I don't need an explanation. I would like to have the answer to compare to the ones I have already

| Type of Deposit | Reserve Requirement |

| Checkable Deposits |

|

| $7.8 − 48.3 Million | 3% |

| Over $48.3 Million | 10 |

| Noncheckable personal savings and time deposits |

Refer to the accompanying table. If a bank has $60 million in savings deposits and $40 million in checkable deposits, then its required reserves are

Top of Form

Multiple Choice

$30 million.

$3 million.

$1.8 million.

$1.2 million.

Bottom of Form

When a bank loan is repaid, the supply of money

Top of Form

Multiple Choice

is constant, but its composition will have changed.

is decreased.

is increased.

may either increase or decrease.

Bottom of Form

Which of the following would reduce the money supply?

Top of Form

Multiple Choice

Commercial banks use excess reserves to buy government bonds from the public.

Commercial banks loan out excess reserves.

Commercial banks sell government bonds to the public.

A check clears from Bank A to Bank B.

Bottom of Form

| Assets | Liabilities and Net Worth | ||

| Reserves | $ 20 | Checkable Deposits | $ 100 |

| Loans | 25 | Stock Shares | 50 |

| Securities | 15 |

| |

| Property | 90 | ||

Refer to the accompanying balance sheet for the First National Bank of Bunco. All figures are in millions. If this bank has excess reserves of $6 million, the legal reserve ratio must be

Top of Form

Multiple Choice

10 percent.

12 percent.

14 percent.

20 percent.

Bottom of Form

Monetary policy is thought to be

Top of Form

Multiple Choice

equally effective in moving the economy out of a depression as in controlling demand-pull inflation.

more effective in moving the economy out of a depression than in controlling demand-pull inflation.

more effective in controlling demand-pull inflation than in moving the economy out of a recession.

only effective in moving the economy out of a depression.

Bottom of Form

Banks' borrowed funds come mostly from

Top of Form

Multiple Choice

buying bonds and loans.

buying stocks and selling Treasury bonds.

issuing stocks and buying Treasury bonds.

issuing bonds and accepting deposits.

Bottom of Form

As a result of policy actions taken by the Fed since 2008, it (the Fed) can no longer expect to affect the federal funds rate through traditional open market operations to alter the overall amount of excess reserves in the banking system. This is because

Top of Form

Multiple Choice

Congress has taken this power away from the Fed.

there is a massive amount of excess reserves already in the banking system.

the federal funds rate has become rigidly fixed by law.

banks are no longer holding any excess reserves.

Bottom of Form

| Assets | Liabilities + Net Worth | ||

| Reserves | $ 60 | Checkable Deposits | $ 150 |

| Loans | 100 | Stock Shares | 135 |

| Securities | 25 |

| |

| Property | 100 | ||

Refer to the accompanying consolidated balance sheet for the commercial banking system. Assume the required reserve ratio is 12 percent. All figures are in billions of dollars. The maximum amount by which the commercial banking system can expand the supply of money by lending is

Top of Form

Multiple Choice

$250 billion.

$350 billion.

$450 billion.

$600 billion.

Bottom of Form

The multiple by which the commercial banking system can expand the supply of money is equal to the reciprocal of

Top of Form

Multiple Choice

the MPS.

its actual reserves.

its excess reserves.

the reserve ratio.

Bottom of Form

All else equal, when the Federal Reserve Banks engage in a restrictive monetary policy, the prices of government bonds usually

Top of Form

Multiple Choice

fall.

rise.

remain constant.

move in the same direction as the bonds' interest rate yield.

Bottom of Form

In the recent financial and economic crises, the economy fell into a so-called liquidity trap, which means that

Top of Form

Multiple Choice

banks did not have enough reserves to continue lending to firms.

the Fed injected reserves into the banking system, but the interest rates remained high.

firms did not want to borrow from banks because they had little need for extra liquidity.

banks held on to excess reserves and people chose to pay off loans rather than spend.

Bottom of Form

The reserve ratio refers to the ratio of a bank's

Top of Form

Multiple Choice

reserves to its liabilities and net worth.

capital stock to its total assets.

checkable deposits to its total liabilities.

required reserves to its checkable-deposit liabilities.

Bottom of Form

A checkable deposit at a commercial bank is a(n)

Top of Form

Multiple Choice

liability to the depositor and an asset to the bank.

liability to both the depositor and the bank.

asset to the depositor and a liability to the bank.

asset to both the depositor and the bank.

Bottom of Form

Money is destroyed when

Top of Form

Multiple Choice

loans are made.

checks written on one bank are deposited in another bank.

loans are repaid.

the net worth of the banking system declines.

Bottom of Form

Which of the following would not be a consequence of negative interest rates?

Top of Form

Multiple Choice

People’s deposits in banks would have shrinking balances over time.

Reduced bank reserves that could cause a contraction in the economy.

People would want to put more money in banks.

People would rather hold cash than bank deposits.

Bottom of Form

The possible asymmetry of monetary policy is the central idea of the

Top of Form

Multiple Choice

invisible hand concept.

ratchet analogy.

pushing-on-a-string analogy.

bandwagon effect.

