A finished Strategic Analysis with all sections completed over the previous seven weeks, presented in a format similar to the Colgate-Palmolive example, that uses all of the data from the Strategic An

Company Overview

One of the most successful companies in online retail industry is Amazon which is a multinational technology company. Amazon started as an online bookstore in 1994 in Seattle, Washington and over the preceding two decades, has expanded enormously into one of the top largest American public companies, thanks to its innovative technologies, practices, management, and more importantly exemplary customer service practices. Amazon owes its success mainly to the service they offer. Amazon’s business strategy is mainly based on technology investments, logistics applications enhancements, conducting research and development activities especially in logistics, web services improvements, improving delivery of financial services, mergers and acquisitions strategy, and its web services segment (Grey, 2020).

Since its early days, Amazon has been striving to achieve its mission and vision according to four main principles: Customer obsession, tendency towards innovation, dedication to operational excellence and long-term planning and thinking. Amazon has been praised for prioritizing its customers’ needs by offering excellent customer service and satisfying their wishes with a diverse products and services which has gained customer loyalty for the company in return. The customers can use its web services segment to create communities to exchange information about products and services (Amazon, 2020). Amazon has a reputation to be “an everything stores” where people can buy anything from books, apparel, electronics, toys, jewelry, cosmetics to gourmet food and groceries.

Given Amazon’s whirlwind success throughout the past decades, it is no doubt that the company will continue to thrive under its dynamic and innovative leadership in today’s competitive retail industry. The key to success would be to enhance and diversify its dominance further in different types of businesses.

Mission statement

We strive to offer our customers the lowest possible prices, the best available selection, and the utmost convenience.

Analysis

The mission statement shapes what consumers should expect from Amazon. Customer will be offered the best options of pricing. The company strives to make it priority to care about the customer’s spending. It gives the customer the lowest prices with keeping the quality of the products. This is where the company is the most attractiveness to consumers. Amazon is also dedicated on providing a great variety. The company strives to provide a great range of services and products to the customer. Consumers can find products with ease and smoothness. This is a major reason why Amazon popularity continues to increase. Essentially, there is no limit, its selection is simply limitless.

Vision Statement:

To be Earth most customer-centric company, where customers can find and discover anything they might want to buy online.

Analysis

The vision statement states how it is Amazon’s priority to make it the company a place where all consumers feel cared for and satisfied. The culture of Amazon prioritized the customer to the upmost. The company regularly engages in having great deals, promotions, rewards for customer loyalty. In addition, the ease to navigate is constantly seeking improvement which is an indication of abiding by the vision statement.

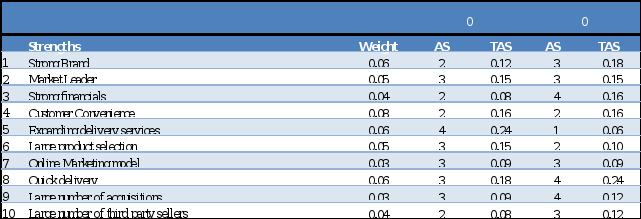

Strengths

Amazon is very convenient. The company understands that in today’s age, this is the fastest way for clients to access anything they want in the comfort of their location. In addition, Amazon works with trusted stakeholders and companies to ship all the orders swiftly. Another strength is Amazon’s global shipping rates. When ordering overseas, there is little difference in price. Global shipping rates are just as affordable. The company has maintained this through its online marketing model that ensures its costs of operations stays at the minimum. This keeps them competitive in the market when offering products and service (Grey, 2020).

Weaknesses

Amazon’s biggest strength is also its biggest weakness. Online retail businesses continue to increase and have become very common. Imitation of Amazon’s business model could be potential. With giants like eBay, Netflix, Walmart, and Apple, they can give Amazon a tough time in the future. In addition, increasing cybercrime can be a possible big factor. In recent years, it has becoming challenging for Amazon to vet products and promise the highest level of safety. Those who engage in Cybercrime can affect the network security system of Amazon. Another big weakness is the huge reliance on distributors. This can cause the company a large range of issues. Relying on distributors can leverage its position to renegotiate terms (Grey, 2020).

