BUSINESS CASE REPORT: LULULEMON ATHLETICA : DRIVING GLOBAL GROWTH The report should be word-processed (or PDF), SINGLE-SPACED, with 11-pt font and a 1-inch margin. It should be 3 pages WITHOUT the exh

Sample Paper

Key Issues

Upon analyzing the challenges faced by Google and Alphabet, there are several key issues that come to light. 1) Google’s collection and security of sensitive user data. The issue of privacy will remain a key issue for most technology companies collecting sensitive personal identifiable information from its customers. 2) Google must embrace innovation to remain at the forefront of emerging technological advancements. Not driving innovation to its very edge may cost Google a competitive advantage. 3) Google should seek strategic partnerships within the generative technology industry. This will save time and resources on research and development (R&D) and will bring top talent in house. 4) Google’s revenue streams could be more diversified in artificial intelligence. Diversified revenue streams will bring in higher profits from new industries with high growth potential. 5) Google needs to focus on the recruitment and retention of top talent to fuel their ventures. 6) Competitor, Apple holds a larger market share for smart speakers. This is a key issue, however it is on the bottom of the list as it holds 27% market share compared to Google at 21% which we believe to be marginal with the competitive strategy implemented throughout this paper.

External Assessment

Based on the strategic group of voice search, we have identified three opportunities/threats:

Opportunity - Expanding Internet of Things Integration (IoT) Types: Voice search can be further integrated with IoT, allowing customers to control a wider range of connected devices through voice. This includes smart homes, wearables, cars, etc., improving the operability of devices, making applications downloaded by users of smart devices more compatible with virtual voice assistants, and providing customers with a more seamless connected experience.

Threat - Privacy and Security concerns: Voice search services collect and process user data which may raise privacy concerns and lead to potential security risks. Improper handling of personal information by voice search companies, resulting in disclosure of personal information or unauthorized access to customers, will cause users to distrust voice search platforms, reduce the acceptance and use of voice search, and reduce the reputation of voice search companies.

Threat - Fierce technology competitors: The competition between voice search companies is fierce, and each company is trying to gain more market share, but voice search is severely restricted by technology, and the technology wins the market. Competitors with new technologies in the market may disrupt the entire industry, correct recognition of speech, correct natural language data processing, and new competitors with artificial intelligence technology may pose a threat to existing voice search companies.

Internal Assessment

Strength - Speech Recognition Accuracy: As recently as 2021, Google assistant was correctly hearing and responding to users 77% of the time, about a 50% increase over its competitors Alexa and Siri. This is clearly valuable as Google’s speech recognition is much more consistent than its competitors, reducing customer frustration while interacting with the product. While having speech recognition technology is not rare in the industry, it is very difficult to catch up to Google’s voice assistants accuracy. In the time it would take Apple or Amazon to get a voice assistant as accurate as the Google Assistant, Google's product would have also advanced further - due to machine learning - making it hard to imitate at the same level. However, without a monetization strategy, Google currently lacks the organization to exploit this strength.

Weakness - Lack of Monetization Strategy: Innovative ideas are valuable. However, without a way to profit off of innovation, it becomes difficult to create a financially sustainable business. Luckily for Google, competitors are also struggling to create an effective monetization strategy. If Google could find a way to utilize its impressive digital advertising systems to create effective ads on its voice assistants, they could quickly turn this weakness into a competitive advantage.

Weakness - Privacy Concerns: Anywhere from 28-41% of smart device owners were reported worried about their privacy, with this also being the primary reason for people to choose to not own smart devices. This is a weakness currently suffered by all players in the space. This a potential area that if Google can focus on, will allow them to tap into a new part of the market of people previously not willing to purchase smart devices, leading to a strong competitive advantage.

Financial Diagnosis

While evaluating the financial diagnosis of Alphabet Inc. we looked at the following ratios to evaluate the financial health of Alphabet Inc. and compared it with the industry average. Price to Earnings Ratio (PE): Alphabet Inc. (NASDAQ: GOOGL) stock is considered to be a very good value based stock based on PE ratio being 27.91x compared to the industry average of 49.7x. Revenue Growth: A revenue growth of over 10% would signify a company doing well. Google has an average revenue growth of 13% year-over-year. Price-to-sales ratio (PS): A PS is a measure that places value on the basis of how much investors value a stock based on their yearly revenue. Google’s PS is 6.01 which is moderately higher than its competitors. Debt-to-equity ratio (D/E): Ideally having a D/E ratio less than 100% is considered marginal/good. Google D/E ratio was 2.52% which depicts an extremely low debt in comparison with the equity it holds.

