Read the instructions Thank you

Background of the Company: DiamondsForever

DiamondsForever has been operating in the diamond business for four years and deals almost exclusively in investment diamonds. Although they occasionally purchase other stones, these purchases are on the basis of special order requests from existing clients. These special order stones are bought from local suppliers and are generally sold within a few days and, as such, they are never material to the total inventory.

DiamondsForever purchases both certified individual diamonds and non-certified parcels of diamonds from a single supplier, DiamondsLast. The certified diamonds arrive wrapped in individual soft paper wrappers that show the diamond categorization details on the front. The recorded details include color (which indicates quality), cut (which indicates shape), clarity (which indicates defects), and carat (which indicates weight). A unique inventory number is assigned to each diamond wrapper and is written on the top right-hand corner of the front of the wrapper. These details are also recorded in the inventory records, along with the purchase price extracted from the supplier invoice. The inventory of wrapped diamonds is stored in inventory number order in a diamond storage box holding similarly classified diamonds. The storage boxes are held in the safe located in the CEO’s office. The CEO is the only person to have the safe code.

The non-certified diamonds included in each purchase arrive as a single diamond parcel in a zip-seal plastic bag. The total carat weight is shown on the front of this bag. The diamonds purchased as a diamond parcel are sorted and split into smaller parcels. These smaller parcels are constructed by sorting and categorizing the purchased parcel of diamonds according to color, cut, clarity, and carat. The categorized diamonds are then stored in parcels in small pre-numbered zip- seal plastic bags. These parcels are sold by DiamondsForever according to the parcel carat weight. Each of the categorized diamond parcel bags includes an inventory record sheet identifying the parcel number, the total quantity and total carat weight of the diamonds in the parcel, as well as the color, cut, clarity, and carat of each diamond in the parcel. This inventory record sheet is used as a subsidiary inventory record, with only the total number, total carat weight, and apportioned purchase price of the diamonds included in the main inventory records. To establish the purchase price of each small parcel, the total purchase price of the original purchased parcel is apportioned on a per-carat basis using the following formula: total purchase price 3 (carat weight of small parcel/ total carat weight of purchased parcel). Similar to the individually wrapped diamonds, the diamond parcel zip-seal bags are stored in inventory number order in a diamond storage box. The storage boxes are held in the safe located in the CEO’s office, along with the storage boxes for the individually wrapped certified diamonds.

You are the new audit senior on the 20X1 year-end audit of DiamondsForever. In planning for this audit, your audit manager has asked you to familiarize yourself with both the physical inventory and the inventory recording system for the diamond parcels. Your audit manager has asked that you specifically consider the key audit assertions that need to be considered in relation to the audit of the diamond parcel inventory and the individually wrapped certified diamonds.

Requirement 1: Inventory

Discuss and complete Answer Template A. As part of your inventory familiarization process, you are required to discuss and provide answers to the following two questions by completing Answer Template A, provided in Exhibit 1. [Note: To assist you in answering the questions, Answer Template A lists the account balance assertions]:

Discuss and determine the key Account Balance Assertions that may be at risk for the diamond inventory, and

Discuss and determine whether the sample of individually wrapped certified diamonds and the sample inventory parcel, including the inventory record, provides evidence that indicates any specific Account Balance Assertion is at risk for the 20X1 year-end audit.

Requirement 2: Sales Transaction

Assume that the sales transaction outlined below has been selected for detailed testing as part of the 20X1 year-end audit procedures:

Sales transaction details. A new client, Innovative Investments, placed an urgent purchase order with DiamondsForever four days prior to year-end for the following diamonds:

Five Rose-colored diamonds (one carat, F color rating, brilliant cut) with a sale price of $25,000 each; and

Ten White diamonds (one carat, G color rating, princess cut) with a sale price of $6,000 each.

This order was able to be filled using two diamond parcels currently in inventory. Specifically, diamond parcel number PX1-5 and diamond parcel number PX1-7, which were the 5th and 7th diamond parcels, respectively, constructed from diamonds purchased by DiamondsForever during 20X1, were identified as containing diamonds matching this order. To ensure these diamonds were not able to be sold to another client, the inventory records and the sales journal were updated to reflect this transaction one day after receiving the order. DiamondsForever shipped diamond parcel PX1-5 to Innovative Investments on the last day of the year, and diamond parcel PX1-7 was shipped on the first day of the new year.

