This case is part of your Harvard Business Coursepack on the IKEA Group attached Imagine that you are Steve Howard, the IKEA Group's Chief Sustainability Officer (CSO). What are your recommendations

![]()

9-515-033

R E V : N O V E M B E R 2 0 , 2 0 1 7

V . K A S T U R I R A N G A N

M I C H A E L W . T O F F E L

V I N C E N T D E S S A I N

J E R O M E L E N H A R D T

Sustainability at IKEA Group

In 2014, the IKEA Group was pursuing an aggressive growth strategy, initiated in late 2012 to

double sales to €50 billion by 2020. The Group Management (GM) planned to achieve this growth by

increasing the market share of their 303 existing stores and by opening nearly 200 more stores, many

of which would tap into the billions of new customers entering the middle class in emerging markets,

especially China and Russia. The market share of IKEA Group in emerging markets was far lower than

its conventional markets in Europe and North America, where demand was expected to grow much

more slowly.

Steve Howard, IKEA Group’s Chief Sustainability Officer (CSO), saw major opportunities from this

planned growth: “Growth is the priority. If you’re growing as a company, everything becomes

possible.” But he also viewed the implications of such aggressive growth through the lens of the

company’s equally ambitious sustainability plans, noting: “Worldwide economic activity, if left

unchecked, is already on track to consuming 150% of planet earth’s resources, and on top of that we

will have 3 billion extra consumers by 2030, mostly from the emerging market countries. If we’re

growing as a company, we have to balance how we use resources to be sustainable. We can grow and

be sustainable.”

In late 2012, IKEA Group launched a comprehensive sustainability strategy called “People & Planet

Positive” that focused on the company’s entire value chain, from its raw materials sourcing to the

lifestyle of its consumers. Sustainability had become integral to IKEA Group’s core business strategy.

As Howard put it, “We are transforming our material base, becoming an independent power producer,

lifting working conditions through the supply chain, and accelerating change in product sectors by

becoming one of the world’s largest retailers of energy-efficient LED lighting. Sustainability is a driver

of growth and is now a fundamental part of our decision making—we have changed the mindset across

the business.” Peter Agnefjäll, IKEA Group’s president and CEO since September 2013, was confident

that the company’s growth strategy would not conflict in any way with the company’s sustainability

targets.

Sustainability issues in the IKEA Group wood supply chain were especially challenging because

the company sought to procure wood and wood products close to its consumer markets to minimize

![]()

Sustainability at IKEA Group

transportation costs, but the growth plans focused on emerging markets in which wood supply chains

lacked well-developed markets for wood that met the company’s stringent sustainability standards.

IKEA Group’s global lumber purchase volume trailed only The Home Depot and Lowe’s among global

retailers1 and represented 60% of IKEA Group’s total raw material procurement by volume and 40%

by value (followed by plastic, steel, and cotton). The enormous scale of IKEA Group’s wood

procurement made the company’s management of its wood supply chain an especially salient issue to

the company’s bottom line, environmental activist groups, and many ecosystems.

Company Overview

IKEA was founded in Sweden in 1943 by Ingvar Kamprad when he was 17 years old. He named the

company with an acronym for his initials and the village in which he grew up, Elmtaryd, Agunnaryd.

Initially selling small items and then furniture through a mail-order catalog, by 1974 the company had

grown from one showroom in Älmhult to more than a dozen stores throughout Europe. Kamprad

sought to sell affordable, quality furniture to mass-market consumers around the world. He believed

his company would succeed if it operated according to a particular set of values: “Our enthusiasm, our

constant will to renew, on our cost consciousness, on our willingness to assume responsibility and to

help, on our humbleness before the task, and on the simplicity of our behavior.” By 2013, the company

had grown to earn €3.3 billion in net income on €28.5 billion in salesa (see Exhibit 1 for IKEA Group’s

financial performance in 2010–2013).

IKEA Group

Organizational structure In 2013, IKEA Group employed 135,000 people, of whom 75%

worked in retail and 70% were in Europe. IKEA Group was organized into three operating units (see

Exhibit 2 for IKEA Group’s organization chart). Range and Supply was responsible for all new product

design and development, and for supply chain management. Production operated and managed several

company-owned furniture and particleboard factories that produced roughly 15% of the furniture sold

at IKEA stores. Retail and Expansion managed the company’s owned and operated IKEA stores. IKEA

Group franchised the IKEA retail system from Inter IKEA Systems B.V., which was the owner of the

IKEA concept and was the worldwide IKEA franchisor.

