Hi, do u guys do exams?

Answer Key

Exercise 4-1

Multiple choice: Select the best answer.

The maximum annual pensionable earnings for the Canada Pension Plan for 2020 is:

$58,700

$55,900

$57,400

$53,900

The maximum annual contributory earnings for the Canada Pension Plan for 2019 is:

$58,700

$55,900

$57,400

$53,900

The maximum annual insurable earnings for Employment Insurance for 2019 is:

$55,900

$54,200

$53,100

$51,700

The maximum annual employee contribution to the Canada Pension Plan for 2019 is:

$2,898.00

$2,748.90

$856.36

$860.22

The maximum annual employee premium to Employment Insurance for 2020 is:

$2,898.00

$2,748.90

$856.36

$860.22

The employee rate for Employment Insurance in 2019 is:

1.88%

1.66%

1.62%

1.58%

The annual exemption amount for Canada Pension Plan in 2019 is:

$3,500.00

$291.66

$145.83

There is no exemption amount for CPP.

The following amounts may be deducted from gross taxable earnings in order to calculate net taxable earnings, except:

Charitable donations

Employee contributions to RRSP’s

Employee contributions RPP’s

Union dues

Exercise 4-2

Part 1

Tony Smithfield is a salaried employee paid on a monthly basis. His 2019 annual pay is $63,000. Tony had no other benefits or allowances during the year.

Required:

Calculate Tony’s monthly gross pay in 2019. $5,250.00

Calculate the Canada Pension Plan contribution and Employment Insurance premium that will be deducted from Tony’s pay for each of the following pay periods:

| Pay Date | Gross Earnings | CPP | EI |

| January 31, 2019 | $ 5,250.00 | $ 252.87 | $ 85.05 |

| February 28, 2019 | 5,250.00 | 252.87 | 85.05 |

| March 31, 2019 | 5,250.00 | 252.87 | 85.05 |

| April 30, 2019 | 5,250.00 | 252.87 | 85.05 |

| May 31, 2019 | 5,250.00 | 252.87 | 85.05 |

| June 30, 2019 | 5,250.00 | 252.87 | 85.05 |

| July 31, 2019 | 5,250.00 | 252.87 | 85.05 |

| August 31, 2019 | 5,250.00 | 252.87 | 85.05 |

| September 30, 2019 | 5,250.00 | 252.87 | 85.05 |

| October 31, 2019 | 5,250.00 | 252.87 | 85.05 |

| November 30, 2019 | 5,250.00 | 220.20 | 9.72 |

| December 31, 2019 | 5,250.00 | ||

| Totals | $ 63,000.00 | $ 2,748.90 | $ 860.22 |

Calculations:

CPP: Pensionable earnings = $5,250

January to October 2019: 5,250 – (3,500 / 12) * 5.1% = 252.87

November 2019: 2,748.90 – (252.87*11) = 220.20

December 2019: There is no CPP deduction in December since the maximum was reached in November 2019.

EI: Insurable earnings = $5,250

January to October 2019: 5,250 * 1.62% = 85.05

November 2019: 860.22 – (85.05*10) = 9.72

December 2019: There are no deductions for EI in December since the maximum was reached in November 2019.

Part 2

On January 1, 2020, Tony Smithfield gets a $3,000 raise. He also is given a company cell phone to use. He is allowed to use the cell phone for personal use, and you have calculated that the person portion of the cell phone bill equals $30 per month.

Required:

Calculate Tony’s monthly gross pay in 2020. $5,500

Calculate the Canada Pension Plan contribution and Employment Insurance premium that will be deducted from Tony’s pay for each of the following pay periods:

| Pay Date | Gross Earnings | CPP | EI |

| January 31, 2020 | $ 5,500.00 | $ 275.01 | $ 86.90 |

| February 28, 2020 | 5,500.00 | 275.01 | 86.90 |

| March 31, 2020 | 5,500.00 | 275.01 | 86.90 |

| April 30, 2020 | 5,500.00 | 275.01 | 86.90 |

| May 31, 2020 | 5,500.00 | 275.01 | 86.90 |

| June 30, 2020 | 5,500.00 | 275.01 | 86.90 |

| July 31, 2020 | 5,500.00 | 275.01 | 86.90 |

| August 31, 2020 | 5,500.00 | 275.01 | 86.90 |

| September 30, 2020 | 5,500.00 | 275.01 | 86.90 |

| October 31, 2020 | 5,500.00 | 275.01 | 74.26 |

| November 30, 2020 | 5,500.00 | 147.90 | |

| December 31, 2020 | 5,500.00 | ||

| Totals | $ 66,000.00 | $ 2,898.00 | $ 856.36 |

Calculations:

