It's a group assignment and I want the 2nd part done, that is "Supply Chain and Logistics". I have attached the assignment instructions file and the previous group assignments 1, 2 & 3 so you have

Sheridan CollegeIntegrated Industry Project

Strategic Business Plan

Operations Plan:

Personal Banker

Author: Insightful Impacts

Umer Amir Rashid

Yudavraj Rambali

Muhammad Arsal Riaz

Adel Osaki

Shiza Akhtar

Professor: Lenny Dinnath

July 20, 2022

Table of Contents1Marketing Plan, Operational Level Recommendations 2

2Supply Chain and Logistics 2

3Human Resources Capability Building 2

4Information Technology Capability Building 2

5Corporate Social Responsibility 2

6Financial Model 2

6.1Financial Summary 2

6.2Projected Income Statement 4

6.3Projected Cash Flow 5

7Key Performance Indicators 6

8Risk Analysis 7

9Investment/Funding Strategies 10

9.1Funding By Directors 10

9.2Hiring Grants 10

9.3Research Grants 10

9.4Small Business Loan 11

9.5Angel Investors 11

10Change Management Plan 11

11Action Plan 11

12Conclusion and Next Steps 13

Appendix 1: Assumptions for Income Statement 14

Appendix 2: Schedules 15

- Marketing Plan, Operational Level Recommendations

- Supply Chain and Logistics

- Human Resources Capability Building

- Information Technology Capability Building

- Corporate Social Responsibility

- Financial Model

- Financial Summary

Chart 1 presents projected revenue over the next three years. The projections are consistent with desires of Personal Banker’s management to double revenue every year for next three years. Accordingly, current revenue of $163,000 will reach just over 1.3 million by the third year. For more details, please refer to 6.2 projected Income Statement and Appendix 1 and 2 for more details.

Chart 1: Revenue Projection

Chart 2: Per Service Revenue Projection

Chart 2 presents per service revenue growth over period. These services include tax reclaim, tax filing, proposed family bundle, and other miscellaneous services as well as services that will be introduced as a result of product development strategy. For more details, please refer to 6.2 projected Income Statement and Appendix 1 and 2 for more details.

Chart 3: Net Income

Chart 3 presents net income growth during next three years. During the third year Personal Banker will be able to generate $246,137 after tax profit by achieving over 1.3 million revenue. For more details, please refer to 6.2 projected Income Statement and Appendix 1 and 2 for more details.

Chart 4: Operating Cash Flow

Chart 4 presents cash flow generated by the business, before investing and financing activities. Please not that with investing activities, technology and equipment, the cash flow position does change necessitating additional financing. For more details, please refer to 6.3 projected Cash Flow and Appendix 2.

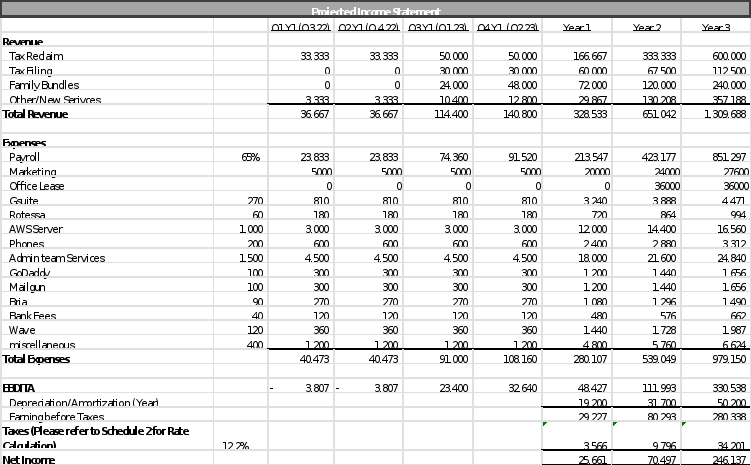

- Projected Income Statement

The following is projected Income Statement for the next three years. The assumptions related to projected income statements haven been included as Appendix 1. The starting point is assumed to be current quarter, Q3 2022. The volume and pricing assumptions are also contained in Appendix 1. The assumptions related to expenses are also listed in Appendix 1.