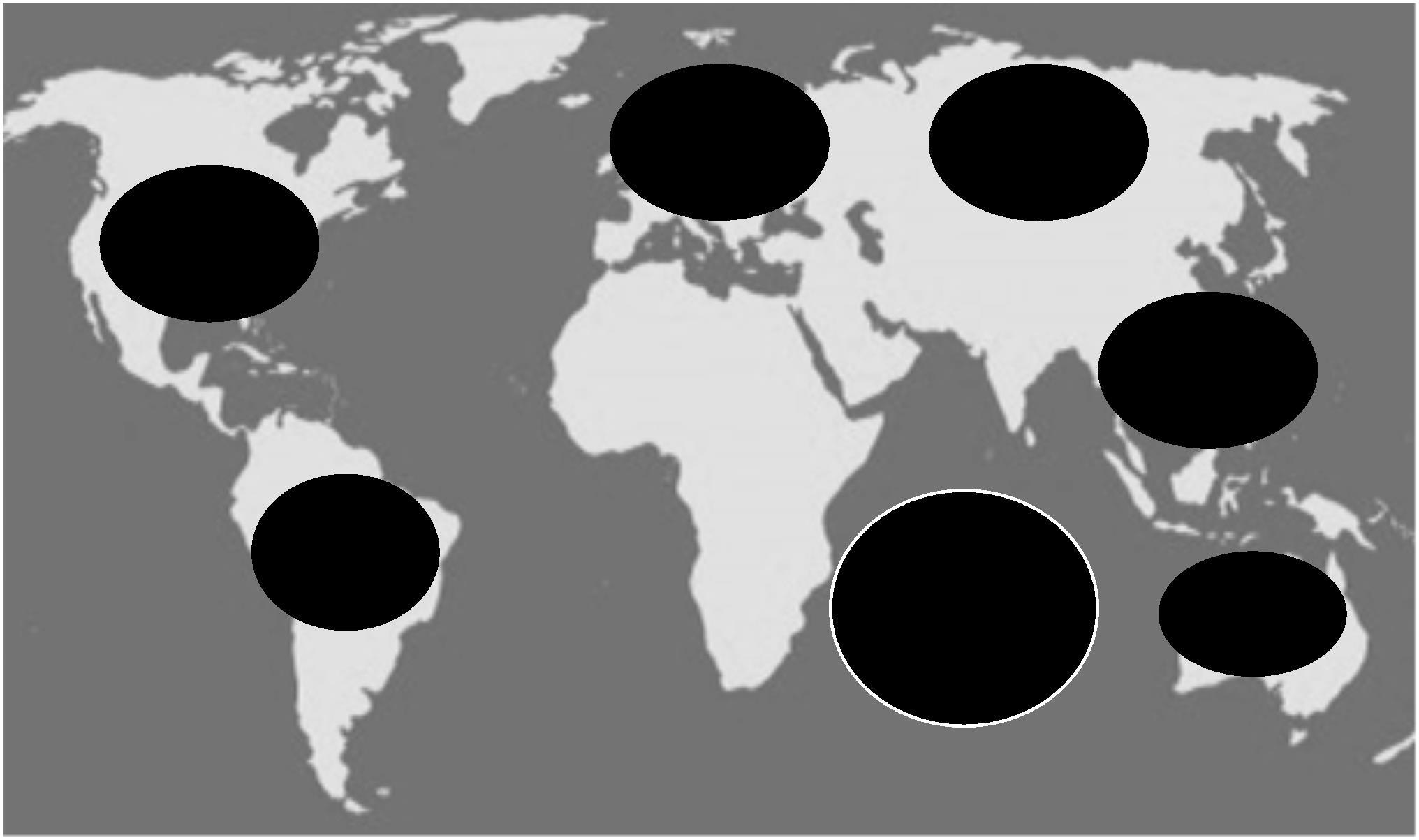

Stores There were 345 IKEA stores in 42 countries by the end of 2013, most of which were located

at the outskirts of large cities. IKEA Group owned and operated 303 IKEA stores and franchised the

remaining 42 stores. IKEA Group store sales were predominately in Europe (69%), followed by Asia

and Australia (16%), North America (8%), and Russia (7%) (see Exhibit 3 for the geographic

distribution of IKEA Group stores). IKEA Group stores averaged 28,700 square meters (309,000 square

feet) and €85 million in annual sales. The largest store, in Shanghai, was twice the average size. IKEA

stores were designed to maximize customer time in the store, with a meandering pathway laying out

a designated route to guide customers through all departments. The store layouts had been described

as “effectively IKEA’s catalogue in physical form, with furniture placed in different settings, which is

meant to show you how adaptable it is.”2

Home furnishing market Home furnishing was IKEA Group’s main market. The €331 billion

global home furnishing market was highly fragmented, with the top five companies accounting for less

than 8% of sales value in 2011. The market was characterized by a large number of category specialists

with limited geographic scope. As a whole, IKEA stores were the world leader in the home furnishing

a This equates to USD 4.5 billion in net income on USD 39.2 billion in sales, using a USD 1.376 to €1 exchange rate as of December 31, 2013.

2

T

For the exclusive use of B. Kanneh, 2023.![]()

Sustainability at IKEA Group 515-033

market, capturing 4.9% of the global home furnishings market in 2011, and faced no comparable global

competitor. The world’s second-largest furniture retailer was Ashley Furniture Inc., whose €4 billion

sales spanned just three countries (the U.S., Canada, and Mexico), constituting a 1.2% share of the

global furniture market. Sealy, the world’s third-largest furniture retailer, recorded sales of €1.7 billion,

mainly in North America and Europe, achieving a 0.5% share of the global furniture market.3

Products The company’s Scandinavian roots were key to the IKEA brand identity and was

manifest in its product designs and Swedish product names (see Exhibit 4 for a sampling of IKEA

Group furniture). IKEA produced a range of 9,500 products that spanned home furnishing, indoor

furniture, home improvement, housewares, and gardening supplies. Roughly 60% of its sales were in

furniture (of which 80% was indoor furniture4) and 40% in non-furniture items in 2011. Much of the

company’s furniture was designed and sold in unassembled flat packaging, which the company

introduced in 1953 to help keep costs and prices low by minimizing transportation costs and

transferring assembly costs to customers. The company had retained Kamprad’s founding principles

of maintaining very low prices without compromising on functionality or technical quality. For

example, its LACK coffee table was priced at less than €10, “cheaper than the coffee itself,” as one IKEA

designer joked. IKEA’s continuous efforts to reduce costs had enabled it to reduce prices every year

since 2000. On the revenue side, the company had experienced a compound annual growth rate

(CAGR) of 5% between 2010 and 2013.

Supply chain IKEA Group managed 1,046 home furnishing suppliers in 52 countries. Nearly

60% of production, including third-party suppliers and wholly owned suppliers, took place in Europe,

followed by Asia and Australia (33%), North America (3%), Russia (3%), and South America (1%). (See

Exhibit 3 for the geographic distribution of IKEA production units.)

While it relied heavily on third-party manufacturers, the IKEA Group furniture and particleboard

factories manufactured 25% of its own particleboard and nearly 15% of its furniture (representing 27%

of its total volume of sourced wood). IKEA Group had already invested €550 million in 2013 to expand

its own board manufacturing capacity by 66%, increasing the number of plants from two to six. The

company also owned and operated 38 furniture manufacturing plants worldwide by the end of 2013

(see Exhibit 3).

IKEA Group’s Growth Strategy

We have a strong foundation for future growth. Our company structure is built to last over time, and

fortunately we also have the financial strength to grow in a balanced and sustainable way. By creating better

products at lower prices, being more inspiring, improving our existing stores, opening new stores and expanding

our e-commerce offer, we plan to double sales by 2020.