In relation to this transaction, you are required to discuss and provide answers to the following five-part question by completing Panel A of Answer Template B, provided in Exhibit 1: What evidence would you need to obtain in order to support each of the following five assertions for this recorded transaction?

the occurrence assertion—in other words, how do you know that the sale to Innovative Investments actually took place?

the completeness assertion—in other words, how do you know that the entire sale was recorded?

the cut-off assertion—in other words, how do you know that the transaction was recorded as a sale in the correct accounting period?

the classification assertion—in other words, how do you know that the sale was recorded in the proper accounts?

the accuracy assertion—in other words, how do you know that the details of the sale, e.g., the sale amount, were correctly recorded?

Requirement 3: Purchases Transaction

Assume that the purchases transaction outlined below has been selected for detailed testing as part of the 20X1 year-end audit procedures:

Purchase transaction details. JGems, a valued customer of DiamondsForever, placed an order for three sapphires of approximately one carat each on November 30, 20X1. Diamonds- Forever recorded a purchase for the three stones on December 5, when they were able to source the required stones from SeptemberStones. SeptemberStones delivered the stones in two separate parcels on December 20 (consisting of one 1.1 carat sapphire) and 14 days later (consisting of two sapphires, each 1.2 carats). In both cases, the sapphires were sold and delivered to JGems two days after taking delivery.

In relation to this transaction, you are required to discuss and provide answers to the following five-part question by completing Panel B of Answer Template B, provided in Exhibit 1: What evidence would you need to obtain in order to support each of the following five assertions for this recorded transaction?

the occurrence assertion—in other words, how do you know that the purchase actually took place?

the completeness assertion—in other words, how do you know that the entire purchase was recorded?

the cut-off assertion—in other words, how do you know that the transaction was recorded as a purchase in the correct accounting period?

the classification assertion—in other words, how do you know that the purchase was recorded in the proper accounts?

the accuracy assertion—in other words, how do you know that the details of the purchase, e.g., the purchase amount, were correctly recorded?

EXHIBIT 1

Answer Template A: Inventory Familiarization

Note: To assist you in completing this Answer Template, recall that the Account Balance

Assertions include: Presentation, Existence, Rights/Obligations, Completeness, and Valuation.

| | |

| | |

| |

Answer Template B: Transaction-Level Assertions for Sales and Purchases![]()

| | ||

| | ||

| | ||

| | ||

| | ||

| |

Part 2:

You are the newly appointed audit senior on the audit of DiamondsForever, and you have been assigned the responsibility for the audit of the inventory. In preparation for this audit assignment and, in particular, to become familiar with both the client and the diamond industry, you review the permanent audit file of DiamondsForever. The relevant information from this file is provided below.

Overview of the Business

DiamondsForever operates an investment diamond business. They conduct their business from offices on the 100th floor of the new Tower building in the center of the city. The entire floor has been leased by the company, and the resulting 360-degree views from the various parts of the office are spectacular. The office space has been constructed to provide a large reception area, which is separated from the remaining space by a security door that is operated by a touchpad screen. The office de´cor has been commissioned by one of the leading interior design firms in the city, and the reception area walls, as well those in the office areas, boast an impressive array of original artwork. The reception area has the appearance of high-tech functionality, and is finished with innovative and sought-after material, such as slate, burnished brass, and gauze-effect glass. In the secure area, there are two large corner offices for the CEO and CFO, two smaller offices, as well as five client viewing rooms, each of which has been decorated with a different theme reminiscent of major cities around the world, including Paris, London, Tokyo, Cairo, and St. Petersburg.

There is a large boardroom, complete with large leather recliner sofa, a large flat-screen TV, a well-stocked bar, and an executive bathroom that has been appointed in a ‘‘night-club’’ style, with one-way glass toilet doors, a shower and a double-sink white marble vanity. A state-of-the-art kitchen has also been installed. A few months after the business moved into its current location, one of the client viewing rooms, itself with amazing views, was converted to accommodate a pull-down wall bed and a locked cupboard space. The audit junior has informed you that there have been rumors that Rob, the CEO, has been living at the office for over one year.

