspectives. After this, a quantitative methodology, unmistakable statistics, is utilized so as to ascertain the outcomes in such a numerical way, that would clearly introduce the result. The outcomes show which demand-side-platforms have the biggest arrangement of highlights that were evaluated in a positive manner. Likewise, the outcomes are summarized in a table introducing the solid and powerless segments of the platforms.

Target Market

Numerous mainstream brands and administrations are increasing steadfast devotees, which are forming into enormous and trustworthy objective crowds. Netflix for instance has become an action word, however, it's presently a thing. It portrays a quite certain gathering of individuals with qualities that claim to organizations around the world. This might be astounding to numerous since Netflix appears to be a genuinely new organization, yet it's really been around for a long time (established in 1997). Alright, so here's the place the pleasant part begins. All things considered, Netflix's initial letter to investors isn't all acceptable. The letter takes note of that "a portion of the lockdown development will end up being pull-forward from the multi-year natural development pattern, coming about in more slow development after the lockdown is lifted nation-by-nation." The letter includes that administrators anticipate "survey to decay and participation development to decelerate as home containment closes, which we trust is soon." "At Netflix, we're intensely mindful that we are lucky to have help that is much increasingly significant to individuals limited at home, and which we can work remotely with an insignificant interruption in the short to medium term," the letter peruses. "Like other home diversion administrations, we're seeing incidentally higher survey and expanded enrollment development. For our situation, this is counterbalanced by a forcefully more grounded US dollar, discouraging our universal income, bringing about income as-estimate." Netflix is playing it safe right now in a questionable time, including "incidentally diminished the quantity of item advancements we attempt."

External Business Climate

Political

Political powers keep on developing in significance for tech organizations around the world. While Netflix is predominantly a spilling administration organization, it is additionally a tech organization and along these lines likewise subject to government examination like the other tech firms. Governments around the globe have fixed their grasp on the innovation organizations concerning their information assortment and different practices. In the European Union especially, the administration has taken a severe position against innovation brands enjoying anticompetitive conduct or focusing on clients through their information assortment rehearses. Contingent fair and square of guideline in each market, Netflix needs to tailor its administrations in like manner for every district. Another territory where the administration's job is featured with regards to worldwide tech organizations like Netflix is tax assessment. In numerous nations inside the EU, the legislatures are effectively considering new expense laws for such organizations which could fundamentally develop the duty risk of Netflix.

Economic

Financial factors likewise assume an immediate job with regard to universal business. Higher financial action and work level lead to higher spending on relaxation exercises and amusement, for as far back as quite a while, the presentation of the worldwide economy has stayed amazing which has brought about individuals around the globe spending more on administrations like Netflix. In any case, patterns have somewhat changed since the spread of the coronavirus, and keeping in mind that the financial movement around the globe has gone down, Netflix has encountered a critical ascent in its participation.

Social

Sociocultural variables are additionally assuming an inexorably significant job with regards to worldwide business and considering their significance organizations are making them a piece of their operational and showcasing procedure. Netflix is obliging a worldwide crowd and, in that capacity, it gets fundamental for the organization to focus on the shifting tastes and inclinations of individuals from various social orders and societies. This is the reason Netflix has brought content that traverses a few classifications and dialects. It offers a wide scope of substance appropriate for crowds of different ages and from various locales.

Technological

One of the most significant explanations for the quick flood in its prominence during the most recent quite a while is its attention to the client experience. The organization has kept on improving its UI to give the endorsers top tier experience. Innovation is the primary wellspring of the upper hand for Netflix. The organization utilizes different calculations and AI to suggest the shows and films worth viewing to singular supporters. This is the way the gushing brand has made a restrictive and interesting experience for its endorsers. Be that as it may, innovation isn't only a wellspring of upper hand however it is additionally driving higher rivalry in the business. Netflix contends with a few organizations including gaming, web-based life, and other web-based spilling administrations

