Team Case Study Paper on KFCThis is a team assignment and students are expected to work together and synthesize their individual parts to produce one (1) paper. Only one (1) student on each team needs

Running head: BUSINESS ANALYSIS CASE STUDY 0

Business Analysis Case Study

Student Name

BA690 – Business Strategy

Abstract

The Campbell Soup Company was begun in the late 1860s as a partnership for canning vegetables, especially tomatoes. The company continued to grow, and it was an early adopter of radio and magazine advertising, which helped to promote Campbell Soup to new heights as one of the most well-known and loved American brands. After the turn of the millennium, there was a slowdown in growth. Over the past decade and more, despite the company’s giant size and revenues of $8 billion per year, revenues were lagging, losses were becoming the main return on investments in new strategies, and new products were failing. This situation did not occur overnight, but rather it was a changing environment along with discoveries of unethical behavior by the company. The turning point for Campbell Soup, and its downfall, was the repeated use of deception in marketing the taste, freshness and health of its products. This paper provides an overview and analysis of the case.

Introduction

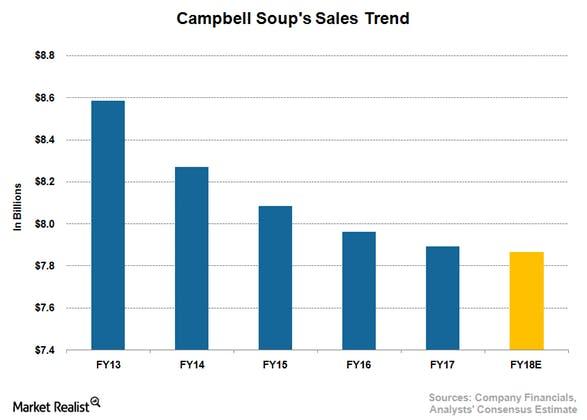

The Campbell Soup Company was begun in the late 1860s as a partnership for canning vegetables, especially tomatoes (Shea & Mathis, 2002). Anderson & Campbell set up their operations in Camden, New Jersey, where there was a significant manufacturing presence, but their marketing was focused on images of gardens and fresh food (Shea & Mathis, 2002). In 1876 Anderson left the partnership, and many of Campbell’s relatives joined the venture (Shea & Mathis, 2002). Canned foods were still an emerging product form in America, however their popularity was growing as was the capacity to transport and distribute products over a vast area, even nationally (Shea & Mathis, 2002). The company continued to grow, and it was an early adopter of radio and magazine advertising, which helped to promote Campbell Soup to new heights as one of the most well-known and loved American brands (Shea & Mathis, 2002). The company went public in 1956 (Shea & Mathis, 2002). Campbell Soup continued to grow and expand it s product lines int eh latter half of the twentieth century, including the introduction of meals that could be prepared using soup as a base, rather than just selling the soup for soup (Shea & Mathis, 2002). After the turn of the millennium, there was a slow down in growth. Over the past decade and more, despite the company’s giant size and revenues of $8 billion per year, revenues were lagging, losses were becoming the main return on investments in new strategies, and new products were failing (Wiener-Bronner, 2018). Shareholders, of which descendants of the original founders represented about half of all shares, were at odds with more focused activist investors, and efforts were diverted into board level debates and battles, rather than corporate needs (Wiener-Bronner, 2018). The turning point for Campbell Soup, and its downfall, was the repeated use of deception in marketing the taste, freshness and health of its products.

