Instructions Cookie Business Final Presentation Now that you have completed running some calculations for the cookie business that are attached, you will present your findings. The learning objective

11

Unit 7: FINAL PROJECT ESSAY

Name

Columbia Southern University

08/17/2022

THE FINAL PROJECT ESSAY

Abstract

For this research paper, we will seek to analyze data and financial information of several accounting processes to develop the right information and insights regarding the cookie company. Throughout the course, we have been comprehensively analyzing the financial health of the cookie business using various accounting tools like internal returning rates, contribution margin, etc. However for this financial paper, we will be analyzing various concepts relating to the cookie business, including the breakeven or contribution margin, special order, cash budget, material and labor variance among others. For the conclusion a recommendations parts, we will be focusing on some potential areas that the company can improve, especially on reporting and analyzing external threats.

Introduction

The sweet cookie company is based in W. Virginia. It seeks other sugar-free and low carbohydrate cookies while focusing on the customer's healthcare; additionally, the company has been growing gradually. The major customers include younger adults and teenagers between 13 to 19 years. Due to an increased customer base, the company began producing three cookies to meet customers' wants, including the specialty, chocolate chip, and sugar times. To meet the current demands, the organization has also employed several workers on a full-time basis. The management has also been considering buying new and high-performing equipment to meet the demands. Additionally, if the production increases, the company will purchase a new warehouse due to relatively larger production. Avon (2021).

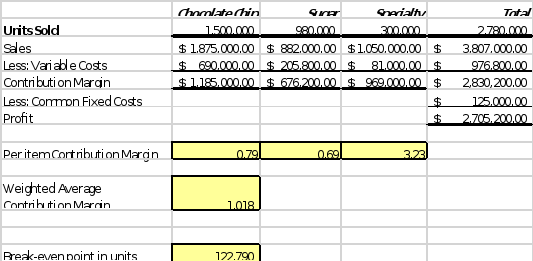

Pt. 1: the breakeven

According to the following metrics, the highest contribution margin comes from the specialty cookies but to relatively higher revenue generation for each unit. We also deduct that the specialty type generated 4.09 times higher than the chocolate chip. Therefore the sugar cookie would be the best type to be cut if the company sought to eliminate unwanted costs and gradually increase specialty cookie production. This would be able to meet the increasing demand for specialty. However, if the contribution margin would be negative, it would mean the money is being lost; therefore, production should be dropped.

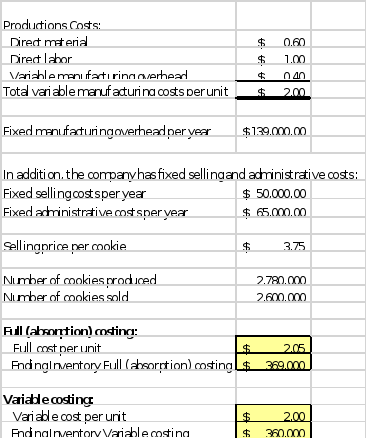

Pt. 2: the full and variable costing

The fill costing refers to all the amounts that the company incurs during the production process, including the fixed costs; however, the fixed costs are normally ignored in variable costing. Therefore, to recover all the business costs, including the fixed ones, the cookie company has to sell adequate products. However, if they do not sell adequate cookies, they will fail. Since the cookie company is a relatively new firm with only cookies as its major products, the full costing will help obtain further insights into the organization's financial health.

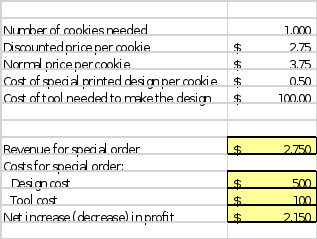

Pt. 3: the special order

Despite the wedding cookies not bringing adequate returns at the company's original expectations according to the current pricing, the profitability will increase by $2150; therefore, it is acceptable. There are no pending orders that may increase profitability, and the business is relatively slow. However, we recommend that the company reject further orders during a busy day when other preexisting orders are more profitable since they will generate a higher income. Perry et al. (2000).

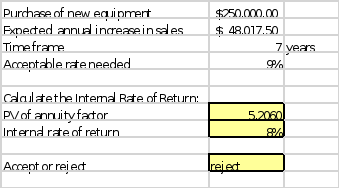

Pt. 4. The internal rates of return

Due to the current acceptable rates developed by the cookie company, the company should suspend any event to buy or procure new equipment. We have to understand that purchasing equipment from the partner's brother is fully legal; however, it may raise concerns among other partners. Therefore, purchasing new equipment will be a relatively large investment; therefore, the company should make its decisions based on current financial aspects and not nepotism (2015).

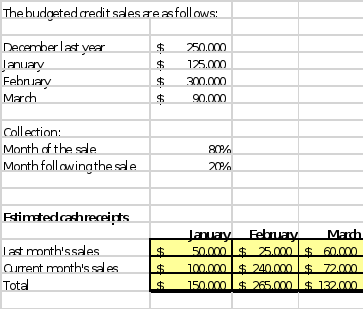

Pt. 5: the cash budget

From the analysis, the company's expenses were $150,000.00 each month between January and February; however, these expenses are normally covered by the cash receipts. There is a tremendous increase in the flow chart in March since the amount available was relatively lower. The major business-standard involves having adequate financial reserve to about three to six months for the operating cash outflow. Therefore the company should have adequate cash flow to deal with emergencies and increase prices.

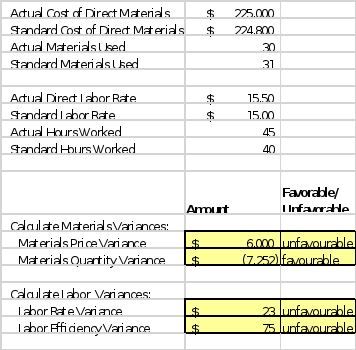

Pt. 6

The company compensated relatively higher amounts for the direct materials than initially forecasted despite the materials being lower than projected. Therefore, the cookie company should have a cushion to prepare for an unanticipated price increase or fluctuation when developing future budgets. The company may have underestimated the time and costs of labor when delivering the cookies from the calculations. Steiner (2012).

Recommendations and conclusion

Despite the cookie company being a relatively new company, its profitability is increasing gradually. However, the firm should focus on several potential areas to improve; through the financial calculations, the organization understands its weaknesses and threats; the insights will be used in making proper improvements example, when reducing the operation costs and promoting efficiency when running the firm. In my view, the company's liquidity is an essential part that should be addressed since the cookie company does not have adequate financial or cash reserves. Therefore the company will face drastic challenges in case emergencies, and prices increase.

References

Avon, J. (2021). Calculations for Financial Modelers. In The Handbook of Financial Modeling (pp. 217-258). Apress, Berkeley, CA. https://link.springer.com/chapter/10.1007/978-1-4842-6540-6_11

Day, A. (2015). Mastering Financial Mathematics in Microsoft Excel: A practical guide to business calculations. Pearson UK. https://books.google.com/books?hl=en&lr=&id=VcDQCgAAQBAJ&oi=fnd&pg=PP10&dq=financial+calculations&ots=HX6hDOnIb5&sig=Le1QGgmSTyajoP-6ba2jhG-h-MQ

Perry, S. C., Grimwood, R. H., Kerbyson, D. J., Papaefstathiou, E., & Nudd, G. R. (2000). Performance optimization of financial option calculations. Parallel Computing, 26(5), 623-639.

Steiner, B. (2012). Mastering Financial Calculations: A step-by-step guide to the mathematics of financial market instruments. Pearson UK.