Can you help solving this accounting calculation and explanation?

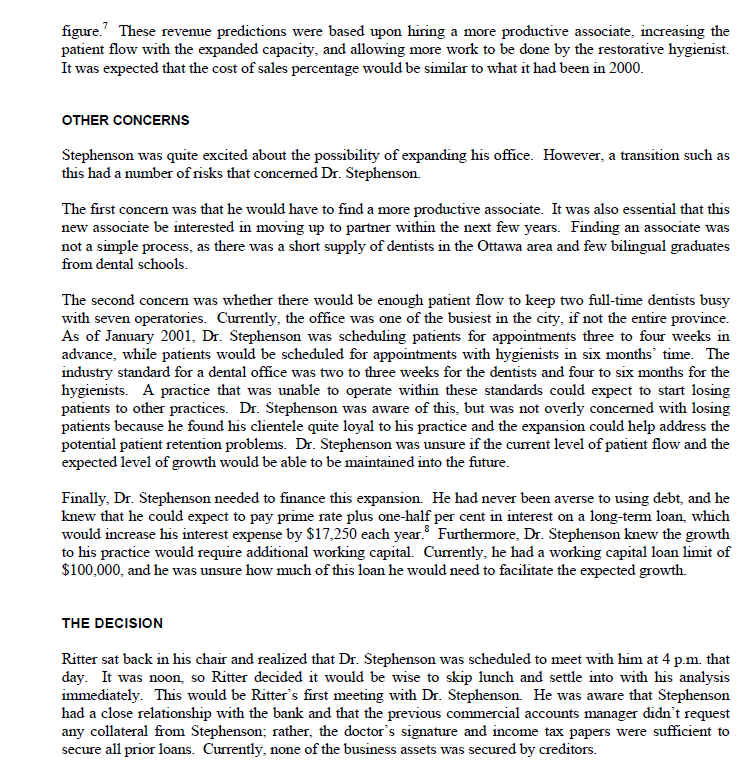

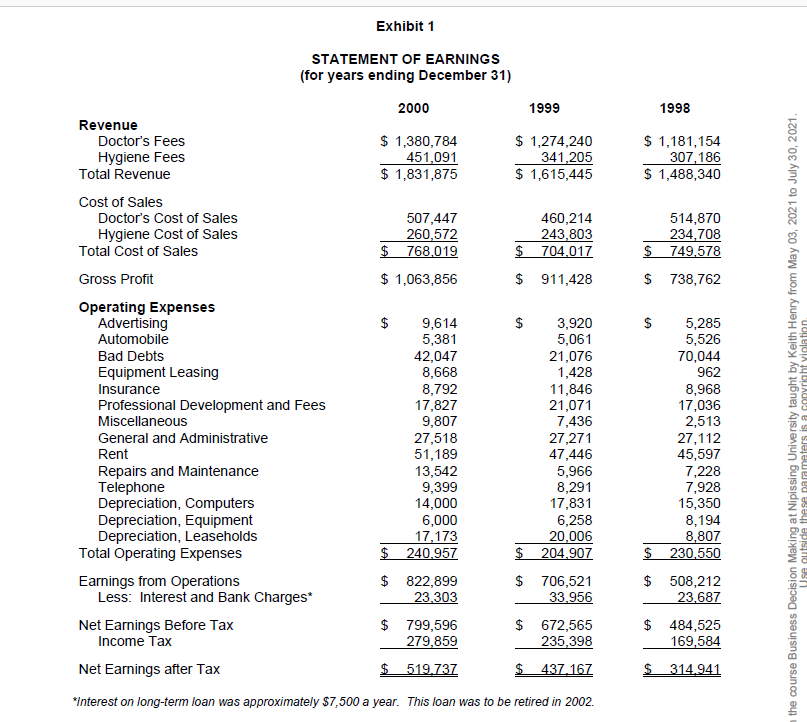

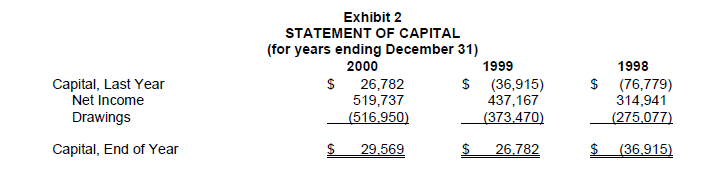

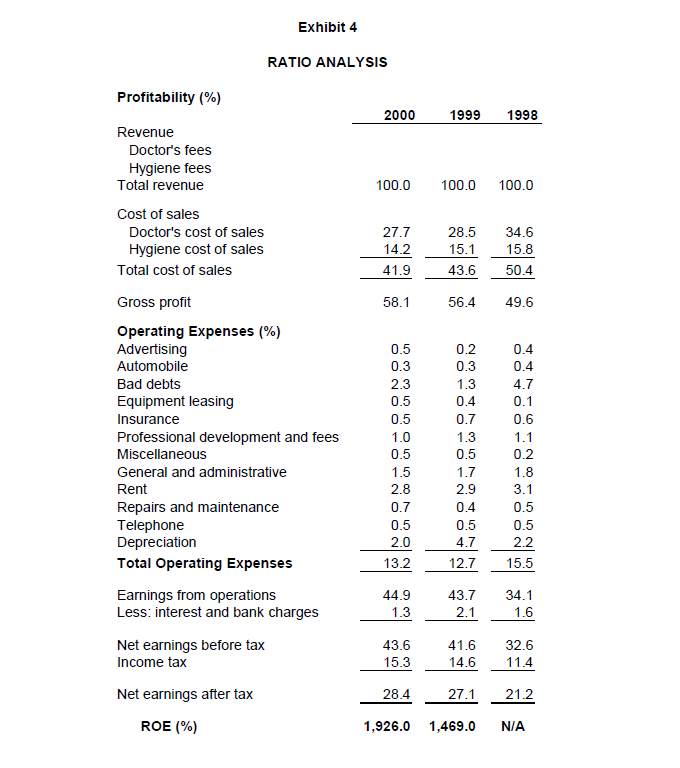

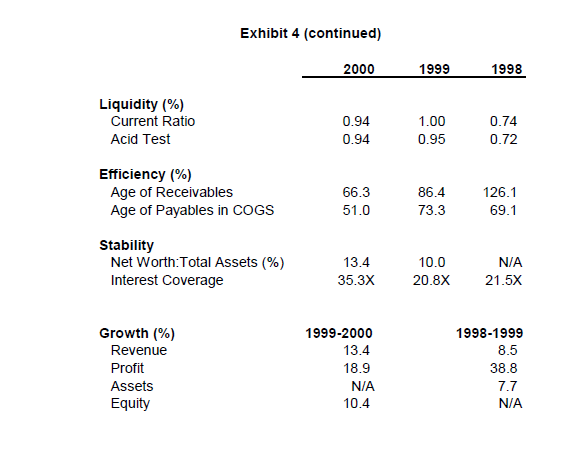

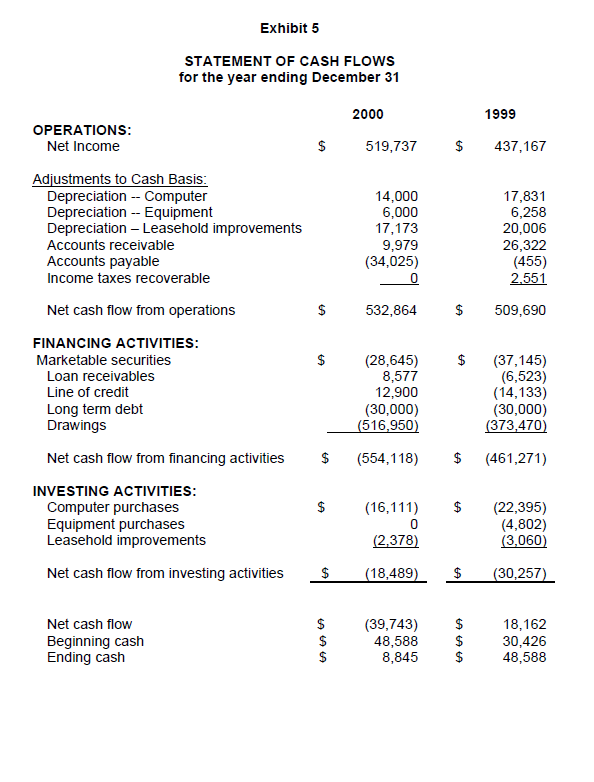

As Ritter, assess past financial performance of Dr. Stephenson’s practice.

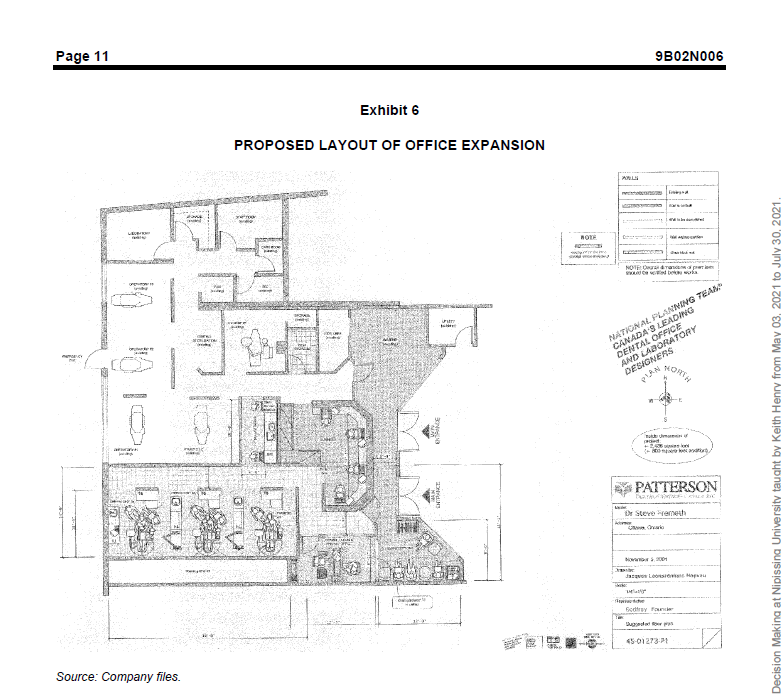

Prepare 2 years of projected earnings, retained earnings and balance sheets for fiscal 2001 and 2002. Plug for the Line of Credit.

How much of a loan is needed? What type and term is required?

Analyze the risk associated with the loan using the Four C’s of credit for Dr. Stephenson and his practice.

What alternatives should you consider?

What is your decision? Provide support for your answer.

Please use the following to explain the case in the word file not more than 2 pages with 12pt font and 1 inch margin

(What business is the organization? Its customers, how to improve customer satisfaction, swot analysis,

What decisions to be made, problem to be solved?( With evidence from the case) what facts are relevantand key to solution, are they symptoms or causes? What the facts mean for this problem?

What are decision criteria and alternatives(creative solutions), evaluation of the alternative in terms of decision criteria. Pros n cons of both

What is your plan of action? Result you expect n why)