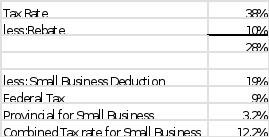

The revenue exceeds $1.3 million by third year, which is consistent with Personal Banker’s desire to double revenue every year. The EBDITA exceed 330,000 by third year and pre-tax profit exceed 280,000 taking into consideration depreciation/amortization on technology platform (existing 90,000 investment as well as new investment) and equipment (e.g., computer for employees). Please refer to Appendix 2: Schedule 1 for more detail. The after tax profit reaches $246,137. Please note that tax rate used is current combined federal and provincial tax rate to arrive at after tax. Income. Please refer to Appendix 2: Schedule 2 for tax rate calculation.

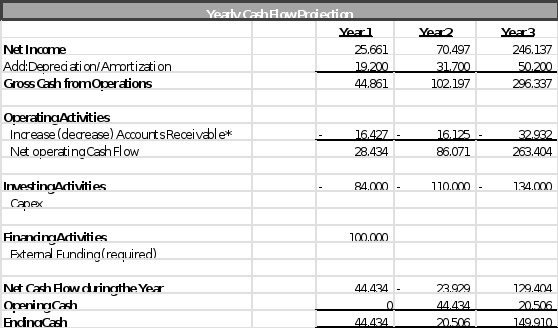

- Projected Cash Flow

The following projected cash flow reflects, the company will require around $100,000 additional funding to support growth initiatives. Please note that funding requirements may change if the income statement projections are not met, or CAPEX requirement change. With current projections, the first year operating cash flow is positive 28,434 but after investment in CAPEX the net flow will be negative necessitating investment. In Subsequent years the company may be able to finance CAPEX internally from operating cash flow. Please refer to Appendix 2: Schedule 1 for CAPEX detail.

- Key Performance Indicators

The Following key performance indicators have been identified to periodically monitor achievement of goals/objectives by the company.

Table 1: Key Performance Indicators

| Objective | KPI | Target Year 1 | Target Year 2 | Target Year 3 |

| Business Growth | Revenue Achievement ($) | 328,533 | 651,042 | 1,309,688 |

| Net Profit ($) | 25,661 | 70,497 | 246,137 | |

| Technology | Technology Enhancement for Competitive Advantage |

| Completion of phase one of enhanced platform with at least 5 new and powerful features | Completion of phase two of enhancement of platform with AI capability for decision making and impact analysis |

| Product Development | Introduction of additional services to meet critical success factors relating to one window operation | Introduction of family bundle comprising of reclaim, tax filing, and personal financial plan. | Introduction of two new services | Full-service Personal Banker with financial planning, tax filing, investments, retirement planning, etc. |

| Customer Satisfaction/ Loyalty | Excellent or very good rating by customers in satisfaction survey | Initiate first survey with 10% sample and achieve 65% excellent or very good. | Achieve 75% excellent or very good rating | Achieve 80% excellent or very good rating |

| Percentage of customers with more than multiple services | 25% | 40% with more than two services | 60% with more than one service | |

| Human Resources | High skilled resources | Add at least one financial planning expert in the team. | Multiple resources with financial planning skills, necessary licenses, and Advanced Taxation Skills | Resources with retirement/ estate planning with necessary licenses. |

- Risk Analysis

A number of risks have been identified, which could lead to Personal Banker’s inability to meet objectives stipulated in the strategic plan. Hence, the achievement of KPIs may become a challenge. The Impactful Insights team has also recommended certain mitigation measures which could help in minimizing the negative impact, should these risks come in to play.