CPP: Pensionable earnings = $5,530 ($5,500 plus $30 non-cash taxable benefit)

January to October 2020: 5,530 – (3,500 / 12) * 5.25% = 275.01

November 2020: 2,898.00 – (275.01*10) = 147.90

December 2020: There is no CPP deduction in December since the maximum was reached in November 2020.

EI: Insurable earnings = $5,500 (salary only since there is no EI on non-cash taxable benefits)

January to September 2020: 5,500 * 1.58% = 86.90

October 2020: 856.36 – (86.90*9) = 74.26

November to December 2020: There are no deductions for EI in November and December since the maximum was reached in October 2020.

Part 3

On January 1, 2021, Tony Smithfield gets a raise to $72,000 per year. He still has a company cell phone that he is allowed to use for personal use, with the person portion of the cell phone bill equaling $30 per month.

Required:

Calculate Tony’s monthly gross pay in 2021. $6,000

Calculate the Canada Pension Plan contribution and Employment Insurance premium that will be deducted from Tony’s pay for each of the following pay periods:

| Pay Date | Gross Earnings | CPP | EI |

| January 31, 2021 | $ 6,000.00 | $ 312.74 | $ 94.80 |

| February 28, 2021 | 6,000.00 | 312.74 | 94.80 |

| March 31, 2021 | 6,000.00 | 312.74 | 94.80 |

| April 30, 2021 | 6,000.00 | 312.74 | 94.80 |

| May 31, 2021 | 6,000.00 | 312.74 | 94.80 |

| June 30, 2021 | 6,000.00 | 312.74 | 94.80 |

| July 31, 2021 | 6,000.00 | 312.74 | 94.80 |

| August 31, 2021 | 6,000.00 | 312.74 | 94.80 |

| September 30, 2021 | 6,000.00 | 312.74 | 94.80 |

| October 31, 2021 | 6,000.00 | 312.74 | 36.34 |

| November 30, 2021 | 6,000.00 | 39.05 | |

| December 31, 2021 | 6,000.00 | ||

| Totals | $ 72,000.00 | $ 3,166.45 | $ 889.54 |

Calculations:

CPP: Pensionable earnings = $6,030 ($6,000 plus $30 non-cash taxable benefit)

January to September 2021: 6,030 – (3,500 / 12) * 5.45% = 312.74

November 2021: 3,166.45 – (312.74*10) = 39.05

December 2021: There is no CPP deduction in December since the maximum was reached in November 2021.

EI: Insurable earnings = $6,000 (salary only since there is no EI on non-cash taxable benefits)

January to September 2021: 6,000 * 1.58% = 94.80

October 2021: 889.54 – (94.80*9) = 36.34

November and December 2021: There are no deductions for EI in November and December since the maximum was reached in October 2021.

Exercise 4-3

Complete the following payroll register for the weekly pay period ending November 26, 2021. Calculate the CPP and EI manually and use CRA‘s Payroll Deductions Tables (T4032) for Federal and Manitoba Income Taxes, assuming a claim code of 1 for each employee.

Note: The earnings to the end of the previous week for each employee was: M. Clark $44,650, J. Green $47,000 and B. Jacobs $62,000

| Employee | Salary | CPP Contribution | EI Premium | Federal Tax | Provincial Tax | Total Deductions | Net Pay |

| M. Clark | 950.00 | 48.11 | 15.01 | 90.35 | 81.15 | 234.62 | 715.38 |

| J. Green | 1,000.00 | 50.83 | 15.80 | 99.70 | 87.15 | 253.48 | 746.52 |

| B. Jacobs | 1,300.00 | 159.10 | 124.15 | 283.25 | 1,016.75 | ||

| Total | 3,250.00 | 98.94 | 30.81 | 349.15 | 292.45 | 771.35 | 2,478.65 |

Calculations:

CPP Contributions

M. Clark: $950 – (3,500/52) * 5.45% = 48.11

J. Green: $1,000 – (3,500/52) * 5.45% = 50.83

B. Jacobs: Since his earnings to the previous week of $62,000 are greater than the maximum annual pensionable earnings of $61,600, he would have already contributed the maximum of $3,166.45. No further CPP contributions are required in 2021.

