please look at the files attaches and answer as requested need references and excel

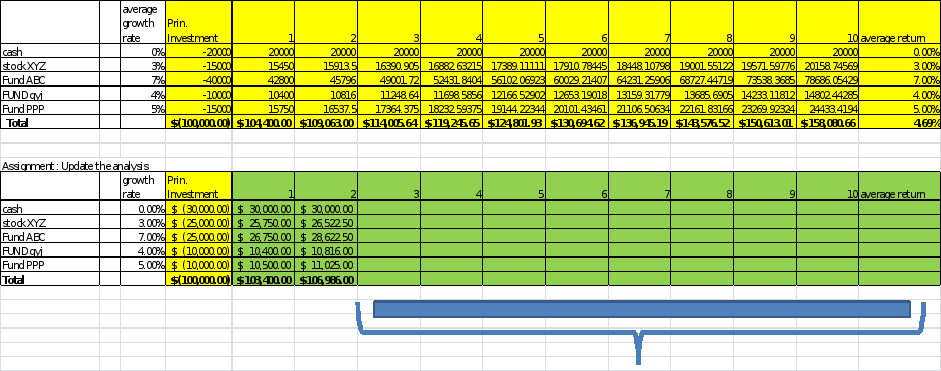

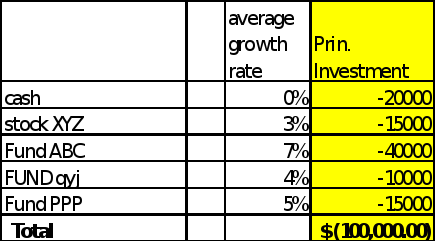

Mary has a total of $100,000. She is thinking of investing most of it, and keeping some as cash. She wants her money to grow and realizes that in order to get a return she will have to take some risk and invest in stocks and or mutual funds that will have stocks and or bonds. Her financial advisor recommended: one individual stock, three funds, and rest in cash. Based on the historical average growth rate the financial advisor forecasted her portfolio for the next ten years.

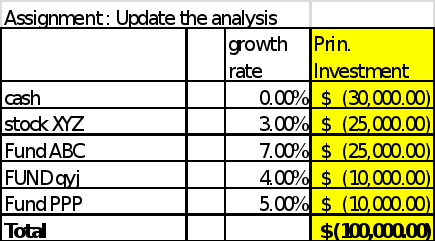

Mary prefers a bit more conservatism in her portfolio and suggested more in cash and a different mix

Her advisor provided her the analysis for the first set of scenario. And started the second scenario but was not able to finish. Please complete the forecast for Mary using Excel. In Canvas an excel sheet is provided. The first tab has the “only the answers,” no formulas for the top scenario. For the second scenario calculations, answers (no formula) are provided for first two years. Assignment: Complete the forecast rest of the years. In order to confirm if your model is working, apply it to the first scenario to see if you can replicate the answers. Hint on Average return for the portfolio ( 4.69 % for the first scenario): It is not arithmetic average ; use “RATE” formula in excel.