1. The title of the case is “AMC: WHO’S CALLING THE SHOTS?” and the file name is W25811_pcu (Case). The case is published by Ivey Publishing. 2. Be sure to use the "AMC Case Update" along with the ca

GMGT 4010 - ADMINISTRATIVE POLICY

TEAM NUMBER 04

Word Count: 847

Page Count: 3

Alok Dua

Section A03

HAND-IN TEAM ASSIGNMENT Winter 2023

Asper School of Business, University of Manitoba

February 7, 2023

External Assessment:

Threat of new entrants in the aerospace industry is low since there are stringent regulations as well as a high cost of capital to break into the market. The high upfront costs coupled with the established competitors who have achieved economies of scale and partnerships with major airlines already make this industry hard to penetrate for new entrants.

The bargaining power of buyers in this industry is moderate as the contracts between airlines and aerospace industry suppliers mitigate the buyers’ power and result in high switching costs, however, these contracts can be retracted if there are defects with the plane. The case study gives an example of this situation by highlighting how Boeing announced over 150 pre-approved orders were canceled after the 737 Max crashes.

The threat of substitutes does exist as major competitors in this industry provide the same product with slight variation. Incidents such as plane crashes can divert an airline’s attention towards the next airplane supplier. According to the case, an example of this was how Boeing’s order book was at an all time low after the crashes and Airbus A320 which was similar to 737 Max was starting to be purchased.

The bargaining power of suppliers does exist as companies in this industry outsource some of their major components to other manufacturers, who may have an influence on pricing. Outsourcing has also led to issues in quality, as well as delays in the whole supply chain process.

Political and economic factors negatively impacted all the competitors in the aerospace industry after the emergence of COVID-19. Governments started to initiate travel restrictions, which led to negative financial consequences of the major competitors such as Boeing and Airbus.

Internal Assessment:

Boeing operates as a dominant player in the aviation industry, producing commercial airplanes, defense products, and space technology for customers in more than 150 countries (Boeing, 2023). Their major customers include the US government, commercial airlines, and aircraft lessors worldwide- all of whom have a need for safe and efficient aircrafts. Boeing strives to fulfill these needs through applying their core values: safety, quality, integrity, and sustainability (Boeing, 2023).

Boeing’s key strength is their historically renowned legacy steeped in decades of success. This intangible capability is rare as other aircraft manufacturers have not produced a model as consistently famous and successful as the Boeing 737. This is inimitable because the actions Boeing undertook to achieve this status requires decades of investment. The organization maintains this competency through meeting demand, diligent delivery times, and ensuring all output is up to their standards.

A distinctive competency of Boeing includes strong and ongoing relationships with the US government. This is extremely valuable as it provides them with a consistent customer, resulting in 27.4 billion dollars in annual revenue; accounting for 27% of Boeing’s earnings. The capacity is sustainable by investing in defense products, helicopters, and jets.

An important sustainable distinctive competency is Boeing’s excellent engineering capabilities, seen in the Boeing 737 Max that reduced fuel consumption by 14%. This DC is valuable as it presents an extremely impressive competitive advantage in the budget commercial air travel market where airlines are looking for fuel-efficient alternative models that Boeing has the innovative ability and initiative to provide. This engineering competency is supported within the organization through Boeing’s cultural focus and continuous investment in innovation.

Financial Assessment:

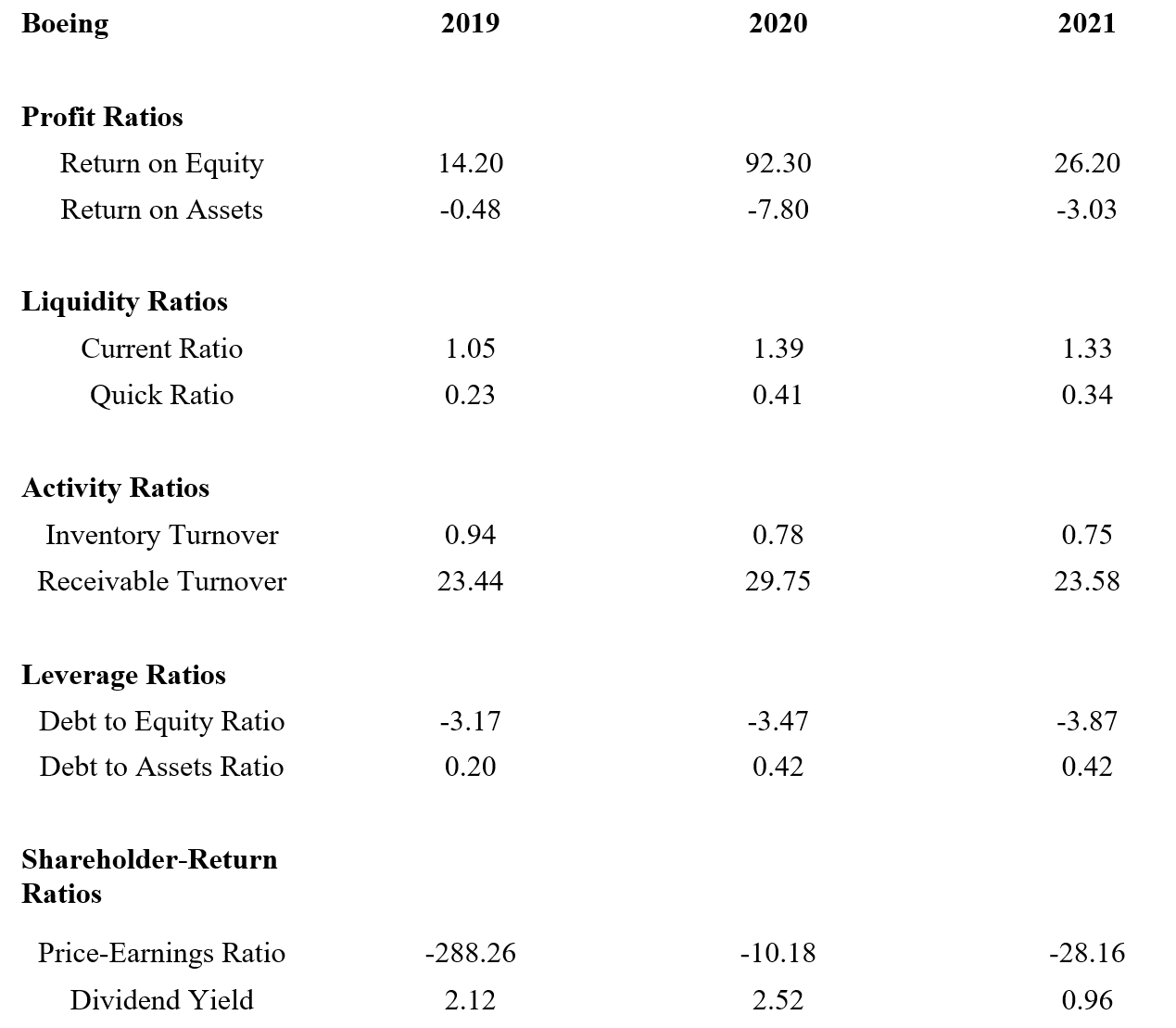

From Exhibit C, we can see that the company generated modest profits in 2019 with an ROE of 14.20%. Due to improved operations and cost management, ROE increased to 92.30% in 2020. Increasing competition or changing market conditions may have affected ROE in 2021, which declined to 26.20%. During the years 2019-2021, the company struggled financially and was losing money. The company's current ratio of 1.05 suggests they had liquidity issues in 2019. By 2020, the current ratio was 1.39, indicating better liquidity. Its current ratio decreased slightly in 2021 to 1.33, but remained above 1, indicating healthy liquidity.

Quick ratio fluctuations suggest the company's liquidity position improved in 2020 but declined in 2021. Inefficient inventory management was evident from the company's Inventory Turnover Ratio in 2019 and 2021. A low ratio indicates high inventory levels or slow sales, leading to higher holding costs and lower profits. In 2019, the company collected receivables efficiently with a turnover ratio of 23.44. However, in 2021, the turnover ratio declined, resulting in a decline in efficiency. Negative values for the debt-to-equity ratios in 2019 and 2020 and 2021 signify an increased risk for the business. The company's reliance on debt financing increased from 20% in 2019 to 42% in 2020 and 2021, as indicated by the debt-to-asset ratio. The company's financial risk could rise as a result of this increase in debt financing. The company has negative P/E Ratios in 2019, 2020, and 2021 which indicates losses.

Over the course of the three years, the company's stocks dividend yields varied, rising in 2020 and falling in 2021. Investors looking for income may find a greater Dividend Yield more appealing than one with a lower Dividend Yield.

Exhibits

Exhibit A: External Assessment Exhibit

Two crashes of the Boeing 737 Max and the impact of COVID-19 immensely devastated Boeing's long-standing reputation in the aviation industry.

