Over that past few Modules, you have analyzed the financial ratios/data for two different organizations, Microsoft and Apple. For the final paper, you will prepare a formal report that compares and co

Builder -2 (writing analysis)

Debt to Asset Ratio Introduction- the debt to asset ration means that how much debt a company hold against their assets. We can say also defined that a total debt to total assets is allocation in the company. It is a financial ratio number which present the company debt liabilities against to their total asset values.

We can also define as below as well-

The debt ratio measures the amount of leverage used by a company in terms of total debt to total assets.

A debt ratio greater than 1.0 (100%) tells you that a company has more debt than assets.

Meanwhile, a debt ratio less than 100% indicates that a company has more assets than debt.

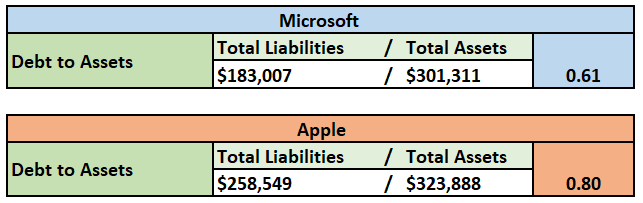

We can also calculate the debt to asset based on the below formula

Debt ratio=Total debt/Total assets

While considering the debt to asset ration for apple and Microsoft as below which is less then 1.0 % and it means that company has more assets than debt .

Conclusion-

the conclusion is that if a company has less than 1.0 debt ratio means company is not having much debt on total organization and if a company has more then 1.0 (100%) means that company has debt value more than total company asset values which indicate that company has less chance of increasing the values/profitability because the company has to clear the dues partially combine with their growth values. The investor has to focus also the company has how big debt ratio while trying to invest or checking the company balance sheet .