DiamondsForever has been operating in the diamond business for four years. Previously, the CEO, Rob Mann, and the CFO, John Peterson, were employed as investment bankers at the same firm, BankersBusiness. Rob and John decided to move into the investment diamond business in 2008, when the market for colored diamonds opened up. Until that time, such rare diamonds were sold only through high-end retailers throughout the world, such as Tiffany & Co.,1 at very high mark-ups. The colored-diamond business grew due to two unrelated key changes in the market. First, the company that, up until this time, supplied most of the wholesale colored-diamonds dealers in the world, ColouredDiamondBusiness, launched a website that originally had been intended as a convenient way for their wholesale clients (retail stores, other dealers, and major collectors) to peruse their inventory of fancy color diamonds. Through making their site open to the public, ColouredDiamondBusiness created an almost instant market for these diamonds, with a number of additional online stores selling fancy color diamonds since being established.

The second change to the colored-diamond market was that high-pressure high-temperature (HPHT)2 processed color diamonds were made more readily available by HighPressureDiamonds- RUs. These diamonds are created by submitting cheap, unprocessed, off- or brown-colored diamonds to high pressure and high temperature to improve the color of the diamond, and this can result in a wide variety of copies of natural fancy diamond colors. These diamonds are much less expensive than an unprocessed diamond of equivalent color and clarity because they are created from the cheapest of diamonds. Also, for someone with experience in the diamond industry, it is fairly easy to tell the difference between a natural fancy color diamond and a treated colored diamond, because the saturation of color in the treated diamonds is so strong that most of them look like semi-precious colored gems. Thus, these diamonds are sold with full disclosure of the nature of the processing, and accompanied by an internationally recognized diamond grading report.

Rob and John noted that in this newly opened market, the lack of competition and the lack of basis of comparison of prices allowed dealers of fancy color diamonds to greatly inflate their prices. And so they embraced the opportunity to make their fortune. Since that time, DiamondsForever has amassed vast experience with investment diamonds. In the past few years, they organized numerous private shows and events promoting diamonds as an investment in major cities across the country. DiamondsForever deals almost exclusively in investment diamonds. Although they occasionally purchase other stones, these purchases are on the basis of special order requests from existing clients. These special order stones are bought from local suppliers and are generally sold within a few days and, as such, they are never material to the total inventory.

As noted above, Rob and John were particularly attracted to the investment diamond market by the ability to enter the colored-diamond market and, thus, their purchases include both white and colored diamonds. DiamondsForever purchases both certified individual diamonds and non- certified parcels of diamonds. The non-certified diamonds are generally not sold as single diamonds, but rather are sold in a parcel and priced according to a ‘‘parcel price.’’3 This is a price per carat for the weight of diamonds purchased, irrespective of the number of diamonds included. Understanding a parcel’s value is a complex process and requires many years of experience, since there is no list dictating baseline prices. Approximately 50 percent of the DiamondsForever inventory is non-certified diamonds stored in diamond parcels.

Diamond Purchases System

DiamondsForever only purchases loose investment diamonds (i.e., those not set in jewelry). These purchases are from a single supplier, DiamondsLast, and include both certified individual diamonds and parcels of non-certified diamonds. DiamondsLast is a company based in Antwerp, which is considered to be the diamond hub of the world. DiamondsLast is owned by John’s brother, George Peterson, who lives in Antwerp. Purchases of diamonds are initiated by Rob placing a purchase order with George. All purchases are collected in person from Antwerp by John. Occasionally, Rob will contact George by phone while John is in Europe in order to place an additional special diamond order to be collected by John. These special phone orders are invoiced separately by DiamondsLast. John makes a trip to Europe every second month, and each trip is for approximately two weeks. All expenses incurred during these trips are paid by DiamondsForever. The certified diamonds collected by John are all pre-wrapped in individual soft diamond paper wrappers (refer to Figure 1, Panel A), which are marked on the front with a unique diamond identification number, as well as the diamond specifications, including color (which indicates quality), cut (which indicates shape), clarity (which indicates defects), and carat (which indicates weight), as well as the certifying body. The non-certified diamond parcels, containing anywhere between three and 30 diamonds, are sealed in zip-sealed plastic bags that have the total number of diamonds and the total carat weight of the parcel written on the front.