Environmental

Ecological components are of importance with regards to almost every huge business which is on the grounds that how organizations sway the earth directly affects their social notoriety and brand picture. Each enormous brand puts resources into the earth including Netflix. Since Netflix is an organization whose whole business is worked online such organizations don't have an immediate and substantial ecological effect. In spite of that, all business forms identified with a huge and worldwide business can't be run without devouring assets. It is the reason Netflix tries to comprehend its ecological effect and limit it however much as could reasonably be expected. While its reliance on the earth for crude material is low still the brand devours power intensely in its tasks. In 2019, the organization utilized around 94,000 megawatt long periods of vitality legitimately. A piece of the vitality that the organization expands in its business tasks including its workplaces and studios just as the broadcast communications offices that are a piece of its substance conveyance arrange originates from non-inexhaustible sources thus so as to limit its ecological effect the organization coordinates that parcel with local sustainable power source testaments. Aside from that the organization additionally bolsters sustainable power source ventures in 20 nations and across 15 states in the United States. Aside from that the organization additionally endeavors to be as supportable as conceivable in its office activities. The manageability rehearses it has embraced over its workplaces incorporate decreased paper utilization just as giving additional food to the destitute.

Legal

Legitimate components will keep on assuming a significant job with regards to the innovation and computerized media outlet since the laws here are despite everything advancing and governments around the globe are taking a shot at building up a solid lawful structure to control the innovation business. An enormous number of tech players on the planet including tech pioneers like Apple, Google, Amazon, and Facebook have confronted countless bodies of evidence against them identified with anticompetitive conduct and client protection. A few of them including Google and Facebook have paid enormous fines. On account of Netflix, client security is one of the most significant concerns separated from the assurance of client information. Lawful consistency is presently more fundamental than any other time in recent memory for the innovation firms since resistance can bring about robust fines and furthermore cause serious harm to a brand's notoriety.

Business Opportunities

Netflix's advertising blend or 4P influences how such market entrance is accomplished. Besides, the online business has the chance to assorted variety, for example, by getting a corresponding firm that could improve generally speaking vital situating and achievement. In the SWOT examination system, this outside factor depends on economic situations just as hierarchical ability to enhance, accordingly requiring Netflix's corporate structure's sufficiency and backing.

Business Threats

Contenders and related business impersonation are a solid danger, as can be resolved through Porter's Five Forces examination of Netflix Inc. The rivalry is an outside key factor that, in this SWOT investigation, is an impediment toward amplifying the organization's incomes and gainfulness in the web-based spilling industry. What's more, theft compromises Netflix by permitting clients to expend pilfered content rather than the ones accessible through the organization's administration

Competitors

WarnerMedia's HBO Max and NBCUniversal's Peacock will dispatch in the coming months, adding to the heap of gushing administrations crowds are now browsing. HBO Max will make a big appearance at $15 every month in May. Peacock will dispatch in April for Comcast clients and completely dispatch in July and will offer different valuing levels.

The two administrations have just grabbed significant resources like "Companions" and "The Office" from Netflix for a huge number of dollars, while Netflix amplifies its record or unique substance. One such Netflix show is the uber-famous "The Witcher," which the organization said is on target to be its greatest debut ever.

Amazon Prime Video is exploring its way through the spilling space by multiplying down on classification ventures like "The Boys," "The Expanse," and "Ruler of the Rings." Hulu is profiting by being under the Disney umbrella with selective FX and Marvel ventures.

The newcomers Disney Plus and Apple TV Plus, which both propelled in November, got off to definitely various beginnings. The previous rounded up 10 million recruits per day in the wake of propelling and flaunts significant resources like "Star Wars" and Marvel. The last got looking rough so far with only a bunch of shows that got inferior audits. However, as of late hit an arrangement with previous HBO CEO Richard Plepler, who will create a unique substance for the administration.

Every one of these administrations offers something else and it's dependent upon crowds to choose what they need to pay for. We figured out the significant resources of Netflix, Hulu, Prime Video, HBO, Disney Plus, and Apple TV Plus underneath. Netflix has a champ on its hands with the dream arrangement, "The Witcher," in light of the novel arrangement by Polish creator Andrzej Sapkowski. Netflix said season one, which appeared a month ago, was its most sat in front of the TV debut ever with 76 million family units viewing in the initial a month. Netflix is now building up a "Witcher" anime film in front of season two.