In conclusion Google has performed above average in almost all the areas of the financial metric, but Google D/E ratio being extremely low at < 3%. This indicates that the company can take on heavy debts in future for expansion through setting up in house operations and performing M&A activity.

Current Strategy

Google is using the broad differentiation business level strategy. This is shown in a few instances. Google's CEO Sundar Pichai points out that voice-enabled technology is in the investment phase of a product. This is likely to find innovation that is really going to excite consumers. Furthermore, Pichai stating in a company memo that he wants computing to become universally available and accessible reflects a broad target market. Through the variety of products with various price points that Google has integrated with its Google Assistant, Google is showing that regardless of your lifestyle, Google Assistant should be a part of it.

Innovation is one of the main goals of Google’s functional strategy. They care little about materials management, and choose to focus heavily on research and development. They do this by using neural networks to continuously improve its AI systems. Additionally, by acknowledging and addressing security concerns of the Google Assistant, they are functionally achieving superior customer responsiveness.

Implementable Business-Level Strategic Alternatives

The first alternative is broad differentiation, finding a unique way to further differentiate Google’s voice assistant products. There are various privacy and security concerns associated with Google Home and similar products. Hacking into someone’s home system can be done easily through Wi-Fi routers or even through any third-party application installed by the end users. Through this, bad actors can make online transactions, listen in on private conversations, and even unlock the front door of user’s homes despite being in an entirely different location (Kellerman, 2019). Despite this, none of Google’s competitors are acting on these security issues. In order to differentiate, Google will have a focus on consumer security, protecting the financial assets and homes of their users. This differentiation will be done through a know-your-customer (KYC) verification process when a request is made to access a Google Assistant device. The KYC process verifies a person's identity through voice recognition, facial recognition, and knowledge-based security questions. Google can begin their differentiation process through the acquisition of leading KYC company, Onfido. The acquisition of Onfido will fit into the five year competitive strategy, providing security benefits to Google’s customers, save on chargeback costs, and eliminate privacy-related legal claims. This implementable business strategy will allow Google to differentiate their product through a focused approach, allow users to feel safer purchasing Google Assistant or Home and will ultimately help to increase their sales.

The second alternative is focus differentiation, targeting corporate buyers and tailoring specific features to suit office spaces and workplaces. Google would be able to execute this by targeting a new ideal customer profile, small and medium businesses. For businesses of this size, it is important to reinforce the value of their productivity and how employee time can dramatically impact the outputs of the company. Given this, Google can employ a focus differentiation technique through increased efforts on technical development and new features. They will need to invest time and resources into the improvement of features that most apply to corporate entities. This plan to target businesses is different from the enterprise efforts Google tried in the past, in helping businesses use Google Assistant as a chatbot for their users or scheduling appointments for B2C small businesses. Instead, Google Assistant will be tailored and marketed towards businesses who will act as the end user.

The features will include improved voice recognition, note taking abilities, on the spot do-to lists, as well as improvements in connecting to Google Calendar. This will increase efficiency within the workspace, eliminating the need for manual work that is often overlooked and forgotten about. A new feature that will be included is syncing Google Assistant to corporate messaging systems such as Slack. Slack already allows for integrations with Google Drive and Google Calendar, however by connecting Google Assistant, meeting notes, reminders, and more will be booked directly into employee calendars without them needing to do so on their own. Criteria and Evaluation by Criteria

The three criteria we have decided to narrow in on are consumer satisfaction, growth, and net present value (NPV). Consumer satisfaction is essential to establishing the long-term viability of an alternative. Failing to attend to consumer needs will push them away into the arms of competitors. Additionally, the growth of the company must be a focus to support the operations, product development, and competitive edge of Google. Lastly, NPV is a financial criterion used to evaluate the maximization of shareholder value. All three criteria work in tandem to create a competitive landscape for our five year strategy recommendation.

The broad differentiation strategy has higher chances of meeting consumer satisfaction needs. Through prioritizing data privacy and security, consumers will be overall more satisfied with the voice assistants and will have more confidence purchasing Google products for their homes. By acquiring Onfido, a company that already focuses on fraud prevention, Google is better suited to serve their customer base. As for focus differentiation, it is more difficult to measure increases in efficiency, which is ultimately what the sale to the businesses is.