— President and CEO Peter Agnefjäll, IKEA Group Annual Report 2013

IKEA Group’s ambitious growth strategy to double worldwide sales to €50 billion by 2020 required

increasing revenue by 10% each year. IKEA Group planned to achieve this by growing sales at their

existing stores and by opening new stores, which would increase the number of stores from 303 in 2013

to 500 in 2020. Nearly 90% of IKEA Group sales in 2013 were in OECD countries, and 70% in Europe,

but IKEA Group management expected to open few new stores in those markets. Instead, senior

management planned to achieve roughly half of its growth targets from expanding sales at their

existing stores and the rest from opening 200 new stores primarily in emerging markets, where the

company had much lower penetration. The rapidly growing markets in China and Russia were key

(see Exhibit 5 for the world’s fastest-growing home furniture markets and IKEA Group’s market share

in each).5

3

For the exclusive use of B. Kanneh, 2023.![]()

515-033 Sustainability at IKEA Group

Since IKEA Group had entered Russia in 2000, it had built a network of 14 stores that generated

sales of €1.96 billion in 2013. In China, the company had opened 16 stores over a similar period,

recording sales of €740 million in 2013,6 and sought to triple its pace of store openings by 2020.7 IKEA

Group entered India in April 2013 with a planned US$2 billion investment to open 25 stores, under an

agreement with the Indian government to locally source 30% of the products sold in those stores.8

To successfully expand in emerging markets, IKEA Group anticipated that it might need to depart

from its conventional approach of designing a common product range for all of its stores. Instead, it

would have to offer different subsets of its product range to different regions. In addition, as it had

done when it entered Japan in 2005 by designing new products to suit local tastes, the company

expected that its designers would create new products and services targeted to specific regional needs

including, perhaps, furniture designed to suit smaller living spaces in China and offering in-home

furniture assembly services in India.9

Sustainability at IKEA Group

To meet future customer needs and address the higher price of raw materials and energy, while driving down

emissions and maintaining our low prices, we need to transform our business. Simply working towards being

less bad will not get us where we need to be—we need transformational change—which means changing old ways

and embracing the new, being bold, innovative, and committed to taking action.

— IKEA Group 2012 Sustainability Report

IKEA Group’s CEO created the role of Chief Sustainability Officer (CSO) in 2011 to be the seventh

member of the company’s Group Management (GM), which was responsible for formulating and

implementing the company’s strategy. Before being hired as the first CSO, Howard had founded and

led The Climate Group, a nongovernmental organization (NGO) that advised business and

government leaders on how to address climate change. Hiring Howard and including him in the GM

was an indication that IKEA’s leadership was seeking transformational change to enable the company

to better anticipate and address sustainability issues. After numerous discussions during Howard’s

initial six months with the company, the GM announced its People & Planet Positive strategy, which

focused on three areas: (1) a more sustainable life at home for consumers; (2) resource and energy

independence for the company; and (3) a better life for people and the communities touched by IKEA

(see Exhibit 6 for highlights). The strategy sought to transform all aspects of the company’s value chain,

including designing products to minimize the use of raw materials, selecting sustainably sourced

materials to reduce the environmental impacts and improve labor conditions within its supply chains,

improving efficiency in production and logistics, and developing programs to ensure that its products

could be reused or recycled at their end of life. At the consumer level, for example, the company

planned to convert its entire range of lighting products by 2016 to LEDs, which were nearly 10 times

more efficient than incandescent lighting and twice as efficient as compact fluorescents.

In its production, distribution, and store operations, IKEA Group was investing substantially to

reduce energy consumption. Its €21 million investments in energy efficiency measures during 2011–

2013 had yielded cost savings of around €40 million over that period. IKEA Group was seeking by 2020

to produce as much renewable energy as the total energy it consumed in its operations, and was a third

of the way toward its goal by 2012. The company had already begun investing in wind farms, using

biomass to power its production facilities, and installing solar panels at its stores.

Howard led a 22-person corporate Sustainability Group consisting of four teams: (1)

Communication developed IKEA Group’s sustainability communication strategy; (2) Innovation

4

![]()

Sustainability at IKEA Group 515-033

developed sustainable innovative solutions; (3) Policy improved guidelines throughout IKEA Group;

and (4) Retail worked to inculcate sustainable practices at the stores. These teams worked with the

operating units to implement the People & Planet Positive strategy. In total, nearly 500 people at IKEA

Group were directly accountable for implementing various aspects of the company’s sustainability

objectives. Howard explained, “95% of actions will happen through leadership and sustainability being

embedded in the organization.”

Howard believed that communicating the new strategy’s goals to NGOs was critical to gaining their

support and building trust. IKEA Group’s Head of Sustainability Communications, Olivia Ross,

pointed out, “We have values, which mean we are less likely to find ourselves in greenwash territory.b

Everything we do must be rooted in humility and facts, and must communicate the journey.” Howard

also initiated a People & Planet Positive advisory group, which included board-level representatives

from key environmental and development NGOs such as the World Resource Institute and Oxfam

Great Britain. The advisory board was charged with holding IKEA Group accountable, and challenging

and inspiring the company on strategic sustainability issues. Moreover, Ross added, “Customers,

coworkers, and the general public also hold IKEA Group accountable.”

Sourcing Sustainable Wood

Wood Supply Chain

Raw material often constituted the largest cost item for wood-based products. IKEA Group worked

with 384 wood suppliers in 50 countries in 2013. Its wood supply chain began in forests or with

recovered wood. Nearly all of these forests were owned and operated by third parties, although IKEA

Group leased nearly 500,000 hectares (1.24 million acres) of forest land in Russia’s Leningrad Oblast

and Republic of Karelia and leased a smaller forest in Slovakia. Timber harvested from forests provided

the raw material to primary processers, including sawmills, board manufacturers, and the pulp and

paper industry. By-products from sawmills and plywood mills were often shipped to board mills,

which produced board material. Lumber and board material were converted to components in

factories. Furniture manufacturers then assembled solid wood and particleboard components into

finished (but unassembled) furniture pieces, and shipped nearly half of these boxed components

directly to IKEA stores and the rest to IKEA Group’s distribution centers, which ultimately delivered

them to stores. IKEA Group’s revenue from particleboard furniture was about three times as much as

from solid wood furniture. (See Exhibit 7 for data on IKEA Group’s wood supply chain.) Some of these

supply chains were fully owned by IKEA’s suppliers, and others by independent chains of sub-

suppliers.

IKEA Group was one of the largest lumber consumers in the global retail and consumer goods

industry. IKEA Group sourced most of its wood from countries in Eastern Europe, and sold most of its

products in Western and Northern Europe (see Exhibit 8 for IKEA Group’s wood procurement value

by region).10

The 14 million cubic meters of round wood equivalent it sourced in 2013c amounted to 1% of all industrial wood sourced on the planet (see Exhibit 9 for IKEA Group’s wood procurement volume).

b “Greenwash” referred to environmental claims that exaggerated a company’s overall environmental performance.

c Round-wood equivalent (RWE) volume is a measure of the volume of logs (round wood) used in the manufacture of wood-

based products (including wood pulp, paper, wooden furniture, joinery, and plywood).

5

For the exclusive use of B. Kanneh, 2023.![]()

515-033 Sustainability at IKEA Group

IKEA Group sourced 21 wood species, primarily pine (nearly 50% of its procured volume), birch (27%),

and beech (12%).