Organization Type and Strategies

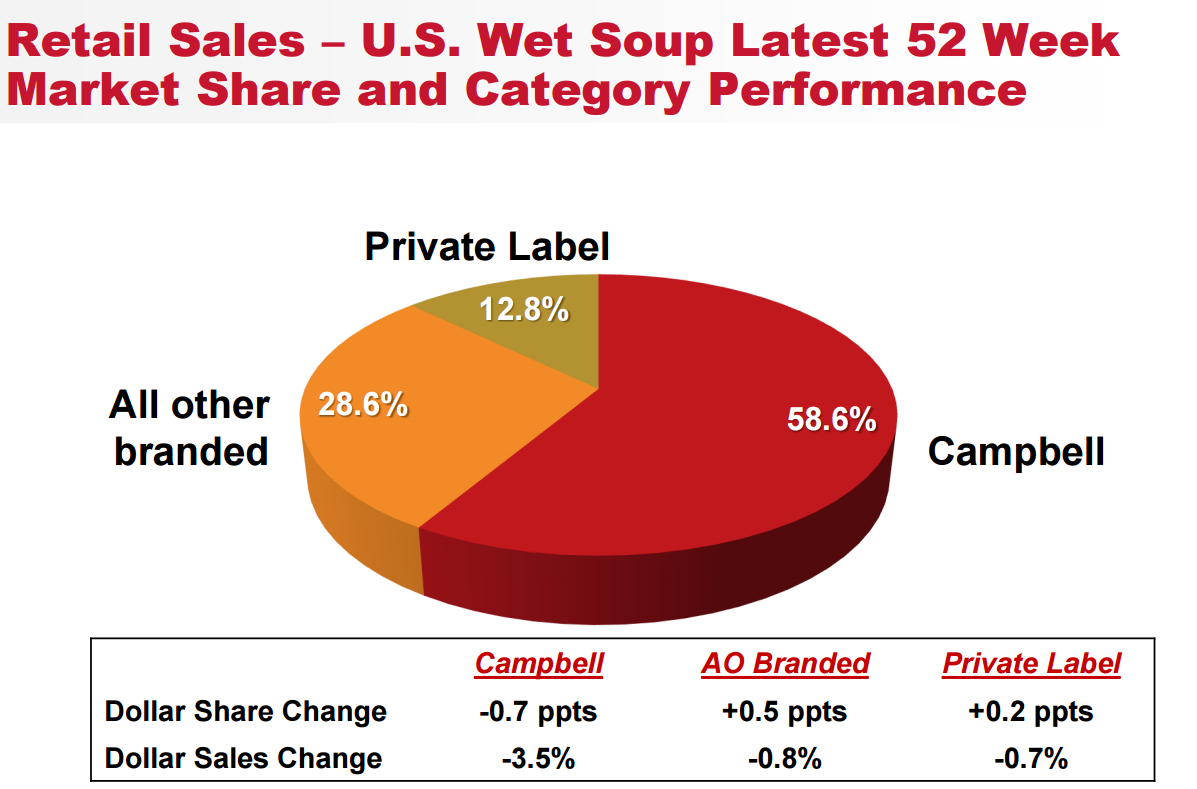

Campbell Soup Company is a multinational manufacturer of household products, with a focus on ready to eat soups. Despite its large size and the wide distribution of products, manufacturing takes place in the United States, and the primary market is the domestic American household consumer market (Shea & Mathis, 2002). The most popular products, chicken noodle soup, tomato soup and cream of mushroom soup, account for a majority of sales (Wiener-Bronner, 2018). The industry is currently undergoing a massive upheaval driven by cultural change and emerging preferences (Cardello, 2018). While overall the ready-made food market is growing in America and globally, multinational food manufacturing companies are getting a smaller and smaller share of this market while emerging small producers of fresh or non-mass produced foods are taking this share while expanding the market (Cardello, 2018). Assumptions have held for decision makers in the food manufacturing for decades, such as the idea that people go to supermarkets, and to some extent “blindly toss their products into the grocery cart” (Cardello, 2018, n.p.). This true of Campbell Soup Company, but also their major competitors One important reason for the failure to adapt is that the competencies of ready-made food manufacturers is mass producing food, and this cannot work with the distribution needs of fresh prepared and small-batch ready-to-eat food (Cardello, 2018). The industry is in crisis, with most of the chief executive officers (CEOs) including the CEO of Campbell Soup Company, terminated in just the last few years (Cardello, 2018).

Table 1: Sales trends in decline (Singh, 2018)

Key Players and Industry

There were many kinds of stakeholders in the ready-made and condensed soup market. These include regulatory bodies like the Federal Trade Commission and the Food and Drug Agency, consumers of soup, competitors, distributors and retailers. Organizations that are not usually considered central to the industry that have been gaining importance are the public health agencies and authorities and non-governmental organizations (NGOs) involved with health concerns (Phillips-Connolly & Connolly, 2017).