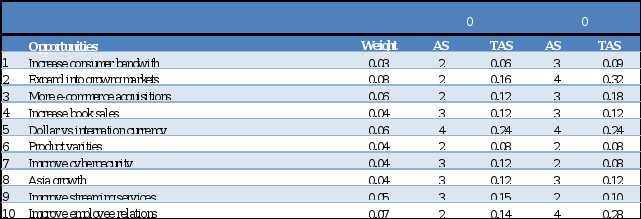

External Factors Evaluation Matrix:

The findings obtained point out that increasing the number of buyers over the internet was positive (0.07). This will increase the number of customers as there is a high chance that they will purchase from Amazon. This opportunity goes together with positive changes in bookselling, as that was one of Amazon's significant strengths (0.05).

If the international markets have grown in their internet, including bandwidth, there is a good chance to use the resources (0.13). Amazon is giving customers access to more bandwidth in all AWS Regions. With the increase bandwidth, customers can now better move data with more efficiency. In addition, the increase will lift the networking bar among the public cloud providers.

Asia growth was at 0.09. The company recently launched a local online store in Singapore, namely Amazon sg. The new store is integrating with its strategy of expanding on an international basis. Amazon sg will offer thousands of products and international brands. This will further strengthen the well-established booming e-commerce business. As the Amazon business model depends on E-commerce, its growth will have similar effects on the firm's sales and productivity (0.1).

The number of categories must increase if the customer base of Amazon is to reach new heights. It is, therefore, the responsibility of Amazon to increase categories (0.09). Suppose young people are tech-savvy and demand innovation and the use of new technology. In that case, Amazon's business model will benefit as they have created a perfect shopping solution for those that want a different experience (0.11). A weak dollar will have a smaller weight (0.02) as it is not highly regarded as an opportunity to advance to international markets.

There has been an increase in competitors globally from Alibaba, eBay, and recently local and regional online platforms. As on the tech side, there are many of B2C and B2B ecommerce stores that growing and thriving. For example, Alibaba is a China-based online retailer that specializes in wholesale selling online, which differentiates for Amazon. The company has huge international presence and a very dominant market share in China.

This has helped it develop and maintain a competitive edge (0.14). Some areas are not adaptive to technological changes, which offer no value to the online business (0.04). Market barriers, including legislation, offer a threat to the business (0.11), while the business's government interference is a threat (0.06). Amazon has become a popular target for more regulation. Today, Amazon is facing antitrust scrutiny. The inquiry is focused on how the company uses its customer data. The data it has access to hurts third-party and allow them to price its own products below what others are offering. Currently, United States Justice Department is conducting an antitrust probe targeting big tech companies.

The growth of the United States dollar can be a threat to international markets' growth at 0.04. Inadequate computer literacy can limit Amazon's growth at a weight of 0.05. All the weights, when added, have equaled 1.

Competitive Profile Matrix:

The Competitive Profile Matrix (CPM) recognizes a firm’s most important competitors and rivals and shows how the firm is performing compared to these competitors, according to several major factors. What distinguishes CPM from EFE and IFF is that CPM utilizes critical success factors and both internal and external factors, strengths, and weaknesses to analyze the firm and its competitors. CPM enables managers to identify who their strongest rivals are and to identify the areas of the firm that needs to be improved (David, David & David, 2020).

In Amazon’s case, the major elements associated with its success are first and foremost price competitiveness and then international market penetration and product variety. There are also some other factors such as marketing position, employee dedication, customer loyalty and product quality that they play important role on company’s overall success as well. As it is shown in our CPM chart, Amazon has been compared to two of its major competitors which are Walmart and eBay. Compared to two other rivals, Amazon is performing moderately good. Based on our CPM analysis, it is noticeable that Amazon receives higher ratings in most of the critical success factors compared to two other competitors and Amazon’s total rate is 7.92 compared to eBay which is 7.78 and Walmart which is 6.41. As a strong firm amongst other rivals, Amazon is facing a difficult task to keep these competitive advantages and keep moving forward. However, Amazon’s CPM analysis also revealed the areas which needs to be worked on and improved such as domestic market penetration, customer service and market share.