Table 2: Identified Risks and Mitigation Strategies

| SL NO | Risk | Mitigation Strategies |

| Financial Risk: Due to shortfall in revenue the company may face financial difficulties. | Two actions can mitigate this risk:

| |

| HR Cost: The strategic plan necessitates hiring of additional resources, in order to position for growth. This could lead to additional cost. In case the revenue numbers are not met the company may end up spending excessive amounts. | HR plan should be tied up with a combination of quarterly forecast of revenue and long-term plan. The HR needs for short-term can be adjusted every quarter and hence the financial risk can only be equal to one quarter of wages. The long-term plan related investment should be based on growth funding. | |

| Recruitment: The company may find it difficult to recruit required human resources as the business picks up. | An effective and proactive recruitment plan linked to expected growth can help address this risk. The recruitment from new immigrants and students/fresh graduates may provide good pool of resources. | |

| Family Bundle: Risk that proposed family bundle may not pick up as expected. | A test marketing of family bundle with a selected sample of potential customers may help validating success of family bundle. | |

| Technology Risk 1: The acceptability of mobile app may be limited. | Once the mobile app is developed, one or more focus group from customers could be given an opportunity to review the app and provide feedback, before formal launch. This will help in improving the app and ultimately the success. | |

| Technology Risk 2: The investment into enhanced technology application may not yield desired results. | A good amount of time need to be invested in defining requirements/functionalities of the application. Additionally, a focus group session of customers could help in validating the features. An important consideration is to use agile methodologies in the development process, which can minimize the risk of failure. | |

| Technology Risk 3: A disruptive technology by a competitor may lead to serious negative consequences. | The company needs to maintain an environment scanning approach to proactively understand what might be going on in the marketplace/ technology space. | |

| Cybersecurity: A malicious attack may compromise security of client data. | The risk associated with cyber security needs to be regularly assessed for occurrence and impact. Higher risk and medium risk areas need to be addressed proactively. Some of the actions that can be taken include:

|

- Investment/Funding Strategies

Insightful Impacts team has identified the following funding opportunities that can be explored.

- Funding By Directors

The existing directors/owners may consider funding the company from their own resources. This funding can be in the form of increased equity or loan from directors. This option provides an easiest route for funding but increases personal financial risk of directors. Further it is also dependent upon the availability of excess resources and willingness to contribute additional funds.

- Hiring Grants

Certain government and non-government institutions extend financial support to employers for hiring/training employees. Some of those sources have been identified as below:

Youth Employment Program, which is administered by the IRAP (National Research Council). The grant provides up to $30,000 per person for hiring fresh graduates

Canada Job Grant, which can provide funding for training resources. The funding can be up to 10,000. The company could use this funding to upskill resources

Canada Summer Jobs: This can enable company to hire students with partial funding (usually 50%) by the Canadian government.

- Research Grants

The following are some of the sources for research grant, which the company can use to enhance/innovate technology application.

National Research Council-IRAP- A program, which can provide funding for innovation to small and medium size businesses. The grant is usually provided to business with less 500 employees. Typically, a project proposal is required to be submitted to NRC-IRAP.

Scientific Research and Development (SRED), which is managed by the CRA. This grant usually requires that company first invest in R&D/technology and then submit claim and the grant can be either refund of part of investment or tax credits.

These grants are only available for funding technology initiatives and Personal Banker can use these funds for enhancing technology application.

- Small Business Loan

Personal Banker can explore possibility of small business loan or start-up financing from BDC. For a company like Personal Banker, the bank may be able to provide the following loans:

Up to 100,000 small business loan to support cash flow or to buy software and hardware. The funds can also be used for website, marketing campaigns for online services provided by Personal Banker

Start-up financing up to 250,000 for buying assets, start-up fee, marketing, and working capital needs

- Angel Investors

Personal Banker could explore possibility of finding an angel investor, who may be willing to finance the business for growth. These angel investors look for superior returns on their investments. Some of these investors can be found from the following:

National Angel Capital Organization ()

Canadian Angel Investors ()

If this option is to be explored, the company will need to approach them a strong pitch and effective business plan.