The industry itself is becoming less dense, and less dominated by established multinational players (Phillips-Connolly & Connolly, 2017). There is an increasing number of very small niche market soups with small regional distribution, and many of these become new entrants at the national level. The main approach has been the use of fresh foods, with some of these requiring refrigeration of the soup and higher spoilage risks for retailers and consumers. Because of this, the other large multinational such as Progresso and Lipton continue to be major competitors, but the real threat has been the local and niche market substitutes.

Figure 1: Market share dominance in a declining market (Scout Finance, 2016)

The Campbell Soup Company was begun in the late 1860s as a partnership for canning vegetables, especially tomatoes. The company continued to grow, and it was an early adopter of radio and magazine advertising, which helped to promote Campbell Soup to new heights as one of the most well-known and loved American brands. After the turn of the millennium, there was a slowdown in growth. Over the past decade and more, despite the company’s giant size and revenues of $8 billion per year, revenues were lagging, losses were becoming the main return on investments in new strategies, and new products were failing. This situation did not occur overnight, but rather it was a changing environment along with discoveries of unethical behavior by the company. The turning point for Campbell Soup, and its downfall, was the repeated use of deception in marketing the taste, freshness and health of its products.

Competitors

Competition in the domestic ready-made soup industry includes corporate giants such as General Mills, Unilever, Nestle and Kraft Heinz, as well as smaller producers that have becomes established in niche areas, often with a health focus. One example of this is Amy’s Kitchen, which has been making clean food with green characteristics such as vegan and GMO free for about three decades. General Mills is the maker of Progresso soup, a leading canned brand that competes directly with Campbell’s Soup brands. These companies also compete on the basis of ready to eat snacks. Kraft Heinz is another major player in the ready to eat food category, although it is dwarfed by the market share of General Mills, which is only a fraction of the size of the Campbell Soup Company market share. Unilever is a company based in Europe, with dehydrated soups that compete as a substitute canned soups. Nestle is somewhat similar to Unilever in that the soup brands are focused on a European market, and dehydrated. New niche markets have developed in relation to canned soup, including the organic, GMO free line of Amy’s Kitchen, which is small, but it has been growing for several decades.

Problems and Issues

False health claims

The American Heart Association (AHA) earns revenue to support their cause by selling product endorsements (Messerli, Rimoldi and Bangalore, 2017). These endorsements are intended for products that meet the criteria of heart healthy foods or meals (Messerli et al., 2017). In 2013 the endorsement of the AHA resulted in claims of fraudulent activity and deception by both organizations (Messerli et al., 2017). The issue was the sodium content of the soups (Messerli et al., 2017). The AHA requirement for endorsement as a low sodium meal required a maximum level of 140 milligrams (mg) of sodium, but the Healthy Request soups which were endorsed under the program had over 400 mg per serving, and non-endorsed Campbell Soup products had more than 800 mg of sodium per serving (Messerli et al., 2017). Campbell Soup Company was developing a distinctly sinister character in terms of the repeated themes of deception and marketing false claims.

Previous deceptive practice scandals

This was not actually the first time that Campbell Soup Company had been caught in the act of deception. In the late 1960s it was Campbell Soup Company that was targeted by the FTC in relation to the use of marbles in the soup during marketing photography (Thorson & Duffy, 2015). The marbles were used to prop of the ingredients in the soup, which would otherwise fall to the bottom. By having the ingredient chunks sit on the marbles, they were lifted out of the soup making it look healthier and heartier (Thorson & Duffy, 2015). This event was considered a major turning point, and a landmark case in marketing standards and the identification of deception marketing practices (Thorson & Duffy, 2015).