John transports the diamonds in a small diamond storage box (refer to Figure 1, Panel B), which he carries in his briefcase. When John returns to the offices of DiamondsForever, he passes the inventory of diamonds to Rob, who takes them to one of the client viewing rooms to be categorized and recorded in the stock records. For the certified wrapped diamonds, Rob matches the specification on each of the wrapped diamonds to the invoice from DiamondsLast and also to the purchase order that he had placed with DiamondsLast. The supplier’s invoice is then forwarded to the accounts payable clerk for payment.

Rob then checks each individual diamond against the qualities noted on the diamond wrapper, after which he returns to his office and calls Lilly Monet to ask her to go to the viewing room to sort the wrapped diamonds. Lilly sorts the diamonds first by carat, then color, and then clarity, and then gives each diamond the next available sequential inventory number for their specific classification. The unique inventory number is written on the top right-hand corner of the front of the wrapper. At the same time, Lilly updates the DiamondsForever inventory record on her notebook with a corresponding entry noting the diamond number, diamond details, and diamond cost extracted from the supplier invoice. When the inventory update for wrapped diamonds is completed, Rob returns to the viewing room to collect the wrapped diamonds and takes them to his office, where he then stores the new diamonds in inventory number order in a diamond storage box holding similarly classified diamonds. The storage boxes are held in the safe located in Rob’s office. Only Rob has the safe code.

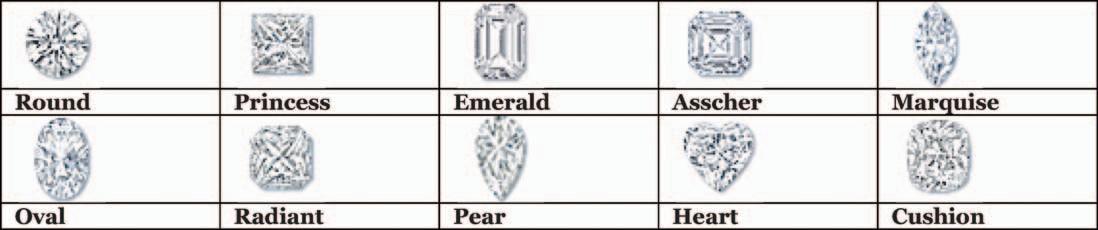

For the diamond parcels, the accompanying supplier’s invoice provides details of the total cost of the parcel, as well as the total number and the total carat weight of diamonds. Rob checks the details of the diamond parcel by agreeing the actual number of diamonds and the total carat weight recorded on each parcel to the supplier invoice, as well as to the original purchase order. These non- certified diamonds are generally sold by DiamondsForever in a parcel which is priced according carat weight. These parcels are constructed by Lilly Monet, by sorting and categorizing the diamonds in each parcel according to color, cut, clarity, and carat. Lilly has two years of experience in working with investment diamonds and is a competent diamond sorter. The majority of the loose parcel diamonds purchased by DiamondsForever are round diamonds. However, sometimes other shapes may be purchased. Thus, Lilly first sorts the diamonds by shape using a Diamond Shape Template (refer to Figure 2, Panel A), and then sorts the round diamonds by size using a Diamond Sieve (refer to Figure 2, Panel D). They are then sorted on color using a set of master stones (refer to Figure 2, Panel C).

These stone sets contain individually graded untreated cubic zirconia stones,4 which are precisely graded to ensure the true diamond colors. The diamonds are then sorted by clarity using a magnifying loupe (refer to Figure 2, Panel B). The loupe allows the perfection of the cut to be seen, since on a perfect cut diamond, one side of the heart and arrow loupe shows the hearts and the other shows the arrows.

