q

Assignment 1: Tracking Your Spending and Budgeting Exercise

Beginning today, track every time you make a purchase with cash, credit, debit, check, etc.

Do not distinguish between credit or money from your bank account, just keep a record of every dollar that leaves your hands.

Accept receipts or ask for them if they are not offered.

Record at a minimum the date, amount spent, and the name of the business.

It may be helpful to add additional information, such as what the expense was for, in cases where a business caters to multiple needs. This will be helpful when it comes time to generate your reports.

For example: Shopping at Walmart could mean you bought gas for your car, groceries, take out Chinese food, or bathroom supplies.

You may also use Apps/services that are designed for expense tracking such as Mint.com. But, if you use a service like that, you should review receipts daily with what the service has recorded, and update fields such as notes/categories to ensure accuracy of your report. Extra care will be needed to track cash expenses too.

Create a budget utilizing the following instructions.

Income:

List all sources of income in a regular month and the amount of money you expect to receive. Examples include: Job wages, Interest & dividends, parental allowance, etc.

Savings:

If you save on a regular monthly basis, use the value you set aside during a regular month.

If you do not save on a regular monthly basis, leave your saving amount as zero.

Everyone will Establish 5 savings goals you would like to attain, including: an Emergency Savings fund of 3 – 6 months of monthly expenses, a Revolving Savings plan, and 3 other options of your choice. These should be in terms of dollars saved per month. Do not include these in the budget calculations, just put some ideas on paper and work out: what is it, how much does it cost, when do you want it, and how much would you need to save each month to reach your goal.

Emergency Savings: This is the sum of your living expenses on a monthly basis multiplied by a number between 3 and 6. This gives you the total amount you should have saved in a liquid account that is strictly used for emergencies.

Revolving Savings: Revolving savings is for recurring but irregular expenses, such as birthdays, car registrations, holidays, home maintenance, etc. To calculate the revolving savings amount, figure out the total that will be spent on these types of purchases throughout the year, then divide that by 12.

Example of another savings goal: If you wanted to save for graduation trip to Europe, you may estimate that it would cost you $3,500, and, if you have 3 years left in school, then you have 36 months. Divide $3,500 by 36mo to get your monthly saving amount of $97.23.

Be realistic with your planning.

Expenses:

Fixed: These are the expenses that don’t fluctuate on a monthly basis. Examples include: rent, car payment, insurance payments, subscriptions (Netflix, Pandora, etc.), and loans. List your fixed expenses, and how much they cost each month.

Variable: These are expenses that change from month-to-month due to how much you choose to use them. Examples include: Eating out, entertainment, utilities (if not on a fixed payment plan), credit card payments, and gasoline. List what you think your variable expenses are, and how much you expect to spend on them in a month.

Budget:

Sum up all sources of income.

Sum up all savings amounts (only the ones you are actually working toward)

Sum up all expenses.

Subtract Savings and Expenses from Income.

Ideally, the budget should have a $0.00 or positive value after all expenses and savings are deducted from income. The golden rule is “Give every dollar a job” or “Spend every dollar on paper first”, meaning don’t leave any income unaccounted for by expenses or savings goals. Go into each month with a full plan of how every dollar will be spent.

Reaction Report (15pts) for [proper formatting, grammar, length, thoughtfulness of answers]:

This report will consist of a 2 pages, double spaced, Times New Roman 12 font, reaction to the evaluation of your spending habits and budgeting experience.

Answer these questions: What technique did you use to track your expenses? (Use Mint.com to track spending and budgeting)What did you discover? Were you surprised (why/why not)? What trends stand out? What were your expectations? Will this exercise influence your future behavior (why/why not)? How do you think this compares to the average college student?

What the experience was like sitting down thinking about your spending habits and categorizing them in such a way. Did anything surprise you? What are some challenges you might anticipate when trying to help another person develop a budget for the first time? If your budget was negative, figure out what you can do to bring it out of the red. Can you reduce any expenses? Can you increase your income in any way? Suggest realistic changes that would allow you to live within your means and are feasible.

Offer any additional musings you may have about this exercise.

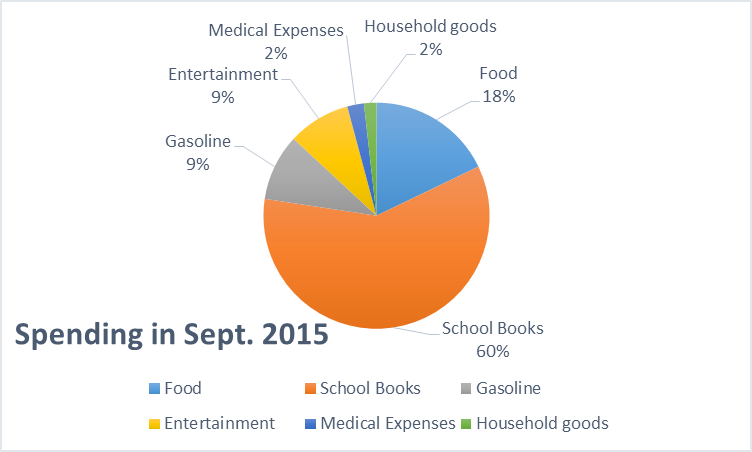

Graphical Report (10pts) for [proper content, neatness, clarity]:

This should have budget worksheet and lists of individual expenses, categorized by groups such as food, gas, medical, etc. with date and amount spent.

In addition there should be some form of graphical representation, in the form of a pie chart, bar graph, or both with keys, representing the data in the lists.

This should be on its own page, separate from the Reaction Report.

***

Graphical Report

Example Pie Chart

Example List

| Food | |||

| Date | Description | Amount | |

| 1-Sep | Groceries | 50 | |

| 3-Sep | Snack | 3.25 | |

| 5-Sep | Eating out | 8.75 | |

| 6-Sep | Snack | 2.5 | |

| 7-Sep | Snack | 2.5 | |

| 15-Sep | Snack | 4.95 | |

| 17-Sep | Groceries | 18.05 | |

| 20-Sep | Eating out | 11.25 | |

| 20-Sep | Coffee | 4.75 | |

| 25-Sep | Snack | 3.5 | |

| 26-Sep | Coffee | 4.5 | |

| 27-Sep | Groceries | 36 |