financial management -final assignment

Final Assessment Outline

Competency Name: Financial Management (BUS325)

Competency Statement: Develop an understanding of the role of financial management in business.

Final Assessment Title: Final Assessment

Program Learning Outcomes: PLOs Assessed in this course include:

BUS BA 3) Our graduates will be able to demonstrate appropriate analytical and quantitative skills by examining a wide range of business models.

ACC BA 4) Our graduates will be able to use clear and concise communication to convey relevant financial and non-financial information so that decision makers can formulate informed decisions.

Competency Learning Outcomes (CLOs)

1. Analyze financial statements and their functions.

2. Assess financial instruments.

3. Evaluate components of corporate governance

4. Explain and calculate the time value of money.

5. Describe and calculate bond valuations.

6. Describe and calculate stock valuations.

7. Identify financial sources and uses, the instruments, and their markets.

Purpose of the Assessment

The purpose of the final assessment is to evaluate your knowledge in this course, Financial Management. Demonstration of your knowledge of each of the course learning objectives (CLO’s) must meet a proficient or exemplary level as seen in the course final assessment rubric.

PLEASE NOTE: All the necessary information required to successfully complete this final is provided within this document. It contains detailed instructions, guidelines, and key concepts needed for each section of the assignment. Any required calculations, formatting specifications, and expectations for academic integrity are clearly outlined. Please ensure that you carefully review the document and follow the provided instructions to meet the assignment requirements effectively. If any external sources are referenced, proper citation in APA format is required.

Submission Artifacts:

Final Deliverable

Comprehensive Written Report: A well-structured report of 2,500-3,000 words, including supporting calculations such as financial ratios, NPV, IRR, and bond & stock valuation. The report should be submitted in Word or Google Docs format.

Formatting Requirements: The document must be formatted in Times New Roman, 12-point font, double-spaced, with standard 1-inch margins.

Academic Integrity: This assignment requires you to present your own work and analysis. If referencing external sources—including books, articles, or websites—you must provide proper citations in APA format. Plagiarism, including the use of uncredited material or direct copying, will not be tolerated. Your submission should demonstrate accuracy, clarity, and a thorough understanding of financial analysis and valuation concepts.

Objective:

Integrate all CLOs into a cohesive financial strategy.

A publicly traded company is planning a significant expansion requiring $5 million in funding. Analyze their financial statements, evaluate funding options, and recommend a course of action.

Connections to CLO:

Financial Statement and Ratio Analysis:

Use the company’s provided financial data to calculate key ratios.

Assess financial health and funding capacity (CLO 1 and CLO 2).

Propose governance improvements to minimize agency problems (CLO 3).

Evaluate a proposed bond issue and stock offering (CLO 5 and CLO 6).

Recommend whether to proceed with the expansion using NPV and IRR calculations (CLO 7).

Financial Statement & Ratio Analysis

Calculate:

Current Ratio

Debt-to-Equity Ratio

Return on Assets (ROA)

Return on Equity (ROE)

Governance Recommendations

Provide recommendations to ensure ethical and financially sound decision-making.

Investment Valuation

Bond Valuation: Use the Present Value formula to determine if bonds should be issued.

Capital Budgeting

Calculate NPV (Net Present Value) and IRR (Internal Rate of Return) for the expansion.

Recommend whether the company should proceed with the expansion.

Company Profile: StellarTech Inc.

Industry: Technology (Consumer Electronics & AI-Driven Software Solutions)

Headquarters: San Francisco, CA

Stock Exchange Listing: NASDAQ (Ticker: STLR)

Current Stock Price: $85 per share

Number of Outstanding Shares: 10 million

Market Capitalization: $850 million

Current Assets: $140 Million

Revenue (Last Fiscal Year): $250 million

Net Income: $25 million

Current Debt: $50 million

Equity: $400 million

Current Liabilities: $70 million

Long Term Liabilities: $80 million

Total Assets: $520 million

Expansion Plan

Project: Expansion into European and Asian markets by setting up manufacturing and distribution centers.