FIGURE 1

Diamond Storage Panel A: Diamond Wrapping Papers

Source: http://www.rubin-and-son.com/index.php?target¼categories&category_id¼1047

Panel B: Diamond Storage Boxes

Source: http://www.rubin-and-son.com/index.php?target¼categories&category_id¼524

Lilly allocates each of the diamond parcels the next available sequential inventory parcel number, and she also creates a separate inventory record sheet to be stored inside each of the parcel zip-seal plastic bags. The inventory record sheet inside each diamond parcel includes the inventory parcel number in the top right-hand corner, as well as the total quantity and the total carat weight of the diamonds in the parcel. In addition, the color, cut, clarity, and carat of each diamond in the parcel is recorded. At the same time, Lilly updates the inventory record on her notebook for the allocated diamond parcel numbers and the parcel contents. The inventory record sheet is used as a subsidiary inventory record, with only the total number, total carat weight, and apportioned purchase price of the diamonds included in the main inventory records.

To establish the purchase price of each small parcel, the total purchase price of the original purchased parcel is apportioned on a per-carat basis using the following formula: total purchase price 3 (carat weight of small parcel/ total carat weight of purchased parcel). When the inventory update for the parcel diamonds is completed, Rob collects the diamond parcels and takes them to his office, where he then stores them in inventory number order in a diamond storage box holding diamond parcels. The storage boxes are held in the safe located in Rob’s office, along with the diamond storage box holding the individually wrapped certified diamonds.

Customer Diamond Viewing System

All client viewings of the diamonds require a previously arranged appointment, thereby ensuring Rob is available to open the safe. In preparation for the viewings, ten minutes prior to the meeting, Rob removes the required diamonds from the safe and takes them to one of the viewing rooms. The room is then locked by Rob until the client arrives. Viewings are conducted by Claude Brilliant, a highly respected diamond sales expert. Claude greets the client in the reception area and then escorts them through the security door to the viewing room. Claude unlocks the viewing room and the viewing then takes place.

If the client decides to make a purchase, Claude phones Lilly Monet, who comes to the viewing room to prepare the sales invoice and the certificate showing the specifications of the diamond purchased. Lilly completes the transaction by processing the client’s credit card details and preparing the receipt. Meanwhile, Claude places the diamond in a velvet-lined black leather presentation box, which is then placed in a small black carry bag embossed with the name DiamondsForever. When the sales transaction is complete, Lilly returns to her office, where she immediately updates the computerized inventory records for the diamond sold, as well as posting the transaction to the sales account. The computerized system automatically updates the cost of goods sold and the bank account from these postings. After the viewing and/or purchase, Claude escorts the client through the security door to the reception area. Claude then returns to the viewing room and uses the phone in the viewing room to contact Rob to collect the unsold diamonds and return them to the safe.

FIGURE 2

Diamond Characteristics Panel A: Diamond Shape Template

Source: http://www.diamondwave.com/-strse-template/diamondsearch/Page.bok

Panel B: Loupe for Assessing Diamond Cut

Source: http://www.rubin-and-son.com/index.php?target¼categories&category_id¼424html

Panel C: Diamond Color Sets

Source: http://www.lumeradiamonds.com/buying-diamonds/diamond-buying-mistakes

(continued on next page)

FIGURE 2 (continued)

Panel D: Diamond Sieve

Source: http://www.rubin-and-son.com/index.php?target¼categories&category_id¼544

General Background on the Diamond Business

Diamonds are the most concentrated store of value that exists, and an important source of liquidity. Diamonds, like other extremely precious commodities, retain their value over time, even during a recession, because their value is not determined by a country’s currency nor government laws. Approximately two-thirds of the world’s diamond trade is controlled by the diamond cartel DeBeers,5 and their price is fixed and non-negotiable. Even diamonds that are not marketed by DeBeers follow their pricing. Cut loose diamonds (i.e., those not set in jewelry) are either sold as certified individual diamonds, or they are uncertified and sold as a ‘‘parcel’’ of diamonds to diamond investment companies (such as DiamondsForever) for eventual sale to the customer. The diamond parcels may be of similar sized or mixed size diamonds. DiamondsForever makes a gross margin of between 50—150 percent on the diamonds they purchase, depending on whether they are parcel or certified diamonds.

Key Elements to Understanding the Value of Diamonds

Although diamonds may last forever, their prices can change frequently.

