Course Project Combine all the research and data you have completed for the Course Project assignments from Weeks 1–4. Do not just copy and paste previous assignments. Rather, analyze and present your

Assignment

South University

4-4-2021

Course Project

The scenario is designed to help you determine and evaluate the payment amount of a car loan and a mortgage, based on the assumption that your household income is $36,000 per year or $3,000 per month. Based on your income, you may spend 28% of your monthly income on housing, and 10% on a car loan. You are to put a 3% down payment on the house and a 10% down payment on the car.

Tasks:

What is the maximum car payment and mortgage payment you can afford with the following conditions: your monthly household income, 10% for the car payment over 4 years, and 28% for the 15-year mortgage payments?

Maximum Monthly Payment in Car Loan

= $3,000 × 10%

= $300

So, car loan 10% on the monthly income is $300.

Maximum Monthly Payment in House Loan

= $3,000 × 28%

= $840

Housing loan consist 28% on your monthly income of $840.

The total amount of Loan is 840+300

= 1140

Create a complete amortization schedule for the car, using the information above.

We have to determine the amount of loan

Annual income = $36,000

Monthly Income = $3,000.

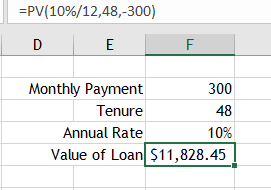

Maximum Car Loan they can afford at 10% interest rate for 48 months is calculated in excel.

The car Loan would be 300*12(months) * 4(years) which is equivalent of $14,400.

We will assume the interest rate of 10% as advised.

Rate = 10%

Period = 48 months

Down payment = 10% of 14,400 = 1440.

Pv of Loan = $11,828.45.

Value of car they can afford is $11,828.45.