- Change Management Plan

- Action Plan

The following high level action plan is presented in this section to facilitate execution of strategy and operating plan.

Table 3: Action Plan

| Activity | Year 1 | Year 2 | Year 3 | |||||

| Q1 | Q2 | Q3 | Q4 | |||||

| Marketing | ||||||||

| Customer Satisfaction | Initiate first customer satisfaction survey | Half-yearly customer satis-faction survey | Half-yearly customer satis-faction survey | |||||

| Technology | ||||||||

| Mobile Application | Complete Develop-ment | Test and Launch | ||||||

| Requirement and Functional Definition of enhance Platform | Initiate defining require-ments and features | Complete requirement, features, and roadmap | Initiate Develop-ment | |||||

| Enhanced Platform | Complete and Launch phase 1 | Comp-lete and Launch phase 2 with AI capab-ilities | ||||||

| Product Development | ||||||||

| Product Roadmap Development | Initiate three year product development roadmap | Complete roadmap | ||||||

| Family Bundles | Initial assessment and focus group | Develop family bundle | Launch family bundle | Upsell to existing clients | Continue enhance-ments in bundles and sales | Continue enhance-ments in bundles and sales | ||

| Enhanced Financial Planning Portfolio | Define services and value prop. | Develop service offeringstech-nology and product proposition need to be consis-tent | Rollout new services | Continue enhance-ment and rollout of services | ||||

| Human Resources | ||||||||

| Accounting/Finance | ||||||||

| Determine Funding Requirement | Completed as per financial model | Initiate funding efforts to achieve desired amount | Required Funding achieved | |||||

| Supply Chain | ||||||||

| Corporate Social Responsibility | ||||||||

- Conclusion and Next Steps

This deliverable has provided a detailed operating plan for the review by the management of Personal Banker. The operating plan covers 11 aspects including marketing, supply chain, human resource, Information Technology, corporate social responsibility, financial projections, key performance indicators, risk analysis, investment/funding, change management, and Action plan.

As a next step an executive summary of all deliverables will be completed and presented to conclude this project.

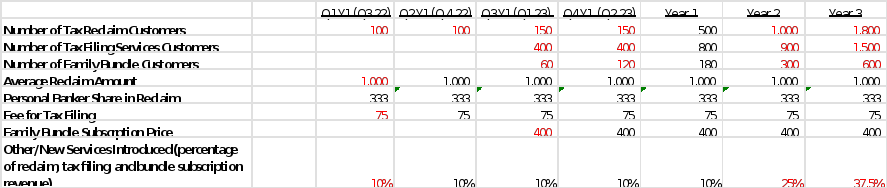

Appendix 1: Assumptions for Income StatementRevenue Related Assumption

Expense Related Assumptions

Payroll is assumed as 65% of revenue which is similar to current ratio (current monthly average payroll*12/yearly revenue)

With growth in business company may need an office space hence monthly lease 3000 is assumed from second year

Most other expenses will grow 20% in year 2 and 15% in year 3 from current level

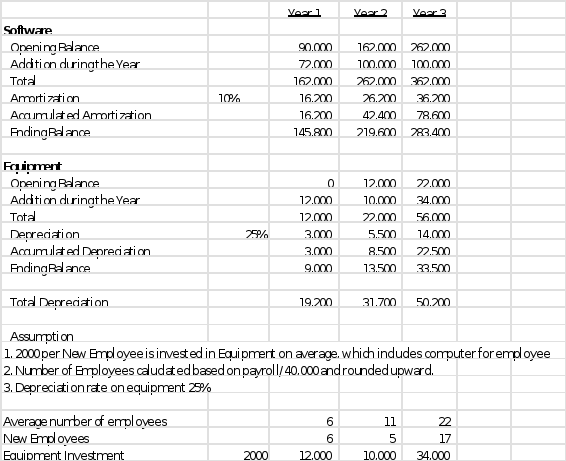

Schedule 1: Capex and Depreciation

Schedule 2: Tax rate Calculation

16 | Page