Over that past few Modules, you have analyzed the financial ratios/data for two different organizations, Microsoft and Apple. For the final paper, you will prepare a formal report that compares and co

Builder – 5

Working Capital:

Working capital is the difference between a company’s current assets, such as cash, accounts receivable (customers’ unpaid bills) and inventories of raw materials and finished goods, and its current liabilities, such as accounts payable. Sometimes it is also known as a net working capital (NWC).

It is a measure of a company's liquidity and refers to the difference between operating current assets and operating current liabilities. also, in other hands if I say that pointwise –

A company has negative working capital If the ratio of current assets to liabilities is less than one.

Positive working capital indicates that a company can fund its current operations and invest in future activities and growth.

High working capital isn't always a good thing. It might indicate that the business has too much inventory or is not investing its excess cash

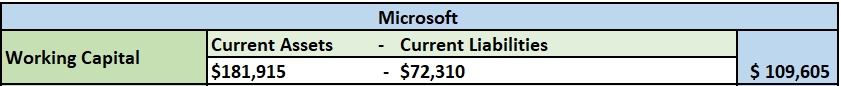

We can calculate the working capital by following the below formula-

Working capital = Current Assets – Current Liabilities

An example based on the builder template for both the companies

Example based on the Microsoft balance sheet-

Example based on the Apple balance sheet from the Builder assignment template-

Conclusion: as per the stats from the apple and Microsoft , the apple is better than Microsoft because it working capital is low to Microsoft and it means that Microsoft WC has too much inventory .

Current Ratio:

The current ratio is a measure the capability of a business to meet its short-term obligations that are due within a year. The ratio considers the weight of total current assets versus total current liabilities. It indicates the financial health of a company and how it can maximize the liquidity of its current assets to settle debt and payables. It is also known as the working capital ratio.

We can calculate the current ratio based on the below formula-

Current Ratio = Current Assets / Current Liabilities

And I can consider the example by following the builder template sheet for the two companies as below –

Example based on the Microsoft balance sheet-

![]()

Example based on the Apple data from the Builder assignment template-

![]()

Conclusion: as per the data available for both the companies , it clearly shows that business currently has a current ratio of 2.52, meaning it can easily settle each dollar on loan or accounts payable twice and half.

A rate of more than 1 suggests financial well-being for the company. There is no upper end on what is “too much,” as it can be very dependent on the industry, however, a very high current ratio may indicate that a company is leaving excess cash unused rather than investing in growing its business. The apple is better then Microsoft in current ratio.

Quick Ratio : Quick assets are those assets that can be converted into cash within a short period of time. The term is also used to refer to assets that are already in cash form. Quick assets are therefore considered to be the most highly liquid assets held by a company.

We can calculate the current ratio based on the below formula-

Quick Assets = Current Assets – Inventories

Now, considering the analysis template from builder sheet for the two companies as below-

analysis based on the Microsoft balance sheet-

![]()

Example based on the Apple data from the Builder assignment template-

![]()

Conclusion- A high quick ratio is an indication that a company is utilizing its short-term assets effectively to meet its financial needs. As seen in the examples above for the apple and Microsoft where the quick ratio of Microsoft is greater than apple, so it means it has enough quick assets to cover all its current liabilities

Companies should aim for a high quick ratio because it can help attract investors. It also increases the company’s chance of getting loans, as it shows creditors that it is able to handle its debt obligations.