Collaborative Planning Forecasting and Replenishment (CPFR)! PLEASE SUBMIT A WRITTEN SUMMATION IN WORD AND A POWERPOINT PRESENTATION BY 27 OCTOBER 2021

Introduction and Reading

The Barilla SpA case and associated readings covered a set of replenishment programs in which one organization in the distribution channel, often the manufacturer, monitors the flow of product through distributors' warehouses. This information allows the manufacturer to make decisions for the distributors on what and when to ship products to the distributors. In contrast to traditional retail replenishment, these programs in effect separate control of product flow from ownership of the product.

Such replenishment approaches have a variety of names, including continuous replenishment (CRP), vendor-managed inventory (VMI), vendor-managed ordering (VMO), continuous product replenishment (CPR) and supplier-managed inventories (SMI). In early versions of these programs, the manufacturer received information on their product flow, typically shipments from distributors' distribution centers, giving the manufacturer better visibility of their product flow deeper through the distribution channel. This enabled the manufacturer to better plan supply to match demand.

Initiatives in the apparel industry (Quick Response or QR) advanced the new replenishment programs through information technology developments, such as electronic point-of-sale (POS) data capturing systems and electronic data interchange (EDI) data transmission systems, designed to enable the real-time transfer and monitoring of inventory data and to provide even deeper visibility into the distribution channel. Perhaps more importantly, additional improvements focused on improving replenishment processes, such as joint forecasting of consumer demand and elimination of individual purchase orders. QR programs also introduced principles of demand-driven logistics that advocated the use of improved information processes, information technology, and rapid response logistics techniques, such as cross-docking, to respond quickly and accurately to actual consumer demand.

In the early 1990s, the grocery industry launched efficient consumer response (ECR) in response to competition emerging from new, very efficient, price competitive mass merchants and wholesale clubs.

ECR applies many of the principles developed in quick response programs to the distribution of fast-moving consumer grocery goods (FMCG), but adds an even more extensive application of demand management techniques. ECR demand side activities include new product development and introductions, trade and consumer promotions, and category management activities such as product ranging and store assortment. (Category management organizes promotion and replenishment around groups of products that consumers view as approximately equivalent in satisfying particular needs.) ECR also encouraged the use of more accurate cost accounting techniques, such as activity-based costing, to monitor and manage the profitability of product categories.

A more recent replenishment program development is collaborative planning, forecasting, and replenishment (CPFR). This approach was pioneered by Wal-Mart and continues to be an area that many major Fortune 500 companies are either assessing or using it. In 2012, GS1 US merged with The Voluntary Interindustry Commerce Solutions (VICS) group and can be found at this link. This association is currently the home for information on current CPFR processes, white papers, etc. CPFR is the subject of the case study (West Marine) and readings for this module that we are exploring.

CPFR formalizes collaboration between two trading partners to improve the planning, forecasting, and fulfillment of customer demand. The initial phase of CPFR encompassed a standardized, sequential nine step process that morphed into the one presented in Exhibit 7 of the case study. While a number of high-profile organizations successfully partnered to implement CPFR, the nine-step process was too often perceived as a rigid sequence--an all-or-nothing undertaking--leading many organizations to abandon partially completed efforts or to not even attempt implementation of CPFR.