|

|

| Amazon | Walmart | eBay | |||||

| Critical Success Factors | Weight | Rating | Score | Rating | Score | Rating | Score | ||

| Marketing Position | 0.11 | 0.44 | 0.44 | 0.33 | |||||

| Domestic Market Penetration | 0.05 | 0.20 | 0.15 | 0.15 | |||||

| Customer Service | 0.05 | 0.20 | 0.20 | 0.20 | |||||

| Product Variety | 0.12 | 0.48 | 0.36 | 0.48 | |||||

| International Market Penetration | 0.13 | 0.52 | 0.52 | 0.39 | |||||

| Employee Dedication | 0.11 | 0.44 | 0.44 | 0.33 | |||||

| Financial Profit | 0.08 | 0.32 | 0.32 | 0.32 | |||||

| Customer Loyalty | 0.11 | 0.44 | 0.44 | 0.44 | |||||

| Market Share | 0.05 | 0.20 | 0.15 | 0.20 | |||||

| Product Quality | 0.11 | 0.44 | 0.44 | 0.33 | |||||

| E-Commerce | 0.08 | 0.24 | 0.32 | 0.24 | |||||

| Price Competitiveness | 1.00 | 4.00 | 4.00 | 3.00 | |||||

| Totals | 2.00 |

| 7.92 |

| 7.78 |

| 6.41 | ||

After analyzing the EFE and the CPM Amazon can use this information to better understand their competitive advantage over its competitors. The EFE is a metric that can be used to identify external factors that Amazon is facing. It then weighs these factors and gives Amazon a better idea of what challenges they can expect to face in the future. The CPM is used to better understand a firm’s competitive advantage over its competitors. Some of the main competitors for Amazon are Alibaba, Walmart, and eBay. Amazon has different competitive advantages over each of these companies and needs to be able to exploit these advantages while minimizing the disadvantages.

Through the EFE matrix Amazon can identified that the biggest external factors regarding opportunities and threats. The biggest opportunities that present Amazon are expanding into global markets and improving employee relations. With the opportunity of expanding into new markets comes an increase in threats that need to be addressed. Without strong employee relations Amazon could lose their strongest asset and be forced to reduce growth. The biggest threats that Amazon needs to address are government regulations and Competition in shipping markets. Both external threats carry the highest identified rate of 0.18 Government regulations are laws that are put into place when a company becomes too powerful and starts to take advantage of the consumer. When this happens the government steps in which could result in Amazon being broken up. To avoid this threat Amazon needs to continue to provide good employee benefits, strong consumer relations, and give back to the communities they operate in. The other threat that was identified was the competition in shipping markets which are companies that include Alibaba, Walmart, and eBay. To better identify what competitive advantages Amazon has over these companies a CPM matrix was completed.

Amazon has a competitive advantage of each of the identified competitors. For Alibaba, the advantage that Amazon holds is a history of doing e-commerce business and a good international reputation. The disadvantage is Alibaba is based in China and consumers in China might feel more comfortable using a location company rather than a foreign company. To change consumers option on this Amazon needs to work on building a good reputation in foreign countries to gain consumer support. Walmart is another competitor of Amazon as Walmart is known brand and trusted by many consumers. Walmart has many store locations and if they decide to grow more heavily into the shipping markets, they could become a major competitor in the two-day shipping world that Amazon has become so strong in. Amazon can stop Walmart from growing into this market by offering competitive prices on their products. Another competitor that Amazon must watch out for is eBay as they offer a similar product that Amazon offers. The main advantage that Amazon offers over eBay is the amount of content and options are much greater. To prevent eBay from growing and taking consumers Amazon needs to continue to grow its many businesses.

Amazon is a large company that spans many consumer environments. By being in all these different consumer sectors it can grow a company at a significant rate like it has for Amazon. With this grow comes different challenges that need to be addressed. To address these issues a EFE and CPM matrices need to be performed. Through the EFE the major opportunities and threats can be identified and through the CPM the company’s competitive advantages over competitors can be identified. Amazon is a major company that always has many threats and opportunities and has many competitors all aspects of their business.

