please answer

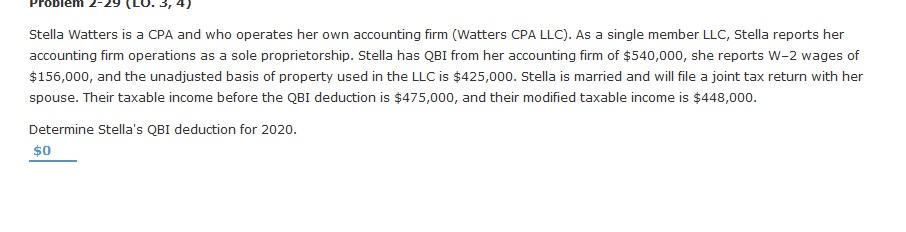

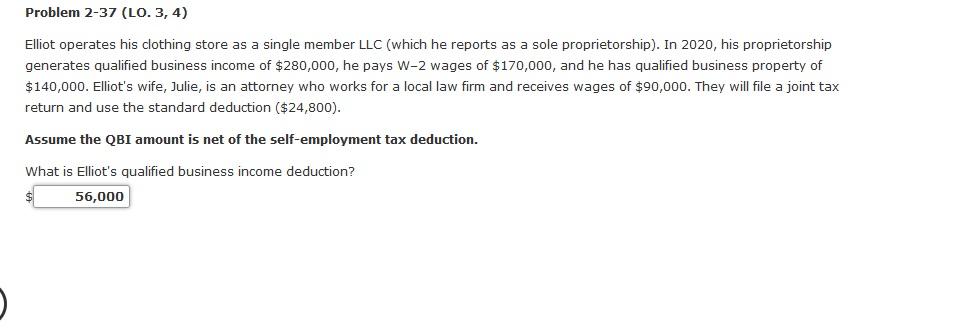

Stella is a CPA and who operate her own accounting firm. As a single member LLC, stella report her accounting firm operation as a sole proprietorship. Stela has QBI from her accounting firm of $540,000, she reports W-2 wages of $156,000, and the unadjusted basis property used in the LLC is $425,000. Stella is married and file joint tax return with her spouse. Their taxable income before the QBI deduction is $475,000, and their taxable income is $448,000

What is stella QBI deduction for 2020?