Hi everyone, I have this homework to do for Investment & Portfolio (Finance) class, If someone can help me with it please, Thank you

Portfolio Project Part Two

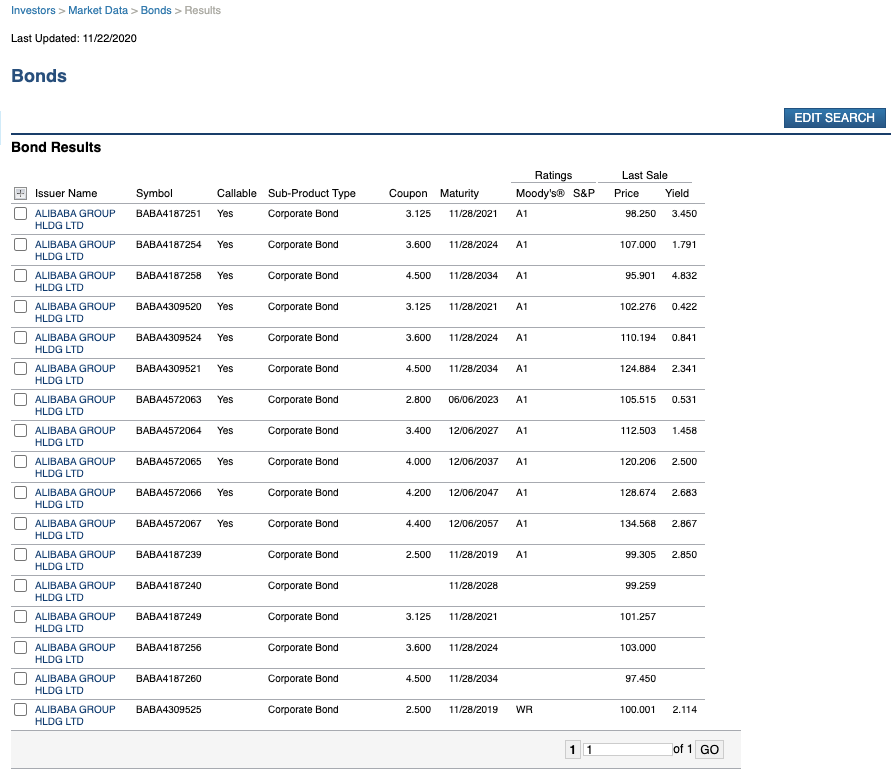

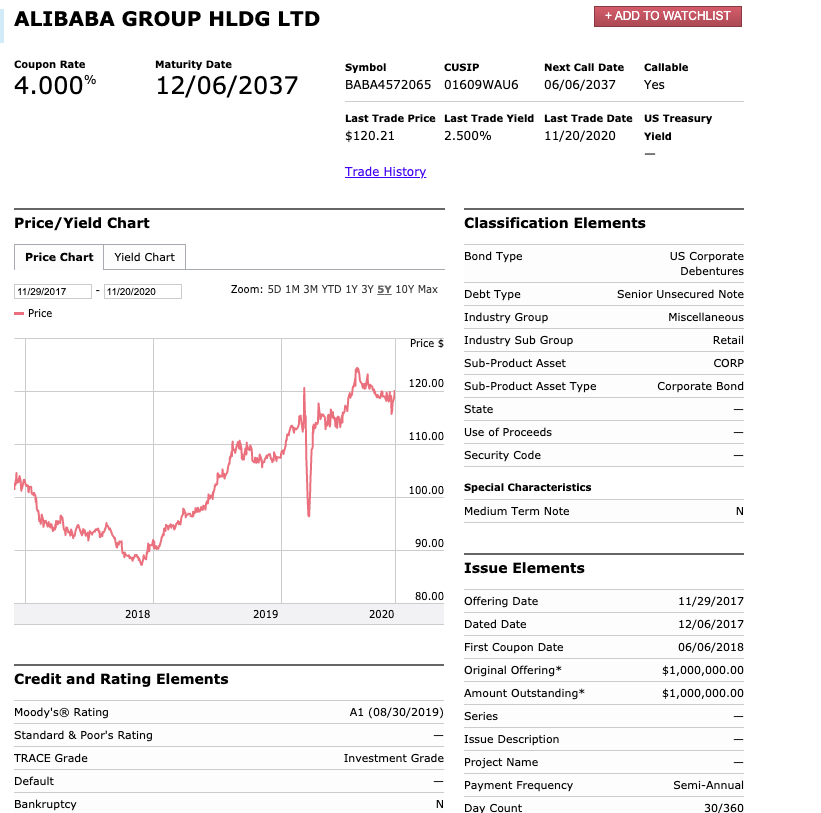

Alibaba Group Holdings has issued just under twenty bonds with the majority of them being callable bonds meaning that the bonds can be redeemed before the stated maturity date allowing a company to pay off their debt early (Chen, 2020). The coupon rates of the bonds range from 2.5 to 4.5 representing the annual coupon payments paid by the issuer relative to the bonds face or par value (Chen, 2020). A majority of the bonds are rated A1 by Moody’s meaning these bonds are judged to be upper-medium grade and are subject to low credit risk with 1 ranking in the higher end of its generic rating category (Rating Symbols and Definitions). The yield of a bond relates to its cash flows which consists of coupon payments and return of principal which is returned at the maturity date (Nielsen, 2020). Specifically, the Alibaba callable bond with a maturity date of 12/06/2037 has a coupon rate of 4.00% with a last trade yield of 2.00% on 11/20/2020 trading at $120.21 with the initial price at offering being $99.73. This bond is a senior unsecured note which means that it must be repaid before most of the other debts in the event of bankruptcy making it more secure and earning slightly lower interest rates (Chen, 2020). Based on the present trading date these bonds are liquid and this would be a considered a premium bond because it is trading above its face value meaning that it costs more than the face amount of the bond (Murphy, 2020). As interest rates fall, bond prices rise and oppositely as interest rates rise, bond prices fall (Lioudis, 2020). The interest rate falling during the current trade represents why the bond price increased and is selling at a premium which is not ideal for investors because they risk paying more than the bonds maturity value (Why would someone buy a bond at a premium?, 2020). However, premium bonds typically will pay out a higher interest rate than the overall market representing an overall sense of risk in either way you look at these bonds (Murphy, 2020). The Price/Yield Chart accurately depicts the inverse relationship between bond prices and interest rates. Since 2018, the bond maturing on 12/06/2037 has been increasing in price from a low of $87.39 to a current price of $120.21, while the yield interest rate has been decreasing from 4.90% to a current yield of 2.50% which could indicate in the coming years a trend of upward rising bond prices and lowering yield interest rates. Good discussion …