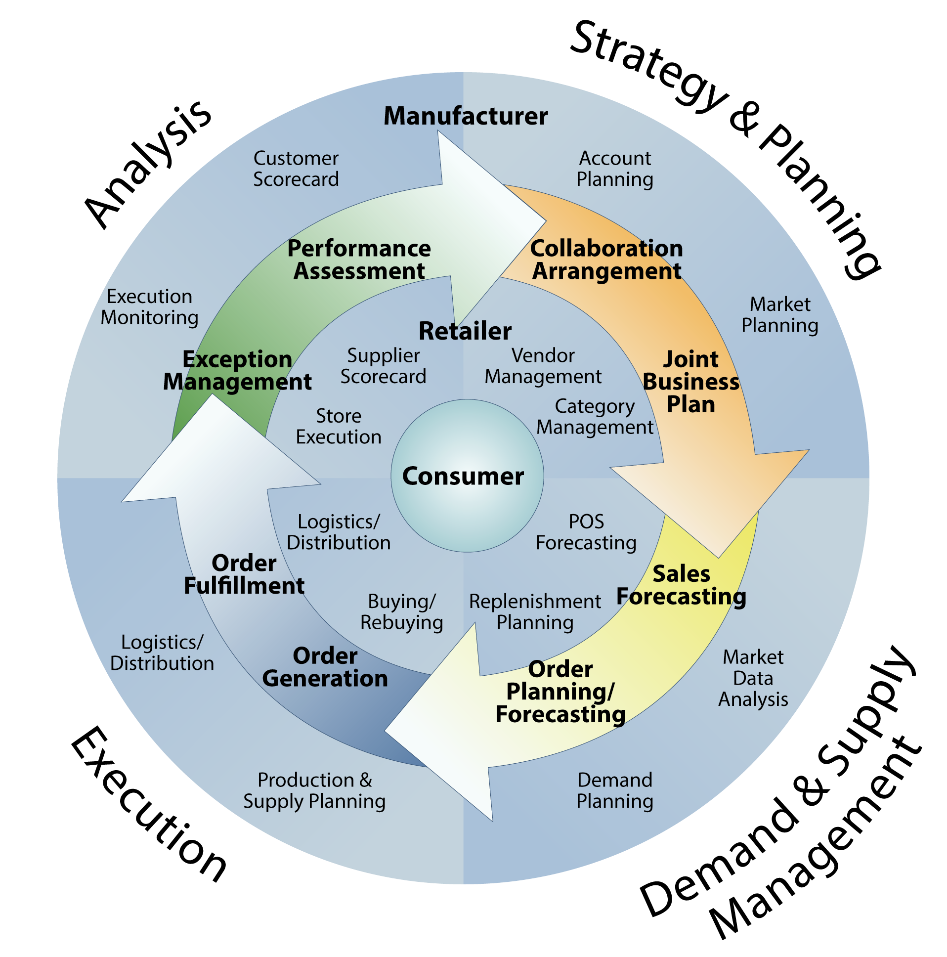

Subsequent revisions produced the current CPFR framework shown in the diagram below. This circular framework emphasizes a consumer focus and highlights that trading partners can realize supply chain benefits from implementation of any one of the four principal collaboration processes: Strategy and Planning, Demand and Supply Management, Execution, and Analysis. In other words, supply chain benefits for the consumer and trading partners can be realized from collaboration in any quadrant of the framework; it is not necessary to implement the entire framework.

CFPR Model

Introduction to West Marine Case

Starting this week, we begin the second major case study assignment, returning to a theme introduced in Clockspeed: value creation through aligning and realigning supply chain capabilities otherwise referred to by Charles Fine as supply chain design. West Marine (www.westmarine.com) is the largest American boating supply retail chain in the nation. According to Larry Smith, West Marine's Senior Vice President of Planning and Replenishment, "The retailer (West Marine) sells more than 50,000 products through its stores, Web site, catalog and commercial sales arm--from stainless steel propellers and anchors to life jackets and wetsuits."

In 1997, my company, West Marine Inc., acquired an East Coast competitor, E&B Marine. The consequences were quickly apparent: Sales fell by almost 8 percent, and peak-season out-of-stock levels rose more than 12 percent compared to the prior year. We soon felt the effects on the bottom line: After six years of steady growth, net income dropped from $15 million in 1997 to not much more than $1 million the next year. Fast-forward six years to 2003, when we purchased our largest competitor, Boat U.S. We successfully integrated their distribution center in just 30 days and their in-store systems inside 60 days. During the 2003 peak season, we had no supply problems in any of our warehouses or stores, and the acquisition was accretive in the first year.