Sustainability Concerns

Sourcing wood posed several sustainability concerns. First, 1.6 billion people worldwide relied on

local forests for their livelihoods—including food, clothing, or shelter—many in regions where their

rights were not adequately protected by governments. As such, harvesting virgin forests and clearing

wood for plantations risked substantially disrupting many people’s lives. Second, managing natural

forests inevitably affected biodiversity and ecological processes, and converting natural habitats to

timber plantations substantially reduced biodiversity. Third, deforestation—often sparked by the

desire to convert forests to cropland and pasture—was a leading contributor to global climate change

by preventing photosynthesis from sequestering atmospheric carbon into the soil. Deforestation also

reduced long-term wood availability, a particular concern in China, whose timber trade deficit was

already acute.11

Wood Sourcing Standards

IKEA Group had already invested a great deal of time and effort to assess and improve the

sustainability of its wood procurement practices. In 2000, IKEA Group developed its code of conduct—

the IKEA Way on Purchasing Products, Materials and Services (IWAY)—to specify minimum

acceptable standards for working conditions and environmental protection at its manufacturing

suppliers. In 2013, IKEA Group’s 90 auditors conducted 917 audits and approved 100% of the

company’s home furnishing suppliers, up from 54% in 2008. As Lin Wang, Sustainability Manager at

IKEA Group China noted, “IWAY is not only an auditing framework, but a business discipline. If

suppliers choose not to maintain compliance, they can no longer supply IKEA Group. By having

internal auditors in all business areas, we integrate IWAY in the business and enforce suppliers’

compliance.” Suppliers in high-risk locations were audited annually, and others were audited at least

every two years. Suppliers that did not comply with IWAY were phased out.

In 2002, IKEA Group introduced an IWAY standard for forestry practices spanning its entire supply

chain, from forests to furniture. As IKEA Group Range and Supply Forestry manager Anders Hildeman

noted, “By engaging with suppliers on IWAY Forestry Standard, we were able to take a step-wise

approach that has led to higher standards across the supply chain—creating a new base level of what

we consider to be more sustainable wood.” By 2013, the IWAY Forestry Standard prohibitted sourcing

wood:

• from forests that had been illegally harvested;

• from forestry operations engaged in forest-related social conflicts;

• harvested in geographically identified Intact Natural Forests or High-Conservation Value

Forests d, unless they were certified as responsibly managed;

• harvested from natural forests in the tropical and subtropical regions being converted to

plantations or non-forest use;

d High Conservation Value Forests is a designation of the Forest Stewardship Council that refers to forest areas that contain

significant concentrations of rare, threatened or endangered species, or that provide to local communities critically important

services (e.g., preventing landslides), products, or traditional cultural identity.

6

![]()

Sustainability at IKEA Group 515-033

• from officially recognized and geographically identified commercial genetically modified tree

plantations.

Beyond these minimum requirements, the IWAY Forestry Standard also specified conditions under

which wood would qualify as coming from “More Sustainable Sources” to be either:

• wood certified to the Forest Stewardship Council’s “Forest Management” and “Chain of

Custody” standards; or

• pre- and post-consumer reclaimed wood (recycled).

The Forest Stewardship Council (FSC) was created in 1993, in the wake of the failure of governments

and NGOs at the 1992 Earth Summit to achieve a consensus on measures to fight deforestation. The

FSC embodied a consultative approach to solving deforestation and was governed by its multi-sector

stakeholder members, which included environmental NGOs, the timber trade, community forest

groups, and forest certification organizations. IKEA Group was one of the founding members. FSC

governance was based on the principles of participation, democracy, and equity. These principles

influenced the structure of the FSC’s General Assembly—composed of delegates from national FSC

initiatives, FSC members, NGOs, FSC certification bodies, FSC certificate holders, trade unionists,

NGOs, and others—and subdivided into three chambers (environmental, social, and economic) that

were further split into sub-chambers of global North and South. Any major decision—national or

international—required a majority vote from these chambers.

The FSC Forest Management standard referred to timber management practices that were based on

a set of 10 principles, including to respect indigenous peoples’ rights; to maintain or restore forest

ecosystems, including their biodiversity and landscape; to implement a documented management

plan; and to comply with all laws, regulations, treaties, conventions, and agreements. The FSC Forest

Management standard was adapted to local conditions to reflect the diverse legal, social, and

geographical conditions of forests. The FSC Chain of Custody standard provided an information trail

for wood products as they flowed through every stage of the supply chain—including timber

harvesting, processing, manufacturing, and distribution—to verify that FSC-certified material was

identified or kept separated from non-certified material. Howard estimated that wood certified under

the FSC Forest Management and Chain of Custody schemes often commanded a 5% price premium.

IKEA Group favored FSC over alternative standards such as the Programme for the Endorsement

of Forest Certification (PEFC) because of FSC’s distinctive governance process that emphasized balance

across various stakeholders. FSC certification was the most widely available commercially within its

key sourcing regions, and had the greatest consumer recognition among various standards. (See

Exhibit 10 for a comparison of the certifications and Exhibits 11a and 11b for the area of FSC certified

forest land.)

Hildeman explained, “IKEA Group’s contracts with suppliers include action plans that specify the

production level and the type of articles or products expected in the future, and typically range from

1–5 years, and therefore lock in sustainability standards, yield, quality, and cost.” IKEA Group only

accounted for solid wood in the volume of wood coming from More Sustainable Sources until 2010,

when the company decided to also include particleboard. IKEA Group had committed to reach 50% of

wood from More Sustainable Sources by 2017 and 100% by 2020. By the end of 2013, the company’s

sourcing had reached 32.4% from More Sustainable Sources composed of 28.4% FSC-certified wood

and 4% recycled material (see Exhibit 9).

7

![]()

515-033 Sustainability at IKEA Group

Achieving a Sustainable Wood Supply Chain: Next Steps

As CSO, Howard was proud of the progress being made on implementing the People & Planet

Positive strategy and the integration of sustainability concerns into core business decisions. This was

certainly true with the company’s sustainable wood initiatives, which spanned its design,

procurement, and supply chain functions. But Howard wanted to construct a framework for how these

interrelated tactics might be integrated into a coherent strategy.

IKEA’s managers faced a substantial challenge as they attempted to decide how to meet the goals

laid out in the company’s ambitious sustainability plan. Among the four potential options described

below, it was unclear which was preferable in terms of risks, profits, and growth. What were the

tradeoffs, and what were the potential synergies among them?

Option 1: Owning More Forests

Per Berggren, IKEA Group Industrial Strategy Manager, noted, “We could possibly replicate what

we do in Russia and Slovakia and lease more forest land.” This would have IKEA Group employees

directly managing timberland and being responsible for ensuring that it was managed according to its

More Sustainable Source terms. Currently, IKEA Group could not tell customers what forest a

particular piece of wood in a product came from, and directly managing forest land could improve

IKEA Group’s ability to trace wood from the forest to the end consumer.