In addition to my current stock investments, purchasing bonds from Alibaba Group Holding Limited would be a good investment and opportunity to diversify my portfolio further. Alibaba has a number of bonds with different ranging yield rates from 0.422 to 4.832, with the majority of rates being a fixed-rate bond which always pays the same level of interest through the entirety of its term (Chen, 2020). Several bonds being offered by Alibaba have maturity dates extending past 2020 into significantly later years such as 2037, 2047, and 2057. With bond maturity dates stretching out this far, there is more room for risk as it is harder to determine bond price increases through this much time. The more quickly maturing bonds are more easily read based upon their trends up until this point, so it’ll likely proceed in the same manner. Ok Additionally, in terms of risk, the bonds are mostly callable meaning the company has the right to purchase the bond after a minimum period of time for the purpose of issuing new bonds with lower interest rates (Harper, 2020). It is important to review the provisions of the bond to ensure compensation for the higher yield (Harper, 2020). With a majority of Alibaba bonds being recently traded and callable this represents liquidity and the company can easily sell the bonds at a higher interest rate and purchase bonds at lower interest rates that have the opportunity to increase in value over time (Bovaird, 2020). In 2016 U.S. Treasury bonds offered a 2.43% ultimate high return while as of 2018 the corporate bond has reached a high of 4.02% showing corporate bonds generally offer stronger returns (Bovaird, 2020). The addition of Alibaba Group Holdings Limited bonds to my portfolio may prove as a wise risky investment for more capital gains being generated in addition to my previously chosen stock options. Typically investors are seeking capital preservation and consistent income when it comes to the motivation for investing in bonds…the potential for additional capital gains is interesting but shouldn’t be the primary factor when considering bond investing.