Boeing's turmoil forced the business to reduce production across the board and fire 16,000 workers, accounting for roughly 10% of its total workforce, leading to financial bleeding.

The demand for narrow-body aircrafts, like the Boeing 737 Max and Airbus A320, were at its peak in the two years leading up to COVID-19. Airbus A320 took the advantage of Boeing's decline to receive and deliver the maximum number of orders, outcompeting Boeing and thereby taking over the position in the industry.

Hence, it is imperative for Boeing to move forward by concentrating more on minimizing rather than fixing the underlying problems and focusing efforts on inducing demand in order to mount a comeback in the industry.

Exhibit B: VRIO Exhibit

| Value Chain Activity | Specific Attributes of the Value Chain | Valuable | Rare | Inimitable | W/S/DC/SDC | Organizational Support | Competitive Implication |

| Outsourcing and Supplier Management | Lack of Oversight | Weakness | Competitive Disadvantage | ||||

| Research & Development | Investment in Innovation | Yes | Yes | Yes | Distinctive Competency | Yes | Sustainable Competitive Advantage |

| Design & Engineering | Differentiated product creation | Yes | Yes | Yes | Sustainable Distinctive Competency | Yes | Competitive Advantage |

| Manufacturing & Developing | Product Quality | Yes | No | No | Strength | Yes | Competitive Parity |

| Marketing & PR | Restoring Public’s Image of Aircraft Safety | Weakness | Competitive Disadvantage | ||||

| Distribution | Prompt Delivery and Order Fulfillment | Yes | No | No | Strength | Yes | Sustainable Competitive Advantage |

| Sales | Order Processing and Contract Partnerships | Yes | No | No | Sustainable Distinctive Competency | Yes | Competitive Parity |

Overall, Boeing’s recent outsourcing of key product components and lack of insight over supplier activities has resulted in a tarnished reputation. These weaknesses have negative implications for the marketing, distribution, and the sales aspects of the value chain. Boeing can leverage their competencies of superior product quality and R&D through emphasis on R&D, supplier management, engineering, and manufacturing to rectify this.

Exhibit C: Financial Ratios Exhibit

ROE changed over time possibly because of market changes. Even though the company was having financial difficulties and negative P/E ratios for 3 consecutive years, it had sustained a current ratio above 1 and good liquidity. The company's increased reliance on debt financing and negative debt-to-equity ratio raised the financial risk. The stock's dividend yields varied, but it should be considered alongside the financial performance of the company and its prospects for the future.