EI Premiums

M. Clark: $950 * 1.58% = 15.01

J. Green: $1,000 * 1.58% = 15.80

B. Jacobs: Since his earnings to the previous week of $62,000 are greater than the maximum annual insurable earnings of $56,300, he would have already contributed the maximum of $889.54. No further EI premiums are required in 2021.

Federal Tax and Provincial Tax were determined using the weekly Online Payroll Deductions Tables (T4032) Learn (and at: T4032 Payroll Deductions Tables - Canada.ca https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/t4032-payroll-deductions-tables.html

Exercise 4-4

The payroll records for Green House Industries provided the following information for the weekly pay period ending December 3,2021:

| Employee | Daily Time S M T W T F S | Pay Rate | Taxable benefit: Value of personal use of company cell phone | CPP contributions to end of previous week | EI premiums to end of previous week |

| Isa McKaw | 0 8 8 8 8 8 0 | 15.00 | n/a | 1,188.00 | 448.20 |

| Mike Lace | 0 9 8 8 8 6 2 | 14.00 | n/a | 1,098.90 | 436.91 |

| Carl Walt | 0 8 8 9 6 0 0 | 25.00 | 8.00 | 2.079.00 | 747.00 |

| Ryan Zuke | 0 6 6 6 6 6 6 | 30.00 | 10.00 | 3,130.50 | 889.54 |

Complete the pay register following Manitoba Employment Standards. Assume a 20% income tax rate for all employees.

| Employee | Regular Pay | Overtime Pay | Gross Earnings | CPP contribution | EI premium | Income taxes | Net Pay |

| Isa McKaw | 600.00 | Nil | 600.00 | 29.03 | 9.48 | 120.00 | 441.49 |

| Mike Lace | 560.00 | 21.00 | 581.00 | 28.00 | 9.18 | 116.20 | 427.62 |

| Carl Walt | 750.00 | 37.50 | 787.50 | 39.69 | 12.44 | 159.10 | 576.27 |

| Ryan Zuke | 1,080.00 | Nil | 1,080.00 | 35.95 | NIL | 218.00 | 826.05 |

| Total | 2,990.00 | 58.50 | 3,048.50 | 132.67 | 31.10 | 613.30 | 2,271.43 |

Calculations

Regular Pay:

Isa McKaw: 40 hours x $15.00

Mike Lace: 40 hours x $14.00 (one hour of overtime on Monday)

Carl Walt: 30 hours x $25.00 (one hour of overtime on Wednesday)

Ryan Zuke: 36 hours x $30.00

CPP Contributions:

Isa McKaw: [600 – (3,500/52)] * 5.45% = 29.03

Mike Lace: [581 – (3,500/52)] * 5.45% = 28.00

Carl Walt: [787.50 + 8 – (3,500/52)] *5.45% = 39.69

Ryan Zuke: [1,080 + 10 – (3,500/52)] * 5.45% = 55.74 Ryan has already contributed $3,130.50, so the CPP contribution will be 35.95. (Max of $3,166.45 less $3,130.50)

EI Premiums:

Isa McKaw: 600 * 1.58% = 9.48

Mike Lace: 581 * 1.58% = 9.18

Carl Walt: 787.5 * 1.58% = 12.44

Ryan Zuke: 1,080 * 1.58% = NIL (already at maximum for the year)

Exercise 4-5

Molly Capp works in Manitoba for a company that pays their employees on a weekly basis and she earns the following in 2020:

$26.50 per hour.

Over-time is paid at 1.5 times for any hours worked more than 8 in a day and for any hours worked in excess of 40 per week.