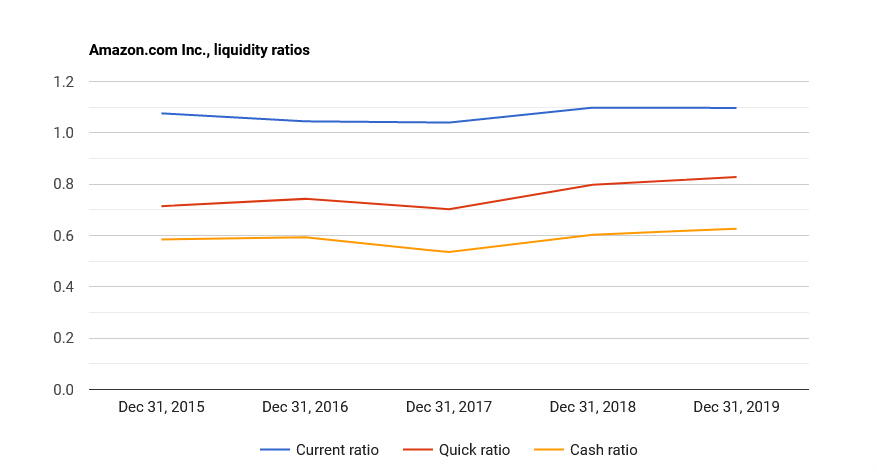

Amazon Inc. is a multinational company whose headquarters are based in the USA. Under the leadership of Jeff Bezos, the company has witnessed tremendous growth over time hence getting a more significant market share than its competitors. By carrying out ratio analysis for this company, there is much information that has been gathered.

Ratio analysis can be defined as carrying quantitative analysis for a given company to gain more information concerning the liquidity, efficiency, and profitability of a company. The analysis comprises uses statements like balance sheets and income statements. The following table presents the ratio analysis of Amazon.

|

| Historical Ratios | ||

|

| 2018-12-31 |

| 2019-12-31 |

| Current Ratio | 1.10 |

| 1.13 |

| Quick Ratio | 0.85 |

| 0.87 |

| Total Debt-to-Total-Assets Ratio | 0.72 |

| 0.72 |

| Total Debt-to-Equity Ratio | 2.51 |

| 2.52 |

| Times-Interest-Earned Ratio | 9 |

| 9 |

| Inventory Turnover | 10.08 |

| 9.14 |

| Fixed Assets Turnover | 3.77 |

| 2.87 |

| Total Assets Turnover | 1.43 |

| 1.23 |

| Accounts Receivable Turnover | 13.96 |

| 13 |

| Average Collection Period | 26.14 |

| 28.13 |

| Gross Profit Margin % | 26% |

| 27% |

| Operating Profit Margin % | 5% |

| 5% |

| ROA % | 6% |

| 5% |

| ROE % | 21% |

| 16% |

From the above table, liquidity ratios are presented by current and quick ratios. These ratios help in determining the company's capability to honor its short-term debt. From the figures, Amazon's capability improved from 2018 to 2019 for both ratios. This shows that the capability to meet short term debt increased, increasing the chances of getting more current debt. The ratio has been going up from the market research, so the potentiality of it going up in the future is high and indicated in the graph below, analyzed by StockAnalysis.com.

Profitability ratios comprise another vital part of ratio analysis. It helps determine, measure, and evaluate an organization's capacity to generate profit, given revenue generated, assets, costs, and equity in a given period (CFI, 2020). It helps to know if the company used its resources to the fullest capacity to generate income. Higher ratios always indicate the company is performing well and are always looked after by organizations. The ratios include gross profit, ROE, and ROA. The table below presents a summary of the Ratios for crucial profitability ratios.

| Gross Profit Margin % | 26% |

| 27% |

| ROA % | 6% |

| 5% |

| ROE % | 21% |

| 16% |

The ROE was reduced from 2018 to 2019. This shows that the company may have invested assets in unprofitable projects or it mismanaged the available assets. This also happened to ROA, which went down from 2018 to 2019. This implies Amazon could have over-invested the assets, which did not, in turn, productivity growth in revenues. The gross profit margin did relatively okay because it increased from 26% to 27%.

