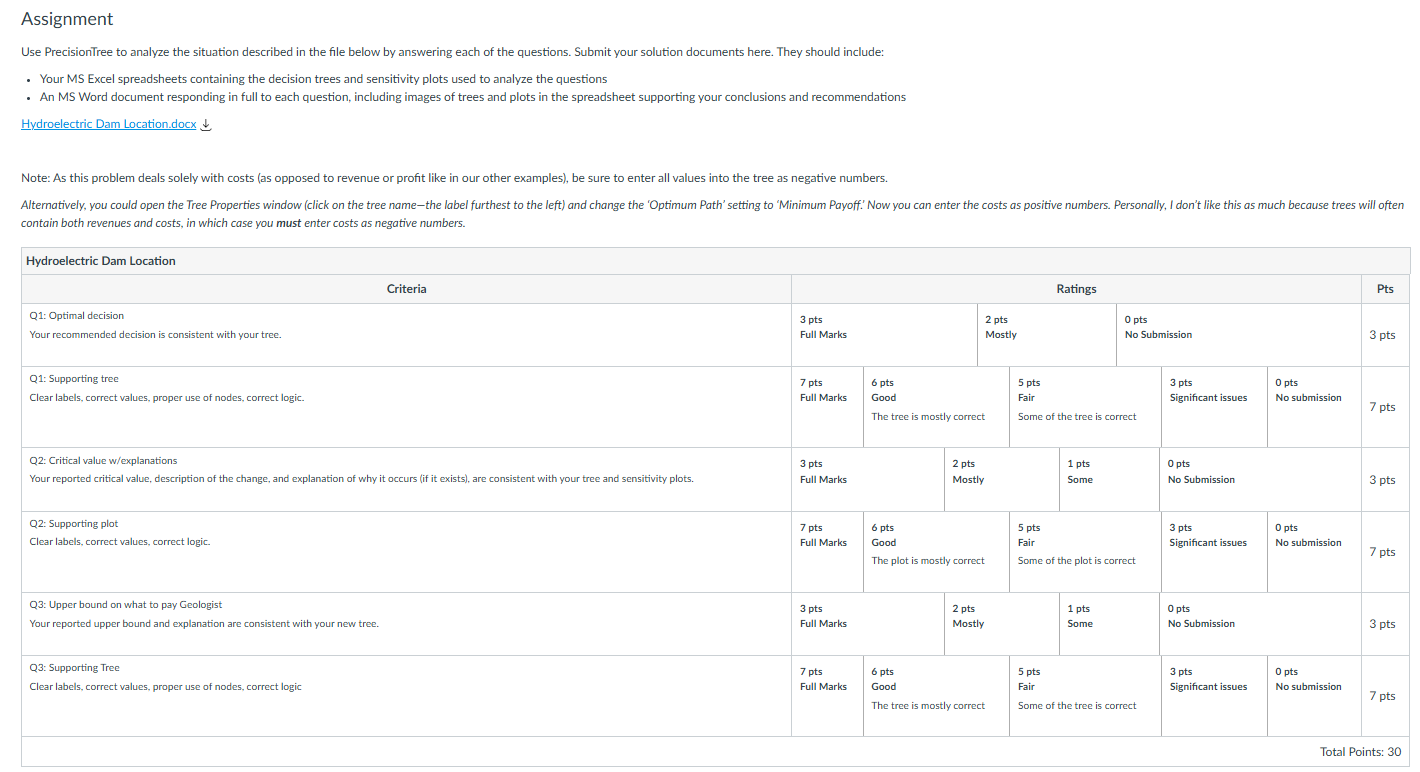

Assignment

Hydroelectric Dam Location

ASP&L is deciding whether to build a hydroelectric dam on the Travers river for $145 million in costs or on the French Canyon river for $170 million. The Travers river site has seen a fair amount of minor seismic activity over recent years and the company believes there is a 15% chance over the next four years that the seismic activity could lead to a large enough earthquake as to render the site useless. In this case, they will be out the full $145 million and will need to rebuild at the French Canyon location.

Please express monetary amounts in millions of dollars ($M) both in the models you construct and in responding to the questions posed.

As this problem deals solely with costs, enter values into the tree as negative numbers.

Assuming ASP&L uses Expected Value (risk-neutral) as their decision criterion, use PrecisionTree to construct and solve a neatly labeled decision tree for their decision. What is the optimal decision for ASP&L?

ASP&L is interested in how sensitive the recommended strategy is to the probability of an earthquake occurring. Use PrecisionTree to perform a sensitivity analysis on this value, varying it from 13% to 17%. Provide a sensitivity plot showing the expected cost over this range for each location choice (you must enter percentages into the Sensitivity dialogue window of PrecisionTree as a decimal: 0.13 and 0.17).

Is there a ‘critical’ probability value within this range at which the optimal decision changes? If so, provide the critical value and the change to the optimal decision, and explain intuitively why the change occurs.

ASP&L could hire a geologist with expertise in this area to predict whether such an event will occur in the next four years. What is the most ASP&L would be willing to pay for an expert prediction? Why? Use PrecisionTree to build a new tree that supports your answer.