In all actuality, Netflix changed its viewership measurements. Presently, it tallies a view if a record watches two minutes of a show or film. Yet, there's no denying that "The Witcher" is a beast of a hit. It's the most sought-after TV arrangement on the planet, as indicated by information from Parrot Analytics.

The achievement of "The Witcher" proposes Netflix's discharge technique, where it drops whole periods of a show on the double, is as yet economical against expanded rivalry, particularly since Netflix is an "increasingly loved brand and known amount in the gushing space," as indicated by Courtney Williams, the Parrot Analytics head of associations.

"More unusual Things" is another significant TV resource for Netflix. The gushing mammoth said that the arrangement, which appeared its third season in 2019, was its most well-known TV show of the year. It delighted in a 21-week streak at the head of Parrot Analytics' interest rankings in the US before it was outperformed by Disney Plus' "The Mandalorian."

Amazon

The greatest competitive danger to Netflix is most likely Amazon (AMZN). As of the final quarter of 2019, Amazon Prime Video had around 150 million supporters—a number that has been developing at a quick pace in the course of recent years as the organization has expanded creation of its unique substance.

YouTube was second in ubiquity as the most visited site. Despite the fact that it serves the world, a few nations, for example, China, Syria, and Pakistan have been obstructed from appreciating YouTube administrations. Thinking about its competitive favorable circumstances, the venture is probably going to concentrate on organizations or businesses identified with online media spilling while applying this serious development technique.

Disney

The understandings must not exclusively be made in light of the household market and its structure (concessions with other market administrators) yet in addition to the various dealings that content suppliers have procured in every one of the outer markets where Netflix additionally operates. The enormous supporter base furnishes you with the money related ability to offer for the substance in the arrangements with different merchants. This has implied that Netflix has gone from being one more window in the chain of business abuse of the content to possess a reference position.

3: Strategy Implementation: OperationsOrganizational Structure

This section should address how your proposed solution will impact the overall operations of the company and its business model. Identify the position or person who will lead this initiative, as well as the divisions and departments that will be involved and their key responsibilities. Consider how the organization needs to work together to make this successful. An organizational chart with responsibilities listed may be an effective alternative to writing a narrative here. Research and in-text citations are expected in this area. iBook reference – Chapter 4, pages 45 - 59

Once this section is complete, use the Expense tab on the Financial Workbook to list these items and a cost for the project budget.

Staffing Needs

Provide a brief description of any new employees needed to implement the solution, how many staff will be needed in each of those positions, and an estimated salary for each. You may want to present this information in a chart format. Research and in-text citations are expected in this area.

iBook reference – Chapter 4, pages 45 - 59

Once this section is complete, use the Expense tab on the Financial Workbook to list these items and a cost for the project budget.

Additional Operational Needs

Address any additional operational needs you will need to implement the solution. This may include a new location, equipment, manufacturing, software, construction, research and development, prototypes, facility builds or remodels, etc. Feel free to adjust the heading of this section to fit your specific needs. Research and in-text citations are expected in this area. iBook reference – Chapter 4, pages 45 - 59

Once this section is complete, use the Expense tab on the Financial Workbook to list these items and a cost for the project budget.

3: Strategy Implementation: MarketingPromotion Strategy

Select a minimum of three of the promotional categories available (check the iBook for options) and develop at least two marketing tactics for each category. You are not limited, rather you can do as many as you want. Select what is innovative, relevant to your idea, your target market, and your company. Explain how you will integrate these tactics with each other to create an integrated marketing campaign. Later in the month, you will be developing an example of your marketing campaign. Be creative and fun here – talk about tag lines, calls to action, and so forth. You are required to develop an example of your marketing campaign in the appendix section. Review and replace the sample in Appendix 4. Research and in-text citations are expected in this area. iBook reference – Chapter 5, pages 60 – 70

Type of Promotional Category – Copy & Paste This Section for Each Marketing Campaign Category

Concisely explain what the campaign strategy is that you are planning. This is high level – the tactics you’ll use are broken down below.

Campaign Tactic 1:

Concisely explain your marketing tactic and how you will implement this. This should include what it will look and sound like, what platform(s) you will use, what the call to action is for the customer, and when and how long you will run the campaign.