The employer paid $400 for the employee’s professional membership dues. This payment was made directly to the professional organization.

During the pay cycle, Molly worked the following hours:

| Mon. | Tues. | Wed. | Thurs. | Fri. | Sat. | Sun. | Total |

| 10 | 40 |

Required:

Calculate the Pensionable Earnings for the pay cycle.

| Regular pay (38 hours x $26.50) | $1,007.00 |

| Overtime (Tues = 2 x $26.50 x 1.5) | 79.50 |

| Plus all other cash amounts | - |

| Gross Earnings | $1,086.50 |

| Plus non-cash taxable benefits | 400.00 |

| Less non-taxable allowances | - |

| Pensionable Earnings | $1,486.50 |

Calculate the Canada Pension Plan contribution for the pay cycle. Molly is not near her maximum contribution amount.

| Pensionable Earnings | $1,486.50 |

| Less Basic exemption: $3,500 / 52 = | 67.30 |

| Contributory Earnings | $1,419.20 |

| x 5.25% | |

| Contribution | $74.51 |

Calculate the Insurable Earnings for the pay cycle.

| Regular pay (38 hours x $26.50) | $1,007.00 |

| Overtime (Tues = 2 x $26.50 x 1.5) | 79.50 |

| Plus all other cash amounts | - |

| Gross Earnings | $1,086.50 |

| Less non-taxable allowances | - |

| Insurable Earnings | $1,086.50 |

Calculate the Employment Insurance premium for the pay cycle. Molly is not near her maximum contribution amount.

| Insurable earnings | $1,086.50 |

| x 1.58% | |

| Premium | $17.17 |

Using the following Income Tax Tables, determine the Provincial and Federal income tax deductions. Molly is a Claim Code 2.

| Gross taxable income (same as pensionable earnings) | $1,486.50 |

| Less: RPP, RRSP, union dues | - |

| Net taxable income | $1,486.50 |

| Federal tax (from table below) | $ 198.15 |

| Provincial tax (from table below) | 152.20 |

| Total income tax deductions | $ 350.35 |

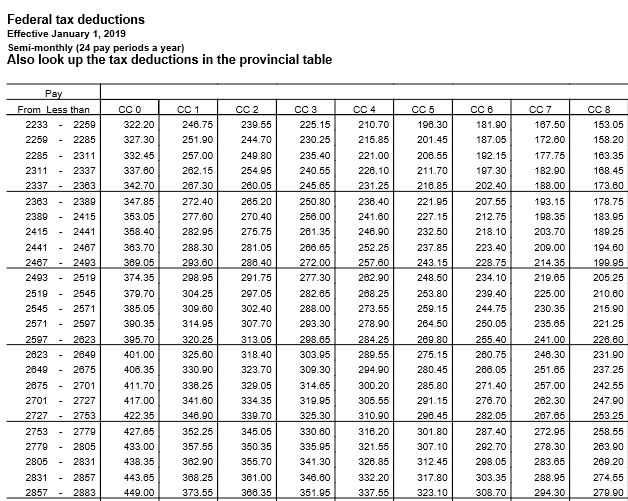

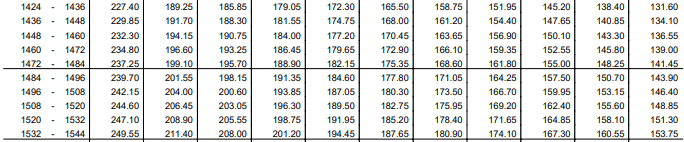

Federal tax deductions

Effective January 1, 2020

Weekly (52 pay periods a year)

Also look up the tax deductions in the provincial table

![]()

