Over that past few Modules, you have analyzed the financial ratios/data for two different organizations, Microsoft and Apple. For the final paper, you will prepare a formal report that compares and co

Builder-4

Free Cash Flow:

Free cash flow as known as FCF, represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the non-cash expenses of the income statement and includes spending on equipment and assets as well as changes in working capital from the balance sheet.

If I explain in other hands then it would like below explanations-

Free cash flow (FCF) represents the cash available for the company to repay creditors or pay dividends and interest to investors.

FCF reconciles net income by adjusting for non-cash expenses, changes in working capital, and capital expenditures (CAPEX).

However, as a supplemental tool for analysis, FCF can reveal problems in the fundamentals before they arise on the income statement. We can use the below calculation to find the FCF -

FCF = Cash from Operations – CapEx

Cash Conversion Cycle:

The Cash Conversion Cycle (CCC) is a metric that shows the amount of time it takes a company to convert its investments in inventory to cash. The conversion cycle formula measures the amount of time, in days, it takes for a company to turn its resource inputs into cash.

We can also know as CCC sometimes to present in the short forms, herewith is the formula explain to calculate the CCC

The cash conversion cycle formula is as follows:

Cash Conversion Cycle = DIO + DSO – DPO

DIO stands for Days Inventory Outstanding

DSO stands for Days Sales Outstanding

DPO stands for Days Payable Outstanding

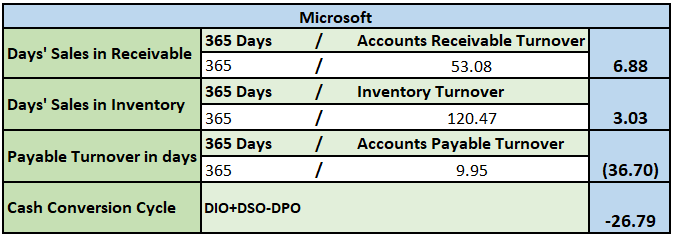

Now , we will compare the two top companies of data analysis and conclude that which company has good CCC. I will show first the example of Microsoft as below

Example of Microsoft data

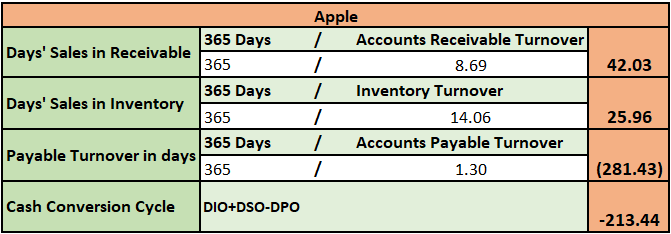

Now let’s take a look of data from the apple builder sheet –

Example of Apple data

as per analysis and data provided we have DIO,DSO,DPO but in the real to calculate we have to first find out the values of all these and we should know each factor to find the ccc

Conclusion- The cash conversion cycle formula is aimed at assessing how efficiently a company is managing its working capital. As with other cash flow calculations, the shorter the cash conversion cycle, the better the company is at selling inventories and recovering cash from these sales while paying suppliers. In this scenario, Microsoft is better then apple which is taking less time approximately -27 days to turn its initial cash investment in inventory back into cash while apple take -213 days.