Another critical ratio type is efficiency ratios, which involve analyzing the company's ability to employ its available resources to generate an income. It includes inventory turnover, fixed asset turnover, and total asset turnover. The table below summarizes the ratios named above. Although there was a slight drop for the three ratios from 2018 to 2019, the company performed well.

| Inventory Turnover | 10.08 |

| 9.14 |

| Fixed Assets Turnover | 3.77 |

| 2.87 |

| Total Assets Turnover | 1.43 |

| 1.23 |

Amazon’s success is impacted by effectively utilizing its strengths. One great strength is the strength of the brand. This has enabled the company to grow its business rapidly. Amazon has grown exceptionally over the years. It has maintained a strong third-party network worldwide. This combined with strong customer loyalty continues to strengthen the brand. The approach has helped its shareholders derive value from the company.

Another strength is customer convenience. The customers are treated to various benefits with the prime membership. Of the benefits are faster shipping on eligible purchases and unlimited video streaming. The product range is immense. This goes along with the massive number of sellers globally. In terms of good customer service, the company can be considered as a model. Another key strength is the company strong financials. Amazon consistently registers high sales. Profits are so high that it can deal with the high operation cost it suffers. Through new technology innovations, Amazon can retain its competitive advantage in the market.

In contrast, weaknesses are the lack of competency within an organization. Amazon has a few. Due to high costs incurred in delivery, the company suffers low profit margins. Operating cost remain high, even with Prime service partly covering for delivery. Another arising issue is product quality. In recent years, there have been many issues on proudest relation issues. This is due to the allowing of its market to be flooded by Chinese and other overseas sellers. The issue continues to be tackled and there has been improvement, nonetheless, it causes a major setback to its brand. In addition, there is has been many reports of product failure. There have been products made by Amazon and overseas sellers that have failed. One reason for this is due to the high competition in the market and ever-changing technological developments. The heavy reliance on third part distributors hurt Amazon and limits their leverage.

| Strengths | Weight | Rating | Weighted Score |

| Strong Band | 0.06 | 4 | 0.24 |

| Market Leader | 0.05 | 4 | 0.20 |

| Strong financials | 0.04 | 3 | 0.12 |

| Customer Convenience | 0.08 | 4 | 0.32 |

| Expanding delivery services | 0.06 | 3 | 0.18 |

| Large product selection | 0.05 | 4 | 0.20 |

| Online Marketing model | 0.03 | 3 | 0.09 |

| Quick delivery | 0.06 | 4 | 0.24 |

| Large number of acquisitions | 0.03 | 3 | 0.09 |

| Large number of third-party sellers | 0.04 | 3 | 0.12 |

| Weaknesses | Weight | Rating | Weighted Score |

| Little presence of physical stores | 0.03 | 3 | 0.09 |

| Ease to copy business, (online retailers) | 0.07 | 2 | 0.14 |

| High reliability of third-party distributors | 0.05 | 3 | 0.15 |

| High delivery cost | 0.05 | 3 | 0.15 |

| Potential cybercrime | 0.04 | 2 | 0.08 |

| Tax avoidance controversy | 0.03 | 1 | 0.03 |

| Safety in the workplace | 0.06 | 2 | 0.12 |

| Product quality issues | 0.07 | 3 | 0.21 |

| Product failure | 0.05 | 3 | 0.15 |

| Use of third-party data | 0.05 | 1 | 0.05 |

| Total IFE Score | 1.00 |

| 2.97 |

In order for Amazon to continue to grow that way it has for years in need to capitalize on its strengths. The first strength that Amazon needs to utilize is its large product selection. Though offering as many products as possible to consumers more customers will be willing to join Prime to get there products quicker. By expanding on this strength Amazon will continue to see growth of new Prime members. Another strength that Amazon need to continue improvement on is its strong brand. Amazon is a brand that is known throughout the world and they have spent a lot of time and money to have a positive brand recognition.