By 2013, IKEA Group was sourcing 20% of its wood from leased forests in Russia. Hildeman

explained, “In Russia there is limited regulatory oversight of illegal logging and low protection of high

conservation value. Integrating vertically can considerably strengthen the control of the origin and the

sustainability aspects of the wood. What’s more, Russian forestry legislation mandates clear-cutting,

which means uniformly cutting all trees in an entire square of forest, which is contrary to sustainable

forestry practices.” He added, “In Russia, there are also a lot of small-scale sawmills, so wood

availability, quality, and prices can fluctuate a lot. In these conditions, it makes sense to vertically

integrate our supply chain.” He therefore wondered if IKEA Group could increase its share of wood

sourced from direct timber management in the coming years, maybe up to 80%.

Vertically integrating the supply chain could also help IKEA Group secure access to more FSC-certified

wood in the future. IKEA Group had started in 2012 to import wood from Russia into China to overcome

the wood shortage in China. IKEA Group contracted with an exclusive supplier, a Russian and Chinese

joint-venture firm that built the entire supply chain to meet IKEA Group’s specifications. The advantage for

IKEA Group was twofold. First, it allowed the company to diversify procurements away from China’s

costly wood market for the logging of birch and pine, which, together represented 60% of the wood used

by IKEA Group in the country. As a result, 25% of the wood sourced in Russia was used in furniture sold

in China. Second, it allowed IKEA Group to closely monitor every step of the supply of wood from Russia

to China. IKEA Group China’s Forestry Manager, Mikhael Tarasov, commented, “Backward integration

allows IKEA Group to control the entire supply chain and push for a sustainable change.”

While there were many advantages to owning or leasing more timber forests, there were some

downsides too. To manage more forest land, IKEA Group would need to deploy more capital to cover

the high fixed costs of lease holds. It would also divert management attention to leasing and managing

timberland, which would require developing forestry planning. Berggren explained, “Managing a

forest in essence makes you a wood trader, which means you need to sell most of the wood you

produce, including residual material that can be hard to sell.” Furthermore, reaping the benefits of

sustainably managing forest lands could be uncertain because the forest rotation period—the time it

takes the forest to grow again after being harvested—could exceed the lease term. Hildeman explained,

8

Sustainability at IKEA Group 515-033

“The forests we have in Russia produce birch and pine, which have rotation periods of 70–80 years and

50–60 years, respectively. Meanwhile, our lease period is only 49 years, which means that we cannot

be sure to reap the benefits from the investments made in better forest management. In Sweden,

owning the forest has been key in incentivizing better forestry management.” In Slovakia, however,

the forest land that IKEA Group leased had a shorter rotation period, which allowed the company to

manage the forest from planting to harvesting.

Leasing and managing land directly would enable IKEA Group to be fully responsible for forest

practices, but made it directly accountable when problems arose. In May 2012, Swedish NGO Protect

the Forest and the Russian Karelia Regional Nature Conservancy SPOK publicly condemned IKEA

Group for logging old-growth forests and other High Conservation Value Forest areas in the two

forests the company leased in Russia.12 IKEA Group publicly responded that both forests had been

certified by the FSC in 2007, and that it had respected the Russian FSC standard that more narrowly

defined old-growth forests than the FSC standards deployed in the West.13 The FSC standard in Russia

was adapted to reflect that country’s context, which featured vast hectares of old-growth forest land

that would be eligible for protection in many European countries. Protecting all such forests in Russia

was not viewed as necessary to protect vulnerable species, as it was in Western Europe, where old-

growth forest land was much scarcer. IKEA Group indicated it would increase dialogue with SPOK

and other NGOs in Russia to better ensure future common understanding of the local standards.14

Option 2: Driving Higher Procurement Targets and Standards

IKEA Group followed a risk-based approach to determine the amount of FSC-certified wood it

would include in its 50% target for More Sustainable Sources by 2017. For example, this meant its target

was 100% in the regions it deemed to be high risk: Southeast Asia, Greater China, Northeastern Europe,

and Southeastern Europe. These regions totaled 20% of the wood sourced by IKEA Group worldwide.

Hildeman believed that FSC was a good fit in the IKEA Group global supply chain. He explained,

“IKEA Group is three or four steps away from the forest; it usually concentrates on the front end, on

design and production, so to exercise forestry management control through FSC certification makes

sense to us.“ Ross added, “Setting a target for using more FSC-certified and recycled wood is a simple

and efficient message to our customers: they see we are clearly committed to sustainability.”

Furthermore, Hildeman noted, “It is not enough if we just ask for FSC-certified materials; we need to

increase the availability of such materials.” In 2002, IKEA Group partnered with World Wide Fund for

Nature (WWF) to work on responsible forest management. As part of that effort, WWF and IKEA Group

collaborated to increase FSC-certified forest areas. Overall, IKEA Group supported 11 WWF projects in

13 countries that focused on four themes: improved forest governance, responsible forest management,

responsible and transparent trade, and improved production efficiency. By the end of 2013, the

partnership had contributed to the certification of nearly 28 million hectares of forest in Russia (of a total

of 200 million hectares of managed forest land in Russia), and around 2 million hectares in China (of a

total of 107 million hectares of managed forest land in China). By the end of 2013, only 7% of the world’s

forests were FSC-certified, but IKEA Group strived to increase that rate, announcing it would contribute

to the FSC certification of 15 million additional hectares of forest in high-risk areas by 2020.

Option 3: Using More Particleboard

IKEA Group sourced solid wood and particleboard, also known as engineered wood (or board

material), that was made of wood particles or fibers bound with glue, often topped with wood veneer,

a thin layer of solid wood. Particleboard was often used for furniture’s less visible structural framing

elements, but could not be used for some components such as round surfaces that required solid wood.

9

515-033 Sustainability at IKEA Group

In 2013, particleboard and solid wood represented 55% and 45%, respectively, of all wood sourced

by IKEA Group. Berggren explained that particleboard more efficiently used wood, noting, “The yield

from log to lumber is a lot higher for particleboard than it is for solid wood, meaning that we can get

more particleboard than solid wood from one log of wood. By shifting from solid wood to

particleboard, we can reduce the global amount of wood we use.” He cited an example: “IKEA has, for

instance, developed a new lightweight particleboard which is 30% less dense than standard

particleboard. This means less wood and resin is used and the product is lighter to transport, so trucks

can be filled up to 30% more efficiently.” He also noted economic benefits: “A product made of

particleboard is around 20% cheaper than a product made of solid wood.”