Bottom of Form

| Reserves | $ 100 |

| Checkable Deposits | 1,000 |

| Loans (to customers) | 300 |

| Property | 400 |

| Securities (owned) | 300 |

| Stock Shares | 100 |

Refer to the accompanying table of information for the Moolah Bank. Assume that the listed amounts constitute this bank's complete set of accounts. Moolah's

Top of Form

Multiple Choice

assets are $1,100.

liabilities are $1,100.

net worth is $300.

profit is $1,000.

Bottom of Form

Lowering the discount rate has the effect of

Top of Form

Multiple Choice

turning required into excess reserves.

turning excess into required reserves.

making it less expensive for commercial banks to borrow from central banks.

forcing commercial banks to call in outstanding loans from their best customers.

Bottom of Form

Which one of the following is presently a major deterrent to bank panics in the United States?

Top of Form

Multiple Choice

the legal reserve requirement

the fractional reserve system

the gold standard

deposit insurance

Bottom of Form

When a check is drawn and cleared, the

Top of Form

Multiple Choice

reserves and deposits of both the bank against which the check is cleared and the bank receiving the check are unchanged by this transaction.

bank against which the check is cleared loses reserves and deposits equal to the amount of the check.

bank receiving the check loses reserves and deposits equal to the amount of the check.

bank against which the check is cleared acquires reserves and deposits equal to the amount of the check.

Bottom of Form

A commercial bank buys a $40,000 government security from a securities dealer. The bank pays the dealer by increasing the dealer's checkable deposit balance by $40,000. The money supply has

Top of Form

Multiple Choice

increased by $40,000.

decreased by $40,000.

not been affected.

increased by $40,000 multiplied by the reserve ratio.

Bottom of Form

A bank that has liabilities of $150 billion and a net worth of $20 billion must have

Top of Form

Multiple Choice

assets of $170 billion.

excess reserves of $130 billion.

assets of $150 billion.

excess reserves of $150 billion.

Bottom of Form

| Type of Deposit | Reserve Requirement |

| Checkable Deposits |

|

| $7.8 − 48.3 Million | 3% |

| Over $48.3 Million | 10 |

| Noncheckable personal savings and time deposits |

Refer to the accompanying table. If a bank has $20 million in savings deposits and $50 million in checkable deposits, then its required reserves are

Top of Form

Multiple Choice

$5 million.

$10 million.

$2 million.

$70 million.

Bottom of Form

The price of a bond with no expiration date is originally $1,000 and has a fixed annual interest payment of $150. If the price of the bond then rises by $200, what will be the interest rate yield to a new buyer of the bond?

Top of Form

Multiple Choice

10 percent

12.5 percent

15 percent

18.8 percent

6.3 percent

Bottom of Form

(Advanced analysis) Assume the equation for the total demand for money is L = 0.4Y + 80 − 4i, where L is the amount of money demanded, Y is gross domestic product, and i is the interest rate. If gross domestic product is $350 and the interest rate is 7 percent, what amount of money will society want to hold?

Top of Form

Multiple Choice

220.

175.

350.

192.

216.

Bottom of Form

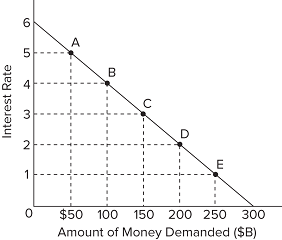

Refer to the graph. If the initial equilibrium interest rate was 5 percent and the money supply increased by $50 billion, then the new interest rate would be

Top of Form

Multiple Choice

4 percent.

2 percent.

3 percent.

1 percent.

Bottom of Form

If nominal GDP is $900 billion and, on average, each dollar is spent six times in the economy over a year, then the quantity of money demanded for transactions purposes will be

Top of Form

Multiple Choice

3,600

900

450

150

750

Bottom of Form

Answer the question based on the following information for a bond having no expiration date: bond price = $1,000; bond fixed annual interest payment = $100; bond annual interest rate = 10 percent. If the price of this bond increases to $1,250, the interest rate will

Top of Form

Multiple Choice

rise to 18 percent.

fall to 8 percent.

rise to 12.5 percent.

fall to 1.25 percent.

fall to 2.5 percent.

Bottom of Form

Answer the question based on the following information: For transactions, households and businesses want to hold an amount of money equal to one-half of nominal GDP. The table shows the amounts of money they want to hold as an asset at various interest rates.

If nominal GDP is $300 and the supply of money is $230, the equilibrium interest rate will be

| Interest Rate | Amount of Money Demanded as an Asset |

| 10% | $ 20 |

| 40 | |

| 60 | |

| 80 | |

| 100 |

Top of Form

Multiple Choice

4 percent.

10 percent.

6 percent.

2 percent.

8 percent.

Bottom of Form

Assume that Smith deposits $80 in currency into her checking account in the XYZ Bank. Later that same day, Jones negotiates a loan for $700 at the same bank. In what direction and by what amount has the supply of money changed?

Top of Form

Multiple Choice

increased by $700

decreased by $80

increased by $780

increased by $80

Bottom of Form