Long-term growth must be heavily weighed heavily across both alternatives. Broad differentiation, focusing on leveraging fraud-fighting capabilities through the acquisition of Onfido, market leader in KYC, would lead to a quick competitive advantage against other virtual assistant companies. Contrarily, focus differentiation would target development towards corporate entities, but leave out the remainder of their customer base, failing to grow all niches of the target market.

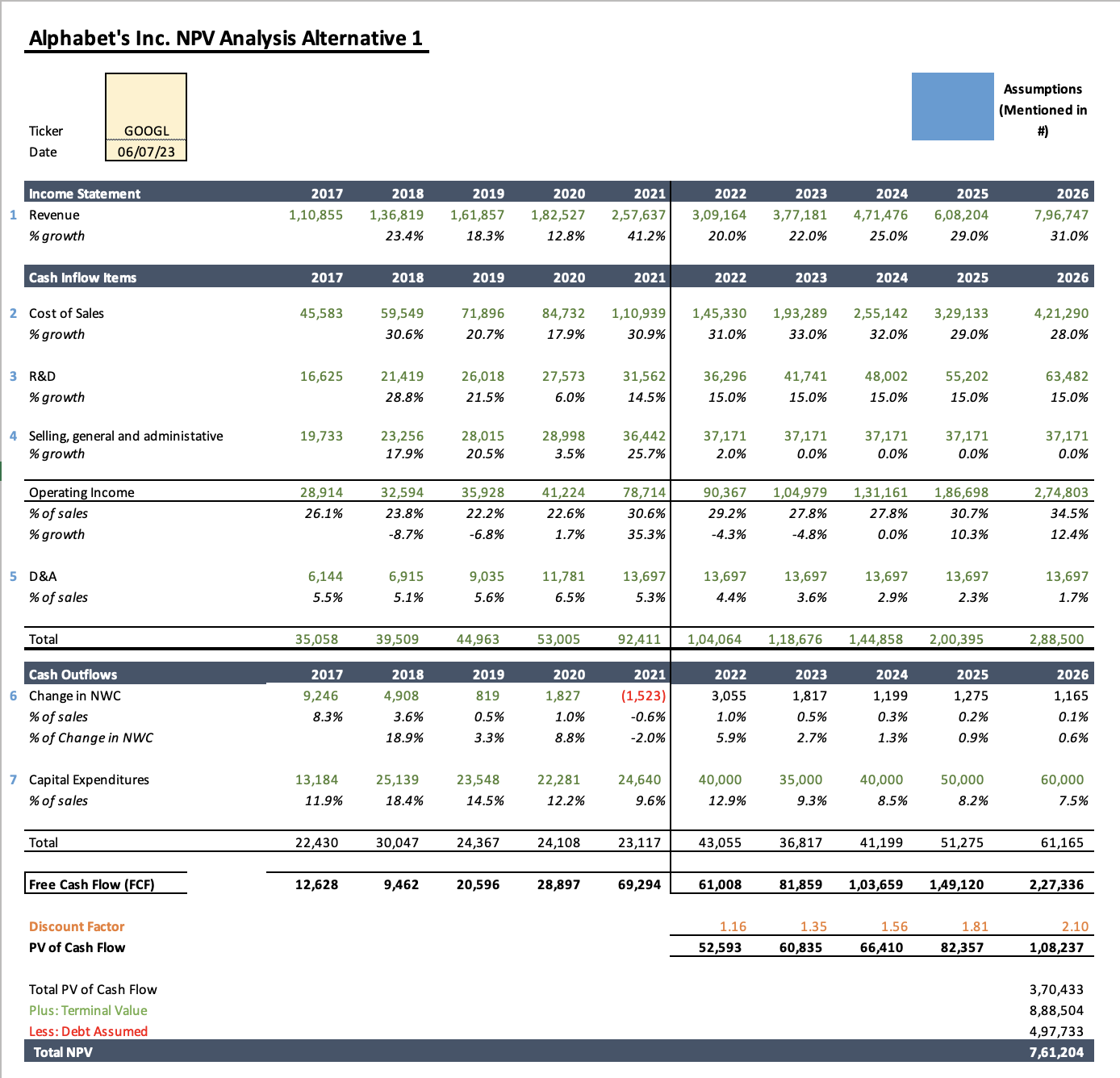

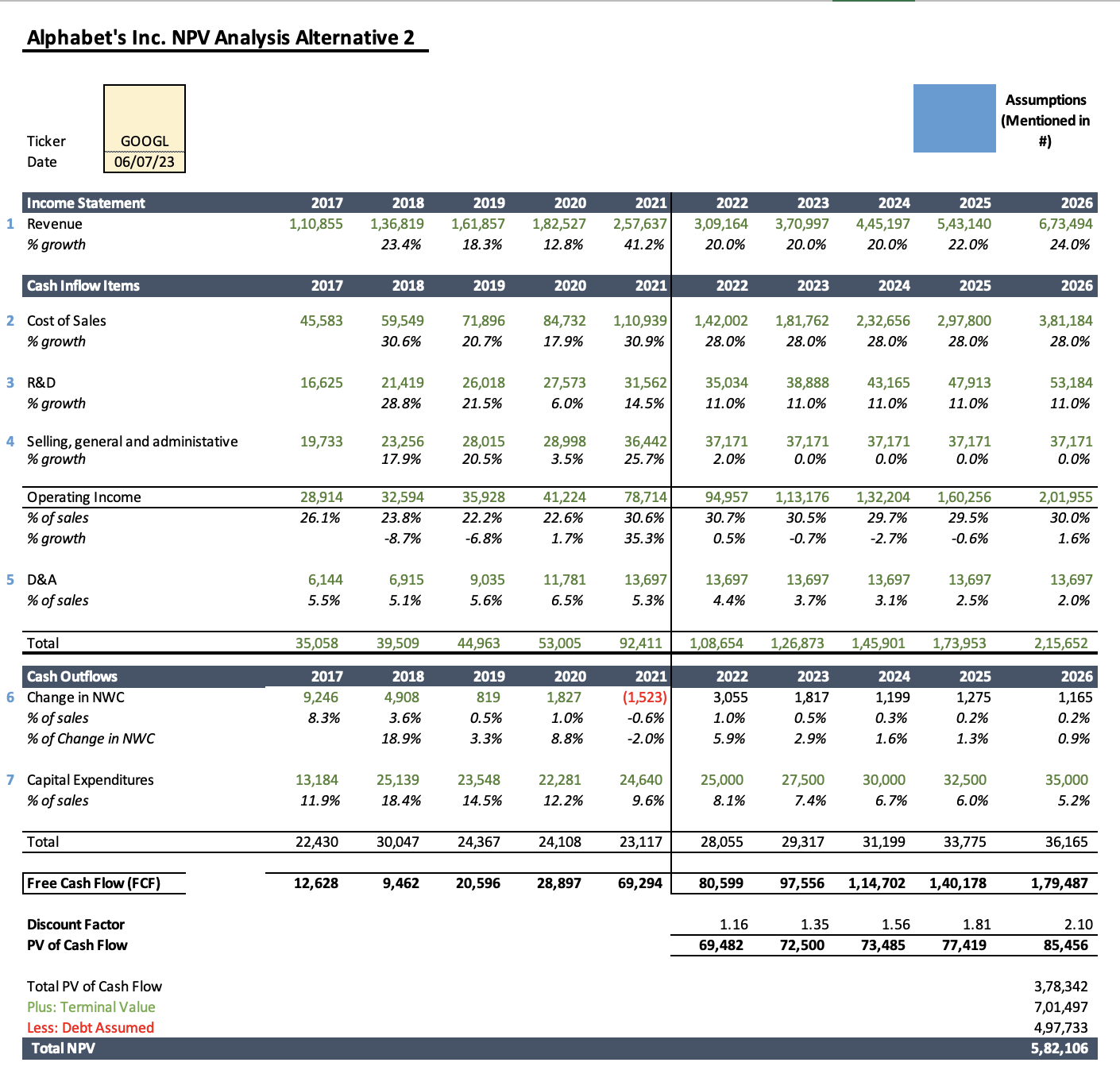

The broad differentiation strategy has an NPV of $761,204 MM (Exhibit 4). The focus differentiation strategy has an NPV of $582,106 MM (Exhibit 5).The first alternative, with a higher NPV, maximizes shareholder value and can better suit the needs of the business over the next five years. Therefore, the broad differentiation strategy is the superior alternative in this decision criterion.