IKEA Group could redesign its products to increasingly shift from relying on solid wood to

particleboard. Berggren believed that the current replacement rate of solid wood by particleboard was

around 5% per year, and that it would be technically possible to accelerate this to increase the share of

particleboard to 80% by 2022. Design and commercial concerns prevented all solid wood from being

replaced by particleboard, however. Berggren noted that consumers perceived solid wood to be worth

more than particleboard, and particle board could diminish consumers’ willingness to pay. As a result,

Berggren estimated that around half of IKEA Group’s procurement of solid wood could realistically be

substituted by particleboard in the coming years. However, limited demand for particleboard in

markets like China and India resulted in little or no particleboard production capacity that met IKEA’s

quality specifications. This meant that developing particleboard production capacity in these regions

would require significant up-front investment from IKEA Group.

Option 4: Using More Recycled Wood

To increase the share of wood coming from More Sustainable Sources, IKEA Group could also focus

on increasing the share of recycled wood from 4% of all wood sourced by IKEA Group in 2013 to 10%

by 2020. Recycled wood was cheaper than virgin particleboard in countries (such as France and

Germany) that had an ample supply of recycled wood due to landfilling regulations and bioenergy

subsidies and in countries (such as Italy) that had limited access to virgin wood-based board.

To increase the share of recycled wood, IKEA Group would need to adapt its board manufacturing

plants to accept recycled wood, which required heavy investment. To minimize the cost of collecting

recycled wood from individuals, only board plants located near urban areas could be used for recycled

wood. Furthermore, the availability of used wood could prove problematic in many regions where

there was no incentive to collect wood for recycling. For example, used wood in Russia was mainly

sent to landfills, and used wood in Sweden was mainly combusted to produce energy. Countries like

India lacked the logistical infrastructure to transport and process used furniture into recycled wood.

Conclusion

The wood supply chain was just one of many strategic dimensions that IKEA Group would have to

address in going forward with its ambitious growth plan to double sales to €50 billion by 2020. Howard

believed that IKEA Group would continue to refer to the multifaceted People & Planet Positive strategy

(see Exhibit 6) over the next few years, using it to help guide the business and each department’s

business strategy. Wood sourcing nevertheless constituted a key lever that IKEA Group could use to

increase its positive impact on sustainability. Worldwide consumers and employees throughout the

entire IKEA Group organization would therefore look to how the company would develop a

transformative wood sustainability strategy, especially with respect to the company’s aggressive

growth plan in emerging markets.

10

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Sustainability at IKEA Group 515-033

Exhibit 1 IKEA Group Financial Figures from 2010 to 2013 ( in euro million)

Income Statement 2010 2011 2012 2013

Revenue 23,539 25,173 27,628 28,506

Cost of sales 12,454 13,773 15,723 15,786

Gross profit 11,085 11,400 11,905 12,720

Operating cost 7,888 7,808 8,423 8,709

Operating income 3,197 3,592 3,482 4,011

Total financial income and expense 76 165 427 81

Income before minority interests and taxes 3,273 3,757 3,909 4,092

Tax 577 781 695 775

Income before minority interests 2,696 2,976 3,214 3,317

Minority interests -8 -10 -12 -15

Net income 2,688 2,966 3,202 3,302

Balance Sheet 2010 2011 2012 2013

Property, plant, and equipment 15,982 16,173 17,264 17,036

Other fixed assets 2,683 2,416 2,672 2,493

Total fixed assets 18,665 18,589 19,936 19,529

Inventory 3,415 4,387 4,664 4,257

Receivables 2,238 2,077 2,270 2,193

Cash and securities 16,955 16,828 17,878 16,000

Total current assets 22,608 23,292 24,812 22,450

Total assets 41,273 41,881 44,748 41,979

Group equity 22,841 25,411 29,072 29,202

Long-term liabilities 4,296 3,123 2,523 1,898

Other non-current liabilities 1,325 1,469 1,625 1,567

Total non-current liabilities 5,621 4,592 4,148 3,465

Short-term liabilities 7,724 7,107 6,814 4,763

Other payables 5,087 4,771 4,714 4,549

Total current liabilities 12,811 11,878 11,528 9,312

Total equity and liabilities 41,273 41,881 44,748 41,979

2023 taught by EVELYN THOMCHICK, The Pennsylvania State University

from Dec 2022 to Jun 2023.

![]()

515-033 Sustainability at IKEA Group

Exhibit 2 IKEA Group Management and Sustainability Group

| Torbjörn Lööf, Chief Executive Officer, Inter IKEA Systems* | Franchise agreement | Peter Agnefjäll, Chief Executive Officer and President, IKEA Group of Companies | |||||||||||||||||||||

| Martin Hansson, Retail and Expansion | Leif Hultman, IKEA Industry | Petra Hesser, Human Resources | Jesper Brodin, Range and Supply | Steve Howard, Chief Sustainability Officer | Helen Duphorn, Corporate Communications | Alistair Davidson, Head of Staff | |||||||||||||||||

| Pia Heidenmark Cook, Retail Sustainability Manager | Cooperation** | Olivia Ross, Communications Manager Hakan Nordkvist, Innovation Manager | |||||||||||||||||||||

Greg Priest,

Policy & Compliance Manager

Pia Heidenmark Cook,

Retail Sustainability Manager

Source: Compiled by casewriters from company documents.

Note: * Inter IKEA Systems B.V. was the franchisor of the IKEA Retail System. IKEA Group was one of 12 independent

groups of companies that owned and operated IKEA stores under franchise agreements with Inter IKEA Systems B.V.

Franchisees paid a franchise fee of 3% of net sales.

12

For the exclusive use of B. Kanneh, 2023.

515-033 -13-

Exhibit 3 All IKEA Group Retail and Production Units at the End of 2013

| North America: 50 stores 3% Purchasing Value 6 Distribution Centers 1 Trading Office 1 IKEA Production Unit | Europe: 215 stores 60% Purchasing Value 19 Distribution Centers 11 Trading Offices 36 IKEA Production Units | Russia: 14 stores 3% Purchasing Value 1 Distribution Center 3 Trading Offices 5 IKEA Production Units |

Asia:

19 stores

33% Purchasing Value

5 Distribution Centers

12 Trading Offices

2 IKEA Production Units

| South America: 1% Purchasing Value 1 Trading Office | Globally: 303 IKEA Group stores 32 Distribution Centers 60% of production takes place in Europe |

Australia: 5 stores

1 Distribution Center

Source: Casewriters, based on IKEA Group 2013 facts and figures, 2014, accessed July 2014.