Estimated Cost: $5 million

Expected Annual Revenue Increase: $2 million per year

Projected Profit Margin on Expansion Revenue: 20%

Expansion Timeline: 5 years

Funding Options

Bond Issue Proposal

Face Value of Bond: $1,000

Coupon Rate: 6% per year

Market Interest Rate (YTM): 5.5%

Time to Maturity: 10 years

Number of Bonds to Issue: 5,000

Stock Offering Proposal

Proposed New Shares to Issue: 100,000

Stock Price: $85 per share

Projected Dilution Effect: Minimal (1% dilution)

Additional Resource

Below are additional resources to aid you in the development of your product or service plan.

Using APA when referencing: https://www.youtube.com/watch?v=f7vhZVlIND8

Using Excel to calculate NPV and IRR: https://www.youtube.com/watch?v=lWY3abc4hz0

___________________________________________________________________________________________________

Submit your Work

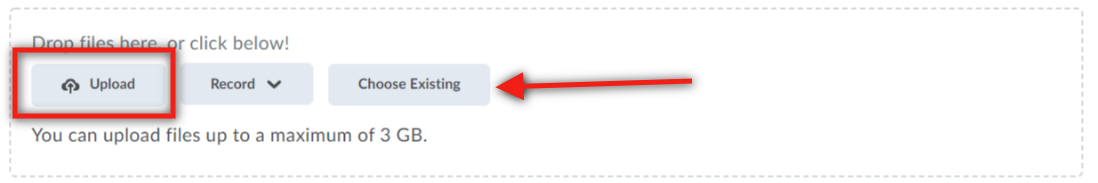

Your completed final assessment documents should be submitted through the Final Assessment link of your competency.

Please note, that you can upload multiple files to the Final Assignment link.

Make sure the files are converted to a doc, docx, ppt, pptx file. (you can share Google Doc and MS OneDrive documents from the “Choose Existing Activities” button)

To upload a file, click “Upload File” and choose the file(s) from your desktop:

![financial management -final assignment 1]()

More tutorial resources can be found at the UMPI Student eLearning Hub

Final Assessment Rubric

Criterion

Exemplary- 4

Proficient- 3

Emerging- 2

Developing- 1

Quality of Post

Fully analyzes financial statements, evaluates corporate governance, correctly applies financial principles (TVM, NPV, IRR, bond/stock valuation), and presents well-supported recommendations.

Mostly analyzes financial statements and evaluates governance, applies financial principles with minor calculation errors, and makes reasonable recommendations.

Somewhat analyzes financial statements and governance but lacks depth or contains multiple errors in financial calculations and interpretation.

Does not analyze or misinterprets financial statements, governance, or financial concepts; recommendations are missing or unsupported.

Connections to Content

Demonstrates strong understanding of financial management by effectively integrating CLOs and using relevant business examples; makes clear connections between financial theories and real-world applications.

Mostly connects course concepts to business applications but may lack depth in integrating some CLOs; some examples are relevant.

Shows limited connections between course concepts and financial strategies; lacks real-world applications or business examples.

Does not connect financial concepts to business strategy; lacks evidence of understanding CLOs.

Originality

Demonstrates independent, creative thinking in financial decision-making; solutions are well-reasoned and supported by strong financial analysis.

Shows some original thought, applying financial concepts with a mix of standard and unique insights.

Limited originality; mostly paraphrases textbook concepts without strong analysis or unique insights.

Lacks independent thought; heavily relies on external sources without demonstrating understanding.

Writing Mechanics

Well-organized, logically structured, and clearly written. No grammar, spelling, or punctuation errors. Uses APA formatting and financial tools (Excel, models, equations) correctly.

Mostly clear and well-organized, with minor grammar, spelling, or formatting issues. Uses financial tools appropriately with minor errors.

Some sections lack clarity or logical flow; multiple grammar and formatting errors. Financial tools are applied inconsistently.

Writing is unclear, disorganized, and contains frequent errors. Formatting and financial calculations are incorrect or missing.