Hi Tutor, attached below is two different homework exercise, I have provided some answers to the first one (homework Exercise 1)while I have not provided any on the second one. I won't mind an additio

For this assignment, you will submit this document containing your answers to the below questions to the assignment link within Blackboard. A specific word count is not required, but each question should be answered thoroughly and in a professional manner.

After reading/viewing the materials for this module/week, answer the questions below. The questions will test your knowledge of concepts from Chapters 2 and 4 from the Principles of Accounting, Vol. II text.

Homework Exercise 5 is due by 11:59 p.m. (CT) on Sunday of Module/Week 5.

Chapter 2

Explain the difference between a period cost and a product cost.

Explain the differences among fixed costs, variable costs, and mixed costs.

Hicks Contracting collects and analyzes cost data in order to track the cost of installing decks on new home construction jobs. The following are some of the costs that they incur. Classify these costs as fixed or variable costs and as product or period costs.

A. Lumber used to construct decks ($12.00 per square foot)

B. Carpenter labor used to construct decks ($10 per hour)

C. Construction supervisor salary ($45,000 per year)

D. Depreciation on tools and equipment ($6,000 per year)

E. Selling and administrative expenses ($35,000 per year)

F. Rent on corporate office space ($34,000 per year)

G. Nails, glue, and other materials required to construct deck (varies per job)

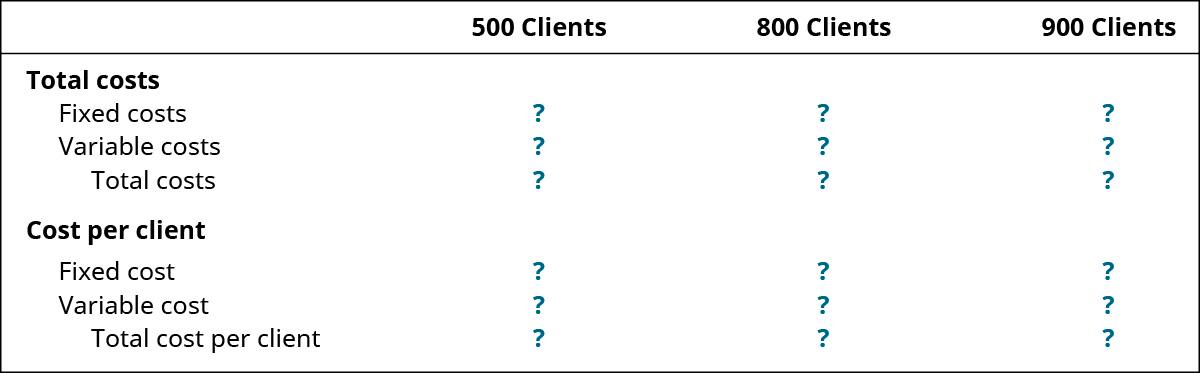

Carr Company provides human resource consulting services to small- and medium-sized companies. Last year, Carr provided services to 700 clients. Total fixed costs were $159,000 with total variable costs of $87,500. Based on this information, complete this chart:

Chapter 4

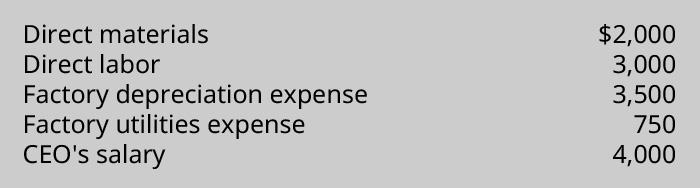

Burnham Industries incurs these costs for the month:

What is the prime cost?

How is the predetermined overhead rate determined?

Match the concept on the left to its correct description.

| A. job order costing | i. computes the overhead applied to each job |

| B. materials requisition sheet | ii. source document indicating the number of hours an employee worked on specific jobs |

| C. overapplied overhead | iii. source document indicating the raw materials assigned to a specific production job |

| D. predetermined overhead rate | iv. the cost accounting system used by pet food manufacturers |

| E. process costing | v. the cost accounting system used by law firms |

| F. time ticket | vi. the result when the actual overhead is less than the amount assigned to each specific job |

| G. underapplied overhead | vii. the result when the actual overhead is more than the amount assigned to each specific job |

Page 4 of 4