Prepare Bank Reconciliation Stevens Company's August 31st bank statement shows a balance of $14,750. McKnight's books show a August 31st cash balance of $13,600. Stevens also has the following informa

MBA 667: TMV basics

Learning Outcome: Basic Investment concepts & applying Time Value of Money concepts using Excel

Analysis to be done using Excel. (Note go over Time value of money recorded lecture and also supplemental reading material on Time value OF money)

EACH QUESTION IS WORTH 20 %

Required format on Excel is shown below for each assignment

If you invest $10,000 today, and do not add any more , calculate future values for ( Grade: points : 20 % of this problem)

r = 1%; for 5 years and 10 years

r = 2%; for 5 years and 10 years

r = 3%; for 5 years and 10 years

| 1. Calculate Future Value ( FV) | |||

| Amount to be deposited (PV) | -10,000 | ||

| growth rates : r | term (n) , years | term (n) , years | |

| percent | 10 | ||

| 1% | |||

| 2% | |||

| 3% | |||

Future Value Using Simple Annual Interest

The FV formula assumes a constant rate of growth and a single up-front payment left untouched for the duration of the investment. The FV calculation can be done one of two ways, depending on the type of interest being earned. If an investment earns simple interest, then the FV formula is:

FV=I×(1+(R×T))

where:

I=Investment amount

R=Interest rate

T=Number of years

Future Value Using Compounded Annual Interest

With simple interest, it is assumed that the interest rate is earned only on the initial investment. With compounded interest, the rate is applied to each period’s cumulative account balance. In the example above, the first year of investment earns 10% × $1,000, or $100, in interest. The following year, however, the account total is $1,100 rather than $1,000; so, to calculate compounded interest, the 10% interest rate is applied to the full balance for second-year interest earnings of 10% × $1,100, or $110.

FV=I×(1+R)T

where:

I=Investment amount

R=Interest rate

T=Number of years

If you put $10,000 (ten thousand) today, plus add $ 1000 (one thousand dollars) every year , calculate future value (FV) in 20 (Twenty years)

r = 1%; for 20 years

r = 2%; for 20 years

r = 3%; for 20 years

| 2. Calculate FV |

| |

| Current value (PV) | -10,000 |

|

| adding annual | -1,000 |

|

| Period (n) | 20 |

|

|

|

|

|

|

| Interest rates : r | term (n) , years |

|

| percent | 20 |

|

| 1% | |

|

| 2% | |

|

| 3% |

If Julie has $500,000 (Half million) in her retirement account. If she invests in a conservative investment that will provide a return of 3.5 % a year, and if she wants her money to last 30 years, how much can she pull out at the end every year for next 30 years

| 3. Withdrawal amount |

|

|

|

|

| Portfolio balance (PV) | -500000 |

| expected return : r | 3.5 % |

| period years | 30 |

|

|

|

| Withdrawal annual amount (PMT) |

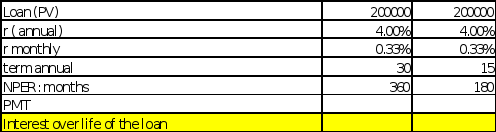

John wants to borrow $200,000 (two hundred dollars) to buy a house. Using a 30 year mortgage with interest rate of 4 %. Calculate MONTHLY PAYMENTS (Please review the narrated PPT where I have covered how to address Monthly payments) and amount of interest paid over the life of the loan. He is also considering paying off the loan in in 15 years.

Calculate monthly PMT and how much interest amount ($$) will he pay over the life of the loan with a 30 year loan ?

Calculate monthly PMT and how much interest will he pay over the life of the loan if he paid of n 15 years

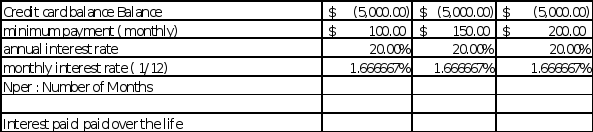

John has a store credit card with annual interest rate of 20 % (monthly: 20 % divided by 12 = 1.666667%). His current balance is $ 5000 and his minimum required monthly payment is $ 100. His friend told him that if he paid $ 150 ( instead of $100) it will reduce the amount of time (NPER) to pay by down the debt by more than fifty percent, and the total amount of interest he will pay will be reduced by almost 60 %. And if he paid $200 the time to pay will be down by 70 % and total interest paid by almost seventy five percent….Do you believe that is true?

Calculate (using excel and using excel formulas) number of months to pay off, and total interest paid for monthly payment (PMT) of $ 100, $ 150 and $200 respectively. And confirm if John’s friend is correct with his assessment.

This is bonus question worth 10 points towards this assignment. Maybe of some help; if you lose any points in required questions 1-5. WORTH TEN POINTS TOWARDS THIS ASSIGNMENT.

Jill has a credit card balance of $10,000 with an annual interest rate of 15.00 %. She plans to pay $ 300 a month, and she also has a monthly charge from her health club that automatically charges $ 50 per month towards her credit card. How long will it take her to pay off ( number of months) her credit card balance ( assuming she does not charge anything more except for the health club fees.