Complete Amortization Schedule for The Car using Excel amortization calculator

| Loan amount | 11,828.45 | ||||||||

| Annual interest rate | 10.00% | ||||||||

| Loan period in years | |||||||||

| Start date of loan | 2021-04-03 | ||||||||

| Monthly payment | $300.00 | ||||||||

| Number of payments | 48 | ||||||||

| Total interest | $ 2,571.55 | ||||||||

| Total cost of loan | $ 14,400.00 | ||||||||

| No. | Payment | Beginning | Payment | Principal | Interest | Ending | |||

| 2021-05-03 | $11,828.45 | $300.00 | $201.43 | $98.57 | $11,627.02 | ||||

| 2021-06-03 | $11,627.02 | $300.00 | $203.11 | $96.89 | $11,423.91 | ||||

| 2021-07-03 | $11,423.91 | $300.00 | $204.80 | $95.20 | $11,219.11 | ||||

| 2021-08-03 | $11,219.11 | $300.00 | $206.51 | $93.49 | $11,012.60 | ||||

| 2021-09-03 | $11,012.60 | $300.00 | $208.23 | $91.77 | $10,804.37 | ||||

| 2021-10-03 | $10,804.37 | $300.00 | $209.96 | $90.04 | $10,594.41 | ||||

| 2021-11-03 | $10,594.41 | $300.00 | $211.71 | $88.29 | $10,382.70 | ||||

| 2021-12-03 | $10,382.70 | $300.00 | $213.48 | $86.52 | $10,169.22 | ||||

| 2022-01-03 | $10,169.22 | $300.00 | $215.26 | $84.74 | $9,953.96 | ||||

| 10 | 2022-02-03 | $9,953.96 | $300.00 | $217.05 | $82.95 | $9,736.91 | |||

| 11 | 2022-03-03 | $9,736.91 | $300.00 | $218.86 | $81.14 | $9,518.05 | |||

| 12 | 2022-04-03 | $9,518.05 | $300.00 | $220.68 | $79.32 | $9,297.37 | |||

| 13 | 2022-05-03 | $9,297.37 | $300.00 | $222.52 | $77.48 | $9,074.85 | |||

| 14 | 2022-06-03 | $9,074.85 | $300.00 | $224.38 | $75.62 | $8,850.47 | |||

| 15 | 2022-07-03 | $8,850.47 | $300.00 | $226.25 | $73.75 | $8,624.23 | |||

| 16 | 2022-08-03 | $8,624.23 | $300.00 | $228.13 | $71.87 | $8,396.09 | |||

| 17 | 2022-09-03 | $8,396.09 | $300.00 | $230.03 | $69.97 | $8,166.06 | |||

| 18 | 2022-10-03 | $8,166.06 | $300.00 | $231.95 | $68.05 | $7,934.11 | |||

| 19 | 2022-11-03 | $7,934.11 | $300.00 | $233.88 | $66.12 | $7,700.23 | |||

| 20 | 2022-12-03 | $7,700.23 | $300.00 | $235.83 | $64.17 | $7,464.40 | |||

| 21 | 2023-01-03 | $7,464.40 | $300.00 | $237.80 | $62.20 | $7,226.60 | |||

| 22 | 2023-02-03 | $7,226.60 | $300.00 | $239.78 | $60.22 | $6,986.82 | |||

| 23 | 2023-03-03 | $6,986.82 | $300.00 | $241.78 | $58.22 | $6,745.05 | |||

| 24 | 2023-04-03 | $6,745.05 | $300.00 | $243.79 | $56.21 | $6,501.26 | |||

| 25 | 2023-05-03 | $6,501.26 | $300.00 | $245.82 | $54.18 | $6,255.43 | |||

| 26 | 2023-06-03 | $6,255.43 | $300.00 | $247.87 | $52.13 | $6,007.56 | |||

| 27 | 2023-07-03 | $6,007.56 | $300.00 | $249.94 | $50.06 | $5,757.63 | |||

| 28 | 2023-08-03 | $5,757.63 | $300.00 | $252.02 | $47.98 | $5,505.61 | |||

| 29 | 2023-09-03 | $5,505.61 | $300.00 | $254.12 | $45.88 | $5,251.49 | |||

| 30 | 2023-10-03 | $5,251.49 | $300.00 | $256.24 | $43.76 | $4,995.25 | |||

| 31 | 2023-11-03 | $4,995.25 | $300.00 | $258.37 | $41.63 | $4,736.87 | |||

| 32 | 2023-12-03 | $4,736.87 | $300.00 | $260.53 | $39.47 | $4,476.35 | |||

| 33 | 2024-01-03 | $4,476.35 | $300.00 | $262.70 | $37.30 | $4,213.65 | |||

| 34 | 2024-02-03 | $4,213.65 | $300.00 | $264.89 | $35.11 | $3,948.77 | |||

| 35 | 2024-03-03 | $3,948.77 | $300.00 | $267.09 | $32.91 | $3,681.67 | |||

| 36 | 2024-04-03 | $3,681.67 | $300.00 | $269.32 | $30.68 | $3,412.35 | |||

| 37 | 2024-05-03 | $3,412.35 | $300.00 | $271.56 | $28.44 | $3,140.79 | |||

| 38 | 2024-06-03 | $3,140.79 | $300.00 | $273.83 | $26.17 | $2,866.96 | |||

| 39 | 2024-07-03 | $2,866.96 | $300.00 | $276.11 | $23.89 | $2,590.85 | |||

| 40 | 2024-08-03 | $2,590.85 | $300.00 | $278.41 | $21.59 | $2,312.44 | |||

| 41 | 2024-09-03 | $2,312.44 | $300.00 | $280.73 | $19.27 | $2,031.71 | |||

| 42 | 2024-10-03 | $2,031.71 | $300.00 | $283.07 | $16.93 | $1,748.65 | |||

| 43 | 2024-11-03 | $1,748.65 | $300.00 | $285.43 | $14.57 | $1,463.22 | |||

| 44 | 2024-12-03 | $1,463.22 | $300.00 | $287.81 | $12.19 | $1,175.41 | |||

| 45 | 2025-01-03 | $1,175.41 | $300.00 | $290.20 | $9.80 | $885.21 | |||

| 46 | 2025-02-03 | $885.21 | $300.00 | $292.62 | $7.38 | $592.58 | |||

| 47 | 2025-03-03 | $592.58 | $300.00 | $295.06 | $4.94 | $297.52 | |||

| 48 | 2025-04-03 | $297.52 | $300.00 | $297.52 | $2.48 | $0.00 | |||

Analyze the distributions of principal, interest and the balance over the life of the loan.

Car

| Loan amount | 11,828.45 |

| Annual interest rate | 10.00% |

| Loan period in years | |

| Start date of loan | 2021-04-03 |

| Monthly payment | $ 300.00 |

| Number of payments | 48 |

| Total interest | $ 2,571.55 |

| Total cost of loan | $ 14,400.00 |

This above table shows the distribution of the principal which is 11,828.45. the inters of the loan is 300 and the total interest paid is 2571.55. the loan is cleared within 48 months for car loan.

House

We have to know yearly Payment; 28% x $3000 per month x 1 years x 12 months

= $10,800 as yearly payment.

Mortgage: 28% x $3000 per month x 15 years x 12 months = $151,200 mortgage payment.

The principle would be = $104,626.95 arrived using excel =-PV(5%,15,10080)