Recommendation and its implementation

Based on our evaluations in the previous section, we are recommending that Google implements the first alternative, broad differentiation. The acquisition of Onfido and implementation of focused KYC efforts to combat fraud meet our criteria selection of consumer satisfaction, growth, and maximized NPV.

Major challenges regarding the implementation of this strategy include complications in the acquisition. Acquisitions can take some time and there is an additional possibility of Onfido not wanting to be acquired. There are a plethora of reliable KYC companies to select from with similar verification checks on users.

Possible limitations of this strategy include user friction that could temporarily impact consumer satisfaction. This friction may occur if the real consumer is trying to access their Google Home from a different location. In these cases, it is essential that Google communicates that it is done in their best interest in order to protect their accounts. While there is a risk of consumer satisfaction being impacted, the overall benefit of this strategy will override it.

Exhibits

Exhibit 1: External Assessment.

Name of the Focal industry or strategic group in the industry: Google: Assistant, voice search industry

Major competitors in the focal strategic group: Apple: Siri, Microsoft: Cortana, Amazon: Alexa, Samsung: Bixby, Meta (previously Facebook Portal), Xiaomi: Xiao AI, Oppo: Breeno, Vivo: Jovi

Who are the suppliers:companies that provide technology, components, or services necessary for the development and functionality of voice search platforms.

Who are the buyers: individual consumers, companies such as technology companies.

Examples of the substitutes (if any): text-based search, manual interaction

Evaluation of the Five Forces

| Five Forces | High/Moderate/Low | Supporting Bullet Points |

| Intensity of rivalry | High |

|

| Bargaining power of suppliers | Moderate |

|

| Bargaining power of buyers | High |

|

| Threat of new entrants | Moderate | New entrants face some challenges:

New entrants face some opportunities:

|

| Threat of substitutes | Moderate |

|

Macro PEST Factors that affect industry profitability (bullet points only)

Political:

Government laws and regulations on privacy settings and voice recognition may affect the progress of the industry.

Economic:

The state of the economy affects people's purchasing power.

Social and demographic:

Voice search has provided great convenience for people's lives.

People's preference for smart home and voice assistants has promoted the development of the voice search industry.

Technological:

The rapid development of technologies such as speech recognition, natural speech processing, and artificial intelligence affects the market share of voice search platforms.

The integration of voice search into other application software expands market opportunities.

Exhibit 2: Internal Assessment

| Value Chain Activities | Specific Attributes Along theValue Chain | V | R | I | W/S/DC/SDC | O | Competitive Implication: Likely to have |

| R&D | Strong Voice Recognition | Yes | Yes | Distinctive Competence | No | Temporary Competitive Advantage | |

| Car functionality | Yes | No | Yes | Strength | Yes | Competitive Parity | |

| Information Security | Susceptible to data breaches | No | Weakness | Competitive Disadvantage | |||

| Consumer information tracking is not clear to consumer | No | Weakness | Competitive Disadvantage | ||||

| Manufacturing | Cutting edge product quality | Yes | No | Yes | Strength | Yes | Competitive Parity |

| Marketing | Multiple versions of the same product to fit different prices brackets & audiences (B2B & B2C) | Yes | No | Yes | Strength | Yes | Competitive Parity |

| Sales | Lack of Profitability or Monetization Strategy | No | Weakness | Competitive Disadvantage |