![]()

![]()

![]()

![]()

515-033 Sustainability at IKEA Group

Exhibit 4 Sample of IKEA Group Furniture Sold in the United States, with Indicated Retail Prices

(in USD)

Source: IKEA 2014 U.S. Online Catalog, http://onlinecatalog.ikea-usa.com/US/en/IKEA_Catalog/, p. 84, accessed

August 2014.

Exhibit 5 World’s 10 Fastest-Growing Home Furnishing Markets and IKEA Group’s Market Share

| Country | IKEA Group's Market Share in 2011 | Market Size in 2011 in USD million | % Market Growth, 2006–2011 |

China 0.8 % 61,363 15.3

South-Africa 0 % 28,999 7.8

Brazil 0 % 20,271 8.4

Russia 10.5 % 13,527 8.0

Turkey 5.0 % 11,411 7.6

Indonesia 0 % 3,491 11.1

India 0 % 3,176 15.3

Argentina 0 % 2,126 19.4

Ukraine 0 % 1,470 8.7

Thailand 1.1 % 683 8.3

Source: Casewriters, compiled from company data and Euromonitor report, “Passport: Company Profile on IKEA Group,”

2012, accessed June 2013.

Note: A 0 market share indicates that IKEA Group was not present in that country in 2011. Market growth is expressed as

compound annual growth rate (CAGR).

14

![]()

Sustainability at IKEA Group 515-033

Exhibit 6 Highlights from IKEA Group’s People & Planet Positive Strategic Plan Principles and

Goals, as of 2014

1. A more sustainable life at home

• Take the lead in developing and promoting products and solutions that enable customers to live a more

sustainable life at home.

• By August 2020, achieve more than a fourfold increase in sales from products and solutions, inspiring and

enabling customers to live a more sustainable life at home.

• Engage and involve people and communities around our stores, our suppliers and co-workers through

impactful, relevant and unique communication.

• By August 2020, IKEA seen as number one home furnishing retailer for operating in a way that is better

for people and the environment on each market. Observe, on a country basis, a minimum 3% increase in

awareness annually on two strategic areas related to People & Planet Positive topics.

2. Resource and energy independence

• Strive for resource independence by using resources within the limits of the planet and by encouraging all

waste to be turned into resources.

• By August 2016, 50% of projected wood volumes will come from More Sustainable Sources (these sources

are currently defined as FSC certified or recycled wood. Once the 2017 More Sustainable Sources goal has

been met, we will re-evaluate this criteria).

• By August 2020, we aim to source 100% of our wood, paper and cardboard from More Sustainable Sources.

• By August 2015, all cotton used will be sourced from More Sustainable Sources, such as Better Cotton.

• By August 2015, all main home furnishing materials, including packaging, will be either made from

renewable, recyclable, or recycled materials.

• By August 2020, 90% of our home furnishing products will be more sustainable with documented

environmental improvements, covering both resource use and product functionality according to our

sustainability product score card.

• Develop our business through investing in renewable energy sources, energy efficiency, store expansion

and refurbishment, low carbon transportation and range development.

• We will maintain or exceed current investment levels and publicly report on progress.

• Every new IKEA Group store, distribution centre, or industrial group factory will be located, designed,

equipped, and operated to be the most sustainable IKEA Group facility at that point in time.

• Strive towards energy independence through being a leader in renewable energy, and becoming more

energy efficient throughout our operations and supply chain.

• By August 2015, we will produce renewable energy equivalent to at least 70% of our energy consumption.

• By August 2020, IKEA Group will produce as much renewable energy as we consume in our operations.

15

![]()

515-033 Sustainability at IKEA Group

Exhibit 6 (continued)

3. A better life for people and communities

• Take a lead in contributing to a better life for people and communities impacted by our business.

• Maintain 100% IWAY approval of all suppliers of home furnishing and other key products and services. • By August 2015 secure 100% IWAY approval for all national IKEA Food, Indirect Material and Services

and retail suppliers within the scope of IWAY.

• By August 2017 secure compliance to IWAY Musts at all sub-suppliers of critical material and processes.

• By August 2017 develop and implement a transparent and reliable system for the responsible recruitment

of migrant workers at first tier suppliers in identified critical areas.

• Continuously identify and develop setups for home based workers to improve working conditions,

protect labour rights and prevent child labour. By August 2020, all home based workers are transitioned

into improved setups and part of our handmade development programme.

Source: Compiled by casewriters from company documents.

16

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Sustainability at IKEA Group 515-033

Exhibit 7 IKEA Group’s Supply Chain Wood Volume

| Forest | Sawmill/ Boardmill | Component Manufacturer | Furniture Manufacturer |

Volume of wood Volume of wood after Volume of wood after Volume of wood

harvested (in RWE sawmill (in million manufacturing (in after manufacturing

million) cubic meters) million cubic meters) (in million cubic

meters)

Solid Wood 6.3 3.2 1.6 1.5

Particleboard 7.7 5.5 5.0

Source: Compiled by casewriters from company documents.

Exhibit 8 IKEA Group’s Wood Procurement in 2013, by Region (% of Total Value)

Region Wood Procurement

East Europe 44

West and North Europe 27

South Europe 13

Asia and Australia 12

North America 4

Source: Compiled by casewriters from company documents.

17

515-033 -18-

Exhibit 9 Selected Sourcing and Certification Volumes for Wood at IKEA Group, 2005–2017 (expected)

Metric 2007 2008 2009 2010 2011 2012 2013 2017

(expected)

World wood market Total wood reserve in forests 214,700,000 214,300,000 213,900,000 213,500,000 212,700,000 213,100,000 213,500,000

(in 000 m3 except

%) –

Total wood harvested 1,694,000 1,573,000 1,429,000 1,528,000 1,578,000 1,742,000 1,645,000

–

FSC-certified wood reserve in forests 14,400,000 14,720,000 16,320,000 19,200,000 21,440,000 23,680,000 25,860,000 –

% FSC-certified 6.7% 6.9% 7.6% 9.0% 10.1% 11.1% 12.1% –

IKEA Group All wood sourced – – – 13,320 13,780 13,560 13,970 –

procurement

(in 000 m3

except %) All wood FSC-certified – – – 2,105 2,232 3,065 3,967 –

% FSC-certified – – – 15.80% 16.20% 22.60% 28.40% 50%*

Solid wood 7,080 7,223 5,800 5,320 5,920 5,690 6,287 –

Solid wood FSC-certified 425 506 928 1,256 1,356 1,337 1,421

% FSC-certified 6% 7% 16% 23.60% 22.90% 23.50% 22.00% 35%

Particleboard – – – 8,000 7,860 7,870 7,683 –

Recycled wood** – – – – – – 0,560 –

Particleboard FSC-certified – – – 848 880 1,723 2,188

% FSC-certified – – – 10.60% 11.20% 21.90% 28.00% –

Source: Compiled by casewriters from company documents.