The Campbell Soup Company had also been caught before in relation to false health claims, as previously this had occurred in the late 1980s. As part of their marketing efforts, the company began making claims in relation to its soup as part of a healthy diet, and a means of avoiding heart disease and cancer (Andrews, Burton & Netemeyer, 2000). In fact, these claims angered the National Cancer Institute, who had never approved or endorsed the products but were quoted in marketing material related to the description of a healthy lifestyle and diet (Andrew et al., 2000).This caught the attention of the Federal Trade Commission (FTC), who further investigated the claims in relation to preventing heart disease. Campbell Soup Company had claimed that since the soups were low in fat, the soup met the healthy lifestyle guidelines that were stated as part of a diet to avoid cancer and heart disease (Andrews et al., 2000). The FTC did not agree, and specifically pointed to the high sodium content of the soup as evidence that the soups were not healthy, and not part of healthy diet. This was in 1989, almost twenty five years before, and yet the company was still continuing to try the same tricks and games. Consumers, however, are far more sophisticated today, and they have a better understanding of nutrition and nutrition labels.

Negative health impacts of product

Public health agencies such as the Centers for Disease Control and Prevention (CDC) and local public health authorities have increasingly promoted healthier lifestyles, including a healthier diet, as a means of promoting health and wellness (Rehm, Monsivais & Drewnowski, 2015). Campbell Soup Company products contain high levels of salt, monosodium glutamate (MSG) which has been implicated in allergies, sensitivity, blindness and child hyperactivity, and often simply the word flavoring without further information. Campbell Soup products do not, however do much to meet a persons nutritional needs, with no nutritional value being more than 5%, and that criteria being fat (Campbell’s, n.d.). Vitamins and minerals for nearly all soups are zero, with the best ones having as much as 2% of the daily requirement for iron (Campbell’s, n.d). This is not a product that can meet anything more than the calorie needs of an individual. This is especially important in the context of the products that are marketed to children, of which there are many, most of them adorned with Disney cartoon characters and attractive packaging (Campbell’s, n.d).

Table 2: Nutrition information for Incredibles 2 soup

| Nutrition Facts | ||

| About 2.5 Servings Per Container | ||

| Serving size | 1/2 Cup (120mL) Condensed Soup | |

| Amount per serving | ||

| Calories | 60 | |

| % Daily Value* | ||

| Total Fat | 2g | 3% |

| Saturated Fat | 0.5g | 3% |

| Trans Fat | 0g | |

| Polyunsaturated Fat | 0.5g | |

| Monounsaturated Fat | 1g | |

| Cholesterol | 5mg | 2% |

| Sodium | 480mg | 21% |

| Total Carbohydrate | 8g | 3% |

| Dietary Fiber | <1g | 4% |

| Total Sugars | 0g | |

| Includes 0g Added Sugars | 0% | |

| Protein | 3g | |

| Vitamin D | 0mcg | 0% |

| Calcium | 10mg | 0% |

| Iron | 0.4mg | 2% |

| Potassium | 60mg | 0% |

| *The % Daily Value (DV) tells you how much a nutrient in a serving of food contributes to a daily diet. 2,000 calories a day is used for general nutrition advice. | ||

(Campbell's, n.d.)

According to this nutritional information, a child would have to eat 50 servings of soup in order to meet their recommended daily requirements of iron, but in so doing they would ingest about ten times the daily requirement of sodium. This is obviously hypothetical, but a more realistic situation where soup is provided for each meal, three times a day, would reveal that soups such as this could contribute to the malnourishment of children, as well as nay health impacts of the high level of sodium.

Changing consumer tastes

Today consumers do not want canned soup that looks like it came from forty years ago, they want fresh food which is minimally processed, and possible organic or made with non-genetically modified ingredients (Cardello, 2018). This is the increasing trend, and it cannot really be stopped (Cardello, 2018). Overall, canned soup does not really represent a good value to consumers, especially since dehydrated soup is much cheaper. There is also growing interest in making homemade meals, and homemade soup has an even lower cost. People are turning away from processed foods and the lifestyle that it represents, and the tin can meal is outdated and past its prime.

SWOT Analysis

Strengths

The main competencies of the Campbell Soup Company are in manufacturing and marketing. Campbell Soup was an early adopter of two innovations in the late 19th century; mass production of food and mass marketing. The company was able to adapt through the twentieth century as radio, magazines and then television became the primary drivers of media advertising. The company adopted leaner production processes, and was able to find new efficiencies and marketing angles that fulfilled American desire for more flavors and novelty. Campbell Soup Company has been phenomenally successful in this regard for well over 120 years. Another strength is the brand recognition and the sentimentality response of many older Americans who remember the height of Campbell Soup Company marketing campaigns.

