FIN/SLP Module 4 - SLP LEVERAGE, CAPITAL STRUCTURE, AND DIVIDEND POLICY Review the 1) dividends for the past three years and 2) capital structure of the company you have been researching for your SLP

FIN 501 SLP 2

Trident University International

FIN 501 Strategic Corporate Finance

March 31, 2024

Tesla, Inc. is at the forefront of the electric vehicle (EV) and renewable energy field and aims to accelerate the world toward a truly sustainable energy application. Tesla’s portfolio includes several electric car models, battery power storage arrangements, and solar energy products. Therefore, it has not only confronted the existing automotive industry norms but has also become a top name in the global pursuit for clean and renewable power of sources.

Tesla's Market Position and Growth Strategy

The Tesla market position is driven by the company’s innovative work in electric vehicles, its ambitious business growth strategy, and the charisma of its leader, Elon Musk. The company has grown in leaps and bounds, penetrating many markets while making production and improving its manufacturing efficiency. Tesla’s strategy concentrates on innovation, scaling production, and bringing down the cost to get a greater audience interested in EVs. Tesla has executed this strategy rather perfectly, which has enabled the company to become one of the leading sellers of green vehicles in the U.S., though with increased risks for operations and finance, too.

Financial Performance Overview

A look at Tesla company's financial statements for recent years shows the company’s growing revenue and profitability trend, the struggles to reach it’s full production line-up, and the supply disruptions. Telsa's revenue has been continuously growing during the recent past, with it reflecting the company's increasing assembly capacity as well as the growth of the electric vehicles (EVs) market globally. However, the company's aggressive expansion has also led to significant capital expenditures.

Stock and Bond Valuation

P/E Ratio Analysis:

P/E Ratio: Tesla's P/E ratio, as of the latest update, is approximately 40.76 (https://ycharts.com/companies/TSLA/pe_ratio ). The figure clearly shows that the investors have a clear indication of coming growth compared to the average rate recorded in the whole market. In terms of Tesla's P/E ratio as a whole, they are considering the other peers in the electric vehicle and broader automotive industries, General Motors (P/E of 5.852) and Ford (P/E of 11.95) with the Finbox (n.d.). Tesla's positional beta for other car manufacturers is substantially higher than that of other car makers, which hints at the market view as being Tesla’s higher speculative (YCharts).

Tesla's is significantly higher, indicating that the market may see Tesla as having higher growth potential or as being more speculative in nature (YCharts). Tesla's Price-to-Earnings (P/E) ratio, as of early 2024, indicates a high valuation compared to traditional automakers. With a P/E ratio significantly above industry averages, the market expects Tesla to continue its rapid growth and expand its profitability. However, this high P/E ratio also suggests that Tesla's stock might be overvalued under traditional valuation metrics, posing a risk if the company's growth does not meet expectations.

Book Value per Share Calculation:

Total Net Tangible Assets for 2023: $62,019,000,000

Outstanding Shares: 3,185,000,000 shares

62,019,000,000/3,185,000,000 =19.4722

As previously detailed, the book value per share is calculated as $19.47. When comparing this to Tesla's current share price of around $175.66 to $177.80 (after-hours), the market price significantly exceeds the book value per share, which could suggest the stock is perceived as overvalued from a strictly book value perspective. However, this does not account for future growth expectations and the Tesla’s intangible assets, such as its brand and technology leadership in electric vehicles and renewable energy.

Tesla's book value per share, calculated using the latest balance sheet information, stands significantly below its current market price. This discrepancy highlights the market's valuation of Tesla's growth prospects and intangible assets beyond its net tangible asset value.

Analysts Opinions and Market Sentiment

Analysts have both bullish and bearish views of Tesla among Analysts; according to some, it may be overvalued using the conventional analysis metrics, while others are optimistic about the company leading the EV market soon. The power of analysts views from all over the world manifests large uncertainties and the great expectations concerning Tesla's future.

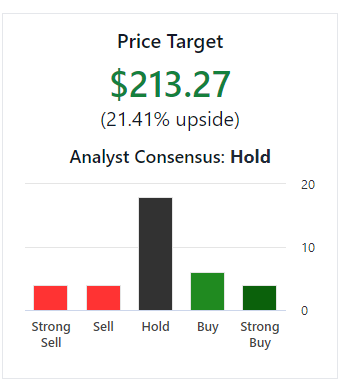

Tesla demonstrated revenue growth in 2023 as compared to the previous year and the "Hold" rating with the share price target of $213.27 (StockAnalysis.com (n.d.)). Tipranks and yahoofinance are also confident about the issue.

Top of Form

Risk Analysis

Tesla's investment bears a few risks, including, those of the competitive market, regulatory challenges, and that of probable production delays. The EV market is having a wee-worry from the viewpoint of crowding, as conventional car manufacturers and newcomers in the market are spending a lot on BEV production. Policymakers' changes and geopolitical issues can add a new dimension to Tesla's vulnerability in advancing its global supply chain and market impart.

Future Outlook and Strategic Initiatives

In its quest for growth, Tesla will likely ride on its waves into new markets, in-built battery technology development, and the possibility of success of autonomous automobiles. Another strength of the company is its diversification and expansion strategies. It explores the development of a fully autonomous driving system and the growth of its energy product line. Such endeavors might translate into new sources of income and a foothold in tech-focused areas.

Conclusion

Tesla stock, Inc. could be considered a splendid but mixed decision, with several sides investors should be aware. It is reflected in its price by the new industry the company belongs to, its ambitions, and the market’s performance expectations of future profits. While the market price of shares close to Tatla on the base of their P/E ratio and market price compared to book value presents a highly optimistic state of growth, investors still must take notice of the company’s inherent risks and bottlenecks. The key to Tesla's long-term success and stock valuation will be its ability to handle growth, market competition, and new opportunities effectively as the company moves forward with the innovations it is making and strives to expand.

References

Finbox. (n.d.). P/E Ratio for General Motors Company. Retrieved from https://finbox.com/NYSE:F/explorer/pe_ltm/

StockAnalysis.com. (n.d.). Tesla, Inc. (TSLA). Retrieved March 20, 2024, from https://stockanalysis.com/stocks/tsla/

Yahoo Finance. (n.d.). Tesla, Inc. (TSLA). Retrieved from https://finance.yahoo.com/quote/TSLA