Notes: * The 2017 figure indicates a target of 50% of wood from More Sustainable Sources by 2017, mainly coming from FSC-certified wood.

** Recycled wood amount is included in Particleboard amount.

– Indicates not available. IKEA Group did not disclose particleboard procurement prior to 2010.

Wood reserve in forests indicates the amount of wood estimated to be present and available for commerce in forests around the world. Wood harvested per year indicates the

amount of that wood harvested per year. FSC-certified wood reserve in forests indicates the amount of certified wood present in forests around the world.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

515-033 -19-

Exhibit 10 Selected Standards on Forestry and Chain of Custody, as of 2013

Forest Stewardship Program for Russian National Forest Forestry Law of the

Council (FSC) Endorsement of Code People's Republic of

Forestry Certification China

(PEFC)

Creation date 1993 1999 2011 1984

| Forest Management (FM) | Global superficies of forests FM certified (in 000 hectares) | 180,000 (including 14,275 in the US) | 245,000 (including 24,600 in the US) | 1,184,000 (including 35,000 FSC FM certified) | 17,000 (including 3,133 FSC FM certified) | |||||||||||||||||||||

| Number of countries using FM certification | 79 36 Russia China | |||||||||||||||||||||||||

| FM Geographical footprint Europe: 43%, North America: 40%, South America: 7%, Africa: 4%, Asia: 4.5%, Oceania: 1.5% | Europe: 32%, North America: 61%, South America: 1%, Asia: 2%, Oceania: 4% | Russia China | ||||||||||||||||||||||||

| Three main countries using FM certification | Canada: 32%, Russia: 19%, USA: 8% | Canada: 46%, USA: 14%, Finland: 9% | NA NA | |||||||||||||||||||||||

| Chain of Custody (CoC) | Number of CoC certificates 26,000 (including 3,400 in the US) | 15000 (including 2,500 SFI* certificates in the US) | 215 2,966 | |||||||||||||||||||||||

| Number of countries using CoC certification | 107 64 Russia China | |||||||||||||||||||||||||

| CoC Geographical footprint Europe: 52% North America: 17% South America: 5% Asia: 24.5% Oceania: 1.5% | Europe: 84% North America: 5% South America: 1% Asia: 7% Oceania: 3% | Russia China | ||||||||||||||||||||||||

Governance Producers Yes Yes No No

NGOs Yes Yes No No

Local Communities Yes Yes No No

Government Agencies No No Yes Yes

Source: Compiled by casewriters, based on data from Forest Stewardship Council (FSC), the Program for Endorsement of Forestry Certification (PEFC), and Russian and Chinese

Forestry Standards organizations.

Note: * The Sustainable Forestry Initiative (SFI) is a forestry program endorsed by the Program for Endorsement of Forestry Certification (PEFC).

![]()

![]()

![]()

![]()

![]()

515-033 Sustainability at IKEA Group

Exhibit 11a Forests Certified to Forest Stewardship Council Standards (in million hectares)

2011 2012 2013

Europe 64.0 72.9 80.9

of which Russia 28.8 33.1 38.2

Asia 5.0 5.6 7.7

of which China 2.7 2.5 2.6

North America 60.5 69.0 74.9

Latin America & Caribbean 9.5 12.2 13.8

Africa 7.4 7.2 6.7

Oceania 2.2 2.4 2.7

Total 149 169 187

Source: Compiled by casewriters, based on data from the Forest Stewardship Council.

Exhibit 11b Annual Forest Land Certified to Forest Stewardship Council Standards

(in million hectares)

Source: Compiled by casewriters, based on data from the Forest Stewardship Council.

20

![]()

Sustainability at IKEA Group 515-033

Endnotes

1 Kiera Butler, “Earth to IKEA Group,” Mother Jones, May 2009, http://www.motherjones.com/environment/2009/05/earth- ikea, accessed August 2013.

2 James Tozer, “Why customers find it so hard to escape an IKEA Group store,” Daily Mail, January 24, 2011,

http://www.dailymail.co.uk/femail/article-1349831/Ikea-design-stores-mazes-stop-shoppers-leaving-end-buying-more.html,

accessed July 2013.

3 Euromonitor, “Passport Home and Garden IKEA Group BV profile,” June 2012, p. 12, accessed July 2013.

4 Euromonitor, “Passport Home and Garden IKEA Group BV profile,” p. 5.

5 Euromonitor, “Passport Home and Garden IKEA Group BV profile,” p. 18.

6Anna Molin, “IKEA Group sales jumped 21% in 2012,” MarketWatch, November 7, 2012,

http://www.marketwatch.com/story/ikea-chinese-sales-jumped-21-in-fiscal-2012-2012-11-07, via Factiva, accessed July 2013.

7 Anna Ringstrom, “One size doesn’t fit all: IKEA Group goes local for India, China,” Financial Times, March 7, 2013, via

Factiva, accessed June 2013.

8 Rajesh Roy, “India clears IKEA Group’s Investment Plan,” Dow Jones Top News, May 2, 2013, via Factiva, accessed June

2013.

9 Ringstrom, “One size doesn’t fit all.”

10 Euromonitor, “Passport Home and Garden IKEA Group BV profile,” p. 33.

11 Don Roberts, “Three reasons the demand for timber is rising (and why you will be managing a more valuable resource,”

Canadian Imperial Bank of Commerce (CIBC) World Markets Inc., October 2012,

http://www.rightsandresources.org/documents/files/doc_5554.pdf, accessed July 2013.

12 Ida Karlsson, “IKEA Group Products made from 600 year-old trees,” Press Inter Service, May 29, 2012, via Factiva, accessed

July 2013.

13 Protect the Forest Sweden, “Expert Confirms the Criticism of IKEA Group's Russian Logging,” May 30, 2012,

http://www.scoop.co.nz/stories/PO1205/S00503/expert-confirms-the-criticism-of-ikeas-russian-logging.htm, accessed

March 2015.

14 Dean Kuipers, “Ikea responds to reports of old-growth logging,” The Los Angeles Times, June 12, 2012,

http://articles.latimes.com/2012/jun/12/local/la-me-gs-ikea-responds-to-reports-of-oldgrowth-logging-20120612, accessed

August 2013.

21