Campaign Tactic 2:

Concisely explain your marketing tactic and how you will implement this. This should include what it will look and sound like, what platform(s) you will use, what the call to action is for the customer, and when and how long you will run the campaign.

Once this section is complete, use the Expense tab on the Financial Workbook to list the annual costs for each category to execute the tactics.

3: Strategy Implementation: LegalRisks & Liabilities

Outline any risks and liabilities that your project creates. Address how you will prepare for those risks. Research and in-text citations are expected in this area. iBook reference – Chapter 6, pages 71 - 80

Once this section is complete, fill out any expenses on the financial workbook. If it is mentioned in the write-up, the costs should be researched and explained here and listed in the Professional Services or Insurance/Utilities section of the workbook.

Regulations

Outline regulations such as industry-specific regulatory bodies, licensing, permits, laws, and government regulations that must be adhered to and explain what steps will be needed to be taken to address these. Research and in-text citations are expected in this area. iBook reference – Chapter 6, pages 71 – 80

Once this section is complete, fill out any expenses on the financial workbook. If it is mentioned in the write-up, the costs should be researched and explained here and listed in the Professional Services section of the Financial workbook.

Contracts

Outline any contractual needs for your idea and explain what steps will need to be taken to address these, such as adding or amending existing contracts and creating new ones. Consider customers, collaborators, strategic partnerships, etc. Research and in-text citations are expected in this area. iBook reference – Chapter 6, pages 71 - 80

Once this section is complete, fill out any expenses on the financial workbook. If it is mentioned in the write-up, the costs should be researched and explained here and listed in the Professional Services section of the Financial workbook.

Insurance

Outline any insurance needs you will have for your idea and explain what steps will need to be taken to address these, such as adding or amending existing insurance agreements or creating new ones. Research and in-text citations are expected in this area. iBook reference – Chapter 6, pages 71 – 80

Once this section is complete, fill out any expenses on the financial workbook. If it is mentioned in the write-up, the costs should be researched and explained here and listed in the Insurance/Utilities section of the Financial workbook.

Intellectual Property

Outline any patent, copyright, trademark, trade secrets, and right of publicity needs you will have and explain what steps will need to be taken to address these. Consider both the needs for your company and your project as well as the use of other people and company’s intellectual rights. Research and in-text citations are expected in this area. iBook reference – Chapter 6, pages 71 – 80

Once this section is complete, fill out any expenses on the financial workbook. If it is mentioned in the write-up, the costs should be researched and explained here and listed in the Professional Services section of the Financial workbook.

4: Strategy Implementation: Sales ProjectionsUsing the sections below, identify how your solution will make money. Explain each product/service that will be sold, the sale price of each product/service (unit), the number of units that will be sold each year, and the unit cost to make the product/service (unit). There is space for three revenue streams, however, you are only required to have one stream. Delete these instructions once you have reviewed them.

Name of Product/Service – Copy & Paste This Section for Each Product/Service (Unit)

Explain the product/service that is being sold. If it consists of multiple items (i.e. merchandise rather than just t-shirts), explain what those items are here.

iBook reference – Chapter 7, pages 80 – 86

Unit Volume Explanation

Explain how many units are being sold annually, what research, calculations, and assumptions you used to come up with the figures you put under Unit Volume of the financial workbook. Research and in-text citations are expected in this area. iBook reference – Chapter 7, pages 80 – 86

Unit Price Explanation

Explain how much you each unit is being sold for, how you decided on this price, and what comparisons you have done to other businesses and their product offerings. Explain what research, calculations, and assumptions you used to come up with the figures you put under Unit Price of the financial workbook. Research and in-text citations are expected in this area. iBook reference – Chapter 5, pages 60 – 70 & Chapter 7, pages 80 – 86

Unit Cost Explanation

Explain how much it costs to produce/create each unit. Unit cost typically applies to a product rather than a service. Provide the research, calculations, and assumptions you used to come up with the figures you put under Unit Cost of the financial workbook. Research and in-text citations are expected in this area. iBook reference – Chapter 7, pages 80 – 86

Using the Sales Projections tab of the Financial Workbook, insert the unit volume, price, and cost. Then put this in Appendix 5. In addition, you’ll include your Project Budget as Appendix 6.