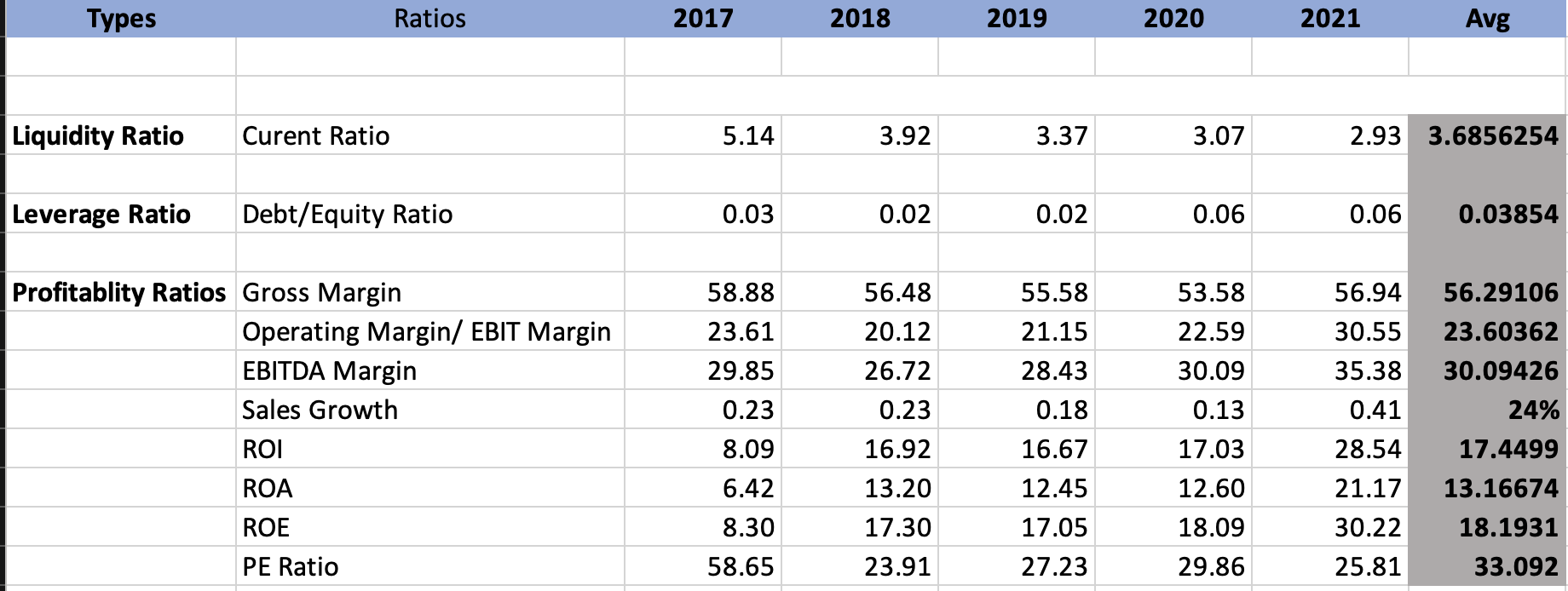

Exhibit 3: Financial Ratio Table*

*These were the following ratios that we used in our analysis to evaluate the financial health of Alphabet Inc.

Exhibit 4: Net Present Value (NPV) Projection Alternative 1

General Assumptions/Calculating Formulas for NPV Projections

1. FY 2021 is counted as the most recent FY. (i.e FY 2022 is not the CY)

2. All numbers are expressed in “millions”

3. PV of Cash Flow: FV/ (1 + d) ^ n

4. Free Cash Flow (FCF): Cash Inflow – Cash Outflow

5. Discount Factor: Discount factor of 16% has been taken since it is a reasonable rate considering the valuation of Alphabet Inc.

6. Total PV of cash flow: An addition of all the 5 future forecasted PV of cash flow.

7. Terminal Value: [FCF x (1+g)]/(d-g)]

g: Terminal Growth Rate – Assumed to be 11% consistent with the industry average.

d: Discount Rate – Assumed to be 16% consistent with the industry considering the valuation of Alphabet Inc.

8. Debt Assumed: Latest FY (2021) Current Liability + Long Term Liability

9. Total NPV: Total NPV of Cash Flow + Terminal Value – Debt Assumed

Alternative 1 NPV Projection

Alternative 1 Justification and Assumptions

Revenue

- We forecast a revenue growth of 20% for the year 2022 and then see a gradual growth of about 2-5% per year.

- Due to the alternative one focusing on one smaller segment of Google’s revenue, this would mean not a huge impact on first year as the plan would be still in implantation but as the years progress, we will see a 2-5% increase due to the elevation of customers buying the home product due to a trust factor bring created as the alternative one would focus on the KYC factor.

- The assumptions would be based on 20% growth as neutral growth for Google for other segments, but the home appliance segment would add to 2-5% after 2023 FY.

2. Cost of Sales

- We forecast a cost of sales growth of 20% for the year 2022 and then see a gradual growth of about 2-3% per year, except for 2025 & 2026 decreasing by the same % due to cost cutting measures.

- The increase in the first year due to cost associated with the KYC that might occur also, the increase in the home appliance and related products would result in higher costs.