Diamond pricing: The Rapaport Price List.6 Prices for regular white certified diamonds are all grounded in the Rapaport Price List, which is the international benchmark used by dealers to establish diamond prices in all major markets. It is published online weekly7 and provides a guideline for valuing loose diamonds sold as single individual diamonds (as opposed to diamonds sold in parcels; refer below). Prices listed are always in hundreds per carat. However, the list provides a price guide rather than an exact valuation, since diamond dealers will negotiate the diamond prices based on variations in diamond quality and supply and demand. In addition, factors such as cut or shape are not included on the list and, thus, prices can vary significantly. Thus, although the Rapaport Price List does not provide transaction prices, it does provide price indications that may serve as a starting point for estimating the value of the diamond inventory held by DiamondsForever.

The Rapaport Price List includes specific sections for parcels of similar size diamonds, as well as mixed parcels; however, these are only indicative of the price and/or value of the individual diamonds, meaning the pricing for parcels purchased by DiamondsForever has significant variation. Further, there is no price list for fancy color diamonds; as such, each color diamond has its own value as determined by buyer and seller equilibrium based on many factors, including shape, certified color, actual color, modifying colors, size, and clarity. DiamondsForever has established a significant clientele for colored diamonds; however, these diamonds are only purchased on the basis of a customer order, and the sale to the customer is usually completed within two days of the diamond arriving. Thus, there is never a significant inventory of fancy color diamonds.

In summary, the value of a diamond is driven by four main characteristics: (1) carat weight, (2) cut, (3) clarity, and (4) color. In order to determine a diamond’s valuation, it is important to be as accurate as possible in relation to each of these diamond characteristics. Without a certain level of expertise, it is likely that mistakes will be made. The basic guideline used by DiamondsForever to estimate the correct value for the diamonds is to first consider the weight (or carat) of the diamond, and then to evaluate the quality of the diamond (i.e., consider cut, clarity, and color). These characteristics are then checked against the Rapaport list of diamond prices.

Company-Specific Data relating to the Current 20X1 Year-End Audit

Diamonds on Loan to Oscars

Your audit junior has informed you that there was a newspaper article on DiamondsForever in the leading daily newspaper earlier in the week. The article noted that the company had provided a showcase of diamonds earlier that week to be displayed at the forthcoming Oscars ceremony.

Diamonds in Transit from Antwerp

Rob has informed you that a large stock of diamonds is currently in transit from Antwerp with John. These diamonds were paid for four days before year-end.

Second Diamond Storage Box

Your audit junior has informed you that he found another ‘‘diamond storage box’’ located in the back of the stationery cupboard while he was looking for a new stapler. This storage box contains approximately 50 diamonds of varying sizes.

Yellow Diamond on Loan from Antwerp

An impressive showcase has been placed in the reception area and it currently has a display of approximately 20 colored diamonds. In the center of the display is a five-carat yellow diamond, the world’s largest stone of this type. This diamond, as well as five of the larger colored diamonds on display, has been provided on loan from the Antwerp diamond company, DiamondsLast.

Certification Variations

The audit junior has brought to your attention that he has identified two diamonds in the DiamondsForever inventory of otherwise equal characteristics that show different certification, from two different certification providers: Certifier A and Certifier B. The inventory valuation for these two diamonds is recorded at an identical amount. On further investigation, you ascertain that, based on industry knowledge, one certifier, Certifier A, has stricter certification criteria than Certifier B, and that, therefore, the Certifier B certified diamond should not be valued as highly as the Certifier A diamond.

When questioned on this, John explains that DiamondsForever believes the strictness of the certification lab is not important, but rather the lab’s consistency, since all diamond grading is subjective. John, therefore, believes it is the characteristics of the diamond rather than the certified level that should inform the diamond’s value. He further justifies their choice of Certifier B certifications through pointing out that Certifier B provides a cheaper and quicker grading service. Claude Brilliant also mentioned casually to the audit junior that on some occasions, DiamondsForever sends a diamond certified by Certifier A to Certifier B to see if they can get it rated as a much higher grade. If this happens, they discard the certificate from Certifier A because they can sell the diamond for a higher price. After learning of this practice, you make a file note for the audit team noting that Certifier B graded diamonds have a lower value compared to diamonds of equivalent grades certified by Certifier A. You make a second note to check purchase orders and suppliers’ invoices to identify the Certifier A certified diamonds purchased by the company, and to ensure that certificates for any such diamonds have not been discarded in an attempt to artificially

inflate the value of the diamonds.