The strengths of a company are important but companies need to be able to address there weaknesses as well. In the case of Amazon, its major weaknesses that they need to address is product quality issues. The quality of the final product is what the customer sees. All the work that leads to the product getting to door is significant and if the product is broke upon arrival Amazon is going to be blamed. This issue could have resulted with the producer but since Amazon is the one delivering it the consumers assumes it was Amazons fault. This major weakness of product quality needs to be addressed before Amazons image is hurt significantly.

Amazon is a company that is currently is a strong financial position and is looking to increase this position in the future. To increase its position Amazon, need to expand on its strengths and address its major weaknesses. The strengths Amazon can improve on are its brand recognition and ways to increase its prime memberships. The major weakness that Amazon needs to address is the quality control of its final product. Without a strong final product Amazon will lose its strong brand recognition. Overall, Amazon is a company that is set up financial to continue growing into the future.

The internal strategic position of Amazon shows strong financial strength. Net income is constantly strong which provides internal financing generated from their own operations. Other financial parameters like the current ratio are showing a steady reduction. More consideration and review should be given to the debt-to-equity ratio. Lenders and investors tend to favor lower D/E ratios as there is lower risk of loan default. One strategy to improve this is to push for investments in new projects, or simply wait for the market to change. Overall, Amazon has very healthy position with the financial strength averaging at 5. The external strategic position displaying environmental stability obtain an average of -3.0. For Amazon, competitive pressure consistently an issue. This is because if the ease to duplicate its business model. In addition, the company is also challenging with barriers to entry such as partnering with the right technology partners and dealing with third parties. These are major external challenges for the Amazon. A strategy that could help with is to put more policy in place to protects sellers’ confidential data so it cannot be used against them.

The competitive advantage of Amazon is its customer loyalty. The company makes it top priority to improve customer satisfaction. In addition, customers trust that they can always buy with confidence on Amazon. This is because product quality remains strong and trusted. Average score is -3.0, which is a good standing position. Amazon industry strength shows an average score 4.2. The industry strength is reduced a bit by the ease of entry into the market. However, this is countered with company’s strong financial stability and growth potential. In addition, Amazon’s high profit potential provides even more strength to the organization. In conclusion, the space matrix has Amazon at (1.2, 2). This shows that the company is has an aggressive strategy positioning. Competitors such as Walmart and eBay show as conservative.

Part 1

|

FP SP CP IP IPIP Defensive Conservative Aggressive Competitive | ||||||||||

|

| Amazon | Walmart | eBay |

| X Axis | 1.2 | -1.0 | -1.0 |

| Y Axis | 2.0 | 3.0 | 1.0 |

| Internal Analysis: |

|

| External Analysis: |

|

| |||||||||

| Financial Position (FP) |

|

| Stability Position (SP) |

|

| |||||||||

| Current Ratio | Rate of Inflation | -3 | ||||||||||||

| Debt to Equity | Technological Changes | -1 | ||||||||||||

| Net Income | Price Elasticity of Demand | -2 | ||||||||||||

| Revenue | Competitive Pressure | -5 | ||||||||||||

| Inventory Turnover | Barriers to Entry into Market | -4 | ||||||||||||

| Financial Position (FP) Average | 5 | Stability Position (SP) Average | -3.0 | |||||||||||

| Internal Analysis: |

|

| External Analysis: |

|

| |||||||||

| Competitive Position (CP) |

| Industry Position (IP) |

|

| ||||||||||

| Market Share |

|

| -5 | Growth Potential |

|

| ||||||||

| Product Quality |

|

| -4 | Financial Stability |

|

| ||||||||

| Customer Loyalty |

|

| -2 | Ease of Entry into Market |

| |||||||||

| Variety of Products Offered |

| -1 | Resource Utilization |

|

| |||||||||

| Control over Suppliers and Distributors | -3 | Profit Potential |

|

| ||||||||||

| Competitive Position (CP) Average | -3.0 | Industry Position (IP) Average | 4.2 | |||||||||||

Part 2

|

Rapid Market Growth Quadrant II Quadrant I Quadrant III Quadrant IV Weak Competitive Position

Strong Competitive Position | |||||||||||||||||||

|

Slow Market Growth | |||||||||||||||||||

Part 3