Weaknesses

Consumers do not want to eat food in a can, and they are seeking healthier alternatives. The current offerings are high in sodium and preservatives, but without nutrition in the form of protein, vitamins, or minerals. Further, Campbell Soup Company has been deceptive in relation to health and claims, and this creates mistrust. Even if the company were to try to create healthier alternatives, the public is unlikely to believe them. The overall greatest weakness of the company, however, is that they want to solve their problems through questionable marketing practices, rather than accommodating the change in consumer tastes, preference and nutritional needs.

Opportunities

The opportunities for Campbell Soup Company are limited. The past bad behavior, in combination with decreasing product relevance, means that not only is Campbell Soup not going to grow, it is competing for maintenance of its share of a declining industry. The main opportunity today is entry into the ready made fresh food market, however the highly centralized and manufacturing focus of the company is not well set up for such an enterprise. Any real opportunity for Campbell Soup Company should be taking advantage of the infrastructure and the expertise which the company has developed, rather than abandoning it. While interest in the products of Campbell Soup Company is waning, there is likely to be increasing interest in the manufacturing capacity and processes as emerging companies try to attain scale and growth. This may be a lucrative market for Campbell Soup, especially if packaged along with marketing development and other strengths. For new companies that have a hit product, the lack of skills and knowledge in relation to Campbell Soup Company’s core’s strengths could result in the failure of production and sales growth initiatives. This could certainly be a win-win scenario for Campbell’s and the companies that have displaced them in the market.

Threats

The threat for Campbell Soup Company and similar firms is the interest in healthy diet and lifestyles. This movement is in generally not interested in processed and mass manufactured food, particularly since this is where the high sodium and processed foods which are a danger to health tend to cluster. In addition to low fat and low sodium, consumers expect health and nutrition from their food. It is expected that food should fulfill some of the recommended daily allowance of proteins, vitamins and minerals which are needed for good health. Even if Campbell Soup Company were to lower the sodium content of their soups to a reasonable, low sodium level, it would not change the fact that it did not have nutrition, and the current product is not going to be able to overcome this barrier which is central to new consumer purchasing patterns.

Ethical Considerations

Ethical considerations that have not been a priority for Campbell Soup Company might have prevented the scandals, the lack of trust, and the inability of the company to make the transition to modern consumer preferences. While it is easier in some ways to understand the use of marbles to prop up the ingredients, it is difficult to forgive the persistent fraud in relation to health claims, and even the presentation of their soup as a healthy meal. From a Christian perspective, there are many concerns with the past behavior of Campbell Soup Company in relation to deceptive practices, but also in relation to not fulfilling the needs of people who need soup in the first place. Decisions were always made to support sales, and not the people buying the products. This is indicative of selfish and greedy behavior. The American people should have been able to trust Campbell Soup Company, and they have been let down. There is therefore concern that if Campbell Soup Company were to provide outsourcing services for scaling up production of food for emerging producers, they would transmit these faulty values in relation to health, community and honesty.

Evaluation and Assessment

It is easy to blame Campbell Soup Company for the fraud and deception that drove their marketing, without attention to the actual health or nutrition value of their products. It is important, however, to realize that this was not an isolated issue. In fact, it was the norm across the industry. In terms of ethics, the focus does not need to be a set of standards and principles which can allow for companies to conduct their own self-assessment of ethical and moral behavior, but that can also provide a reference point when claims against a company are made, or when fraud in marketing is discovered. A history of progression in relation to marketing, claims, deception and time reveals that ultimately the best enforcement comes from education and aware consumers, rather than rules, regulations and lawyers. Food with poor performance in terms of nutrition per serving has become irrelevant for much of the population, and perhaps that is appropriate penalty to be paid.