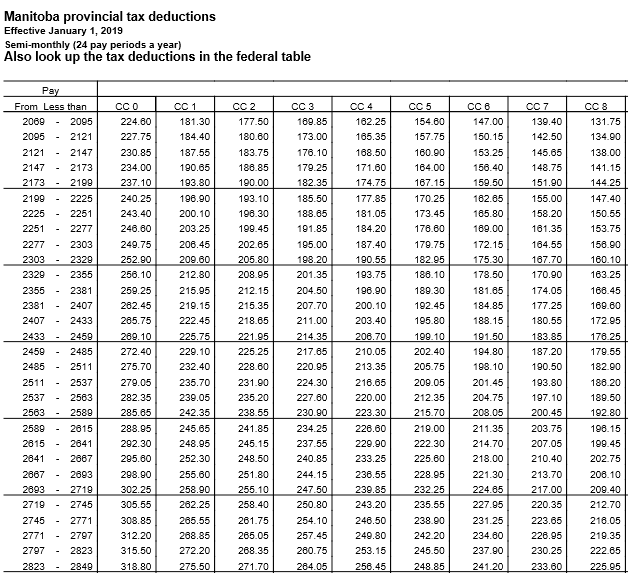

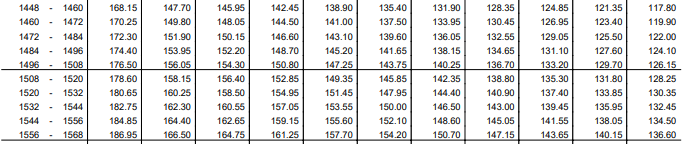

Manitoba provincial tax deductions

Effective January 1, 2020

Weekly (52 pay periods a year)

Also look up the tax deductions in the federal table

![]()

Payroll deduction tables for 2020 can also be found here: https://www.canada.ca/content/dam/cra-arc/migration/cra-arc/tx/bsnss/tpcs/pyrll/t4032/2020/t4032-mb-1-52pp-20eng.pdf

Exercise 4-6

Elizabeth Willems works in Manitoba for a company that pays their employees on a semi-monthly basis. The following details her earnings information for 2019:

Annual salary of $60,000

Elizabeth does not need to use her vehicle for work, but the company provides with a parking spot worth $100 per month.

The employer changed their logo, so they provided Elizabeth with a new shirt sporting the updated company logo on April 17, 2019. Elizabeth is expected to wear this shirt to certain corporate events. The shirt cost the company $43.50.

On April 19, 2019, the employer provided Elizabeth with a new laptop worth $1,500 in order for her to work more efficiently.

Her 2019 TD1 forms show that she has federal personal tax credits totaling $14,000 and Manitoba personal tax credits totaling $12,000.

Required:

For the pay period ending April 30, 2019:

Calculate the Canada Pension Plan contribution for the pay cycle.

| Regular pay (60,000 / 24) | $2,500.00 |

| Plus all other cash amounts | - |

| Gross earnings | 2,500.00 |

| Plus non-cash taxable benefits (100 x 12 / 24) | 50.00 |

| Less non-taxable allowances | - |

| Pensionable Earnings | $2,550.00 |

| Less: Exemption (3,500/24) | 145.83 |

| Contributory earnings | 2,404.17 |

| CPP rate for 2019 | x 5.10% |

| CPP contribution | $ 122.61 |

Calculate the Employment Insurance premium for the pay cycle.

| Regular pay (60,000 / 24) | $2,500.00 |

| Plus all other cash amounts | - |

| Gross earnings | 2,500.00 |

| Less non-taxable allowances | - |

| Insurable Earnings | $2,500.00 |

| EI rate for 2019 | x 1.62% |

| EI premium | $ 40.50 |

Determine the Federal Tax and Provincial Tax deductions using the semi-monthly Payroll Deductions Tables (T4032) found at: https://www.canada.ca/content/dam/cra-arc/migration/cra-arc/tx/bsnss/tpcs/pyrll/t4032/2019/t4032-mb-24pp-19eng.pdf

Hint: Determine her Federal and Provincial claim codes first. The claim codes can be found in your Module 4-8 course notes, or here: https://www.canada.ca/en/revenue-agency/services/forms-publications/payroll/t4008-payroll-deductions-supplementary-tables-previous-years/t4008mb-january-2019/t4008mb-january-general-information.html

| Gross taxable income (same as pensionable earnings) | $2,550.00 |

| Less: RPP, RRSP, union dues | - |

| Net taxable income | $2,550.00 |

| Federal tax (claim code 2) | $ 302.40 |

| Provincial tax (claim code 3) | 227.60 |

| Total income tax deductions | $ 530.00 |