Required

Identify fraud risk. In planning for the audit of the inventory account balance, an auditor must assess the potential for material misstatements in the account balance. As part of the audit planning process, auditors must give specific consideration to fraud risk, particularly where the auditor identifies potential areas of risk that are not adequately controlled by the internal control system and may, thus, provide the opportunity for asset misappropriation.

You are required to perform a fraud brainstorming session relating to the DiamondsForever inventory system and to indicate areas of potential fraud that you identify by completing the provided Answer Template C (Exhibit 2). In completing this task, Google the Fraud Triangle, which suggests fraud risk is heightened where there is incentive or pressure, opportunity, and attitude or rationalization.

Risk of material misstatements. Through completion of tasks (a) and (b) below, you will gain a further understanding of the risk of material misstatement for the DiamondsForever inventory account.

You are required to discuss and provide answers to each of the following tasks: (a) and (b) by completing the provided Answer Template D (Exhibit 2):

Identify three (3) key business risks faced by DiamondsForever that could result in a material misstatement in the inventory account.

Identify the key assertion at risk for each of the three (3) identified business risks in part (a).

Year-end events. You are required to indicate how each of the five (5) company-specific data items provided in the case materials would impact your inventory audit planning by completing the provided Answer Template E (Exhibit 2).

Use of outside expert. Based on your preliminary investigations during the audit planning for DiamondsForever, you have determined that there is a very high risk of material misstatement in the inventory valuation. To address this risk, your audit manager, who has three years’ experience on the DiamondsForever audit, has asked you to select a sample of diamonds and to send them to an expert diamond valuer for confirmation of the value recorded by DiamondsForever.

You have selected a random sample of 20 wrapped diamonds for valuation and, based on the recommendation of Rob, you engage DiamondExperts to perform the valuation. DiamondExperts has an office two floors below the offices of DiamondsForever, and has been owned and operated solely by Peter Renard for two years. Peter previously worked with John and Rob at BankersBusiness as a financial analyst. When you deliver the sample diamonds to Peter, you are impressed by the office decor, the professional appearance of Peter, the security system in place to gain access to the diamond assessment laboratory, and the modern-looking scientific equipment in the laboratory. You also notice a framed certificate in the reception area dated 12 months ago stating Peter Renard is a certified diamond valuer. The valuation report provided by DiamondExperts for the selected sample of 20 diamonds confirms the valuation recorded by DiamondsForever for these diamonds. On the basis of this report, and your confidence in Peter as a certified valuer, you conclude that the inventory is correctly valued.

However, during the review of your audit work, your audit manager indicates that he is not pleased with how you have undertaken the inventory valuation audit work, nor with the conclusion you have made.

Suggest at least three (3) reasons why the audit manager is not pleased with your inventory valuation work, including the processes used and the conclusion drawn.

For each of the three (3) reasons you identify for part (a), provide suggestions as to how you could improve your inventory valuation audit work.

Provide your answers to parts (a) and (b) by completing Answer Template F (Exhibit 2).

EXHIBIT 2

Answer Template C: Fraud Brainstorming

|

|

| |

| |

| |

| |

Answer Template D: Audit Risks, Account Balance Assertions, Audit Procedures, and Internal Controls

| | | ||

| | |||

| | |||

| |

Answer Template E: Impact of Additional Company-Specific Data on Inventory Audit Planning![]()

| | |

| | |

| | |

| | |

| |

Answer Template F: Inventory Valuation

| | | |

| | ||

| | ||

| |

1http://www.tiffany.com/international.aspx

2http://rough-polished.com/en/expertise/57606.html

3See: http://www.diamonds.net/Prices/RapaportPriceGuide.aspx

4See: http://chemistry.about.com/b/2012/01/01/what-is-cubic-zirconia.htm

5See: http://www.debeers.com/

6See: http://www.diamondsnews.com/rapaport_diamond_prices.htm

7See: http://www.diamonds.net/Prices/GuestPriceGuide.aspx