Implementation Plan

Implementation of a plan to serve emerging ready to eat food producers begins with marketing research and a marketing plan. While Campbell Soup Company has an extensive skill set in Business to Consumer distribution and marketing, the Business to Business model may initially present some challenges. Finding an initial partnership to highlight the benefits for thriving new companies would be a good way to build a storyline and portfolio of success stories that create interest for other companies. In this way, Campbell Soup Company could be increasing its manufacturing and production capacity, all of which occurs during the United States, within the next few years. It would help to support small brands to become bigger brands, and in this way Campbell Soup Company can take its rightful pension of sorts for building the industry in the first place- as a mentor and production outsourcing service to the very competition that has created the downfall of an era.

Closing

Summary

The main solutions for Campbell Soup Company are to wind down operations and minimize costs as the industry declines, to completely transform their product and processes to meet new taste and nutrition preferences, or to pivot their business based on a new angle. While there are new possible areas for marketing, such as focusing on niche areas of canned food production such as for hurricane and emergency kits, overall the products are not in everyday use in American households, and preparations should be made for decline. The competency in manufacturing and efficiency in flavor marketing and development might be a new area where Campbell Soup Company could provide services directly to other food manufacturers, especially the growing population of small, niche market products that are becoming increasingly popular.

Recommendations

The strength of Campbell Soup Company could become the outsourcing service to the emerging and niche area foods as they find a broader market. Soup in a can is not in demand, at least not Campbell’s products. While the new and fresher version of ready-made foods are intentionally the opposite of mass produced products, there are still aspects which could become more viable on a large scale with the addition of preservation in a bottle, jar or other format. Further, small market restaurants and ready to eat foods that are interested in expanding with a product line that builds on their in-restaurant branding are likely to be interested in complete services that take the product from the kitchen to the supermarket shelves, virtual or physical. There are few alternatives, except for winding down operations. No one wants old, canned food.

Logical conclusion

Companies which mass produce ready to eat foods have shown poor ethical decision making skills n their decisions for half a century. Many people will in fact feel that given the level of deception and fraud against the American public, as evidenced by over $100 billion in sales over the past century for what amounts to a food with no nutritional value that consists of water, salt and flavorings. Every company, however, should be given a chance to make things right, and to target a better approach to their operations. Ideally however, Campbell Soup Company would pass on valuable knowledge in relation to its marketing and manufacturing capacity without transmitting its questionable values as a company.

References

Andrews, J. C., Burton, S., & Netemeyer, R. G. (2000). Are some comparative nutrition claims misleading? The role of nutrition knowledge, ad claim type and disclosure conditions. Journal of Advertising, 29(3), 29-42.

Cardello, H. (2018). 5 Ways Big Food Companies Can Make America (And Themselves) Healthier Forbes. Available from: https://www.forbes.com/sites/hankcardello/2018/09/17/5-ways-big-food-companies-can-make-america-and-themselves-healthier/#47d718e35313

Messerli, F. H., Rimoldi, S. F., and Bangalore, S. 2017. Salt, tomato soup, and the hypocrisy of the American Heart Association. The American journal of medicine, 130(4), 392-393.

Phillips-Connolly, K., & Connolly, A. J. (2017). When Amazon ate Whole Foods: big changes for Big Food. International Food and Agribusiness Management Review, 20(5), 615-622.

Rehm, C. D., Monsivais, P., & Drewnowski, A. (2015). Relation between diet cost and Healthy Eating Index 2010 scores among adults in the United States 2007–2010. Preventive medicine, 73, 70-75.

Rhea, M. E., and Mathis, M. 2002. Campbell Soup Company. Arcadia Publishing.

Scout Finance. (2016). Campbell’s Soup in a Bubble? Seeking Alpha. Available from: https://seekingalpha.com/article/3989173-campbell-soup-bubble

Singh. A. (2018). Campbell’s Soup has been hit the worst. Market Realist. Available from: https://articles2.marketrealist.com/2017/09/campbell-soup-has-been-hit-the-worst/

Thorson, E., & Duffy, M. (2015). Marbles in the Soup and Crushed Volvos. Persuasion Ethics Today, 286.

Wiener-Bronner, D. (2018). Feud over Campbell Soup's future could break up the 149-year old soup company. CNN Business, October 28, 2018. Available from: https://edition.cnn.com/2018/10/27/business/campbell-proxy-fight/index.html