What changed? Two words: supply chain. In the late 1990s, West Marine had not fully recognized the value of effective supply chain management. After the tough E&B acquisition, our management team realized we had to make a significant cultural shift. Traditionally run by 'boaters first and businessmen second' (as one manager put it), the company now had to be run with discipline. Part of the transformation involved overhauling our supply chain operations internally and with our suppliers. A crucial element would be the development of a supplier collaboration program based on collaborative planning, forecasting, and replenishment (CPFR) principles."

Because of the expanded product lines, acquisitions, increasing costs, and a changing boating environment, West Marine needed to differentiate their products and service experience in a way that added value for consumers. All of these items added complexity to the supply chain, which placed a great deal of pressure on the sales, production, and distribution processes.

Distribution costs rose dramatically, as did stockout costs and inventory carrying costs, due to many different reasons. To combat these problems, the West Marine Team proposed CPFR. CPFR, however, was relatively new, and while it potentially would provide significant benefits, there were significant hurdles to overcome in implementation, including disagreements among proponents on the best course to pursue.

According to information supplied by West Marine in July 2012:

Today, West Marine has over 300 stores in 38 states, Puerto Rico, and Canada. The company now carries more than 50,000 products, ranging from the rope that started it all, to the latest in marine electronics. In addition to its retail stores and Port Supply wholesale divisions, the company serves boaters in more than 150 countries worldwide through its mail order and internet divisions."

In the 2011 Annual Report, the firm's net sales were $643.4 million with a net income of $29.7 million, with total assets of $335.7 million--all increases from 2010! Currently, they operate two distribution centers--one in California and the other in South Carolina. West Marine relies on outstanding customer service, selection, and quality as its anchor. 'West Marine's prosperity has been the result of its strong connection to the boating community,' says Repass.

According to their 2011 "10K Filings":

We [West Marine] have three reportable segments: Stores; Port Supply, our wholesale segment; and Direct-to-Customer, which includes eCommerce, catalog, and call center transactions. The Direct-to-Customer segment was formerly referred to as our Direct Sales segment. We consider our individual stores to be operating segments which we aggregate into one reportable segment. Our Stores segment generated approximately 90% of our 2011 net revenues. Our 319 Company-operated stores open at the end of 2011 are located in 38 states, Puerto Rico and Canada. We sell to both retail and wholesale customers in our Stores segment. In addition, we have three franchised stores in Turkey. Our Port Supply segment is one of the largest wholesale distributors of marine supply and equipment in the United States. Products shipped to Port Supply customers directly from our warehouses represented approximately 4% of our 2011 net revenues. Our Direct-to-Customer segment offers customers around the world approximately 75,000 products and accounted for the remaining 6% of our 2011 net revenues. We have undertaken a number of strategies designed to build our long-term strength. If one or more of these initiatives is unsuccessful, our profitability could be adversely affected.

Over the past few years, we launched a number of initiatives designed to increase sales and lower costs. These initiatives include optimizing our supply chain and inventory levels, closing underperforming stores with corresponding workforce adjustments, expanding our merchandise assortments, accelerating the development of West Marine private-label brands, expanding our wholesale business, improving the retail experience for our retail and wholesale customers, placing emphasis on driving comparable store sales, and investing in real estate optimization by expanding to more large format and flagship stores."

‘Today, West Marine has over 300 stores in 38 states, Puerto Rico and Canada. The company now carries more than 50,000 products, ranging from the rope that started it all, to the latest in marine electronics. In addition to its retail stores and Port Supply wholesale divisions, the company serves boaters in more than 150 countries worldwide through its mail order and internet divisions.’

The exploration of this real-world case will help you to understand and "tie" together many of the concepts we have discussed including Clockspeed, inventory calculations, Bullwhip Effects, Lean, Just In Time Distribution at Barilla SpA, and a host of other concepts highlighted in the readings. In addition, the key role of collaboration will now be investigated to see how this "shared creation" can positively impact a company. Remember, at a point just before CPFR was implemented, West Marine teetered on bankruptcy. Although other factors were involved in the turnaround, CPFR--according to many of the main players--was an integral component in making that success occur.