4: Strategy Implementation: Income StatementExplain how much money you are going to be making or losing from your solution. Look at the Income Statement tab on the Financial workbook. The net profit/loss line calculates your solution’s profit or loss for Years 1, 2, and 3. Discuss whether or not you are making a profit and what is helping or hindering profitability each year.

iBook reference – Chapter 7, pages 80 – 86

Include your Income Statement from the Financial Workbook as Appendix 7.

5: Strategy Implementation: Project TimelineThis section should explain your plan and timeline for implementation. If it is listed in any of the Strategy Implementation sections, it should be outlined here. Alternatively, if it is listed here, it should appear in other areas of the proposal.

When identifying what and how you will evaluate, think back on the purpose of this project and consider what needs to be tracked to identify whether or not this was a success. Put yourself in the role of the board – when you look at the results of your project, consider what you want to know, how you want it tracked, and what you want to know from it. Include a visual timeline that represents the information in this section. Include the timeline as Appendix 8. Delete these instructions once you have reviewed them and make sure the format matches the rest of the proposal.

iBook reference – Chapter 8, pages 87 - 92

Pre-Launch

Outline the steps you will take to prepare for the launch of your project. Consider when you want to launch and what needs to be done and by when in order to be done by your launch date. Identify at least two significant milestones for this period.

Year 1

Outline what will take place during Year 1. Identify at least two significant milestones, two goals, and your evaluation plans (key performance indicators) for this period.

Year 2 & 3

Outline what will take place during Year 2 & 3 that is different than Year 1. This should not be a copy and paste of above. Identify at least two significant milestones, two goals, and your evaluation plans (key performance indicators) for this period.

Adner, R., Ruiz-Aliseda, F., & Zemsky, P. (2016). Breaking Trade-Offs: When is Dominating from the Middle a Winning Generic Strategy? In Academy of Management Proceedings (Vol. 2016, No. 1, p. 16580). Briarcliff Manor, NY 10510: Academy of Management.

Hussain, S., Khattak, J., Rizwan, A., & Latif, A. (2014). Interactive effects of Ansoff growth strategies and market environment on firm’s growth. British Journal of Business and Management Research, 1(2), 68-78.

International Trade Administration of the U.S. Department of Commerce – The Media and Entertainment Industry in the United States.

International Trade Administration of the U.S. Department of Commerce – The Software and Information Technology Services Industry in the United States.

Manjoo, F. (2010). Netflix. Meet Hulu. Now, How About Merging Together?

https://www.fastcompany.com/1686635/netflix-meet-hulu-now-how-about-merging-together

Netflix Inc. – Investors – Long-Term View.

Netflix Inc.’s Annual Report to the U.S. Securities and Exchange Commission (Form 10-K).

Netflix Inc.’s Website.

Pauwels, K., & Weiss, A. (2008). Moving from free to fee: How online firms market to change their business model successfully. Journal of Marketing, 72(3), 14-31.

Sakellaridis, K., & Stiakakis, E. (2011). Business model change due to ICT integration: An application to the entertainment industry. International Journal of Computer Information Systems and Industrial Management Applications, 3, 1-13.

Spry, A., & Lukas, B. A. (2016). Brand Portfolio Architecture and Firm Performance: The Moderating Impact of Generic Strategy. In Looking Forward, Looking Back: Drawing on the Past to Shape the Future of Marketing (pp. 866-867). Springer, Cham.

Reference the attached appendices and any supplemental items that support your problem and solution, such as financial forms and marketing materials, in the body of your proposal (ex. See Appendix 1 for Customer Persona). Give a brief description of each appendices before it. Delete these instructions once you have reviewed them and make sure the format and fonts match the rest of the proposal.

Appendix 1: Idea Mock-Up

Appendix 2: Target Market

Appendix 3: Competitive Analysis

Write a brief explanation of the information below.

| Netflix | Warner | Hulu | HBO | |

| Direct or Indirect Competition | ||||

| Competitive Product/Service | ||||

| XXX | ||||

| XXX |

Appendix 4: Marketing Sample

Appendix 5: Sales Projections

Appendix 6: Expense Budget

Appendix 7: Income Statement

Appendix 8: Project Timeline