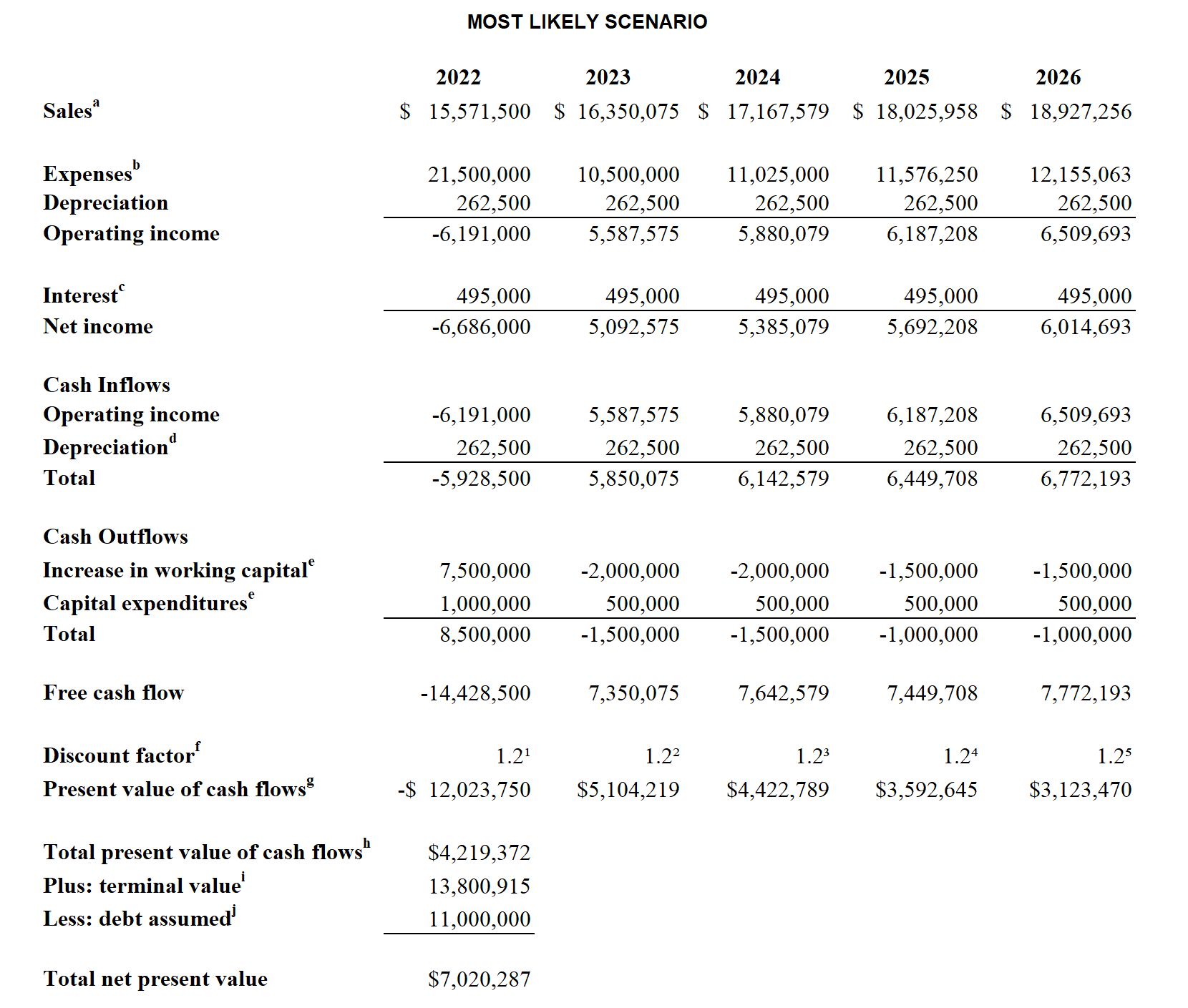

Exhibit D: NPV Exhibit

The Net Present Value calculation that was undertaken was based off a full redesign of the 737 Max and recertification by the FAA. This is to ensure that no subsequent planes crash resulting from design flaws, which would irreversibly destroy Boeing’s reputation and ultimately their business model.

Exhibit E: Assumptions and Justifications Exhibit

Boeing’s strategy was to full redesign of 737 Max

Assume sales to increase by 5% from 2020 - 2025 as the market increases by 5% globally for the narrow body aircraft in Exhibit 9.

Assume first year expenses are based on manufacturing costs of 100 million dollars to manufacture one plane and 11 billion for recertification and redesign (7 billion for recertification and 4 billion for R&D). Following years increase 5% alongside market.

Assume interest expense of 4.5%. Rate calculated using approximation of prior years.

Assumed to be constant at $262,500. Commercial airplane depreciation listed at $525,000 in the annual report, with our estimates of 737 Max accounting for half of it.

The working capital/capital expenditures portion of long-term debt incurred as a result of recertification and R&D will be used for working capital, with a large upfront cost that decreases over time.

Assume 20% per year, or 1.2 raised to the nth year number.

Assume all cash flows were discounted at a rate of 20%, or yearly free cash flow divided by the discount factor for the year.

The sum of values for each year.

Assume sales growth continues to grow by 4.6% from 2025 - 2040 to follow past market growth trends.

Assume 11 billion stems from previous recertification and redesign.

References

Boeing Co. Balance Sheet (n.d.). Market Watch.

https://www.marketwatch.com/investing/stock/ba/financials/balance-sheet

Boeing Co., Profitability Ratios (n.d.). Stock Analysis on Net

https://www.stock-analysis-on.net/NYSE/Company/Boeing-Co/Ratios/Profitability

The Boeing Company 2021 Annual Report (n.d.). Boeing.

https://s2.q4cdn.com/661678649/files/doc_financials/2021/ar/The-Boeing-Company-2021-Annual-Report.pdf

The Boeing Company (n.d.). General Information and Values Index

https://www.boeing.com/company/general-info/index.page#/state

The Boeing Company (BA) (n.d.). Stock Analysis Ratios and Metrics (Annual).

https://stockanalysis.com/stocks/ba/financials/ratios/

The Boeing Company (BA) Income Statement (n.d.). Yahoo Finance.

https://finance.yahoo.com/quote/ba/financials/?guccounter