3. Research and Development (R&D)

- R&D is assumed to be consistent with all the years, as Google is looking into measures to increase their efforts in AI so the 15% would be consistent with the Previous years.

4. Selling, General and Admin (SG&A)

- SG&A would not see a huge impact due to the alternative one as for that forecasted to be the same as the subsequent years.

5. Depreciation and Amortization (D&A)

- D&A would not see a huge impact due to the alternative one as for that forecasted to be the same as the subsequent years.

6. Change in Net Working Capital (NWC)

- Formula: Current Asset – Current Liability

- Balance sheet items assumed to be consistent with the subsequent years.

7. Capital Expenditures (Capex)

- Capex is increasing as the alternative one implementation would add a cost of acquiring the Startup. So, 2022 FY would have an increase by about $14,000 MM but it would gradually decrease in the 2023-2026 years.

Exhibit 5: Net Present Value (NPV) Projection Alternative 2

Alternative 2 Assumptions & Justifications

1. Revenue

- We forecast a revenue growth of 20% (which is marginal growth we expect Google to have every year), but as the year progresses, we expect an additional 1-3% growth from the implementation of the strategy.

- Due to the alternative two focusing on one broad sector but solves minor issues, this would not have a huge impact on the company's financials as the plan would be to add a couple of updates within the software’s. This would certainly make the software more popular among companies using Microsoft, but we forecasted that we would see a 2-3% increase due to the nature of the update would be minimalist.

- The assumptions would be based on 20% growth as neutral growth for Google for other segments, but the home appliance segment would add to 1-3% after 2023 FY.

2. Cost of Sales

- We forecast a cost of sales to be consistent at 28% year by year as it would be based on the average cost of the previous five years, as the implantation strategy would not account for any additional cost associated.

3. Research and Development (R&D)

- R&D is assumed to be consistent with all the years, as Google is looking into measures to increase their efforts in AI so the 11% would be consistent with the previous years.

4. Selling, General and Admin (SG&A)

- SG&A would be forecasted to be the same as the subsequent years.

5. Depreciation and Amortization (D&A)

- D&A would be forecasted to be the same as the subsequent years.

6. Change in Net Working Capital (NWC)

- Formula: Current Asset – Current Liability

- Balance sheet items assumed to be consistent with the subsequent years.

7. Capital Expenditures (Capex): Capex is increasing as the alternative two implementations; this would add a cost of acquiring more employees to complete and update the software with the updates. So, 2022 FY would have an increase by a consistency of $2,500 MM per year.

References

Alphabet (NASDAQ:GOOGL) - stock price, news & analysis. Simply Wall St. (n.d.).

https://simplywall.st/stocks/us/media/nasdaq-googl/alphabet

Alphabet Financial Ratios for analysis 2009-2023: Goog. Macrotrends. (n.d.).

https://www.macrotrends.net/stocks/charts/GOOG/alphabet/financial-ratios#google_vignette

DePersio, G. (2023, January 10). Google’s 5 key financial ratios (GOOG). Investopedia.

https://www.investopedia.com/articles/markets/021316/googles-5-key-financial-ratios-goog.asp

Dybek, M. (2023, February 4). Alphabet Inc. (NASDAQ:GOOG): Analysis of profitability ratios.

Stock Analysis on Net.

https://www.stock-analysis-on.net/NASDAQ/Company/Alphabet-Inc/Ratios/Profitability

Ganti, A. (2023, March 9). Terminal value (TV) definition and how to find the value (with

formula). Investopedia.

https://www.investopedia.com/terms/t/terminalvalue.asp#:~:text=Terminal%20value%20(%20TV)%20is%20the,of%20the%20total%20assessed%20value.

Tom Kellermann, head cybersecurity strategist at Vm. C. B. (2019, December 20). If your home

is getting smarter, don’t leave it vulnerable to hackers: Cyber Strategist. CNBC.

https://www.cnbc.com/2019/11/30/how-to-defend-your-smart-home-from-hackers-after-black-friday-buys.html

Understand the discount rate used in a business valuation. Mercer Capital. (2021, April 14).

https://mercercapital.com/article/understand-the-discount-rate-used-in-a-business-valuation/

Yahoo! (2023, July 7). Alphabet Inc. (GOOG) stock price, news, Quote & History. Yahoo!

Finance. https://finance.yahoo.com/quote/GOOG?p=GOOG%5C&guccounter=1

Team Number: 17 Section: D01 29